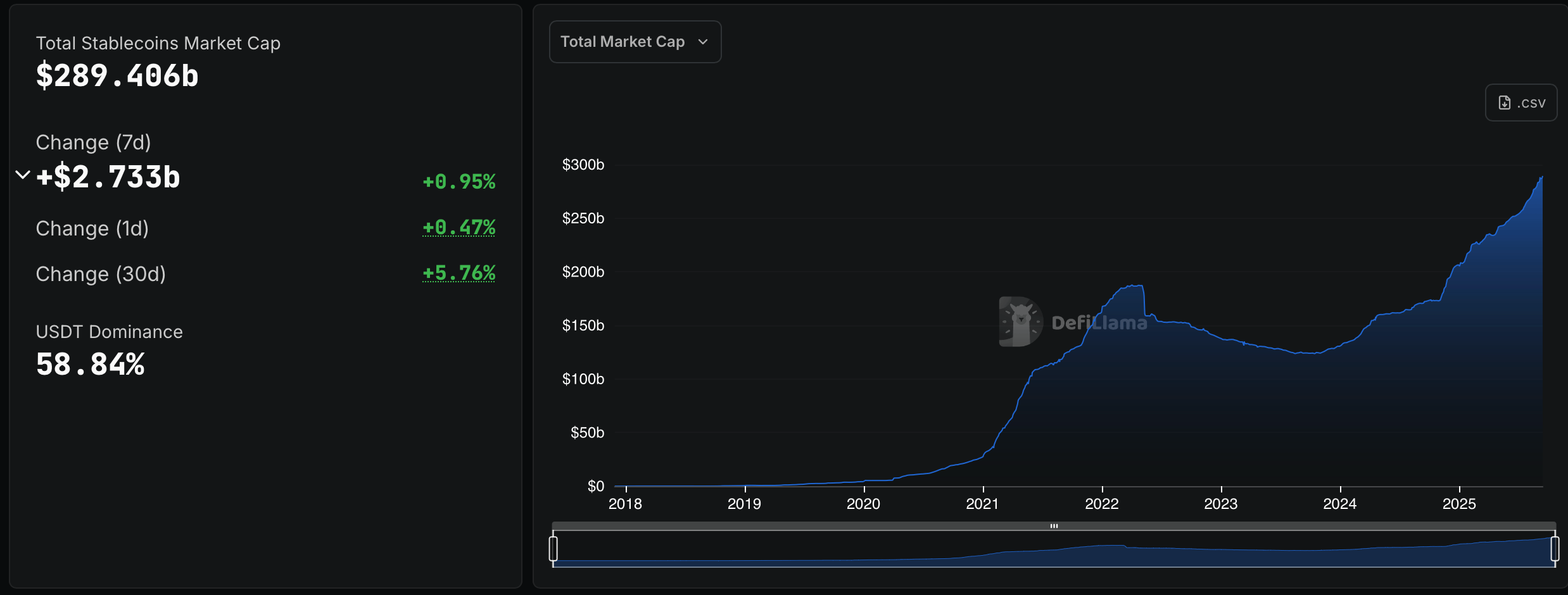

本周通过 defillama.com 获取的法币挂钩代币快照显示,该领域在七天内扩张了 27.33 亿美元。Tether 的市场份额有所下滑,降至 89% 线以下,现为总量的 58.84%。Tether (USDT) 几乎没有变动,但仍然实现了 +0.86% 的周涨幅,市值高达 1702.73 亿美元。

Circle 的 USDC 稳定在 +0.48% 的小幅上涨,总额达到 725.6 亿美元。排名第三的 Ethena 的 USDe 引起了关注,猛增 +4.87% 至 133 亿美元。Sky 的 DAI 略微下跌 -0.91%,定格在 50.38 亿美元。Sky dollar (USDS) 跌幅更大,下降 -4.70% 至 45.15 亿美元,而 World Liberty Financial 几乎没有变动,微涨 +0.08% 至 26.62 亿美元。

Blackrock 的 BUIDL 下滑 -1.71% 至 21.95 亿美元,但 Ethena 的 USDtb 反弹,猛增 +13.45% 至 18.15 亿美元。Falcon USD (USDf) 也上涨 +5.39% 至 16.24 亿美元,而 Paypal 的 PYUSD 则以 +14.72% 的涨幅点燃了市场,达到 13.47 亿美元。将市值前十的稳定币相加,总额达到 2753.3 亿美元。

稳定币市场的潮流变化突显了一个市场平衡的行为,主导地位动摇,新兴代币表现超出预期。由于发行者之间的供应增长不均,数据显示对与美元挂钩的流动性需求正在变化,为提供商之间的竞争重新注入活力。在 defillama.com 跟踪的 289 种稳定币中,前十名的重量级代币占据了整个市场的 95.14%,剩下的数百种代币则在为剩余的市场份额而争夺。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。