Gold has been hitting new highs, while digital gold #BTC seems to have stalled, but the US stock market is still soaring. This recent trend is indeed a bit perplexing!

With the upcoming interest rate cuts, will it be beneficial for gold (safe-haven asset) or for US stocks and #BTC (risk assets)? Today, let's discuss this using historical data!

As someone who has long been in the financial industry and has endured countless market beatings as a veteran in US stocks and crypto, I often get asked: Is an interest rate cut good or bad?

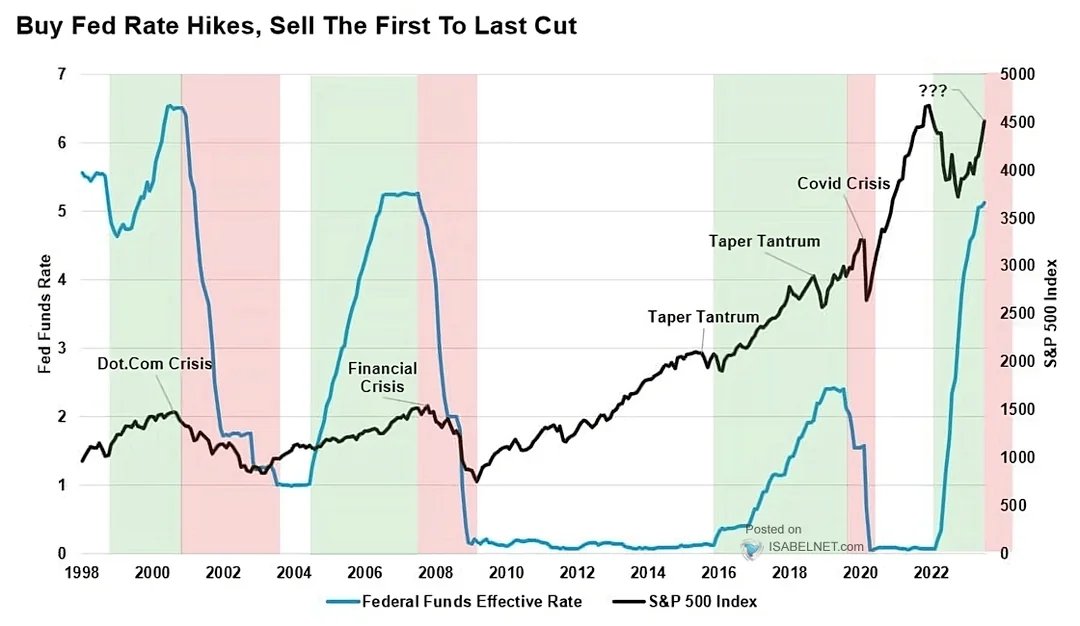

Take a look at the chart below (showing the Federal Reserve's interest rates and the S&P 500 index from 1998 to now). The blue line represents the Federal Funds Rate, and the black line represents the S&P 500 index. The green background indicates a rate hike cycle, while the red background indicates a rate cut cycle.

At first glance, from an intuitive perspective, you might think that "cutting rates" is a big positive because money becomes cheaper, financing costs decrease, and both businesses and consumers find it easier to borrow money for consumption and investment, which stimulates the economy. However, history tells us that the starting point of rate cuts is often a selling point for the stock market.

📌 Why?

Because the Federal Reserve only rushes to cut rates when it believes the economy is about to face problems. For example:

• In 2001, when the internet bubble burst, the Federal Reserve cut rates significantly, and as a result, the stock market fell sharply;

• In 2007, during the financial crisis, the Federal Reserve cut rates, and the stock market couldn't hold up, crashing directly;

• In 2019, amid the US-China trade war and economic slowdown, compounded by the pandemic in 2020, the Federal Reserve began cutting rates, and the stock market first fell before rebounding.

So, a rate cut itself is not "good news," but rather a signal of economic risk. When the market sees a rate cut, it worries whether the economy is heading for a recession and whether corporate profits will decline, leading to a withdrawal of funds. As the saying goes, investments are based on expectations; before the rate cut, everyone expects the benefits of a rate cut, but when the cut actually happens, it may raise concerns about the probability of a recession.

📌 But note another point:

Historically, the best buying points for US stocks are often not at the beginning of rate cuts, but rather when the cuts are nearing their end. For example:

• In 2003, 2009, and 2020, after a full round of rate cuts, the economy hit bottom, corporate profits recovered, and the stock market entered a bull market. Simply put: early in the rate cut → market panic; late in the rate cut → market recovery.

Recently, Trump has been boasting about an unexpected rate cut; if it exceeds expectations, it could be by 50 basis points. Although the probability is currently low, if it exceeds expectations, market dynamics may differ from what we anticipate, especially since the market has already priced in a potential benefit of 25 basis points, while 50 basis points remains uncertain.

Overall, early rate cuts are not considered good news; they indicate potential economic problems. However, if corporate profits can hold up, the stock market may not necessarily crash (similar to the first rate cut in September 2024, when corporate profits were still quite good, and valuations were not considered expensive, with Google still under a 20x PE). But today is different; valuations are high, and whether they can hold up is another matter. In fact, the market is currently divided into three groups: one group is trading on the expectation of rate cut benefits; another group is trading on recession fears; and the last group is watching and waiting for the dust to settle. So, which group do you belong to? Let’s see in the comments! 🧐

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。