原文作者:Eniola

原文编译:CryptoLeo(@LeoAndCrypto)

上周我写了一篇关于预测市场新项目的文章——《2025 新预测市场最全盘点(上)(下)》,出发点基于“潜力新项目或作为早期用户能获得潜在利润”,因较多的预测市场项目因处于早期,其交易量和流动性暂时还没走起来,对于很多需要小周期赚钱的用户吸引力不大。

今天则为大家带来短线用户的预测市场套利策略,文章由Eniola撰写,Odaily星球日报编译如下:

有市场的地方,就有套利。根据市场类型,套利可能表现为价差较小/价差较大,但它始终存在。预测市场也不例外,乍一看,利差可能很小,但只要策略得当,就能累积成丰厚的利润。

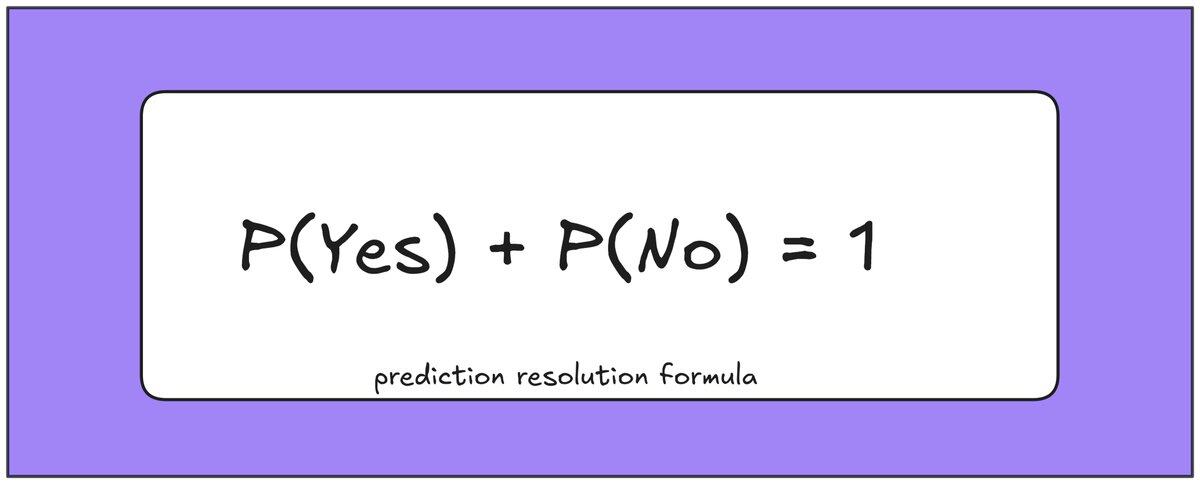

预测市场是交易未来事件结果的平台,其中价格代表概率。如果市场上“是”的交易价格为 0.65,则意味着该事件发生的可能性为 65%;“否”的交易价格为 0.35。

当事件最终确定后,对应结果的市场价格可能涨至 1 美元,也可能归零。[ 0.65 + 0.35 = 1 ]

如果你是预测市场新人,建议你看一下预测市场是什么以及它是如何运作的:《预测市场的技术类型:机制与权衡》

我还写了关于语义陷阱的文章(预测问题的措辞不明确,如何定义某些事件是否发生),这些预测事件中的措辞比较棘手,如果不仔细阅读,还是会影响你的交易。

我们需要的是稳固的新利基市场和去中心化平台,而不是复制现有的预测市场模式。此外,每个新市场的出现都会有效率不足的问题,而低效率=套利。

我们需要更多高质量的市场,而不是更多的噪音。我个人看好的项目之一是Opinion,我在另一篇文章中分享了原因。

我的套利策略

本文中,我将把我熟悉的预测市场主要套利策略分为两个层面进行详解:

易于理解:这样你就能“直观理解”而无需太多数学运算。

技术证明:这样你就知道这些数字实际上是相符的。

1. 跨市场套利

当两个平台对同一事件的价格设定不同时,就可以应用这种套利模式。你在Yes价格较低的平台买入“Yes”,而在“Yes”定价过高的平台买入“No”进行对冲。这样,无论结果如何,你都能赚取差价。

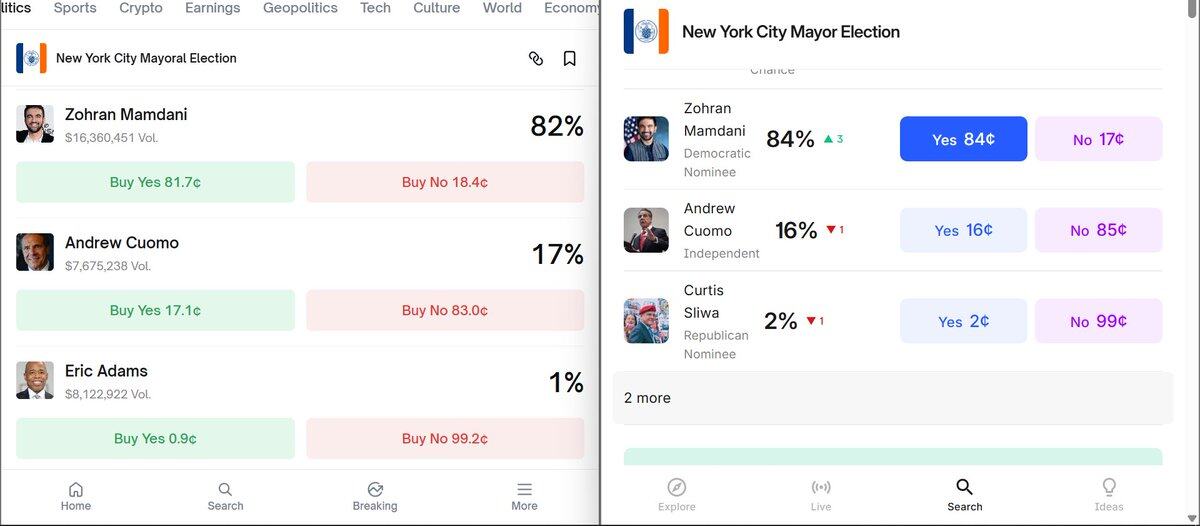

以纽约市市长选举市场为例:

在 Polymarket 上,Andrew Cuomo“Yes”的交易价格为 17.1 美分,“No”的交易价格为 83 美分。

在Kalshi上,同一市场上“Yes”的价格为 16美分,“No”的价格为 85美分。

如果你在 Kalshi 上买入“Yes”,并在 Polymarket 上买入“No”对冲:

Yes(B)+No(A)= 0.16 + 0.83 = 0.99美元

这意味着你可以花费 99 美元来确保得到100美元,即 1% 的无风险利润。

注意:你可能会觉得1%的利润太低,但不要被表象所迷惑。在套利交易中,即使微小的差价,经过重复或扩大规模,也能累积成可观的收益。

有时,定价错误会更严重。流动性较低、受关注度驱动的市场或多结果市场很容易产生5%至10%以上的价差,这些是你需要关注的。

2. 时间套利(早买与晚买)

有些市场炒作得太早,尤其是政治类预测,比如某位候选人在辩论前定价过高。随着时间的推移和现实事件,价格肯定会降低,即使幅度不大。如果你在正确的时间买入或对冲,你就可以从这种“重新定价”中获利。

这在选举市场中非常常见。例如,假设在六月,炒作将候选人A的胜算推至70%,到九月,其胜算可能会降至50%-60%之间。

所以,如果你在炒作达到顶峰时买入“No”,那你就是在赚钱。秘诀在于,要知道早期价格往往会夸大现实,如果价格过早被高估,这一点就会非常明显。

技术策略:

假设你以0.3的价格买入“No”。随后,“Yes”价格跌至0.5。

对冲:以0.5的价格卖出,锁定50美元。

如果你的交易规模足够大,你就可以锁定0.30到0.50之间的无风险利差。这本质上是在预测市场中进行均值回归交易。这就像你买入一支被过度炒作的股票,知道它肯定会重新定价。

3. 事件处理套利

有时,某些平台的处理速度(或处理方式)会比其他平台更快(或不同)。如果你在其他市场更新之前就知道某个市场将如何结算,你就可以提前交易。

示例:

Polymarket上“SpaceX会在9月前发射吗?”的预测在火箭发射后处理得很快,但Kalshi的订单簿仍然滞后。在Kalshi更新之前,你可以以较低的价格购买“是”的选项。

这是延迟套利,你是在利用信息差下注,因此,如果你持续关注实时信息源(例如,选举结果、法院裁决、体育赛事),你就能轻松领先于速度较慢的平台。

4. 流动性套利

订单簿稀少或突然炒作都可能扭曲价格。如果几笔大额交易涌入,它们可能会使赔率至少暂时远离实际情况。

比如某个事件因大额交易突然上涨而偏离实际情况,你就可以买入No,在矫正至实际情况后平掉仓位并获利。

5. 语义/预言机套利

这个有点狡猾,如果你读过我关于语义陷阱的文章,你就会明白我的意思以及如何发现它们。这涉及预言机的解读与交易员的感知。如果你能预测或完全理解预言机的解析方式,就能利用错误定价的赔率。少一些数学知识,多一些规则/文本套利。

事实是现阶段预测市场机制并非完美高效,市场中总是存在着微小的差距,你的任务就是发现它们,利用它们,然后让复利发挥作用。

5% 的差异复利 20 次会增长 2.65 倍。

10% 的差异复利 20 次会增长 6.7 倍。

套利工具

如果你足够敏锐和耐心,上述大多数策略都可以手动完成。但这个领域正在快速发展,新的工具层出不穷,推荐两个比较适合的套利工具:

1、dk推出的一款能够研究市场、扫描波动性甚至发现套利机会的代理,由Kalshi提供支持。目前已面向私人 Beta 测试用户开放,可以通过邮箱加入候补名单,通过后即可注册账户。

2、ArbX:一款付费工具,可以发现 Kalshi 和 Polymarket 等平台上同一事件的价差。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。