Hey everyone, let's take a look at the trends of Bitcoin and Ethereum first.

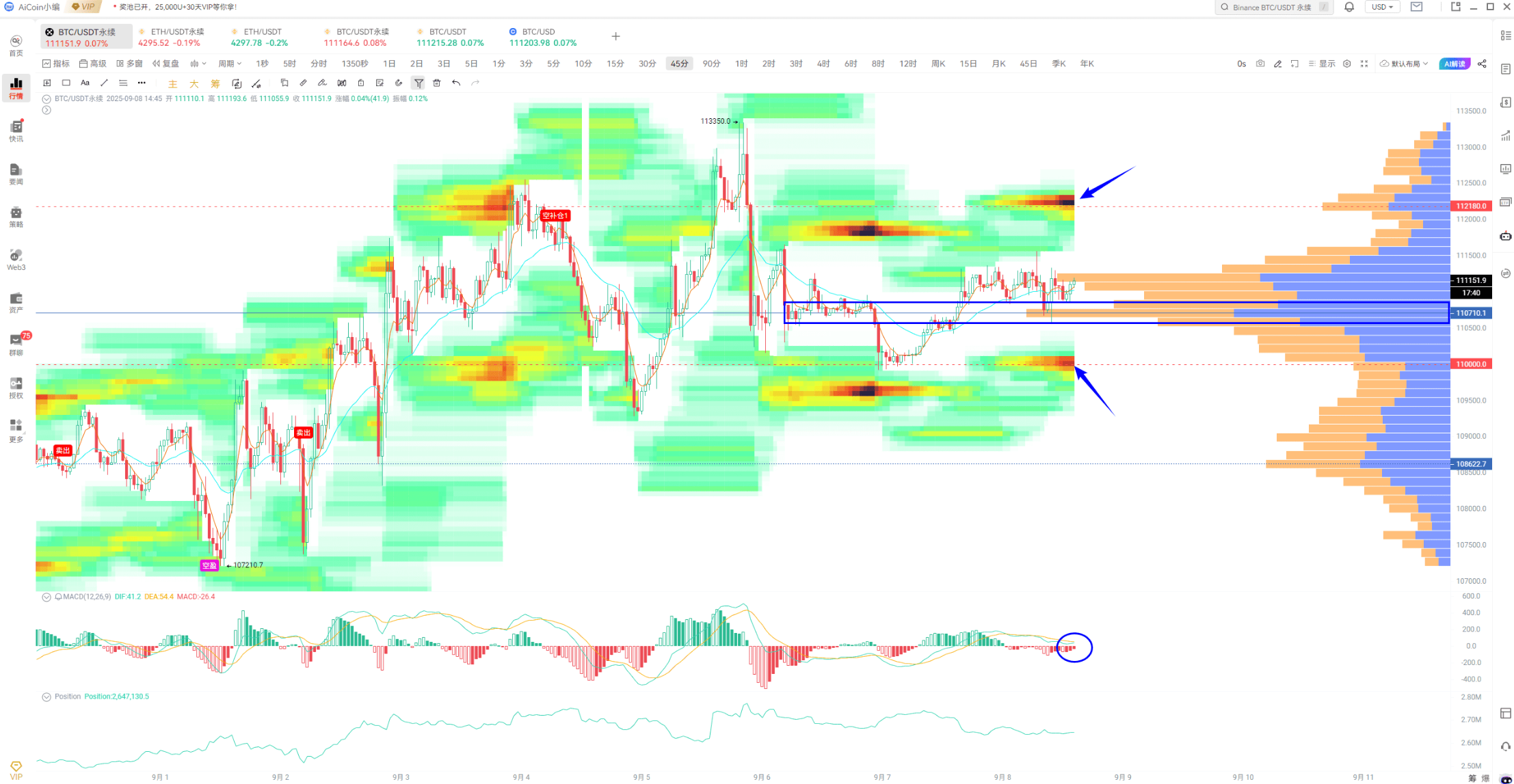

The current price of BTC has firmly stood above the support level of 110.7K, and the MACD fast and slow lines have crossed positively, showing a good momentum. However, we need to pay attention to the estimated liquidation range above the current price, which is 112K~112.3K. This range overlaps with the resistance at 112K, making it a short-term resistance area.

Now, let's take a look at the daily chart.

What is the logic behind the support and resistance in the larger cycle? The AiCoin editor has highlighted: the expectation of the Federal Reserve's interest rate cut has not yet materialized, and the interest rate decision will be announced next Thursday at 2 AM! Based on past market performance, it is common to see negative impacts when the decision is made (not 100% guaranteed), which is very important for the US stock market, US bonds, the US dollar, and the cryptocurrency market. Everyone should keep a close watch.

Next, let's look at Ethereum.

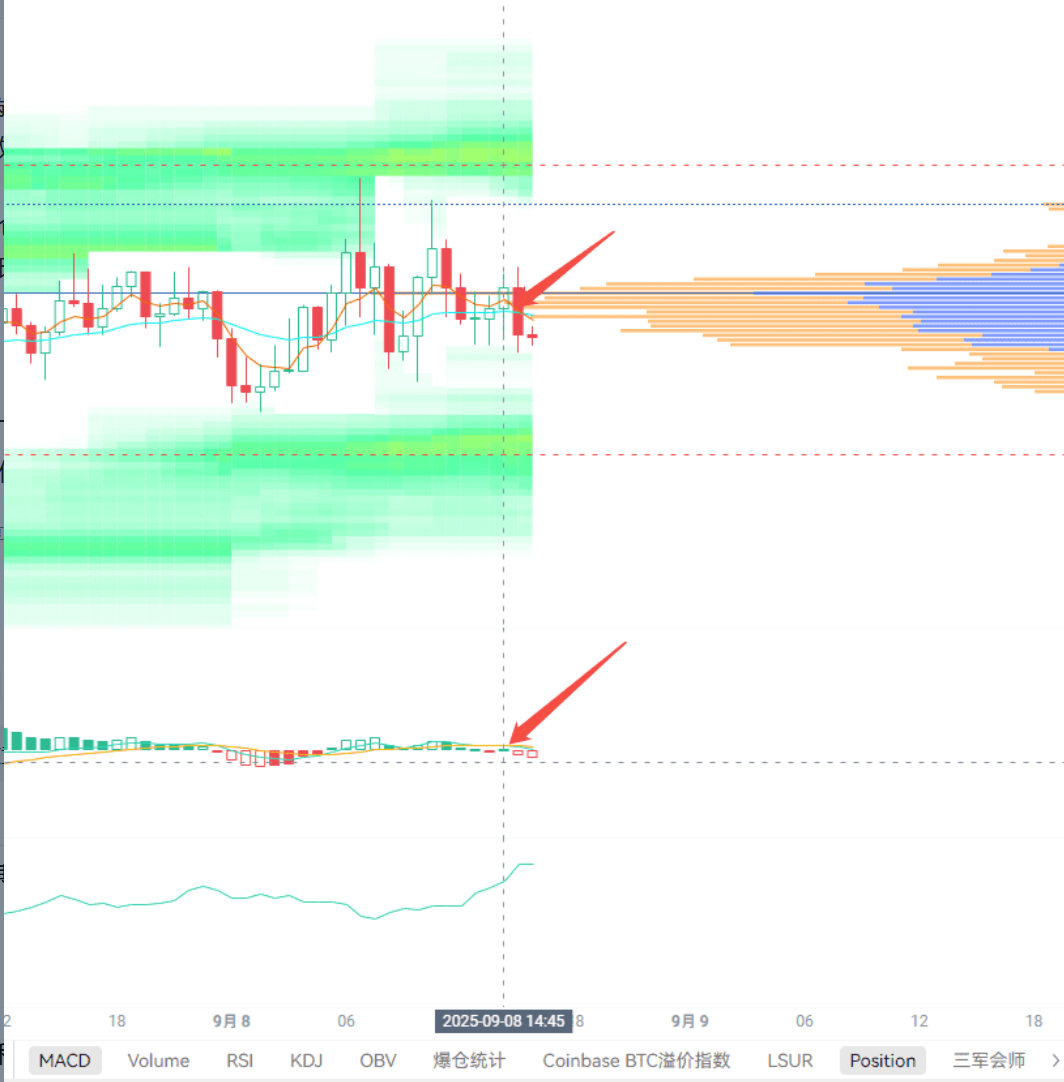

The current price has fallen below the support level, and the MACD has shown a death cross with insufficient momentum.

At the same time, the open interest is increasing, and there is no obvious magnetic zone in the short term. Focus on 4255, with resistance at 4340. In the daily cycle, the EMA24 has crossed below the EMA52, so we need to pay attention to the support at 4280. If the larger cycle breaks down, the next support will be at 4060; if it holds, we can look at 4565.

Let me emphasize that the support and resistance points mentioned above are based on the objective data from PRO's chip distribution, for reference only, and do not constitute any investment advice. Specific decisions should be made by you; I'm just sharing the data.

As long as it doesn't break 3950~4000, the overall trend of Ethereum is still intact. The 3-day high death cross indicates that we should watch the retracement of ETH during the period when the fast and slow lines approach the zero axis. If the retracement is not large, there is still a chance for a rally.

Additionally, for friends interested in the chip distribution feature, you can check out this tutorial: https://www.aicoin.com/article/364321.html. For those who didn't get selected, there will be more opportunities later. Our 10% discount for limited-time membership is still available: https://www.aicoin.com/vip/chartpro?code=041JY2KAGJy.

Now back to the live sharing session, combining the previous chip support, we can see that the current price is not particularly far off. Currently, Bitcoin and Ethereum have institutional support, and the previous rise brought in a lot of capital due to the ETF. Therefore, I personally believe that even in a significant drop, Bitcoin is unlikely to easily fall to the 9K range, making it suitable for bottom fishing.

Next, I want to share a super useful bottom-fishing tool — All-Coin DCA.

Our APP strategy cloud also supports running DCA.

The core value of this feature is: to give up one-time bottom fishing, by buying in batches + smart triggers to average down the cost, while also using stop-loss to protect the principal. Time is limited, so I won't explain the functional principles; I've shared them before, and you can also check the live replies.

This feature is really useful. I now use DCA for both spot and contract trading, which helps me pull down the average price, and it works well even with small funds. For those who are unsure about the direction, you can directly run spot DCA, selecting mainstream coins in the top 10 or top 20 by market cap, like BTC and ETH, as they are the most resilient (unlikely to drop more than 15%) and rebound steadily.

For those with a certain foundation, you can play with sector combinations according to your needs, such as RAW, AI, etc., or use a custom combination. One way is to directly run the recommended strategy.

Set the parameters in the program, and you can run it with the invested amount;

Another way is to create your own.

Customize the initial order amount, the price difference for adding positions, the multiple for adding positions, take profit and stop-loss settings, and trigger conditions, etc.

If you want to use DCA to lower the average price, the initial order amount should not be too heavy and should be lower than the amount for adding positions. For mainstream coins, you can set to add positions when they drop by 3~5%, but don't add too frequently. Set the number of additional positions based on your personal financial situation; don't set it too high or add positions infinitely, as it can easily become a bottomless pit. You can discuss specific situations with customer service.

Here, I want to emphasize that the multiple for adding positions should not be set too high; 1.0 or 1.2 times is sufficient, and I do not recommend more than 2 times. This is because it is exponential adding; for example, if the adding position amount is 100u and the multiple is 2, the future adding amounts will be 100, 200, 400, 800… If it's a contract, it will increase the risk of liquidation.

Additionally, when running, you can prioritize using TD/RSI/MACD indicators to trigger, as indicators replace emotional judgment, and you don't need to trigger the first order at market price.

If you are running based on sectors/market cap, pay special attention to the trading volume settings to filter out inactive coins. It is essential to set this to prevent buying into worthless coins, as you may not be able to sell them during a crash.

Our DCA now also supports profit reinvestment, which automatically invests the U earned from DCA into a new round of trading, increasing the initial and additional position amounts, creating a snowball effect. If you are worried about being trapped by a crash, you can set a maximum holding protection, which will help you close the position even if there are losses when it expires, or set a stop-loss.

Using custom indicators to run DCA is also possible, but the two strategies in my screenshot are paused, so the holding floating loss is not accurate. Using these smart tools for trading really frees up your hands, and you will love it. If you want to learn more about the DCA feature, you can check out this guide: https://www.aicoin.com/article/413786.html. Additionally, if you are concerned about device or network issues affecting the strategy, you can consider using our DCA, which also supports manually creating strategies!

This article only represents the author's personal views and does not represent the platform's stance or views. This article is for information sharing only and does not constitute any investment advice to anyone.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。