今天的作业和预想中的差不多,新公布的 CPI 数据对于市场的影响非常的小,美股和加密货币都维持着良性上涨,尤其是 $BTC 能明显发现一级现货 ETF 的成交量大增,不过现货市场的成交量就没有太大的变化,说明目前的愿意下场的可能还是传统投资者占多数。

市场的主要博弈还是在川普和美联储的保守派之间,虽然有点说烂了,但确实还是这么回事,市场现在都已经预期了美联储会在2025年降息3次或者是 75个基点,所以九月点阵图就格外的需要关注了,九月大概率降息应该是跑不了了,如果点阵图还有50个基点的话,川普的胜率会更高一些。

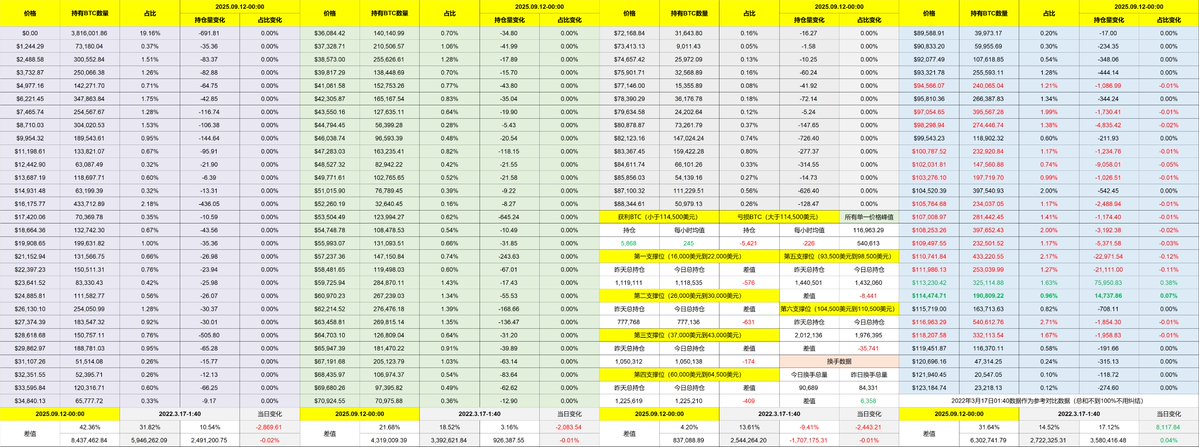

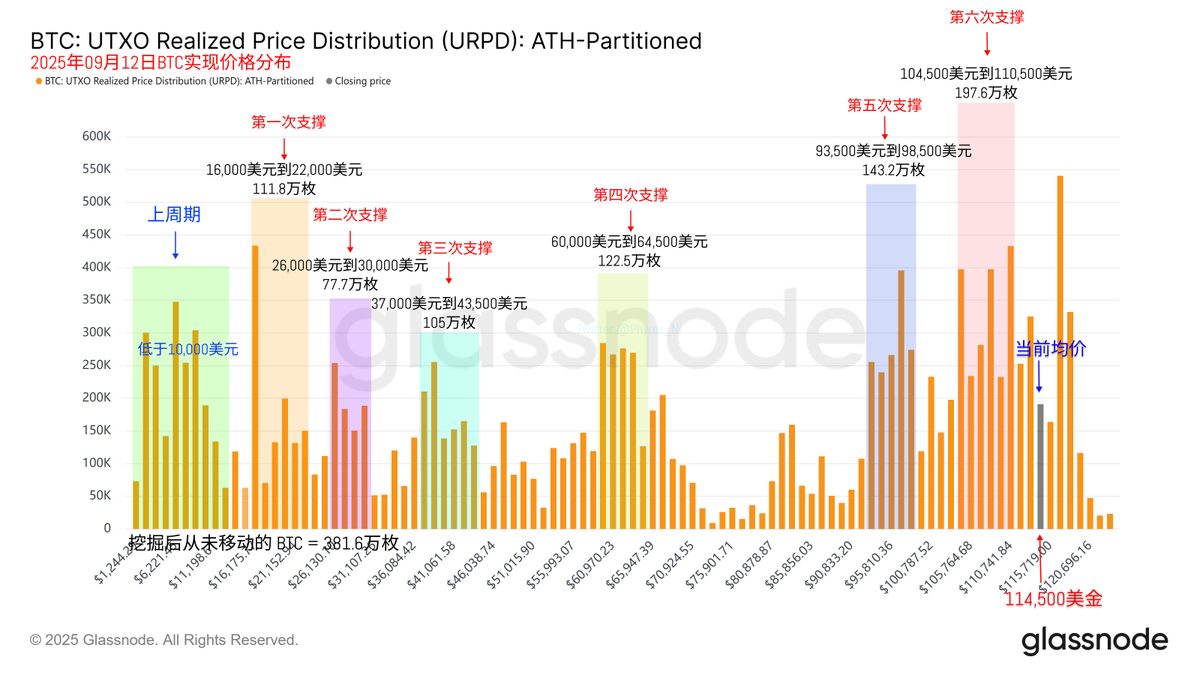

回到 Bitcoin 的数据来看,虽然 BTC 的价格突破了 114,500 美元,但换手率并没有增加很多,最近两天抄底的投资者是离场最多的,其它较早期的投资者还在观望,其实最近很长时间都是这样,即便是换手率加大的时候也都是短期投资者最多,而长期投资者多数都没有动静。

支撑方面仍然非常的坚韧,这已经说过多次了,这周也没有什么重要数据了,就等着下周的一个零售数据,然后就是议息会议了,不知道米兰是否可以赶得上,如果能赶上川普一方就能顺利+1。

本文由 #Bitget | @Bitget_zh 赞助

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。