Today's homework is easier to write, but there are still quite a few pitfalls. The improvement in market sentiment is mainly due to today's positive PPI data. Even Trump specifically posted that inflation no longer exists. Of course, this is not correct. As we have always said, Trump is completely uninterested in data; what he wants is interest rate cuts to stimulate the economy and boost his approval ratings, which is completely opposite to the Federal Reserve's stance.

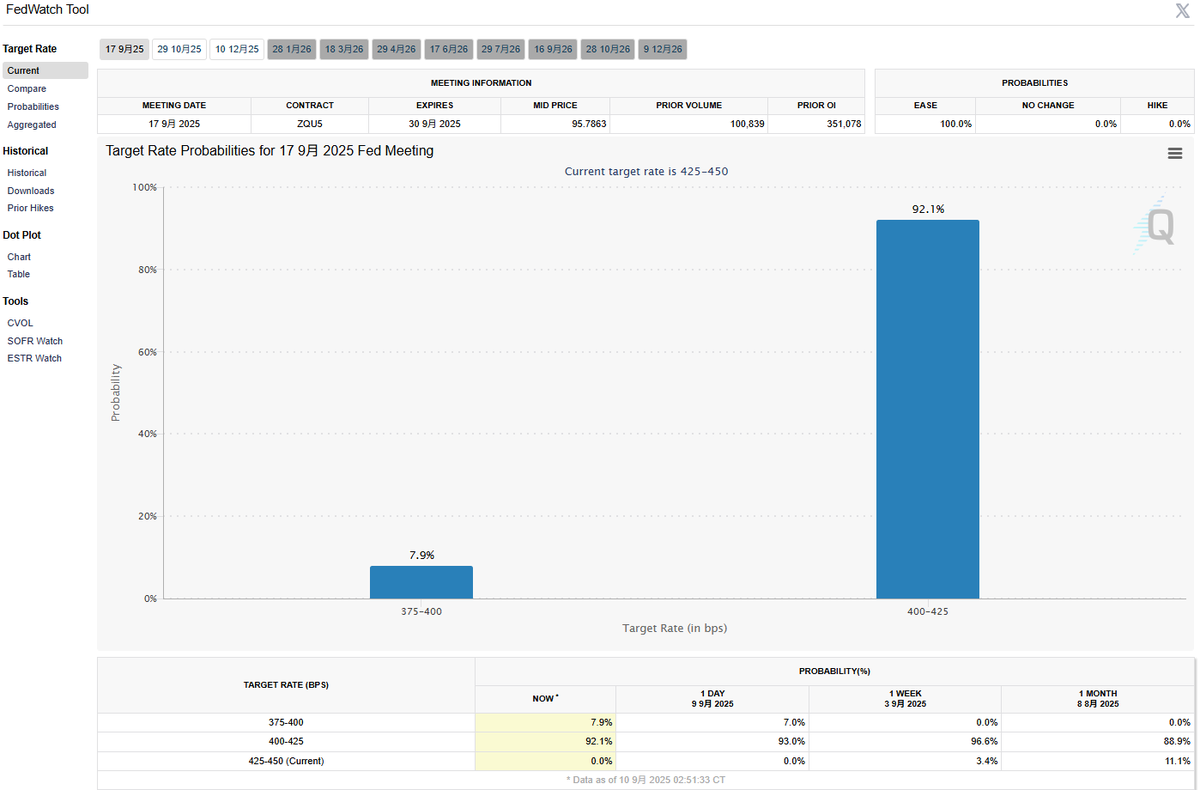

For the interest rate adjustment in September, both PPI and CPI data are actually not that important anymore. The Federal Reserve has anticipated that inflation may fluctuate. Even today's PPI data, which was below expectations, still reflects an increase in tariffs. An increase in tariffs leading to rising inflation is quite normal, and the Federal Reserve is well aware of this issue, so they are considering whether this inflation is temporary.

The main reason that could lead the Federal Reserve to cut rates in September is the decline in the labor market. If the Federal Reserve only considers inflation, it is not impossible that they won't cut rates in September. However, considering both the job market and inflation, a 25 basis point cut in September might be the biggest concession from the conservatives. Whether they can secure more depends on Trump's efforts.

Tonight, not only was the PPI data good, but the wholesale data was also impressive, significantly exceeding both the previous value and expectations, indicating that the market is not too bad. Of course, the increase in wholesale data may also be due to tariff-related reasons. Overall, we are still far from a recession, and the Federal Reserve's current rate cut will be more defensive in nature.

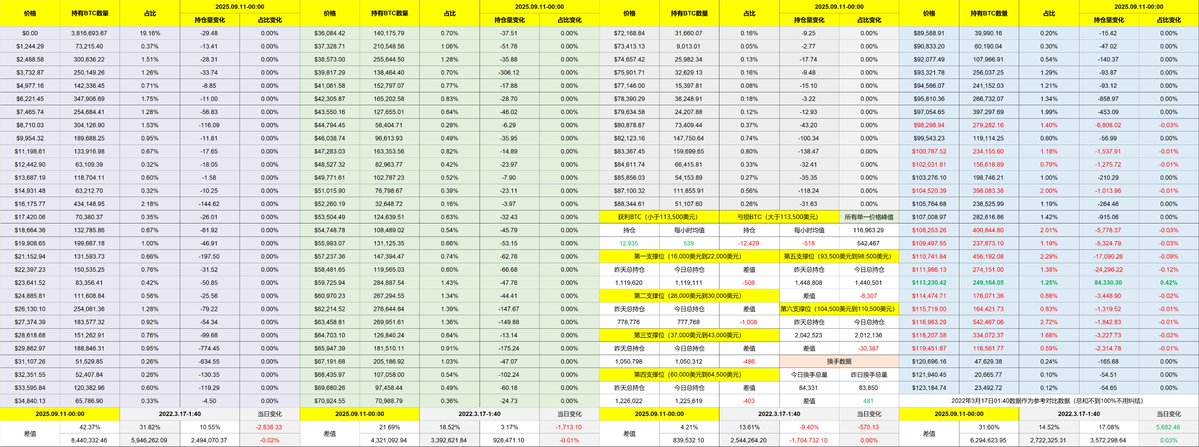

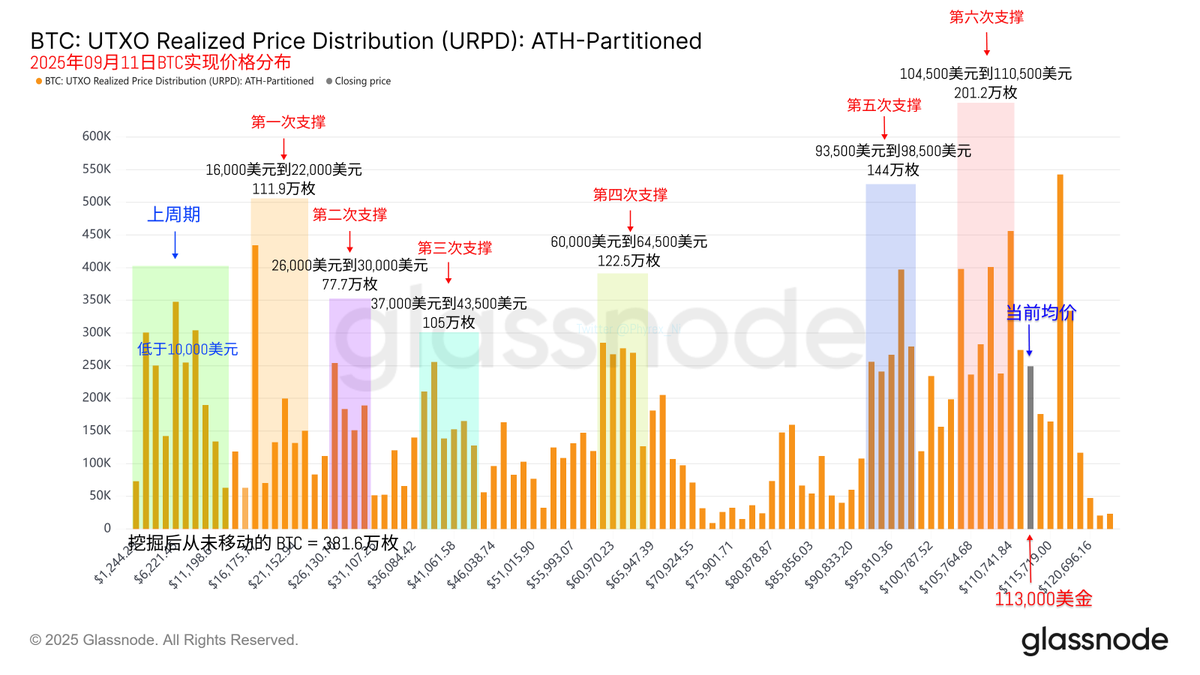

Looking back at Bitcoin's data, today's turnover rate is still not high, and the increase compared to yesterday is negligible, mainly due to some short-term investors' trading. The decrease in turnover rate again indicates that the current price has lost its appeal to many investors, even short-term investors are finding it less attractive.

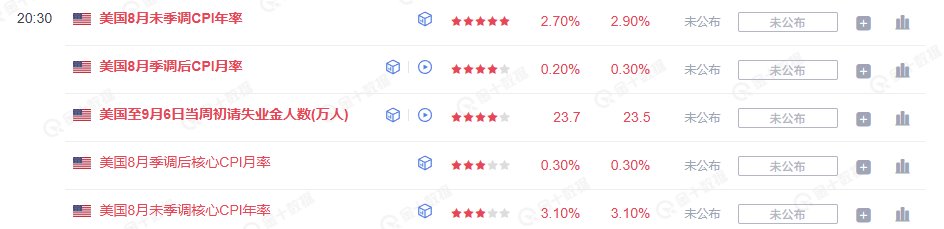

As for tomorrow's CPI, market expectations are not very good. Both the annual and monthly rates of broad inflation are expected to rise, while core inflation is expected to maintain the previous value. If the published data is lower than expected, it will definitely boost market sentiment. If it is higher than expected, although it won't have a significant impact on rate cuts, the market will certainly be conflicted.

CPI data is also the most important data before the interest rate meeting. Next week, another data point to pay attention to is retail data, which can also reflect the state of the U.S. economy.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。