On the 1-hour chart, XRP registered a sharp pullback to $2.962, followed by a rapid recovery into the $3.02 to $3.04 zone. Since then, price movement has entered a phase of lateral consolidation, characterized by alternating red and green candlesticks that signal indecision among market participants. A potential bullish divergence appears to be developing as price remains stable while volume begins to rise, suggesting a possible accumulation phase. However, the structure remains ambiguous and could also signify distribution, making volume confirmation critical for validating either scenario.

XRP/USD via Bitfinex on Sept. 15, 2025. 1-hour view.

The 4-hour chart reveals a broader, mild bearish trend, with XRP forming lower highs since peaking at $3.183. Resistance around $3.05 has proven durable, while support has emerged near $2.939 following a recent attempt to rebound. Volume activity is showing signs of accumulation at lower levels, hinting that bearish momentum may be weakening. A sustained hold above the $3.00 level could provide the springboard for a short-term rally toward the $3.08 or $3.15 resistance zones. Traders are advised to monitor for any breakdown below $2.95, which would undermine the recovery outlook.

XRP/USD via Bitfinex on Sept. 15, 2025. 4-hour view.

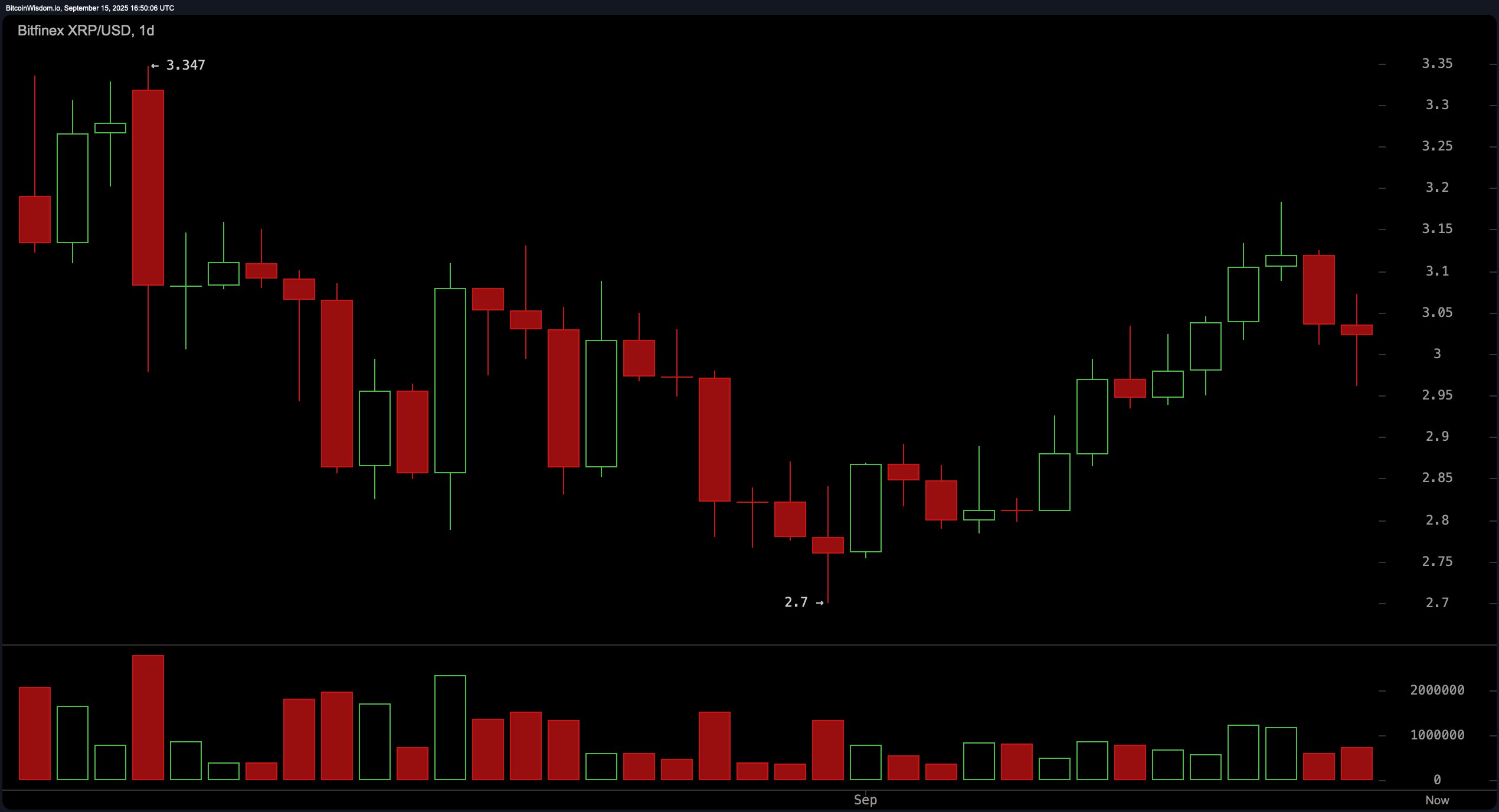

The daily chart points to a retracement from a recent peak of $3.347 to a local bottom near $2.70. Price action has since entered a consolidation phase following a minor upward move. Selling pressure appears to be weakening, as evidenced by declining volume on red candles. Strong horizontal support remains intact at $2.70, while resistance forms in a broad band between $3.15 and $3.35. For swing traders, the $2.80 to $2.95 range could present favorable entries on a retest, with a tight stop-loss positioned below $2.70 to guard against further downside.

XRP/USD via Bitfinex on Sept. 15, 2025. Daily view.

In the category of oscillators, technical signals remain largely neutral. The relative strength index (RSI) reads 53.24, indicating balance between buying and selling pressure. The Stochastic oscillator is at 71.77, the commodity channel index (CCI) sits at 64.31, and the average directional index (ADX) stands at 17.36, each reflecting a lack of clear momentum. The Awesome oscillator prints a value of 0.09072, further reinforcing the neutral tone. However, the momentum indicator has turned slightly bearish at 0.20148, while the moving average convergence divergence (MACD) level of 0.02158 signals a subtle bullish crossover.

Moving averages (MAs) continue to support a bullish structure across all major timeframes. The 10-period exponential moving average (EMA) at $3.00019 and 10-period simple moving average (SMA) at $2.99021 both support short-term upward movement. The 20-period EMA at $2.97107 and 30-period EMA at $2.96671 extend this bias. Medium- to long-term indicators confirm sustained bullishness, with the 50-period EMA at $2.94117 and SMA at $3.00379 maintaining elevated levels. The 100-period EMA and SMA at $2.81354 and $2.77262, along with the 200-period EMA and SMA at $2.56543 and $2.51125, collectively reinforce a strong technical floor well below the current price.

Bull Verdict:

XRP’s current consolidation near $3.02, supported by a full suite of bullish moving averages and weakening sell-side volume, points to a potential breakout scenario if the price can reclaim $3.05 with conviction. While momentum remains mixed, the underlying technical structure favors accumulation over distribution, giving bulls a cautiously optimistic edge in the short term.

Bear Verdict:

Despite stable pricing and positive moving averages, XRP’s inability to break above resistance at $3.05, coupled with neutral oscillator readings and fading momentum, raises concern over upside sustainability. A close below $2.95 would invalidate the current base and potentially trigger a deeper pullback, suggesting bears are still well positioned if buying volume fails to materialize.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。