比特币的1小时图表显示出在达到$113,279的峰值后短期整合的迹象。在显著上涨后,出现了疲软的看跌压力,表现为成交量下降和小幅回撤。微支撑位于$110,624附近,而买家正试图重新夺回更高的水平。从$112,000的支撑反弹或成功回测并保持在$113,000的成交量可能会暗示新的上行动能。日内阻力明显位于$113,200到$113,500之间,$114,000则是当天的关键心理障碍。

BTC/USD 1小时图表,来源于Bitstamp,日期为2025年9月9日。

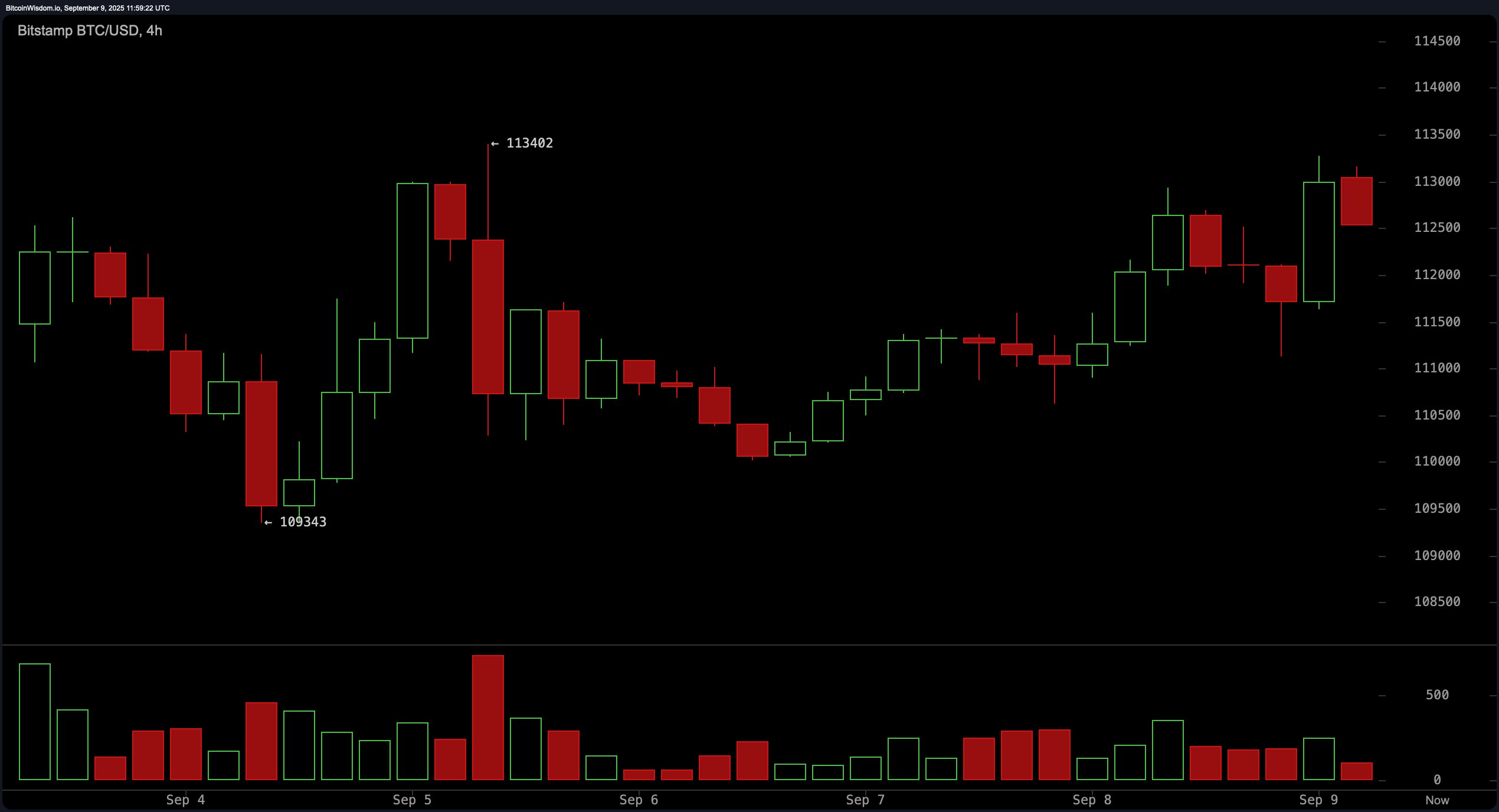

从4小时图来看,比特币显示出坚实的高低点结构,暗示上升趋势的延续。在$109,343形成局部底部后,价格已攀升至$113,402的局部高点。值得注意的是,牛市蜡烛的成交量激增,为反弹增添了可信度。在$111,500附近形成的看涨吞没蜡烛标志着一个有利的重新入场机会。建议交易者考虑在$111,500到$112,000之间的回调时入场,保护止损位设在$110,000以下。即时阻力位于$113,400到$114,000之间,突破此水平可能会打开更高收益的路径。

BTC/USD 4小时图表,来源于Bitstamp,日期为2025年9月9日。

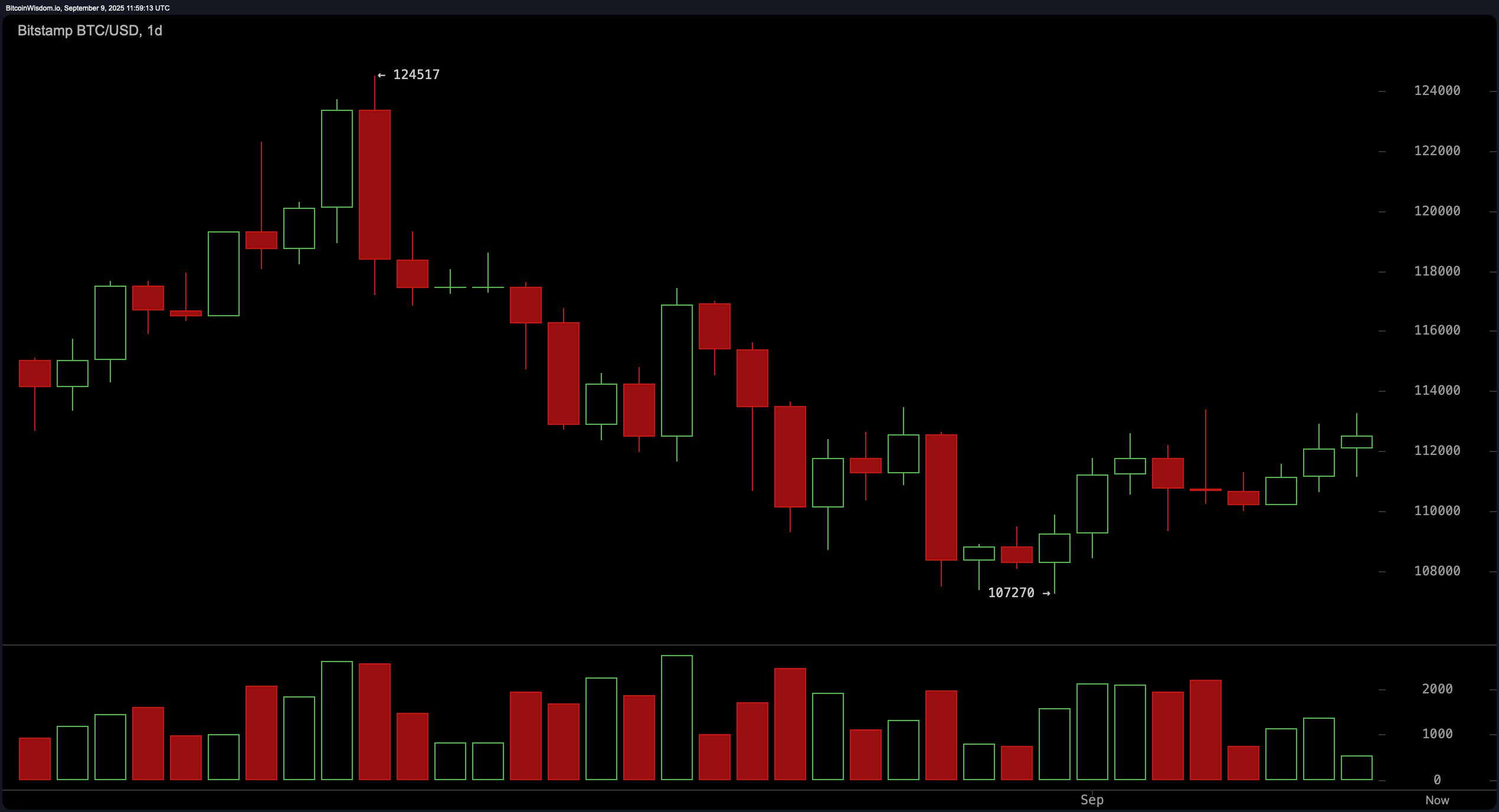

在日线图上,比特币的价格走势反映出在从$124,517急剧下跌至最近的$107,270底部后的恢复模式。这一修正伴随着高成交量,表明了清算事件或恐慌性退出。目前,价格结构形成了一个看涨的阶梯形态,持续出现更高的低点和高点,可能指向$107,000区域的双底形态。虽然在$110,000附近的激进入场机会已经过去,但保守策略应等待日线收盘在$113,500以上。关键阻力预计在$114,000到$115,000之间,随后是$120,000到$124,000之间的更强区域。

BTC/USD 1日图表,来源于Bitstamp,日期为2025年9月9日。

技术指标的分析支持谨慎看涨的立场。振荡器大多处于中性,相对强弱指数(RSI)为50.5,随机指标为74.9,商品通道指数(CCI)为43.3,平均方向指数(ADX)为14.9,强势振荡器为−2,511.1。然而,动能显著为正,达到3,777.0,移动平均收敛发散(MACD)水平为−961.4,均暗示着持续上行的潜力。

移动平均线提供了混合但总体上有利的前景。10日和20日的指数移动平均线(EMA)和简单移动平均线(SMA)均显示出看涨信号,价格水平在$110,799.4到$111,941.4之间。30日EMA保持看涨,位于$112,596.7,尽管30日SMA已转为看跌,位于$113,518.7。长期支撑由100日和200日EMA及SMA强化,均位于当前价格下方,突显出潜在的强度。预计50日EMA和SMA将提供阻力,分别位于$112,950.7和$114,831.5,均高于当前水平。

看涨判决:

如果比特币果断突破并收盘在$113,500的门槛之上,并伴随成交量,当前的上升趋势可能会加速。各时间框架上形成的更高低点和动能指标的强支撑表明进一步上涨的潜力,目标设定在$114,000到$124,000之间。

看跌判决:

如果比特币未能重新夺回$113,000并维持在其上方,当前的反弹可能会减弱,使资产面临新的卖压。跌破$111,000可能会使看涨结构失效,下行风险将延伸至$109,000,并可能重新测试$107,000的支撑区。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。