手续费的过山车体验

在链上世界里,许多用户都经历过这样的瞬间:昨天只花了几分钱完成转账,今天同样的操作却要付上几美元。手续费像一辆情绪化的过山车,常常让人不知所措。过去几年,稳定币正是在这样的环境中成长为最受关注的资产类别之一——它们承担着结算、支付、储值等基础功能,是 DeFi 的血液,也是外部资金进入加密世界的重要入口,市值规模和用户渗透率已经使它们具备无可替代的地位。然而热闹背后同样暗藏脆弱:许多项目在起步阶段依赖补贴和叙事聚拢人气,一旦市场环境转凉,补贴难以为继,模式的弱点便不可避免地暴露出来。最明显的就是手续费的波动,不仅让用户心生挫败,也让开发者难以建立稳健的商业模型,更无法准确预估终端用户的付费意愿。

那么问题出在哪儿、路又怎么走?

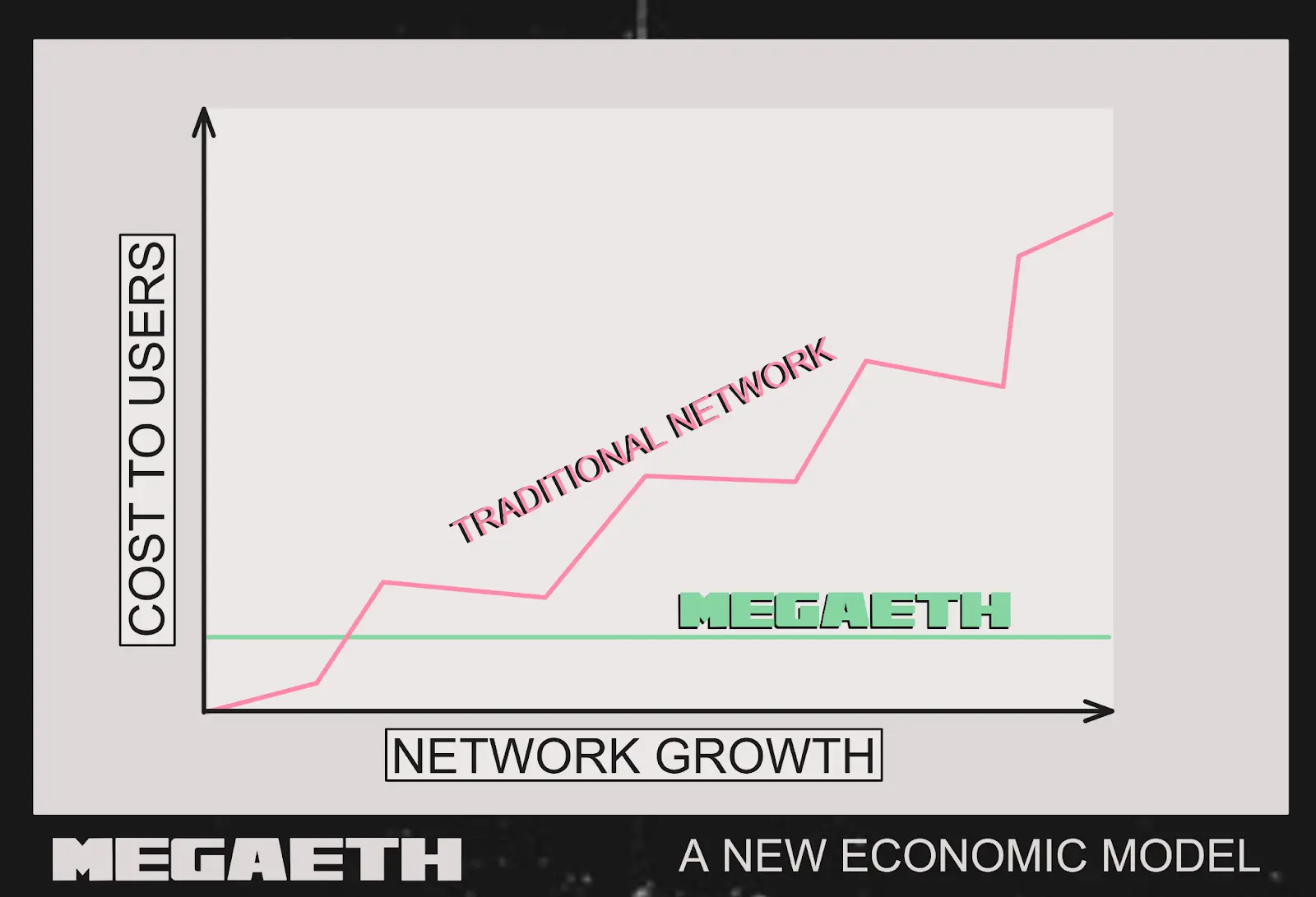

现在的错位很明显:稳定币把储备放到链下的美债、货币基金里稳稳赚利息;可区块链要花的是真金白银,集中在链上的排序器、节点、数据结算等日常运维。赚钱在链下,花钱在链上,中间没通道。结果很多网络只好在手续费上加价来“养活自己”,可用户和开发者又需要低费环境,这就形成了剪刀差。以太坊主网数据成本越来越低,“加价空间”也被挤压:涨价伤体验,不涨又难维持运营,迟早走不长。

一个更直接的思路是:把稳定币储备赚到的利息,当成网络的“水电费”。用户存入美元铸稳定币,资金去买安全、流动性强的资产,定期产出可审计的利息;这笔利息不留在发行方,而是直接支付排序器和节点成本。这样网络不必靠加价,手续费有望贴近真实成本,带来稳定的低费体验。低费→更多交易和应用→储备变大→利息更多→网络更稳,形成正循环。它的优势在于:路径透明、可持续(只要有储备就有利息)、体验更好,高频小额场景如社交消息、游戏内经济、微支付才真正有机会跑起来。

落地实践:从理论到现实的第一步

这种想法并不仅停留在书面上。近期,MegaETH 与 Ethena 联手推出了 USDm,尝试实际运行这条新路径。MegaETH 背景实力雄厚,获得了 Vitalik、DragonFly 等顶级个人与机构的支持,定位为"实时区块链",技术上能做到 10 毫秒延迟、10 万 TPS 的超高性能,交易几乎即时确认。但光有性能还不够,低廉的网络费用才是应用大规模增长的关键。就像 Memecoin 虽然诞生在以太坊,但最终在 Solana 生态爆发一样,便宜的手续费往往决定了应用的成败。

在具体操作上,USDm 由 Ethena 的稳定币基础设施发行,储备主要投资黑石的代币化美债基金 BUIDL,同时保留部分流动性稳定币作为赎回缓冲。BUIDL 是个透明、合规的机构级投资标的,受托管与合规要求约束,能产生稳定收益。关键是这些收益不会躺在账上,而是通过编程化机制直接用来覆盖 MegaETH 排序器的运维成本。这样一来,网络就不需要靠"多收手续费"来生存,可以按成本价给用户定价,最终用户看到的就是分厘级、可预期的 Gas 费用。这彻底颠覆了传统模式:以前是"用户付得越多,网络赚得越多",现在变成了"网络增长越快,储备收益越多,费用反而越稳定"。

选择 Ethena 合作也有讲究。Ethena 是目前第三大美元稳定币发行方,管理着超过 130 亿美元资金,在 DeFi 圈子里用户基础很 solid。这种利益对齐机制真正实现了正循环:随着网络交易规模扩大,USDm 储备上升,利息回流更加充足,网络收入与生态增长第一次形成良性互动,不是依靠用户承担更多成本,而是让增长本身养活网络。结合 MegaETH 的实时性能和成本价手续费,这为开发者打造实时交互型应用提供了理想土壤。这种模式如果跑通了,手续费稳定在分厘级的环境就能让很多以前"想都不敢想"的高频应用变成现实,比如链上高频交易、实时游戏互动、微支付等场景。

Source: MegaETH

如何面对未来的挑战?

先看大环境。稳定币的利息多来自美债和货币基金,利率高时,利息够用,还能补贴网络费用;利率低了,利息变少,低手续费还能不能扛住,就是个硬问题。这种对外部利率的依赖本身有周期风险,需要提前设计“缓冲垫”。再看技术与规模:按理说交易越多,利息池越大,费用越有下降空间;但一遇到跨链、高频应用、生态扩张,机制更容易被拉扯出问题,稳定性要经得住。还有竞争这一关:USDT、USDC、DAI 都有稳固用户,新模式哪怕看起来更聪明,也需要时间做教育、把生态搭起来,才能赢得开发者和用户的信任。

说到底,手续费的大起大落,暴露的是“收入”和“开销”没对齐的老问题。靠补贴堆起来的热闹往往不长久。把利息直接用来“养网络”,是在探索更可持续的路:让稳定币不只负责支付结算,还能反哺网络。接下来真正的考验,是这套设计能不能同时在治理透明、长期可持续、和规模做大上过关。如果能,那些被高手续费压住的高频、便宜、好用的应用,才有机会真正走进日常。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。