一、引言

近日,BNB Chain迎来上线五周年,从最初被视为“以太坊仿盘”,成长为一个用户规模突破6亿、承载千万级日交易量、生态项目超过5000个的超级区块链网络。从最初依靠低手续费和高吞吐量快速吸引DeFi用户,到如今覆盖GameFi、NFT、RWA、社交、AI等多元赛道,BNB Chain完成了从追随者到生态巨头的转型。其背后,既有性能升级与安全机制的不断迭代,也离不开币安交易所的强力赋能。2025年初币安推出的 Web3钱包 与 Alpha平台,成为推动BNB Chain进入新一轮繁荣周期的关键引擎,将数百万原本停留在中心化平台的用户引流至链上,使BNB Chain的活跃地址数和交易量实现了跨越式增长。Alpha更是成为项目孵化与用户教育的重要场域,为BNB Chain注入源源不断的新鲜血液。

本文首先梳理BNB Chain五年来的发展历程,揭示其从DeFi爆发到生态多元化的演进路径;其次,结合链上数据与Ethereum、Solana、Base等竞品对比,全面呈现BNB Chain的生态全景与竞争格局;然后重点解析币安Alpha与Web3钱包如何推动生态繁荣,并探讨Meme、RWA、AI等新兴赛道的表现;最后,对BNB生态代表性代币进行潜力评估,并展望未来五年的机遇与挑战。通过这一全景式剖析,本文旨在帮助读者理解BNB Chain在行业格局中的独特地位,以及它在技术、合规与创新方面的长期价值展望。

二、BNB链这五年:从崛起到繁荣

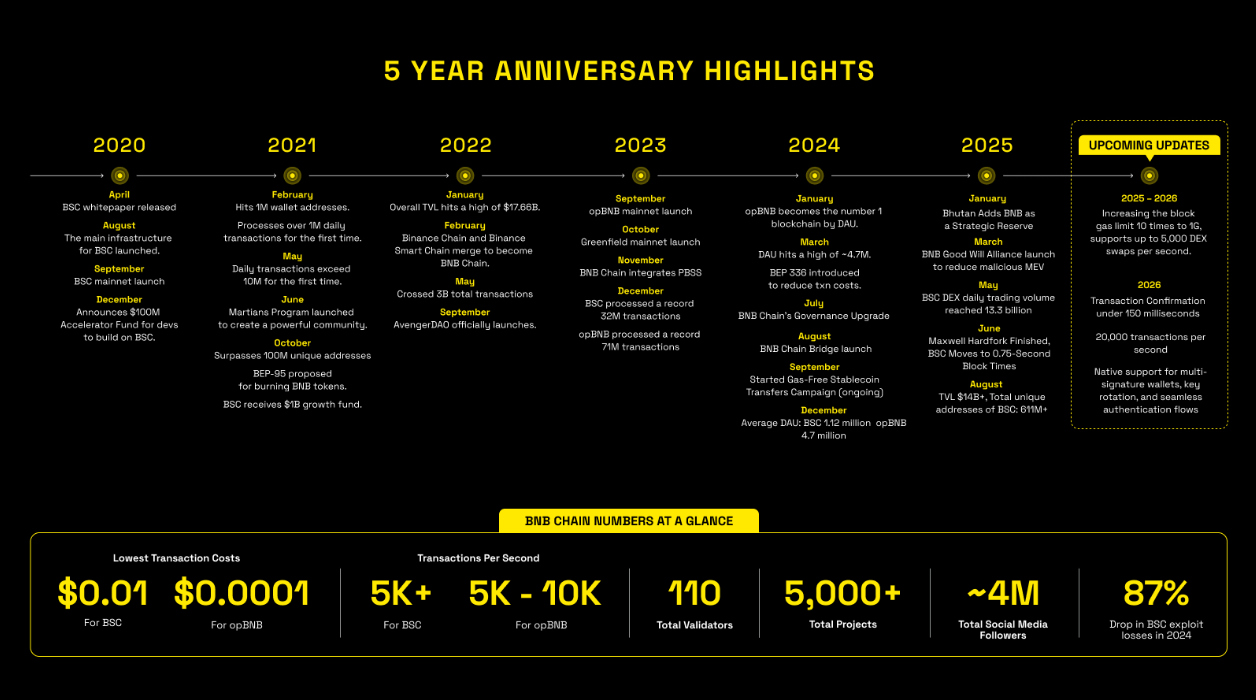

来源:https://www.bnbchain.org/en/blog/5-years-of-bnb-chain-accelerating-the-future-of-web3

1. 初期定位:低成本高性能的以太坊替代链。 2019年4月Binance推出了早期的Binance Chain(现称BNB Beacon Chain),主要用于BNB币的发行和去中心化交易所。但真正掀起BNB生态热潮的是2020年9月推出的Binance Smart Chain (BSC)。BSC从诞生之初就瞄准了解决以太坊拥堵昂贵的问题,采用Proof of Staked Authority (PoSA)共识,仅21个验证者,使其具备快速出块和低手续费的优势。彼时DeFi浪潮正劲,以太坊因Gas费高企阻碍了普通用户参与,而BSC提供了几乎百倍于太坊的性能和几美分的交易费,定位为“更快更便宜的以太坊”迅速获得市场青睐。

2. 2021年爆发:DeFi复制浪潮与用户激增。 2020年末至2021年初,DeFi“挖矿”热潮带动BSC生态迅猛起飞。BNB价格在2021年初随DeFi热度飙升,市场开始将其重新估值为主流公链代币。PancakeSwap等去中心化交易所率先在BSC上崛起,复制Uniswap模式并推出高额流动性挖矿激励,吸引大量资金涌入。紧随其后,Venus(借贷协议)、Alpaca(杠杆挖矿)、Mdex(跨链DEX)等一批仿照以太坊明星项目的协议相继上线。在这一阶段,BSC链上TVL呈指数级增长,于2021年高峰时达到约200亿美元,日交易笔数屡创新高,一度日均超过1000万笔,远超彼时以太坊日均100万笔左右的水平。每日活跃地址数也在2021年末达到约150万的历史峰值。大量新用户通过Binance交易所的桥接和宣传进入BSC生态,BNB链上地址总数在2021年底突破1亿。BSC俨然成为DeFi用户和开发者的重要阵地之一。

3. 生态多元化:GameFi与NFT兴起。 伴随2021年加密市场牛市,BSC生态除DeFi外开始出现GameFi、NFT等新热点。GameFi方面,BSC因低成本、高TPS非常适合游戏类DApp,不少“P2E(边玩边赚)”游戏选择在BSC部署。例如角色扮演游戏CryptoBlades和Faraland、农场养成类的Plant vs Undead等曾在2021年大热。Mobox的NFT农场游戏以及BinaryX的元宇宙概念也让BSC游戏板块一度繁荣。NFT领域,虽然以太坊主导高端NFT市场,但BSC也涌现了BakerySwap这类集DEX+NFT市场于一身的平台,以及专注NFT借贷的NFTb等应用。Binance自身推出的币安NFT市场进一步为BSC引流艺术品和收藏品交易。2021年的BSC生态可谓百花齐放,在DeFi之外逐步形成GameFi、NFT的雏形。

4. 2022年调整:品牌重塑与安全事件。 进入2022年,加密市场转入熊市,BSC生态也经历了一轮洗牌和调整。2022年2月,Binance正式将“Binance Smart Chain”与“Binance Beacon Chain”统一重命名为“BNB Chain”,淡化Binance品牌烙印。这一举措旨在突显BNB Chain作为独立公链生态的发展愿景。熊市中BSC的锁仓价值从峰值大幅回落,到2022年底生态TVL已跌至不足30亿美元,相比峰值缩水逾八成。部分高泡沫项目如部分GameFi迅速衰退。然而,BNB Chain在熊市中持续投入资源孵化项目,通过Most Valuable Builder (MVB)加速器等计划扶持开发者。这一时期BNB Chain也遭遇了安全考验:2022年10月其跨链桥发生重大黑客攻击,约1亿美金资产被盗,幸好及时暂停链上验证者避免更大损失。此外,不少BSC上的山寨项目在牛转熊过程中崩盘或跑路,这在一定程度上影响了BSC生态声誉。面对挑战,BNB Chain团队开始加强安全措施,如推出AvengerDAO社区安全联盟,并着手提升去中心化水平。尽管行情低迷,BNB链上用户规模仍在增长:2022年底链上地址总数已突破2亿,熊市中仍有大量新增用户地址涌入。

5. 2023年恢复与技术升级。 2023年加密市场逐步回暖,BNB Chain生态也出现复苏迹象。首先,LayerZero跨链协议等新技术在BSC上得到应用,带来了跨链桥和全链借贷的创新场景。例如Radiant Capital跨链借贷协议于2023年初部署BSC,Stargate桥接业务在BSC上的日交易量一度高达20万+笔。这些跨链应用提升了BSC的活跃度。其次,社交Fi成为亮点:Hooked推出的“Quiz to Earn”模式吸引大批新手用户,CyberConnect在2023年下半年登陆Binance Launchpad,其代币上线引发关注。此外,2023年BNB Chain在技术上进行了多次硬分叉升级:先后完成Planck、Luban硬分叉,引入并行处理和其他优化,提高性能和安全。基于Optimistic Rollup的BNB Chain二层网络opBNB于2023年9月主网上线。opBNB进一步降低费用(每笔仅$0.0001级)和提升吞吐,使BNB生态迈向多链并存的新阶段。BNB Greenfield去中心化存储链也在2023年底测试,为数据存储类应用提供支持。经过这些努力,2023年末BNB Chain的日均活跃地址数恢复到140万左右,接近2021年牛市高点。BNB Chain生态TVL在2023年下半年随市场反弹而回升至50亿美元以上水平。可以说,2023年BNB Chain走出了低谷,在技术基础和生态应用上都为下一步增长打下基础。

6. 2024-2025年加速:性能飞跃与现实资产上链。 进入2024-2025年,BNB Chain围绕“下一波Web3用户”的愿景,加速推进网络升级和生态布局。在性能层面,2024年进行了Maxwell和Lorentz硬分叉,将BSC出块速度从3秒缩短到0.75秒,Gas费用降至$0.001左右。TPS和确认时间的大幅优化,使BNB Chain迈入亚秒级出块时代。安全性方面,BNB Chain于2024年上线Goodwill Alliance保护机制,有效抑制了链上MEV抢先交易等行为,将三明治攻击次数减少95%,使BSC因黑客漏洞导致的损失同比下降87%。与此同时,BNB Chain把握RWA的行业风口,积极引入合规资产上链:2024年以来,美国资管机构VanEck通过Securitize在BNB Chain发行美国国债收益代币vBILL,Backed Finance也将苹果、特斯拉等美股股票的代币引入BNB Chain并在Kraken交易。DeFi平台Ondo将其机构级国债基金份额在BNB Chain上提供交易。BNB Chain针对RWA设立了激励计划,吸引更多传统金融资产登陆。这些举措令BNB Chain在2024年成为链上稳定币交易和活跃用户数排名第一的区块链,链上稳定币市值超过110亿美元,链上总地址数突破6.11亿,生态项目数量超过5000个。BNB Chain已从五年前的单链网络跃升为一个庞大的多链生态系统,在全球100多个国家拥有超过400万社区粉丝。

BNB Chain官方在五周年之际发布了未来技术路线:2025-2026年实现Gas上限提升10倍至10G(支持每秒5000笔DEX交易)、交易确认时间缩短至150毫秒级、全网TPS提升至2万,并引入无缝账户抽象、密钥托管轮换和多签支持等新一代安全机制,打造下一代DeFi、游戏、AI应用的基础设施。可以预见,BNB Chain正蓄力迎接下一个五年的机遇与挑战。

三、BNB生态全景:链上数据与竞争格局

经过五年发展,BNB Chain已成为仅次于以太坊的主流公链之一,其用户规模和交易活跃度在业内名列前茅。以下从链上数据和与其他公链的对比来刻画BNB Chain的生态全景和网络地位。

来源:https://defillama.com/chain/bsc

1. 链上数据全貌:用户与交易领先。 截至2025年9月,BNB Chain(BSC主网与opBNB合计,下同)在多项指标上表现强劲:每日活跃地址数保持在数百万级,BSC主网日均交易笔数约为1000万-1500万之间波动。据统计,2025年9月单日交易笔数达1372万,比一年前增长了逾330%。链上累积交易总笔数已数百亿级。链上地址数量方面,BNB Chain累计独立地址已超过6.3亿,较2024年同期增长约34%。此外,BNB Chain还是去中心化交易量最高的网络之一:2023-2024年多次出现日均DEX交易额超过以太坊的情况。在稳定币流通市值上,BSC链一度达到100亿美元以上规模。以上数据表明,BNB Chain在用户基数和链上交易频率方面遥遥领先大部分公链,实现了大众用户的规模化参与。

2. 性能与成本:高吞吐低费用的优势。 BNB Chain选择了性能优先的发展路线。BSC主网采用PoSA(权益授权证明)共识,仅有21个活跃验证节点(总候选节点约40-50个),由持币人投票选出。这使BSC能将出块间隔压缩到目前0.75秒左右,并行处理大量交易。而以太坊尽管转为PoS,但需全网共识确认,出块时间在12秒左右。Solana虽号称高TPS,但其复杂的PBFT共识和超高硬件要求使网络数次宕机。BNB Chain目前峰值TPS已达到数千级,官方规划未来拓展至2万 TPS。交易手续费方面,BNB Chain通过降低Gas上限、增大区块Gas容量等手段,将每笔交易费维持在约0.001-0.01美元的极低水平,极大降低了用户使用门槛。此外,BNB Chain近年来也在平衡性能与去中心化,提出了扩容验证者至100个的计划,引入“Balanced Mining”奖励模型和验证者声誉系统,以期提升网络安全和去中心化水平。总体而言,在性能/成本维度,BNB Chain仍然保持了领先的用户体验,这为其在竞争中赢得大众市场提供了基础。

3. 去中心化与合规:对比竞品的取舍。 BNB Chain在去中心化程度上一直饱受争议。其验证节点虽非Binance直接运行,但绝大多数与Binance有密切关系,决策治理上也有Binance影子。因此有观点称BNB Chain更像“公司链”,不像以太坊那样中立。这种集权在过去几年也带来了高效执行力和资源倾斜,使BNB Chain生态扩张迅猛。相比之下,Ethereum以去中心化和安全著称,拥有全球最多开发者和最丰富的DeFi蓝筹项目,但其高Gas费和扩容速度较慢的问题突出,需要依靠Layer 2解决方案承载大众用户。Solana走的是与BNB Chain不同的技术路线:它不是EVM兼容而是自成体系,通过革新共识实现高TPS和低费用,同时保持上千节点参与的较高去中心化。但Solana网络自2021年以来多次宕机,质疑声不断;所幸2023年后Solana性能逐步稳定,并凭借在美股结算、去中心化社交等领域的探索重新获得发展动力。Base则是2023年由Coinbase推出的以太坊二层网络,主打合规背景和对亿万交易所用户的引流。但Base目前仍由Coinbase作为唯一序列器,实际中心化程度不亚于BSC,而且其生态刚起步、项目较少。不过,Base背靠合规牌照和美国市场,未来有望承载机构和合规资产,这也是BNB Chain有力的竞争对手。

4. 生态特点:平民化用户结构。 BNB Chain生态呈现出鲜明的“平民化”特征:用户以新兴市场的散户居多,偏好低门槛、高收益的应用。这一点从BSC上Meme币和游戏的火爆可以看出。许多来自东南亚、南亚、拉美的年轻投资者通过Trust Wallet等钱包参与BSC上的投机热潮。相较之下,以太坊上高净值参与者和机构较多,更强调资产安全和理性收益。Solana社区则偏向欧美科技极客、NFT和Meme玩家。Base由于背靠Coinbase,也吸引了不少欧美合规用户。BNB Chain的社区地域分布更广泛,在亚洲特别是中国、东南亚拥有庞大用户群,也包括土耳其、俄罗斯、非洲等地的用户,这些市场对于低手续费环境需求强烈。在用户行为上,BNB Chain上小额高频交易极为普遍,很多用户每天进行Swap、Yield Farming、链游操作,链上交互频繁,这与以太坊上高净值用户偶尔大额操作形成对比。

综合来看,BNB Chain在大众用户规模和综合活跃度具有领先优势。然而,在开发者生态和创新原创项目方面,Ethereum依旧是行业源头,Solana等也在崛起,BSC早期项目多是Fork为主,真正技术突破性的协议较少。此外,监管和合规风险也是BNB Chain不可回避的问题——由于与Binance关联,BNB Chain的发展常受到Binance整体遭遇的监管压力影响。相比之下,Base等受监管机构青睐程度更高。在RWA等需要合规的场景上,BNB Chain虽然抢先布局,但能否获得各国监管认可仍待观察。BNB Chain正在寻求“去Binance化”的社区治理转型,但短期内Binance的支持仍是其生态重要支柱。

四、币安Alpha与Web3钱包助推BNB Chain生态繁荣

币安钱包与Alpha平台降低了用户参与链上交易的门槛,大批原本停留在中心化平台的资产被引入链上,推动了BNB Chain链上资金活跃度和流动性的显著提升。币安Alpha独创的TGE+空投模式有效激活了存量用户的参与热情。Alpha采用积分奖励和空投竞速相结合的机制,鼓励用户深入参与项目早期阶段。这种玩法提升了用户粘性,也帮助新项目在启动阶段就获得大批关注者。

1.链上用户增长:交易所引流与用户活跃攀升

2025年初币安推出内置的Web3钱包并升级Alpha平台后,BNB Chain链上用户数出现了显著增长。一方面,币安将海量CEX用户低门槛引流至链上:用户只需在币安App内一键开通币安Web3钱包,即可直接访问BNB Chain的DApp和DeFi服务。这种无缝衔接降低了Web2用户进入Web3的门槛,大幅拓展了BNB Chain用户基础。2025年Q1期间,币安Web3钱包新增用户数超过200万,其中约40%的用户通过参与币安Alpha的代币发行活动(TGE)首次接触并使用了BNB Chain。得益于此,BNB Chain链上日活跃地址在2025年不断创出新高:日均活跃地址从年初约120万攀升至Q2的160万,每日交易笔数从600万激增到超过1500万,日活跃地址接近200万。中心化交易所->链上导流效应十分显著:一键式的钱包接入使数百万原有币安用户转化为BNB Chain链上参与者,推动了链上用户规模和活跃度的飞跃式攀升。

2.链上资金活跃度与TVL趋势

币安Alpha和Web3钱包的推出也为BNB Chain链上带来了可观的资金增量,表现在TVL和去中心化交易活跃度的提升。2025年Q2,BNB Chain上的DeFi总锁仓价值升至约99亿美元,较上一季度增长了14%,其中一个重要原因是币安Alpha推出的新项目吸引了大量链上资金涌入锁仓。例如,通过Alpha平台进行的“Mubarak”代币发行就吸引了3,200,000枚BNB的锁定参与,相当于近亿美元规模,大幅提振了BNB Chain链上的资金沉淀。同时,链上交易流动性达到新高:2025年Q2期间BNB Chain全网DEX日均交易量达33亿美元,位居所有区块链之首。为了承载暴增的交易量,BNB Chain在2025年上半年进行了网络升级,将平均Gas费下调了90%至约0.1 gwei、区块出块时间缩短至0.75秒,有效保障了高并发交易下网络的稳定低费率运行。这些举措进一步激励了用户将资产留在链上参与DeFi和交易,形成良性循环。

3.DApp活跃度提升:用户互动与Gas消耗

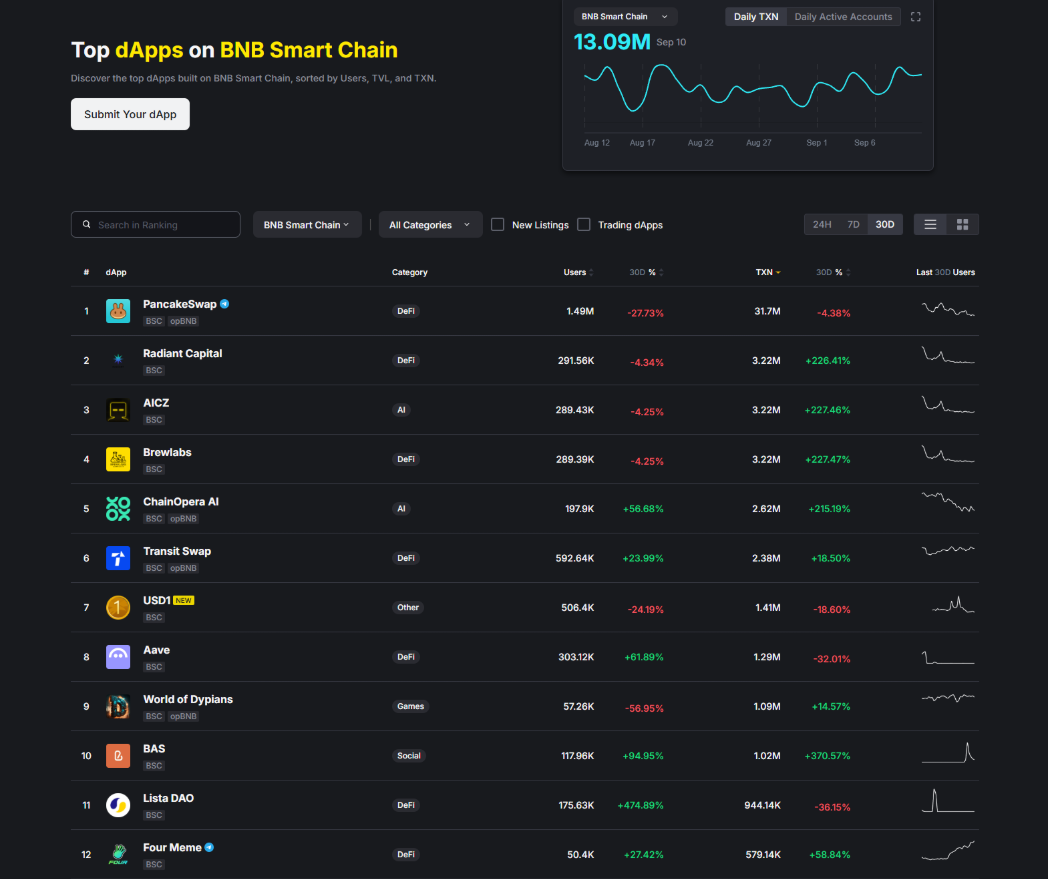

随着币安Alpha平台和钱包的普及,BNB Chain上DApp的活跃度显著提高。大量新用户涌入链上后,各类DApp的用户数和交互频次均有上涨:2025年上半年BNB Chain日均交易笔数较2024年翻倍以上,达到近千万级别。PancakeSwap稳居链上流量之王,贡献了BNB Chain约85%的DEX交易量。在Meme币浪潮带动下诞生的Four.Meme协议,一度在24小时内产生了74.7万美元的费用收入,接近PancakeSwap的1/5,跻身BNB Chain上费用收入最高的协议之一。用户互动频率的增加也体现为链上Gas消耗排行的变化:除了DEX和借贷等传统高Gas合约外,Meme币相关合约、空投交互合约开始占据显著比例,显示用户在链上的活动更趋多元化。opBNB作为BNB Chain扩容的Rollup网络,在2025年中期主网上线后也吸引了一定流量,跨链桥入资金迅速增长——上半年跨链TVL已达到约6,490万美元。随着opBNB提供更低Gas和更高TPS,不少游戏和社交类DApp开始部署其上,为BNB Chain整体生态增添活力。

Source: https://dappbay.bnbchain.org/ranking

4.Meme币热潮的再起与影响

2025年初在币安社区引爆的新一轮Meme币热潮,为BNB Chain生态注入了巨大的活力和流量。币2月,CZ在X平台随口提及了自己宠物的名字“Broccoli”,社区立即响应推出同名Meme代币,两天内交易量飙至3,000万美元。3月,CZ更以1枚BNB的象征性资金购入了新代币“MUBARAK”和“TEST”,此举被市场视为信号,结果MUBARAK市值在48小时内从区区6千美元暴涨至2亿美元,涨幅高达25000%,TEST市值也冲至5千万美元。何一在社交媒体上力推艺术风格的Meme币BUBB,引发话题传播,BUBB市值从300万美元飙升至3,400万美元,涨幅超10倍。这股Meme风潮带来了链上用户和交易的爆发式增长:2月和3月的“Meme季”中,BNB Chain链上日均交易笔数一度突破400万笔,活跃地址数攀升至440万的量级。为顺应并引导这股热潮,BNB Chain基金会还专门设立了“Meme币扶持计划”,将其纳入新的生态激励范畴。可以说,这轮Meme币狂潮让BNB Chain生态在2025年上半年迎来了空前的社区狂欢,不仅吸引了众多新用户入场,也促使官方因势利导,通过资源倾斜将短期的投机热转化为长期留存的用户和项目资源。

5.对AI、RWA、GameFi等赛道的赋能

币安Alpha平台及其钱包生态在2025年为BNB Chain的多条重点赛道引入了增量流量和资金。

AI赛道:币安Alpha筛选了一批AI+区块链项目上线,让BNB Chain成为AI赛道项目的主要孵化温床。例如Alpha上架的SIREN就是一款AI驱动的Meme币概念项目,在社区中引发讨论。此外,BNB Chain官方的MVB加速器和黑客松也将AI列为重点方向,为AI初创团队提供资金和技术支持。可以预见,随着Alpha筛选机制的成熟,AI赛道会有更多优质项目通过BNB Chain生态脱颖而出。

RWA赛道:币安于2025年5月推出了RWA专项激励计划,拿出数百万美元用于补贴合规资产的上链发行。这极大促进了传统资产Token化项目在BNB Chain落地。例如,BlackRock发行的链上国债基金(BUIDL)在BNB Chain上吸引了28.7亿美元规模,Ondo Finance的国债收益代币OUSG也锁定了4.46亿美元。

GameFi和其它Web3热点:币安于2024年底启动的$1亿生态基金除了投向DeFi和Meme,也重点扶持游戏、社交等应用。2025年上半年,多款GameFi新游通过BNB Chain上线测试并在Alpha平台获取早期用户反馈,一些优秀项目后续登陆币安Launchpad或主板交易。此外,BNB Chain也在资助DeSci项目,利用区块链募集科研资金、共享成果数据。这些应用虽很早期,但预示着BNB Chain生态正在向更广泛的Web3应用领域延伸。

2025年币安新上线的现货交易对中有近一半曾经先在Alpha平台亮相,Alpha正成为筛选优质Web3项目的可靠过滤器。这些通过Alpha孵化的项目一旦转入Launchpad或直接上市,往往表现亮眼,为BNB Chain生态注入新鲜血液和投资机会。币安Alpha平台与Web3钱包的结合,通过资金扶持+流量导入+创新玩法,为BNB Chain带来了显著的增量用户与资金支持。不仅孵化出一批高潜力的新项目,也推动Launchpad/Launchpool上的项目屡获成功,实现了生态繁荣与币安平台发展的双赢。

五、结论与展望

从2020年上线到2025年形成全球化多元生态,BNB Chain用五年时间走过了辉煌的历程。其间既有高光时刻,也经历过低谷的磨砺。如今的BNB Chain,日活用户数、交易量等硬指标位居行业前列,DeFi、GameFi、RWA等版块百花齐放,孕育出 PancakeSwap、Four.meme 等现象级应用,沉淀了庞大且多元的社区基础。在与Ethereum、Solana、Base等竞品的竞争中,BNB Chain凭借币安的强力支持以及自身的性能和成本优势赢得了大众市场的青睐。

展望未来五年,BNB Chain要实现“再上台阶”,仍需在几个方面发力:

首先,技术持续升级是立身之本,只有保持高性能并提升去中心化和开发友好度,才能吸引更多优质DApp扎根。

其次,生态创新与原创是长久生命力所在,BNB Chain需要出现属于自己范式的创新项目,而不仅是以太坊成功模式的跟随者。

再者,合规与主流接纳将是决定BNB Chain能走多远的关键,要积极拥抱合规、参与制定行业标准,让BNB Chain成为传统机构愿意使用的区块链基础设施。

最后,社区治理与独立性不容忽视,随着Binance可能受到的监管限制,BNB Chain必须有能力“断奶”,形成真正社区驱动的治理体系,只有这样才能赢得更广泛的行业信任。

正如BNB Chain官方博客所言:“过去五年证明了一切皆有可能,未来五年将树立行业标准”。经历了五年淬炼的BNB Chain,已做好准备在下一个五年续写更多可能。

关于我们

Hotcoin Research 作为 Hotcoin 交易所的核心投研机构,致力于将专业分析转化为您的实战利器。我们通过《每周洞察》与《深度研报》为您剖析市场脉络;借助独家栏目《热币严选》(AI+专家双重筛选),为您锁定潜力资产,降低试错成本。每周,我们的研究员还会通过直播与您面对面,解读热点,预判趋势。我们相信,有温度的陪伴与专业的指引,能帮助更多投资者穿越周期,把握 Web3 的价值机遇。

风险提示

加密货币市场的波动性较大,投资本身带有风险。我们强烈建议投资者在完全了解这些风险的基础上,并在严格的风险管理框架下进行投资,以确保资金安全。

Website:https://lite.hotcoingex.cc/r/Hotcoinresearch

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。