Binance Records Huge $2B Stablecoin Inflows of 2025 Amid FOMC Meeting

According to the latest market update, reports showed that nearly $2 billion worth of stablecoins flowed into Binance just before the U.S. Federal Reserve’s key policy decision. This huge inflow is an indication that investors are preparing to experience potential volatility when the Federal Open Market Committee (FOMC Meeting) makes its announcement concerning interest rates.

What’s the News

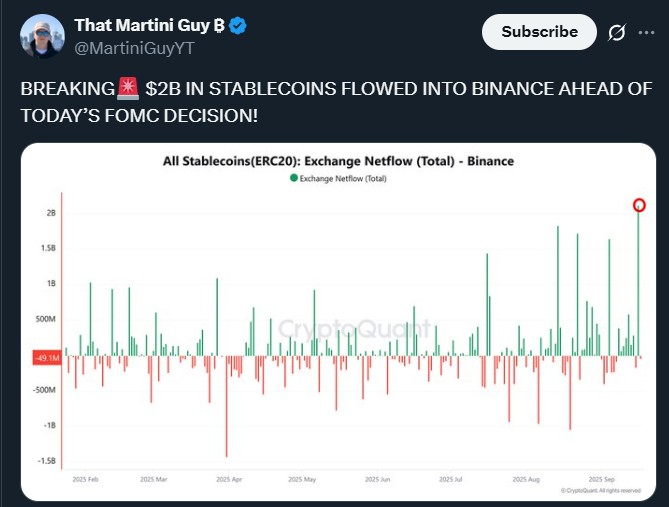

As per the market observers, Binance has so far registered the highest inflow of stablecoins in 2025, with a total of $2 billion in a single day. This sharp rise is an indication of high positioning before the FOMC Meeting today on 17 September 2025 .

Cryptos have historically demonstrated great responses, sometimes moving up to 10% of the Bitcoin price in 24 hours after a Fed announcement. The inflow is an indication that traders, retail and institutional, are busy gearing up for what may turn out to be a defining moment in the market.

Source: That Martini Guy

Why $2B Stablecoins Inflows Into Binance?

The inflow of stablecoins is frequently regarded as a pre-trading activity. Whenever traders transfer stablecoins to exchanges such as Binance, they tend to be interested in the ability to purchase Bitcoin, Ethereum, or other currencies on the spot.

A study by the National Bureau of Economic Research (2023) revealed that huge inflows tend to coincide with institutional purchases, also known as smart money.

This suggests that the $2B inflow could not only be retail speculation, but larger investors could also be positioning depending on how the market will react to the Fed's decision.

How the FOMC Decision Matters in This Step

The Fed interest rate decision is one of the most important events in worldwide financial markets. By indicating that it will reduce the rates or leave them at the same level, the Fed might stimulate greater risk-taking, and the crypto prices might increase.

Conversely, an increase in the rate would cause the precautionary effect, since the tightening of the monetary policy will lead to a decrease in liquidity and will tend to drive investors to less risky securities such as bonds. Since crypto is considered a high-risk asset, traders are looking forward to the outcome.

The $2 billion of inflow is indicative of the desire of participants to be ready to act immediately, either to buy into a rally or to take advantage of price swings.

Is It a Good Flow or a Bad Flow?

Whether this inflow is good or bad depends on one's viewpoint. From a market activity perspective, it's a good thing because it indicates that there's a lot of activity and liquidity on Binance. It indicates that traders believe that the exchange is the most convenient place to operate during volatility.

Nonetheless, it also indicates that the markets can have an increased risk in the short term, and the prices will be prone to sudden changes as soon as the Fed declares its policy. In other words, it's not so much good or bad--it's an indication of big moves forward.

What to Expect from This News?

The most probable case is that there will be increased volatility in Bitcoin and major altcoins after the FOMC decision is released. In case of a dovish approach from the Fed, institutional investors may use a portion of the stablecoin for buying Bitcoin, which will boost the bullish rally.

On the other hand, traders might use stablecoins to hedge or short positions. Either way, the inflows suggest heavy trading volume and volatility in the next few hours.

Conclusion

The inflow of the stablecoin of $2 billion into Binance shows that the crypto market is sensitive to macroeconomic factors such as the FOMC decision. It demonstrates the way traders are planning, and they are relying on stablecoins as a versatile means of responding swiftly to policy changes. Although it remains unknown whether the result will either trigger a rally or a sell-off, one thing is definite: the market is gearing up to act, and volatility is virtually inevitable.

Also read: Runwago Listing on KuCoin and Gate.io: What Will be Listing Price免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。