一小时图反映出紧密的整合阶段,伴随着日益增强的看涨压力。XRP在$2.934支撑区强劲反弹,确立了一个明确的短期底部。最近,价格走势正向接近$3.02的区间上限推进,伴随交易量的增加,表明积累可能即将结束。如果XRP突破$3.04的阈值,这可能验证短期突破,并引发快速的看涨延续。该设置为关注下一阶段决定性动作的交易者提供了有利的风险回报情景。

XRP/USD通过Bitfinex的1小时图,2025年9月10日。

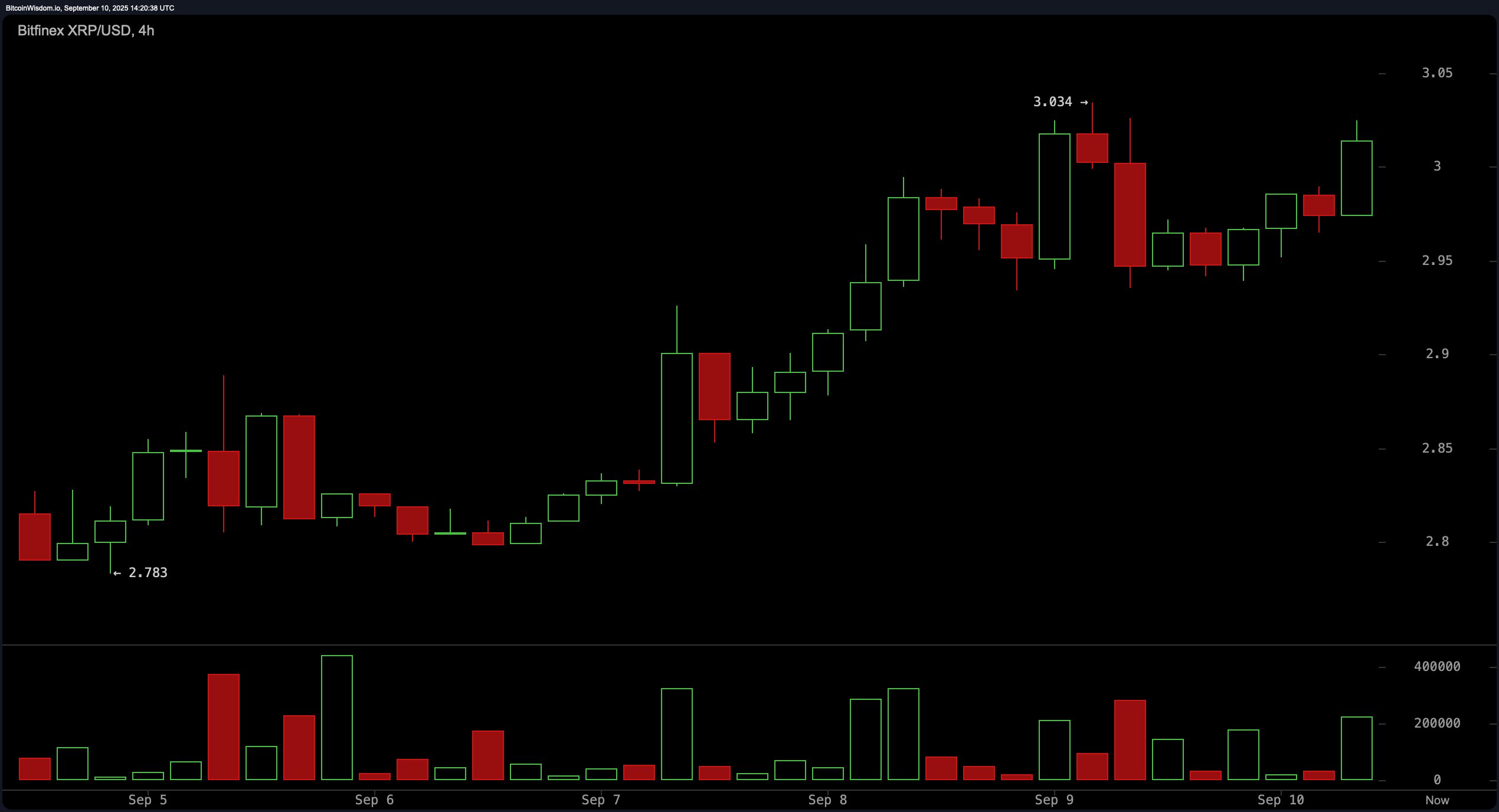

四小时图提供了对当前看涨结构的更广泛视角。在从$2.78突破至$3.03后,XRP进入了一个小幅回调阶段,并自此在$2.95和$3.03之间整合。该区域现在作为看涨延续模式,可能是旗形或三角形,得到了交易量明显增加的支持。若能干净利落地突破$3.03,将完成该模式并确认进一步的上行潜力。交易量的行为支持了延续的论点,特别是如果动能维持在$3.04以上。

XRP/USD通过Bitfinex的4小时图,2025年9月10日。

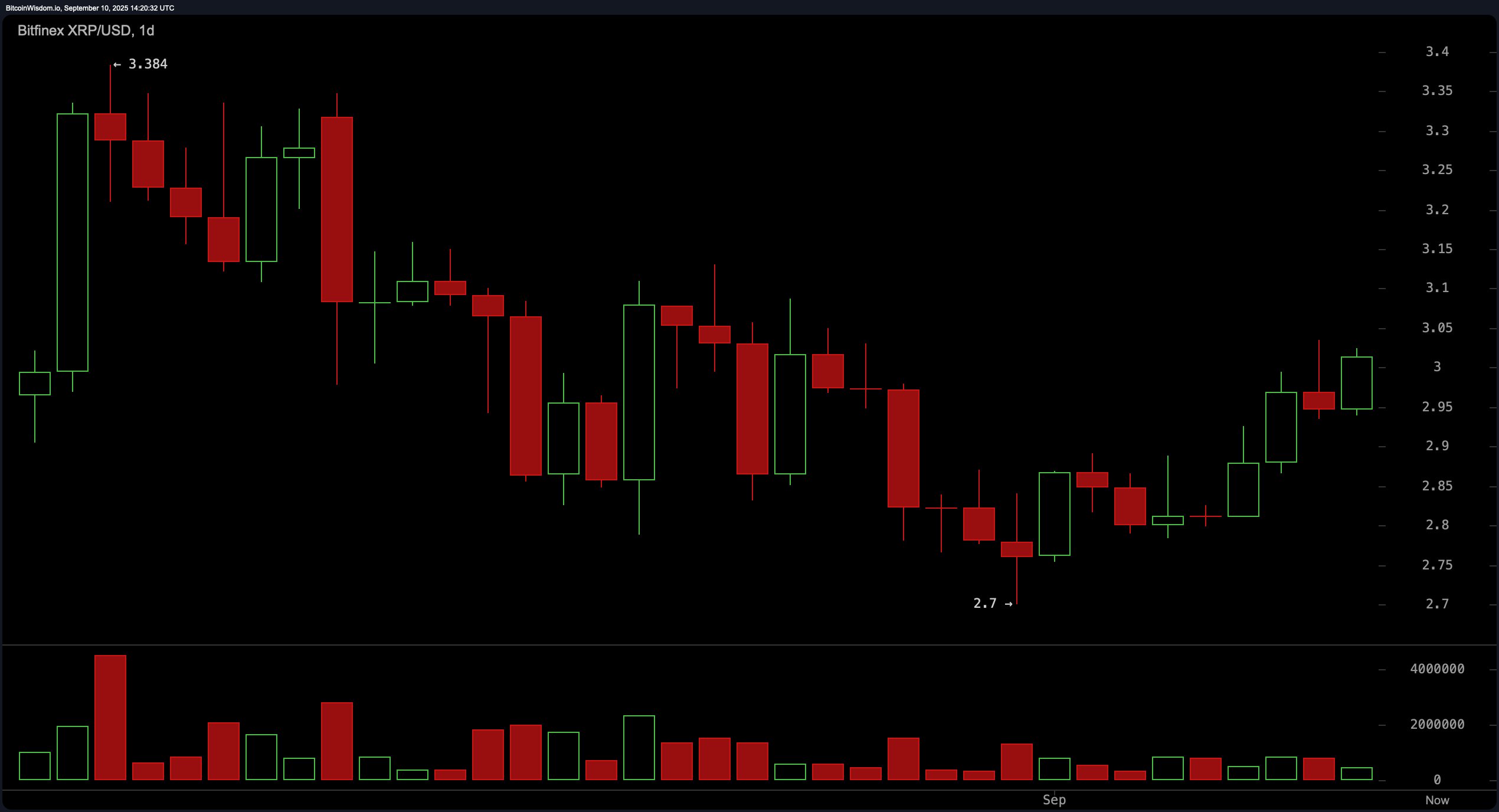

日线图揭示了在经历了8月的长期下跌后,趋势反转的宏观图景。XRP在约$2.70触底,自此形成了更高的低点和更高的高点——这是上升趋势发展的技术特征。最近的看涨蜡烛和稳定的交易量进一步证实了买入压力的增强。随着接近$3.38的阻力位作为下一个上行目标,只要XRP保持在关键支撑$2.93之上,趋势仍然是积极的。突破$3.38可能会将涨幅延伸至$3.50区域。

XRP/USD通过Bitfinex的1日图,2025年9月10日。

振荡器数据描绘了一个中性到轻微看涨的技术环境。例如,相对强弱指数(RSI)为54.93,表明买卖压力之间的平衡。随机振荡器为78.20,商品通道指数(CCI)为72.33,均处于中性区域。同样,平均方向指数(ADX)为16.52,反映出趋势强度较弱。然而,动量指标为0.23341,移动平均收敛发散(MACD)水平为-0.02207,均发出看涨信号——指向潜在的早期上行动能正在积聚。

移动平均线(MAs)进一步强化了XRP价格走势中的看涨基调。10、20、30、50、100和200周期的指数移动平均线(EMAs)均发出积极信号,表明持续的上行偏向。同样,10、20、30、100和200周期的简单移动平均线(SMAs)也支持价格持续上涨。唯一的例外是50周期的SMA,发出看跌信号,可能是由于其接近当前价格。这些指标的广泛一致性支持了趋势延续的可能性,$3.04及以上作为关键突破支点。

看涨判决:

在所有时间框架中看涨模式的汇聚,加上关键动量指标和移动平均线的买入信号,为XRP的持续上涨提供了有力的支持。确认突破$3.04可能为向$3.38及更高区域的反弹奠定基础,标志着上升趋势的恢复,并强化看涨前景。

看跌判决:

尽管短期内表现强劲,XRP在$3.04和$3.38附近面临强大的上方阻力,振荡器中缺乏明确的方向性强度值得谨慎。如果未能突破阻力或收盘低于$2.93,将使看涨设置失效,可能触发回调至$2.70区域,并强化看跌动能的转变。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。