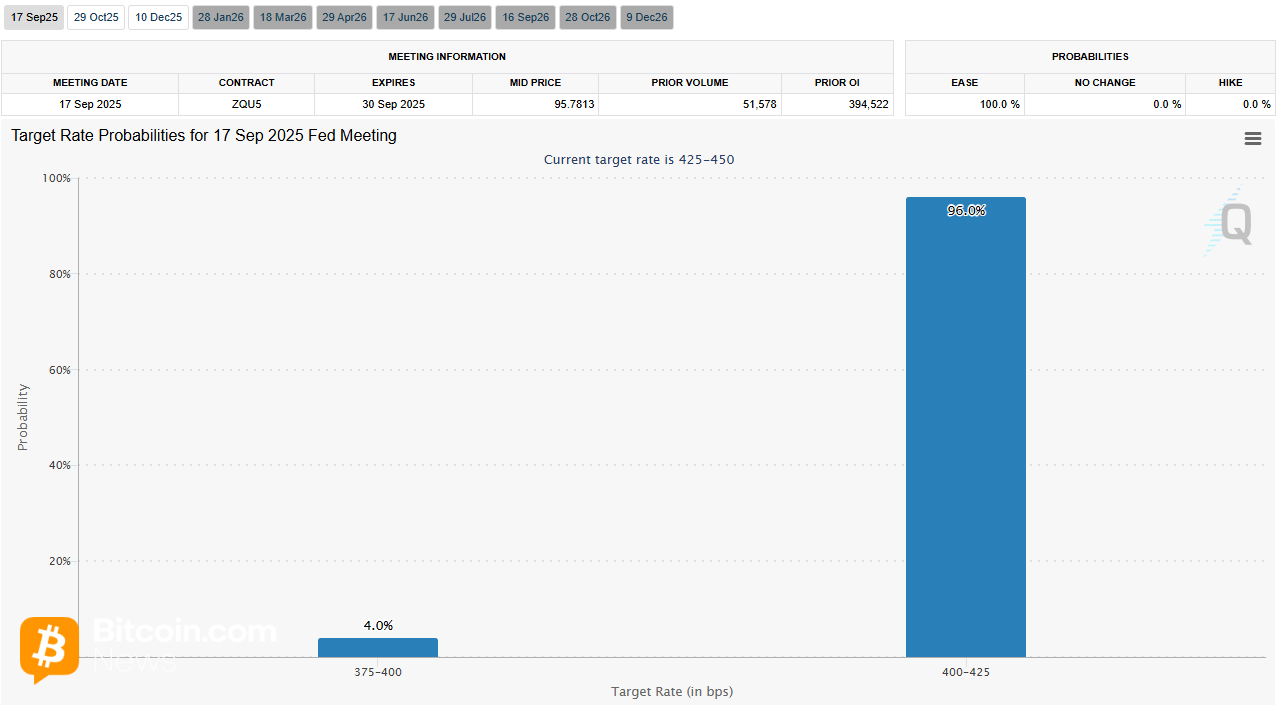

美国联邦储备委员会周三的降息并不令人感到意外,毕竟就在宣布前几分钟,CME集团的Fedwatch工具显示降息25个基点的概率为96%,降息50个基点的概率为4%。但市场希望看到实际结果,尽管许多人表示降息已经被市场消化,比特币(BTC)仍在消息公布后跳涨,重新回到116,000美元,随后迅速回落至115,000美元。

(大多数专家在周三下午官方宣布降息前几分钟就已预期降息25个基点 / cmegroup.com)

上周,由于就业数据出乎经济学家的意料,新增失业申请创下纪录,降低政策利率的可能性大幅上升。随后,特朗普提名的斯蒂芬·米兰(Stephen Miran)昨天被确认成为七位联邦储备委员会理事之一,增加了今天降息的可能性。米兰参加了中央银行的会议,并且是唯一呼吁降息50个基点的委员会成员。

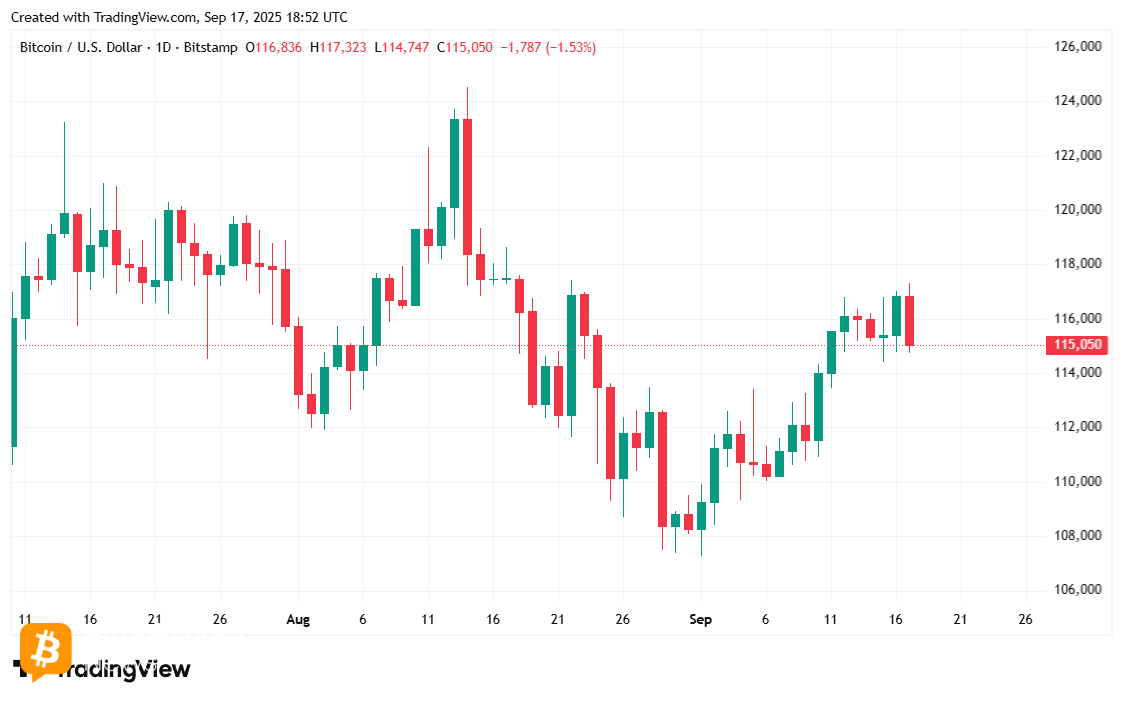

尽管确认了近一年来的首次降息,BTC仍在115,000美元至116,000美元区间徘徊。许多人预计美联储在今年10月和12月重新召开会议时将进一步降息,这可能是2025年比特币最后一次反弹的机会。

“委员会关注其双重任务两方面的风险,并判断就业的下行风险上升,”美联储在周三的新闻稿中宣布。“为了支持其目标,并考虑到风险平衡的变化,委员会决定将联邦基金利率的目标区间下调1/4个百分点至4%至4.25%。”

正在对英国进行国事访问的美国总统唐纳德·特朗普对降息没有立即作出反应。总统曾批评美联储主席杰罗姆·鲍威尔未能降息,甚至试图解雇拜登任命的美联储理事丽莎·库克,指控其涉及抵押贷款欺诈。在这一戏剧中,另一位拜登提名的前美联储理事阿德里安娜·库格勒神秘辞职。

尽管降息,比特币在撰写时仍下跌约1.00%,报115,143.95美元,依据Coinmarketcap的数据。自周二以来,这种加密货币的价格一直在114,803.05美元和117,328.61美元之间波动。

(比特币价格 / Trading View)

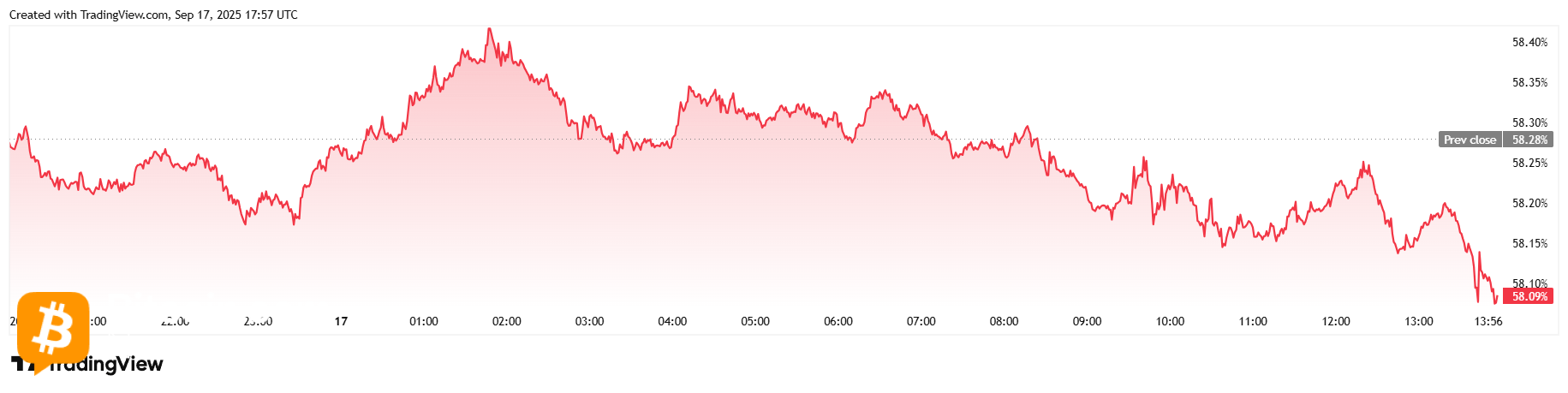

24小时交易量上升8.02%,达到494.5亿美元,但市值与价格一样,微跌至2.3万亿美元,轻微回落0.95%。比特币的主导地位在大部分时间内保持不变,但最终下降0.37%,降至58.09%。

(比特币主导地位 / Trading View)

根据Coinglass的数据,总比特币期货未平仓合约自昨日下降0.71%,达到830.7亿美元。过去24小时内,比特币清算总额达到2539万美元。长仓清算1451万美元占据了大部分,其余1088万美元为空仓清算。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。