Bitcoin dropped to $113K on Thursday morning after the Bureau of Labor Statistics (BLS) announced slightly hotter-than-expected inflation in its August Consumer Price Index (CPI) report. The news comes just a day after the BLS revealed August wholesale inflation eased 0.1% as measured by the Producer Price Index (PPI).

But just hours after the CPI announcement, the cryptocurrency had reclaimed $114K as gloomy employment data from the Department of Labor showed a record jump in jobless claims, a development that dramatically increases the chances of an interest rate cut by the U.S. Federal Reserve next week.

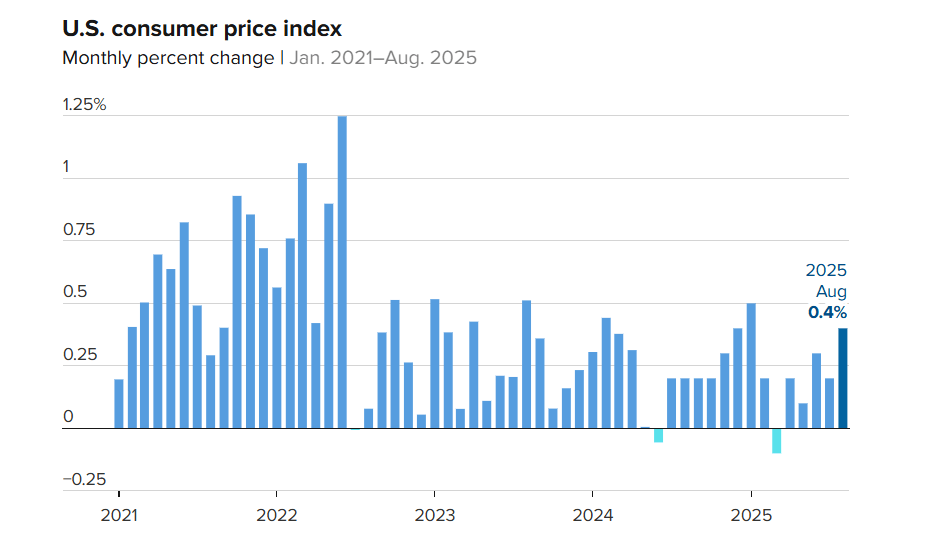

August’s CPI climbed 0.4% pushing the annual inflation rate to 2.9%, mostly spurred by increases in shelter costs. Core inflation, where the volatile categories of food and energy are removed, rose 0.3% and stood at an annual rate of 3.1%. The core figure is typically favored by the Fed.

(August’s annualized CPI came in at 2.9% which was a 0.4% increase from July / U.S. Bureau of Labor Statistics via CNBC)

But the real eye opener was not inflation, but rather the surprise jump in weekly unemployment insurance claims from 236,000 to 263,000 for the week ending September 6. It’s the highest jump in jobless claims since October 2021 and will likely compel the Fed to finally start cutting rates to stimulate an increasingly sluggish economy. The anticipation of a rate cut appears to be what triggered bitcoin’s recovery soon after a somewhat disappointing CPI report.

“The main market mover this morning is jobless claims, which came in far higher than expected,” said economist and Queen’s College President Mohamed Aly El-Erian on X. “Inflation may still sit above the Fed’s target, but the greater risk to the economy lies in the pace and severity of labor market weakening.”

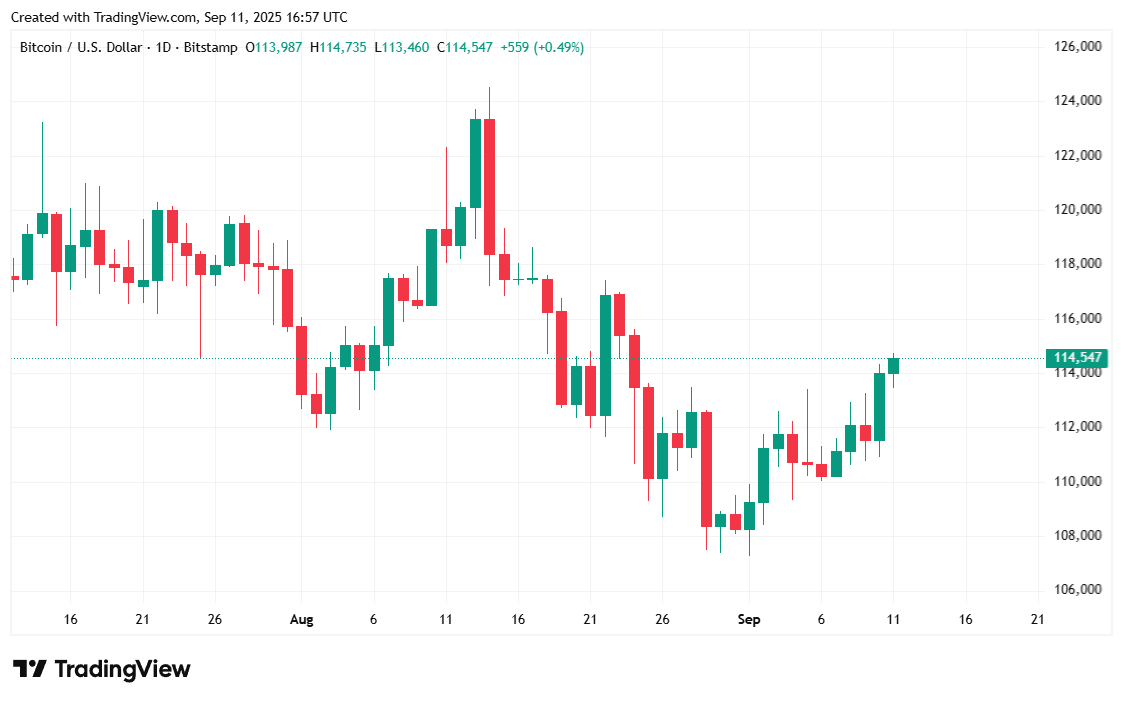

Bitcoin was priced at $114,499.05 at the time of reporting, up slightly by 0.75% in the last 24 hours according to Coinmarketcap. The digital asset has been trading between $113,181.30 and $114,714.55 over the past day.

( Bitcoin price / Trading View)

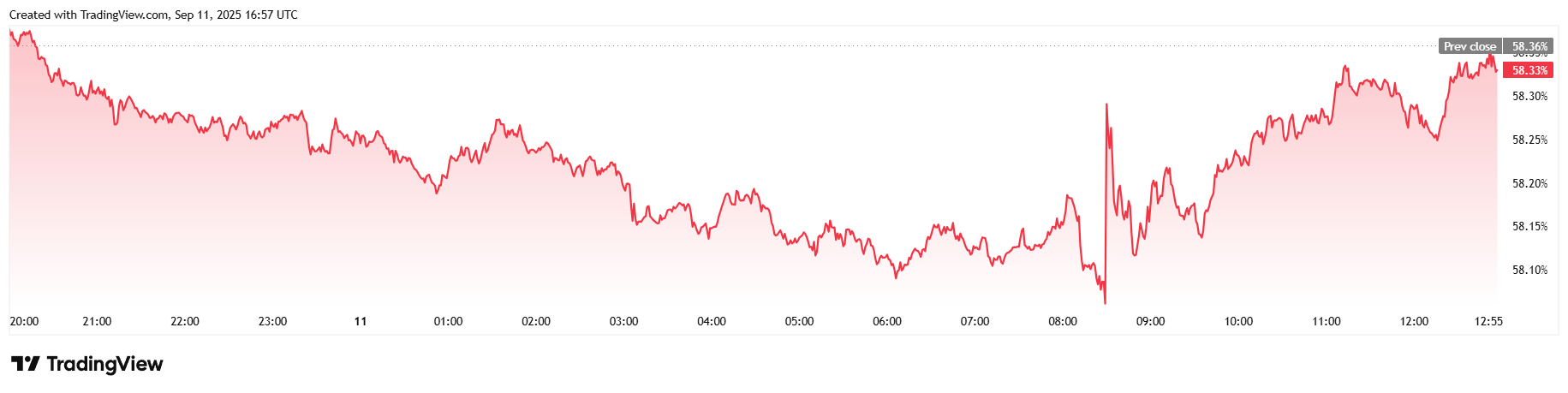

Twenty-four-hour trading volume eased slightly, dipping 8.45% since Wednesday and standing at $48.38 billion at the time of writing. Market capitalization was in line with price, climbing 0.72% to $2.28 trillion. Bitcoin dominance was mostly flat, inching downward by 0.06% to 58.33% over 24 hours.

( Bitcoin dominance / Trading View)

Total bitcoin futures open interest climbed slightly by 0.60% to $84.91 billion since yesterday, according to Coinglass. Bitcoin liquidations totaled $37.96 million over 24 hours and were relatively evenly split between short and long liquidations, $13.63 million and $17.53 million, respectively.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。