我们重新审视了一些AI聊天机器人,以评估它们对比特币在第四季度走势的看法。我们从穆斯克的Grok、OpenAI的ChatGPT、威尼斯AI、Anthropic的Claude、Deepseek等模型中获取了回应,以捕捉对未来几个月的多种观点。为了保持一致,以下预测请求被呈现给每个系统:

请充分运用您的分析能力,估计比特币月底的价值。目前价格在$113,500–$114,246区间内,请提供2025年9月、10月、11月和12月的具体收盘数字。您的回应必须包含确切价格和90字以内的简要理由。

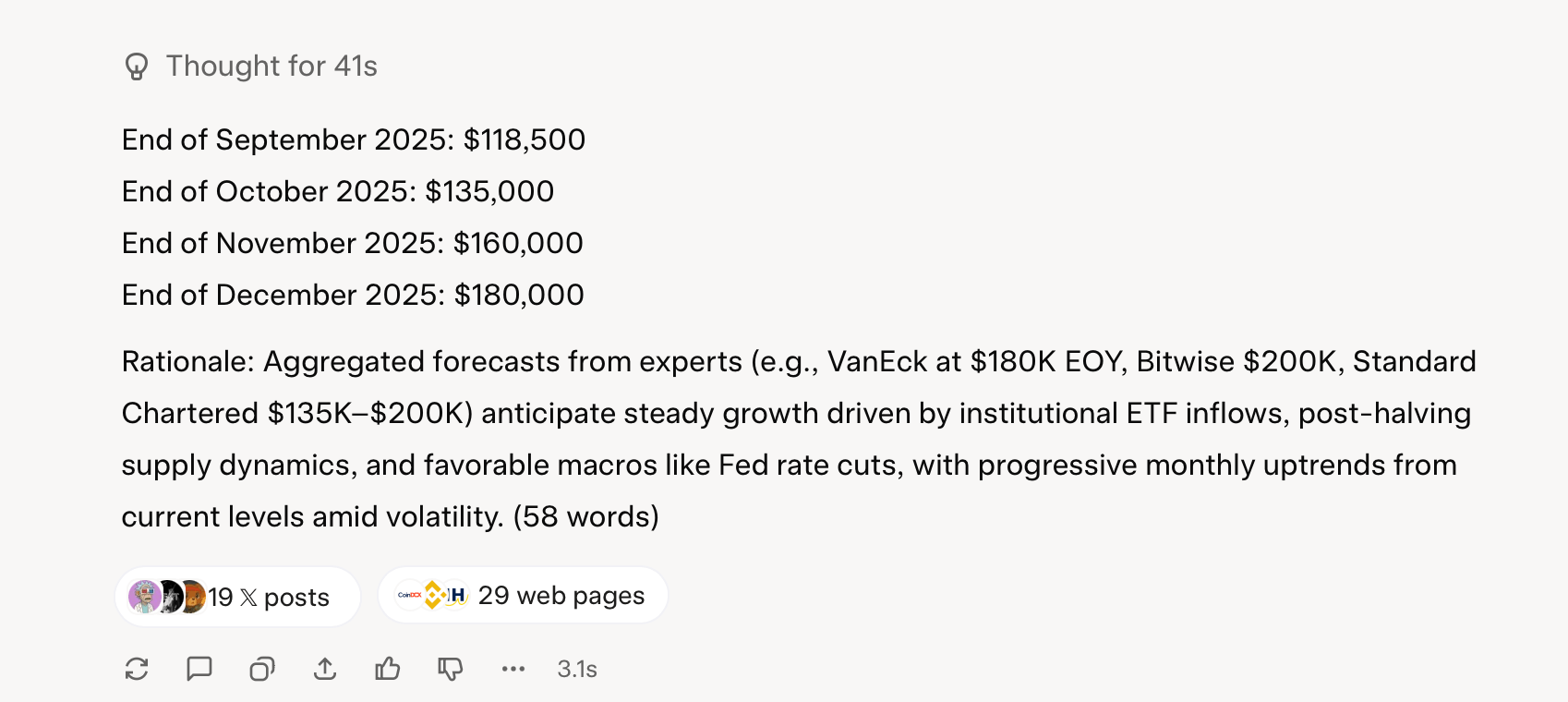

Grok 4的回答:

Grok 4回答的截图。

ChatGPT 5思考模式的回答:

估计(月底收盘):

2025年9月:$120,900;2025年10月:$128,700;2025年11月:$123,200;2025年12月:$131,800。

理由: 从$113,500–$114,246的基础上,我预计稳定的ETF净流入、减半后的供应紧张以及第四季度的风险偏好季节性将偏向上涨。10月通常受益于积极的资金和动能;11月因获利了结和期权布局而降温;12月因年末配置和减少矿工卖压而恢复。假设没有过大的监管或宏观冲击。

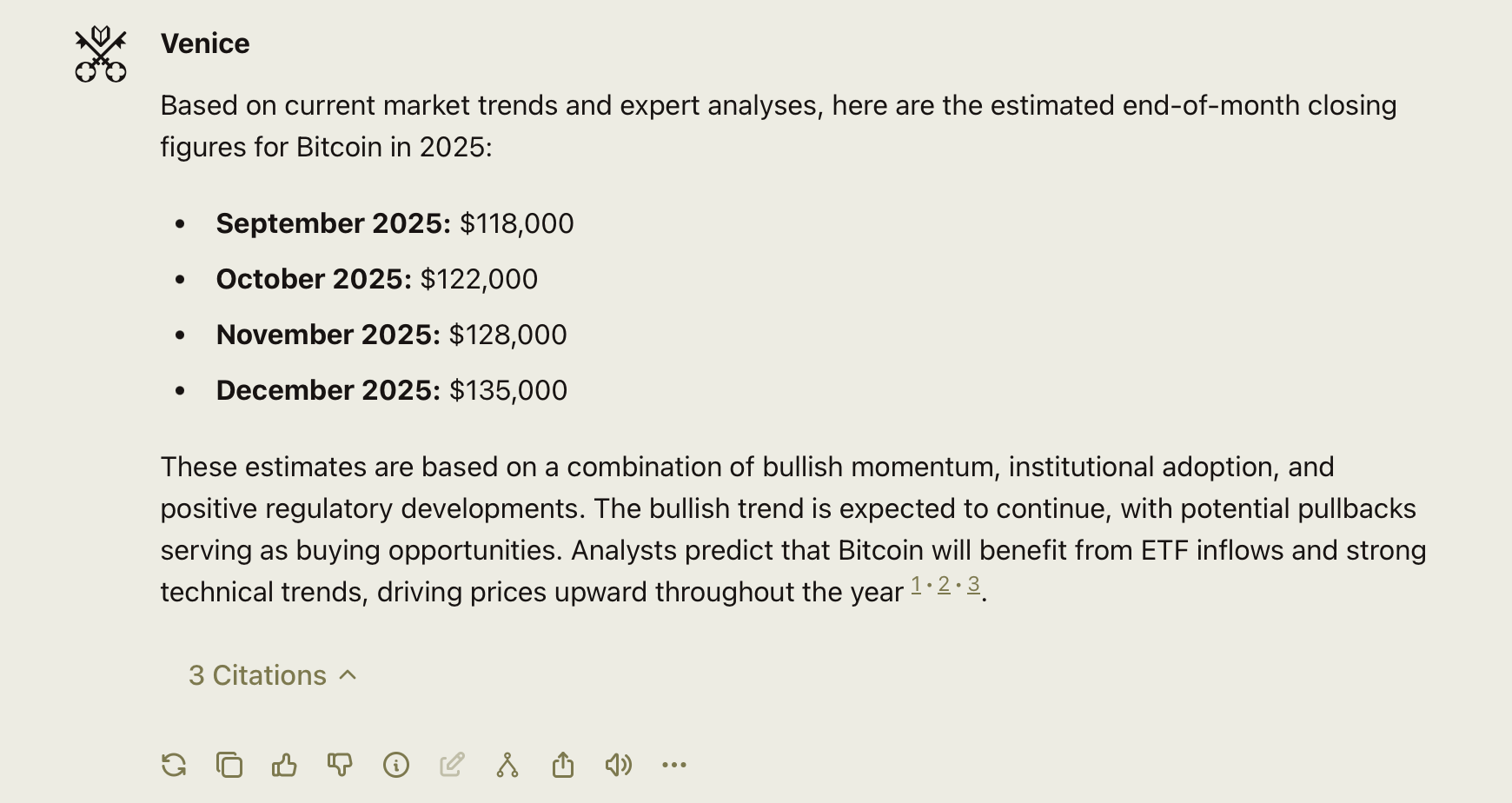

威尼斯AI的回答:

威尼斯AI回答的截图。

Deepseek与Deepthink的回答:

- 九月: $118,500(来自当前区间的动能)

- 十月: $125,200(机构流入加速)

- 十一月: $134,800(选举后波动与ETF需求)

- 十二月: $141,500(年末投资组合再平衡与周期高峰预期)

理由: 预计的收益受到持续的机构ETF采用、宏观流动性顺风和典型的减半年加速的推动,克服短期波动。每个月都建立在逐步的资本部署和积极的情绪之上。

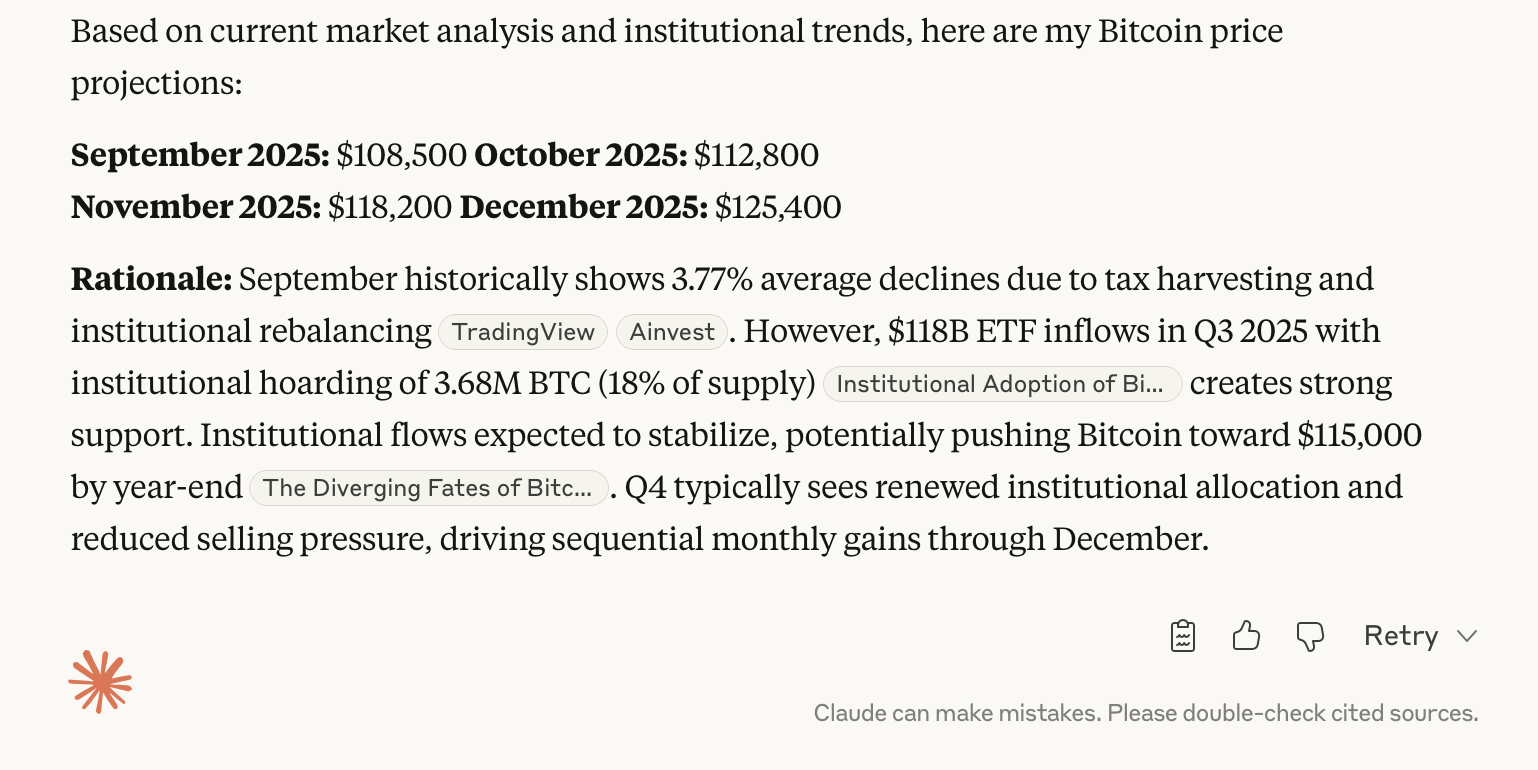

Claude Sonnet的回答:

Claude的回答截图。

Le Chat的回答:

预计比特币在2025年9月收盘为$118,000,10月为$122,000,11月为$114,743,12月为$117,674。这些目标反映了看涨的动能、机构ETF流入和宏观经济顺风,尽管11月和12月可能会出现整合或小幅回调。分析师指出强劲的需求和季节性趋势,尽管上涨潜力受到波动和获利了结的抑制。

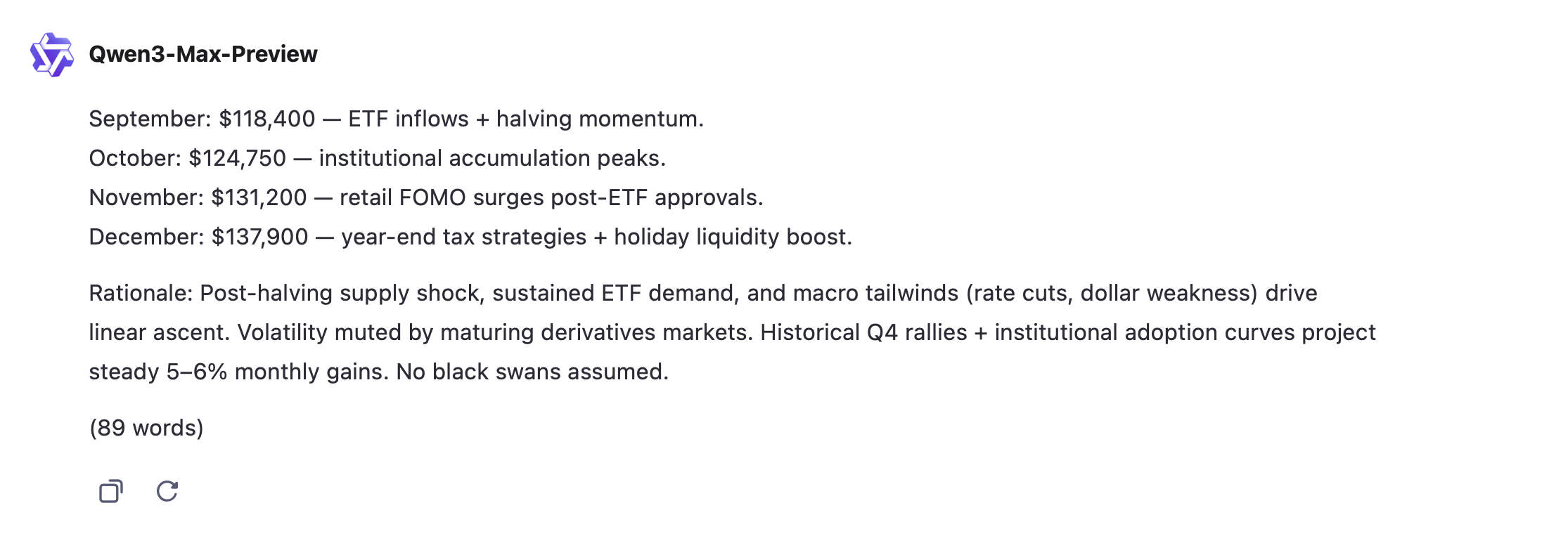

Qwen 3 Max的回答:

Qwen的回答截图。

ChatGPT 4o的回答:

预测的每月收盘价格(估计,90字以内)

- 2025年9月:$118,000 – 看涨动能可能在月底接近上方阻力

- 2025年10月:$121,000 – 与9月的适度上涨延续相一致

- 2025年11月:$119,000 – 预计在10月的高峰后略微整合

- 2025年12月:$122,000 – 年末假期季节性强劲和宏观乐观提供顺风

理由:基于乐观的9月展望(接近$118K),然后在年底继续适度上涨,并伴随周期性整合。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。