Michael Saylor’s Strategy (Nasdaq: MSTR) just announced another 525 bitcoin ( BTC) purchase on Monday, bringing the firm’s stash to 638,985 BTC, but MSTR’s mNAV dipped to 1.47. And now, one of Standard Chartered Bank’s research divisions says lower mNAVs are dogging digital asset treasury companies (DATs) and stalling “fresh buying,” which may explain why bitcoin’s recent rally appears to have taken a breather.

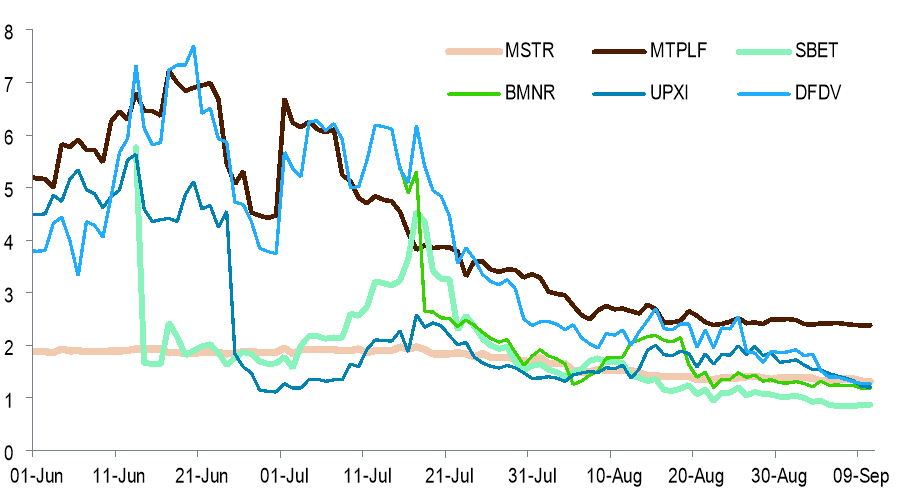

(Chart showing the ratio of enterprise value to crypto holdings for selected DATs such as MSTR / Standard Chartered Research)

In the world of DATs, mNAV simply refers to a company’s enterprise value in relation to the dollar amount of its bitcoin holdings. There was a time when bitcoin DATs like Strategy enjoyed mNAVs as high as 3.00, meaning MSTR was valued at three times the market value of its BTC reserve.

But now, with hundreds of companies jumping onto the DAT bandwagon, those mNAVs are whittling down to the 1.00 level, and Standard Chartered says at that threshold, it will be difficult for DATs to continue buying more bitcoin.

“Digital asset treasuries (DATs) have struggled recently. Share prices have fallen on the back of lower mNAVs,” said Geoffrey Kendrick, head of digital assets research at Standard Chartered bank in a Monday newsletter. “A higher mNAV means a business is more sustainable, and means more coins can, and will, be purchased. A lower mNAV means the opposite.”

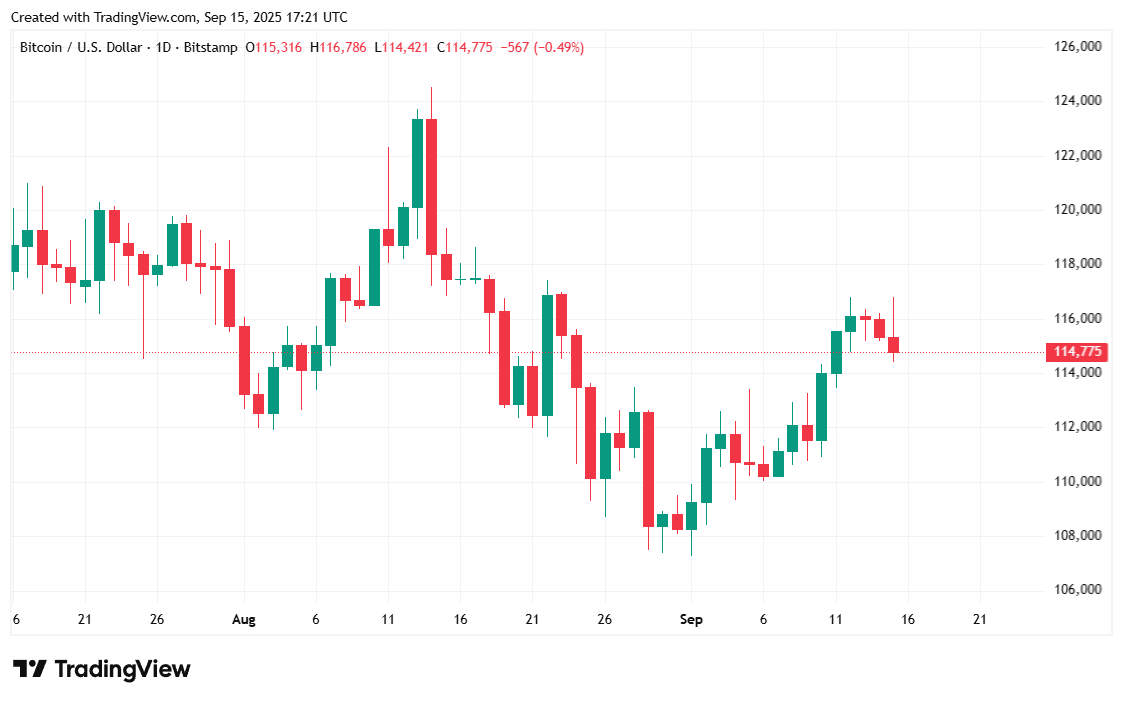

Bitcoin was priced at $114,883.07 at the time of reporting, mostly flat but down slightly by 0.56% over 24 hours according to Coinmarketcap. The digital asset has traded between $114,461.06 and $116,747.88 since Sunday.

( Bitcoin price / Trading View)

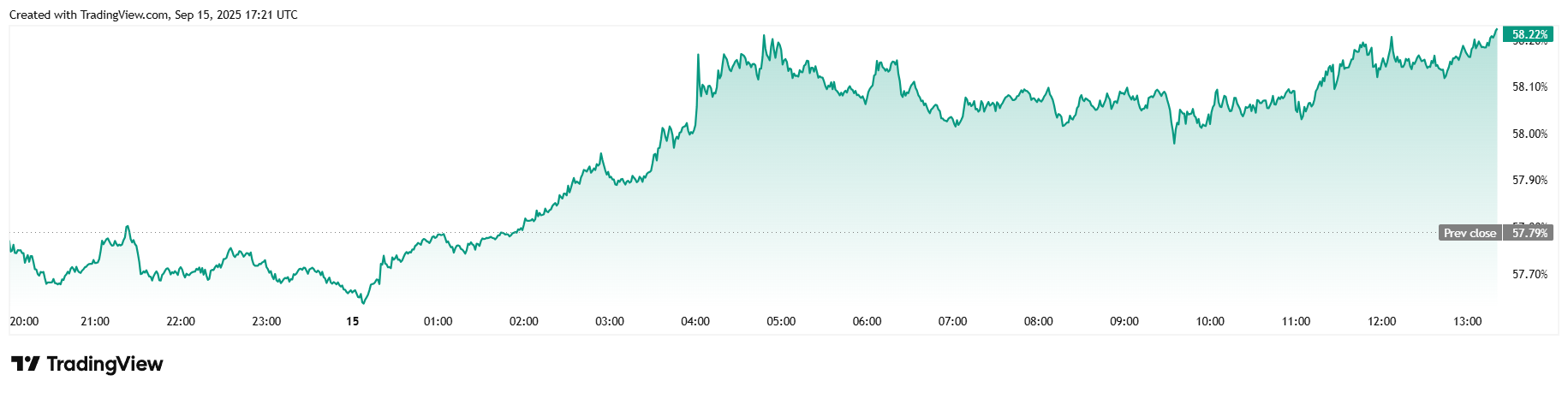

Twenty-four-hour trading volume climbed 55.56% to $49.79 billion after the weekend, an expected post-Sunday jump. Market capitalization was relatively flat, dipping 0.56% in tandem with price to reach $2.28 trillion. Bitcoin dominance, however, saw a 0.73% uptick since yesterday, inching up to 58.22%.

( BTC dominance / Trading View)

Total bitcoin futures open interest was also mostly unchanged over 24 hours, down slightly by 0.22% at $83.12 billion according to Coinglass. Bitcoin liquidations were sitting at a grand total of $45.92 million, with long liquidations contributing $35.22 million to that figure while shorts made up the remaining $10.70 million.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。