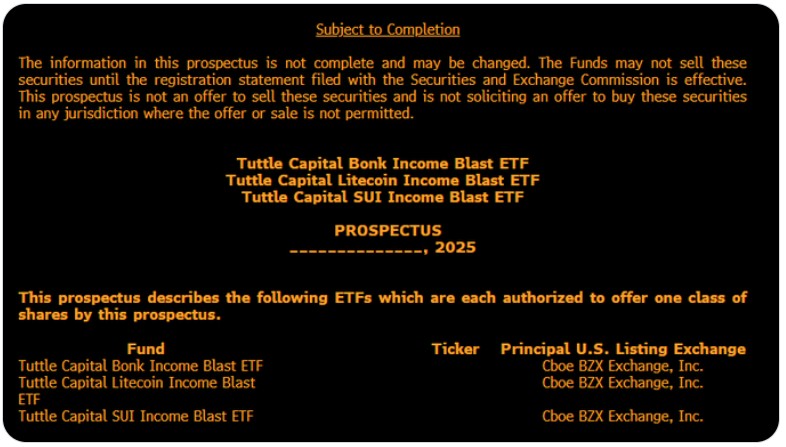

Tuttle Capital adds Litecoin and SUI ETFs to Income Blast lineup

Tuttle Capital has filed for a new fund called the Bonk Income Blast ETF. This news follows other recent ETFs moves tied to meme coins and Altcoins. Tuttle Capital’s step could add another option for investors who want a meme coin or altcoin ETFs without buying tokens directly.

Source : X

It sits alongside two sibling filings reported today: Litecoin Income Blast ETF and SUI Income Blast ETF. The news of SEC Exchange Traded Fund filing always gives a kick surge in crypto tokens.

Market Reaction

After news of Tuttle Capital’s Bonk Income Blast ETF filing, social posts and traders talked about the token more. Bloomberg analyst Eric Balchunas posted on his social media stating “Blast treatment” for altcoins.

These type of action can move prices, even if the SEC has not yet approved them. Investors often buy tokens in the hope that a fund will make token demand rise. That pattern has happened before with other spot Bonk & meme coin ETFs filing.

Source : Eric Balchunas

This filing is not alone. Other issuers, like REX Advisers and Osprey Funds have also filed funds tied to meme coins including this token. Those earlier filings showed asset managers testing whether U.S. regulators will allow more crypto funds. The market has watched these filings closely because they could mean mainstream access to meme coins through regulated funds.

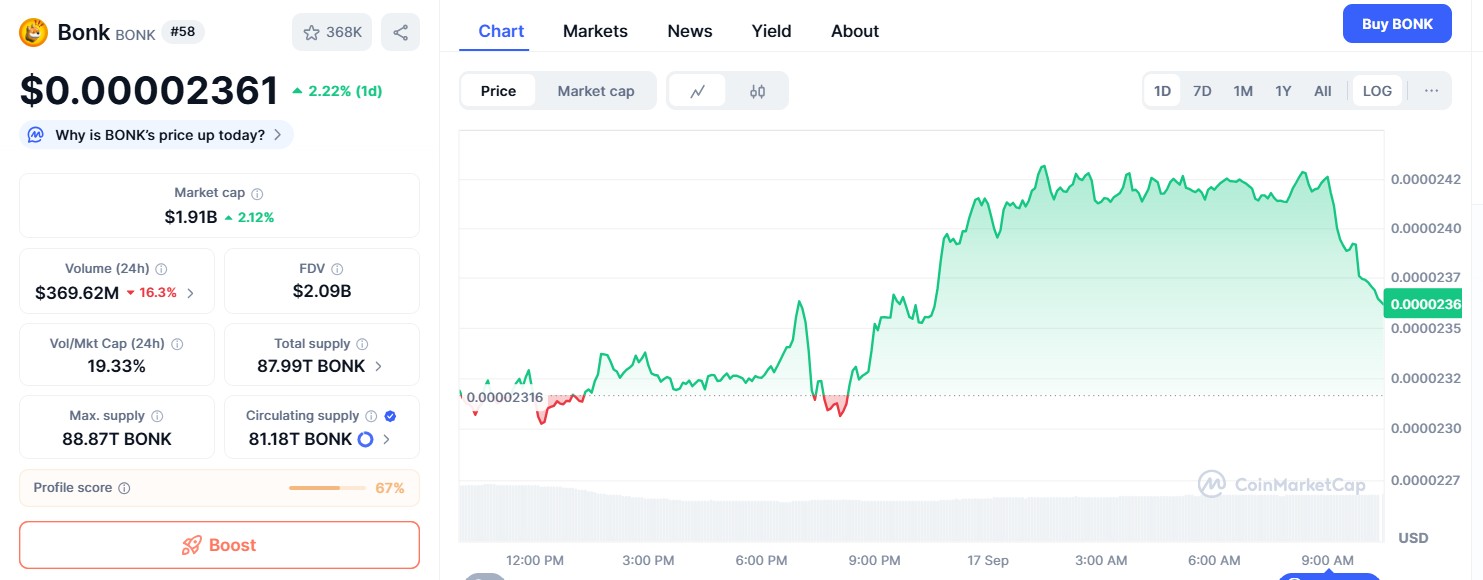

Bonk Coin Price Surged

The coin is trading very low per coin but with large supply and market activity. The live price today is about $0.00002361 as per CoinMarketCap data. The token gained a 2.22% of price surge in the past 24 hours.

Source : Coinmarketcap

Short-term price moves can be sharp after filings like this. If this idea gains momentum, we could see higher demand and short-term price lifts. But if regulators or markets react negatively, the token could fall back.

A conservative view: expect volatility, possible spikes on good news, and falls on wider market stress. Always use small size and risk control for memecoin investing.

How these ETF filings can affect BONK

-

More visibility: A Tuttle Capital Exchange Traded Fund launch would put token in front of mainstream investors.

-

Potential demand: Funds buying coin to back shares could push prices up, at least temporarily.

-

Regulatory test: Approval or rejection will shape future memecoin investing.

-

Competition: Other filings (REX, Osprey, and others) create a crowded field. That can help or hurt prices depending on which funds win approval first.

Tuttle Capital’s filing for a Bonk Income Blast ETF adds another chapter to the story of memecoin and U.S. spot crypto innovation. It brings attention and possible short-term demand for coins. Keep expectations low, manage risk, and watch for official SEC updates and fund prospectuses before acting.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。