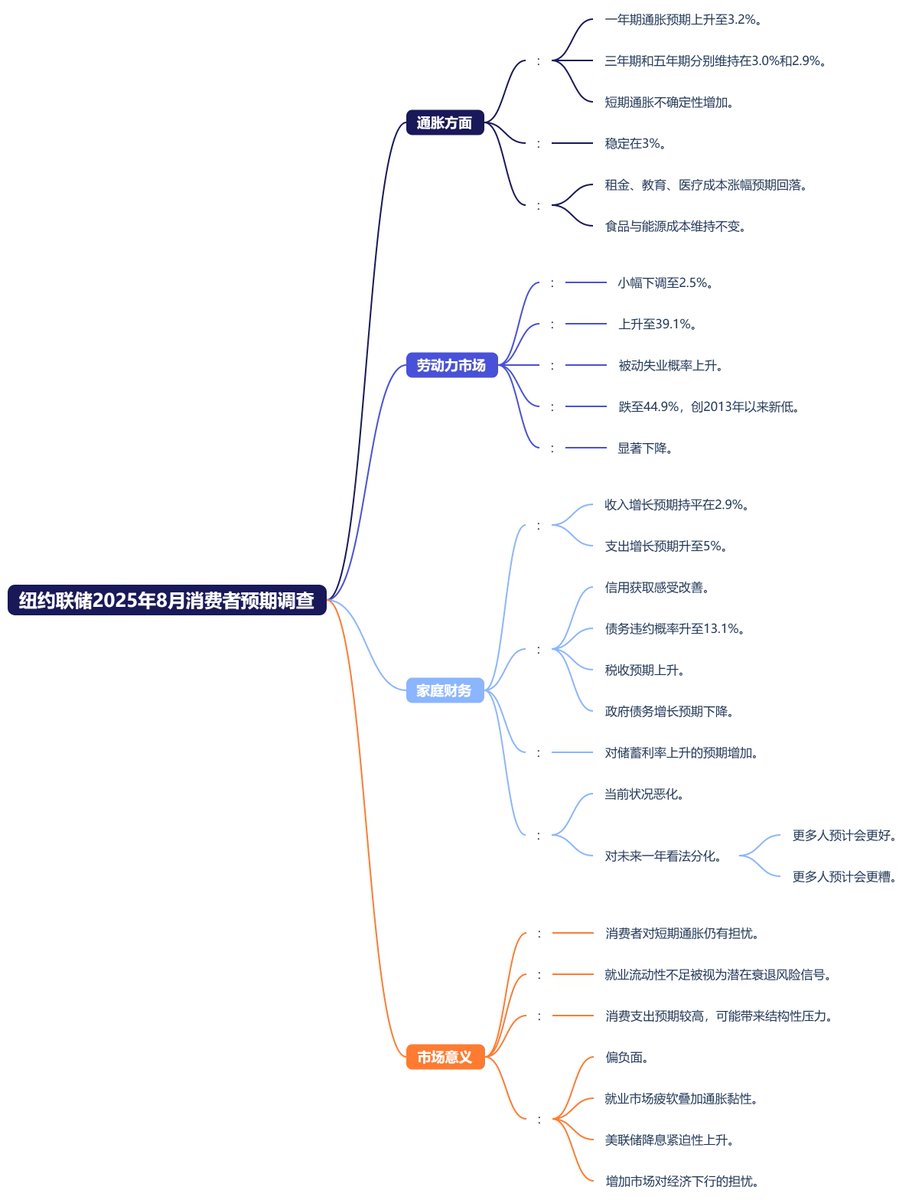

On September 9, Beijing time, the New York Federal Reserve released the Consumer Expectations Survey for August 2025. Overall, the survey indicated a slight increase in inflation expectations, a deterioration in employment confidence, and a divergence in household financial expectations. Regarding inflation, the one-year inflation expectation rose to 3.2%, while the three-year and five-year expectations remained at 3.0% and 2.9%, respectively, with short-term inflation uncertainty increasing. Home price expectations have stabilized at 3% for three consecutive months, while expectations for rent, education, and healthcare cost increases have receded, with food and energy remaining unchanged.

In terms of the labor market, wage growth expectations were slightly revised down to 2.5%, while the unemployment rate expectation rose to 39.1%. The risk of unemployment and the probability of passive unemployment increased, while the success rate of job searching fell to 44.9%, marking a new low since the series began in 2013, indicating a significant decline in employment confidence.

For household financial conditions, the expectation for household income growth remained flat at 2.9%, while the expectation for spending growth slightly increased to 5%. The perception of credit availability improved compared to last year, but future expectations tightened, with the probability of debt default rising to 13.1%. Tax expectations increased, while expectations for government debt growth decreased. There was an increase in expectations for rising savings rates. The current assessment of household financial conditions worsened, but views on the next year were mixed, with more people expecting improvement, while more also anticipated deterioration.

Overall, this survey reflects that American consumers still have concerns about short-term inflation, but more critically, confidence in the labor market has sharply declined, with insufficient job mobility seen as a potential recession risk signal. Expectations for consumer spending remain high, which may bring structural pressures. The report conveys a predominantly negative message to the market; the weakness in the job market combined with sticky inflation will increase the urgency for the Federal Reserve to cut interest rates, but it also raises concerns about economic downturns.

From the perspective of actual economic impact, rising inflation and economic downturns are mutually constraining. If the Federal Reserve chooses not to cut interest rates in September, I would not be surprised at all. However, considering the already tense labor data, a 25 basis point cut followed by using the dot plot to manage the market may be effective.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。