Original|Odaily Planet Daily (@OdailyChina)

As the official L2 network under Coinbase, Base has previously claimed multiple times that it would not issue a token. However, times have changed, and Base is now showing signs of action.

On the evening of September 15, Jesse Pollak, the head of the Base protocol, stated at BaseCamp, "Base is exploring the issuance of a network token." Subsequently, Base officially released a statement: "We are still in the early stages of exploration, and there is currently no specific information to share regarding timing, design, or governance. We are committed to working with the community and building openly." Coinbase CEO Brian Armstrong later confirmed this news, stating, "This could be a powerful tool to accelerate decentralization and expand the growth of creators and developers within the ecosystem."

Odaily Planet Daily will briefly analyze the internal and external motivations, interaction references, and market capitalization scale of Base's token issuance in this article.

Base Breaks Its Promise Due to Changing Times

In August 2023, Base officially launched its mainnet and rapidly developed in a short period. According to Dune data, as of September 13, 2025, the total number of addresses on the Base network reached 245 million; protocol revenue reached $157 million; on September 15, the average number of active addresses on the Base network over the past seven days exceeded 1.018 million; on June 19 of this year, the number of active addresses on Base approached 3.6 million in a single day, with the weekly active address count reaching 14.9 million.

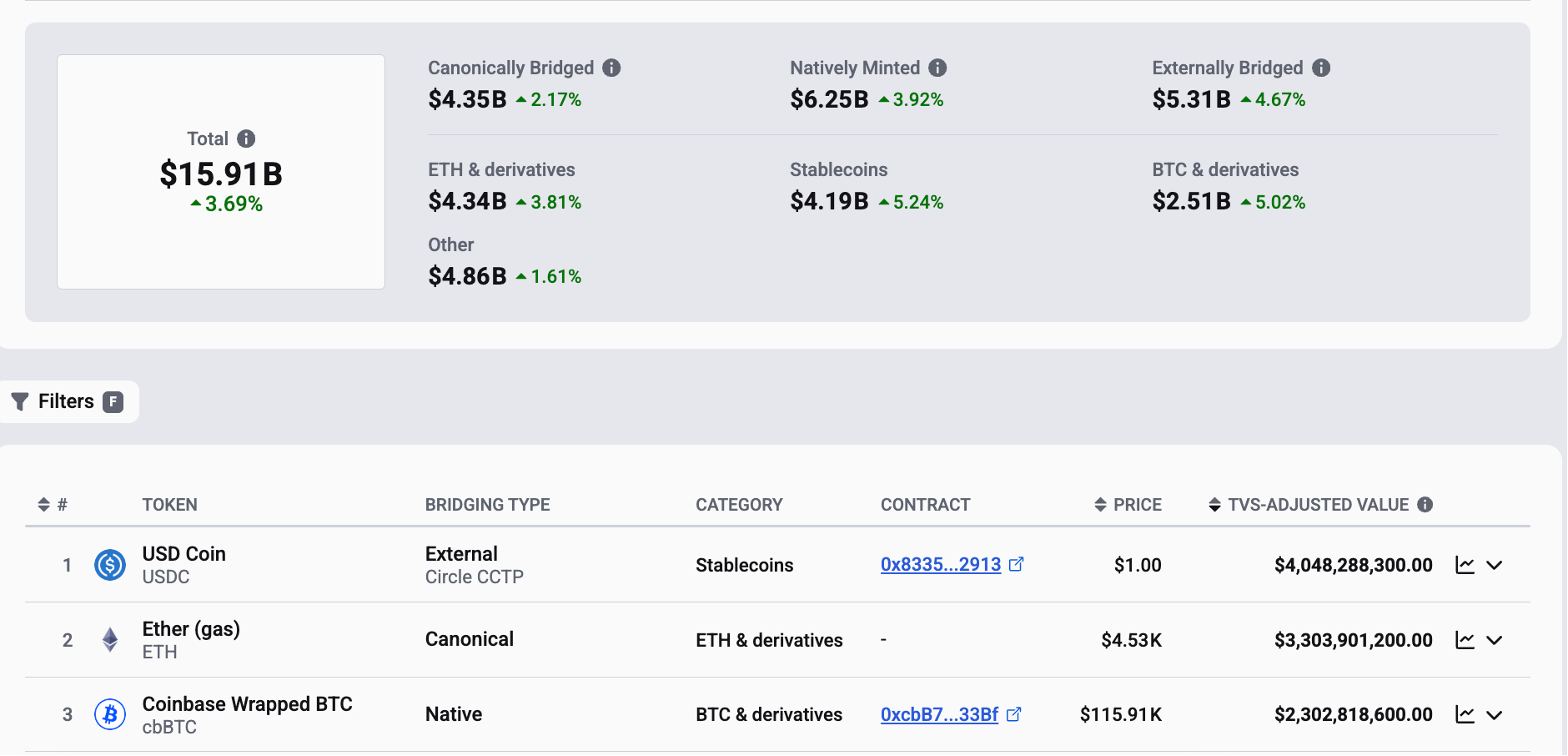

Additionally, Base's TVL (Total Value Locked) is also among the top in L2 networks. According to L2 Beat data, as of September 16, the TVL of the Base ecosystem was $15.91 billion (second only to Arbitrum's TVL of $20.11 billion). Among these, the bridging funds amounted to $4.35 billion, native minting funds reached $6.25 billion, and external bridging funds totaled $5.31 billion. The top three tokens by market capitalization in the Base network are:

- Stablecoin USDC with a market cap of $4.048 billion;

- ETH with a market cap of $3.303 billion;

- cbBTC with a market cap of $2.302 billion.

L2 Beat Data

Despite the impressive data, the Base ecosystem is far from a stage where it can rest easy. It is not an exaggeration to say that the current Base ecosystem faces both internal and external challenges.

Internal Concerns of the Base Ecosystem: Overstated Trading Volume and TVL Outflow

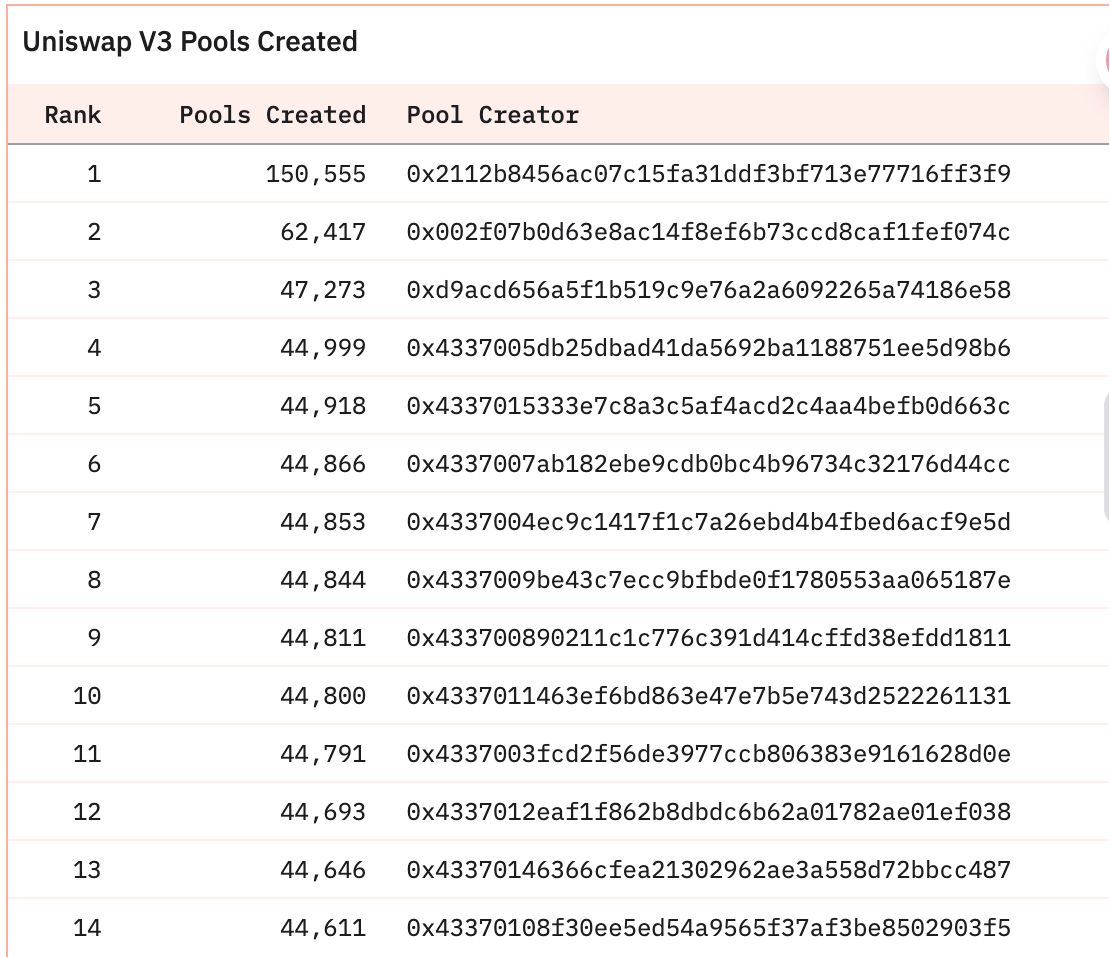

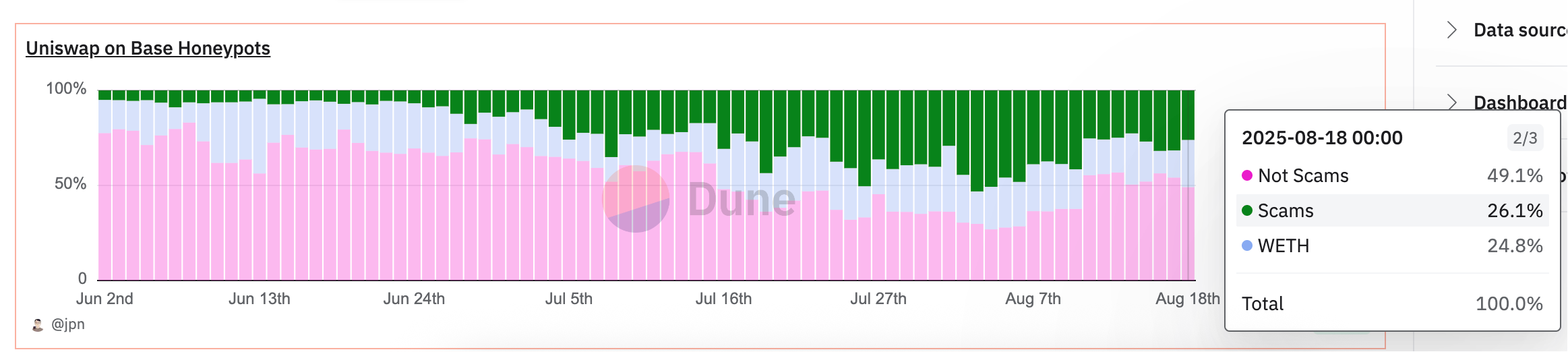

During last year's meme coin craze in the Base ecosystem, on-chain analyst @jpnmemelord revealed that 65%-80% of the trading volume on Uniswap in the Base ecosystem came from rug funds; according to Dune data, the Uniswap V3 liquidity pools in the Base ecosystem are controlled by a small number of addresses, with over 150,000 addresses creating liquidity pools, highly correlated with meme coins. Another Dune panel created by @jpnmemelord shows that as of August 18 this year, 26.1% of contract addresses in the Base ecosystem were associated with scams.

Moreover, data shows that the outflow of funds from the Base network over the past three quarters reached $4.6 billion, with a total outflow of $5.7 billion for the year. The increase in TVL is accompanied by a significant amount of funds flowing back to the Ethereum mainnet ecosystem.

External Challenges for the Base Ecosystem: Resurgence of Exchange Public Chain Wars

As an Ethereum L2 network under Coinbase, Base still faces intense external competition:

On one hand, there is the rapid development of exchange public chains such as Binance's BNB Chain, OKX's X Layer, and Kraken's Ink;

On the other hand, there is the "growing pains" of ecosystem development brought about by the collapse of the Ethereum L2 narrative, with many L2 networks entering a "financing-token issuance-ecosystem decline" death spiral, which serves as a cautionary tale for Base's development.

Additionally, the Onchain Summer concept that Base has been promoting has struggled to attract more users. SocialFi and creator economy platforms like Friend.tech, Farcaster, and Zora have mostly faded from the mainstream market after experiencing a brief surge.

Macro Positive Stimulus: U.S. Crypto-Friendly Regulatory Policies

With the U.S. government shifting to a "crypto-friendly government" since Trump took office, the SEC and CFTC opening the U.S. market to overseas crypto exchanges, lifting restrictions on derivatives trading, and the SEC launching "Project Crypto," the previous restrictions on Base issuing a native token are gradually loosening. It can be said that the intense external competition and favorable regulatory conditions require Base to respond to the crisis more proactively and seek new breakthroughs. Consequently, the Base team has shifted from a previously conservative stance to actively embracing a native crypto development path and preparing to issue an ecosystem native token.

Furthermore, according to Jesse Pollak, the head of the Base protocol, he stated that "Base will launch a new bridge connecting Base and Solana, aimed at allowing users to seamlessly use SOL, ERC-20s, and SPL tokens between Base and Solana, achieving:

- Depositing and using SOL in any Base application;

- Importing any Solana token into Base applications;

- Users can export the Base tokens they create to the Solana ecosystem."

This also means a full integration of the Base ecosystem with the Solana ecosystem, becoming another crypto hub outside of the Ethereum ecosystem.

Interaction Reference Guide Before Base Issues Tokens: On-Chain Transactions, Onchain Score, Base Name

Currently, the specific timing for Base's token issuance has not been determined, with estimates suggesting it could be as early as the end of this year or as late as the first half of next year or even longer. Therefore, for users who have not deeply participated in the construction of the Base ecosystem, although the official has not specified a concrete token airdrop plan, there is still certain interaction value. Currently, it may be possible to engage in the following three aspects:

1. Participate in On-Chain Transactions and Interactions

Main platform: https://zora.co/

As a strongly supported on-chain trading platform within the Base ecosystem, Zora currently integrates various functions such as token creation, NFT trading, referral commissions, and creator token trading.

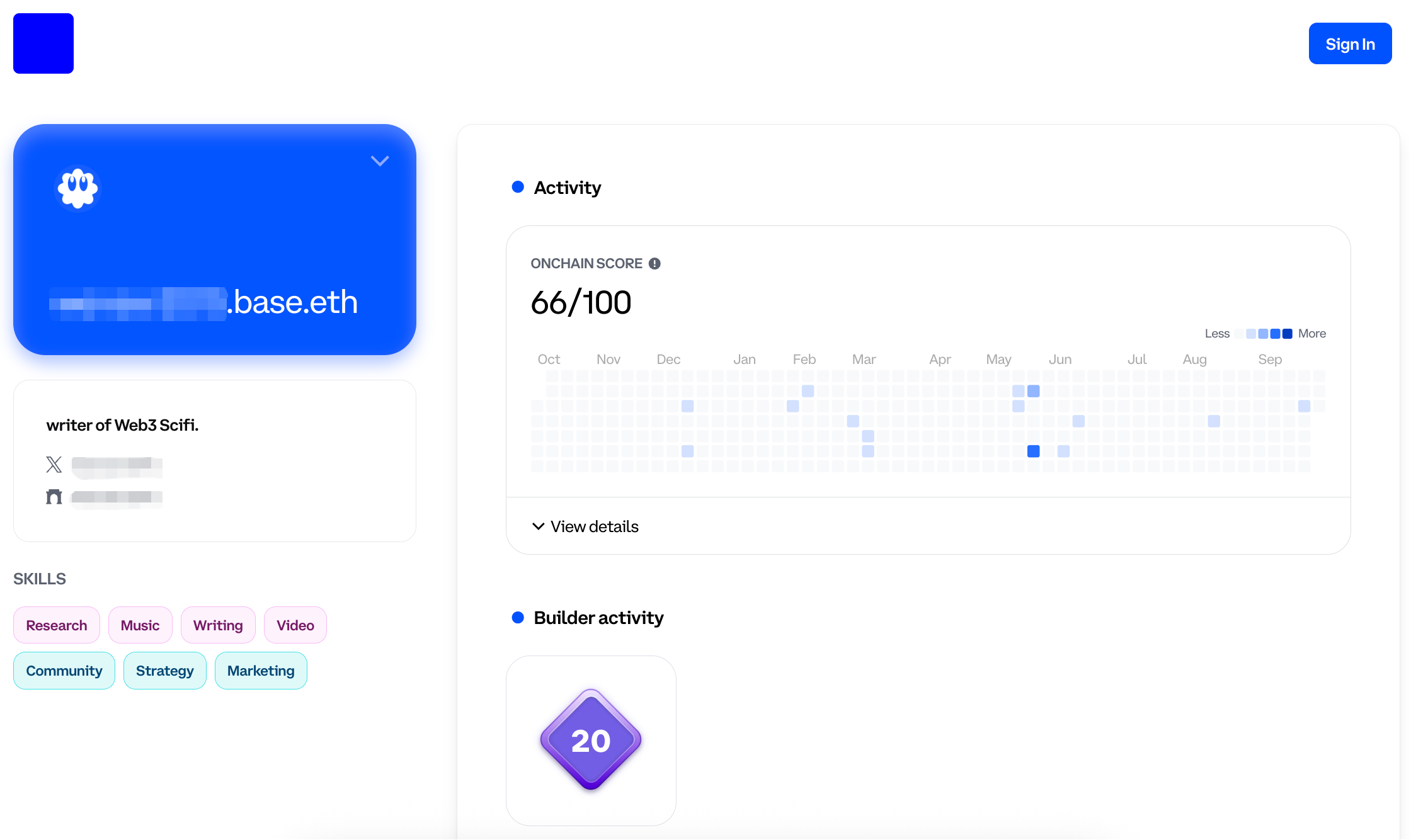

2. Onchain Score Query

Reference platform: https://www.onchainscore.xyz/

According to a post by @Crypto_Pranjal, this website was launched by Coinbase CEO Brian Armstrong in August 2024, allowing users to check the "on-chain score" corresponding to their wallet address based on the information on the site, thereby assessing their participation activity in the Base ecosystem.

The main assessment criteria include total trading volume, unique usage days, longest consecutive usage days on Base, swaps, bridging, lending and borrowing, and deployed smart contracts.

3. Base Name (ENS Subdomain)

Registration platform: base.org/names

In addition to the above two methods, as a loyal supporter of the Ethereum ecosystem, Base previously launched ENS-based subdomains xxx.base.eth. Users can register corresponding domain names to view address-related information and participate in corresponding activities.

In addition, the DEX Aerodrome and the SocialFi application Farcaster in the Base ecosystem are also worth interacting with and using as platform tools.

Market Capitalization and Future Outlook for Base Token

Finally, regarding the potential market size of the upcoming Base token, the current representative views in the market are as follows:

Nick Tomaino, Founder of 1confirmation: If Managed Properly, BASE Could Become a Top Five Token by Market Cap

Nick Tomaino, founder of 1confirmation (Note from Odaily Planet Daily: It is worth mentioning that he is also an early member of Coinbase and previously participated in Coinbase's business development) stated, if Base issues its token correctly, it is expected to immediately rank among the top five by market cap.

He suggested avoiding VC participation and insider trading, and instead distributing tokens through transparent airdrops to developers and users, based on actual usage. Tomaino stated that Base is the most successful tokenless blockchain in history, and the airdrop will become a strong driving force for its development.

Jia Yueting: If Base Issues a Token, It Could Change the Way Cryptocurrency and Traditional Capital Work Together

Faraday Future founder Jia Yueting stated, if Base launches a token, it could change the way cryptocurrency and traditional capital collaborate. With token support, Base may become the first secure bridge connecting publicly listed companies and crypto assets, a strategy that all major banks could emulate. As an asset class, cryptocurrency could shift from being a "risk bet" to a "core business asset."

In terms of capital flow, if this model proves successful, trillions of dollars will flow into cryptocurrency, and the valuation narrative for the entire L2 and blockchain space will be rewritten. Regulation may become the final hurdle, but this is not just related to fintech; it also involves Wall Street.

Conclusion: With Base Token Issuance, Coinbase Will Be the Biggest Winner

There is no doubt that with the issuance of the Base token, the ultimate and biggest winner will still be Coinbase behind it.

On one hand, Coinbase can gain more protocol revenue, further enriching its business cash flow; on the other hand, Coinbase can leverage the Base ecosystem to expand more application scenarios, deepening its penetration into mainstream audiences while enhancing its market share, providing a solid foundation for user growth and liquidity growth. Moreover, Coinbase can also use the Base token and Circle's stablecoin USDC to create a perfect ecological closed loop, achieving a "deep integration of traditional finance and decentralized finance," providing diversified channels and entry points for traditional financial markets to deeply participate in cryptocurrency and tokenized stock trading.

A "new crypto golden age" belonging to the United States is one that Base does not want to miss.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。