下次联邦公开市场委员会(FOMC)会议定于9月17日,现在距离会议不到两周。FOMC是美联储的政策制定机构,负责通过利率决策指导货币政策。每年举行八次定期会议,官员们评估经济状况并对联邦基金利率目标区间的变化进行投票。

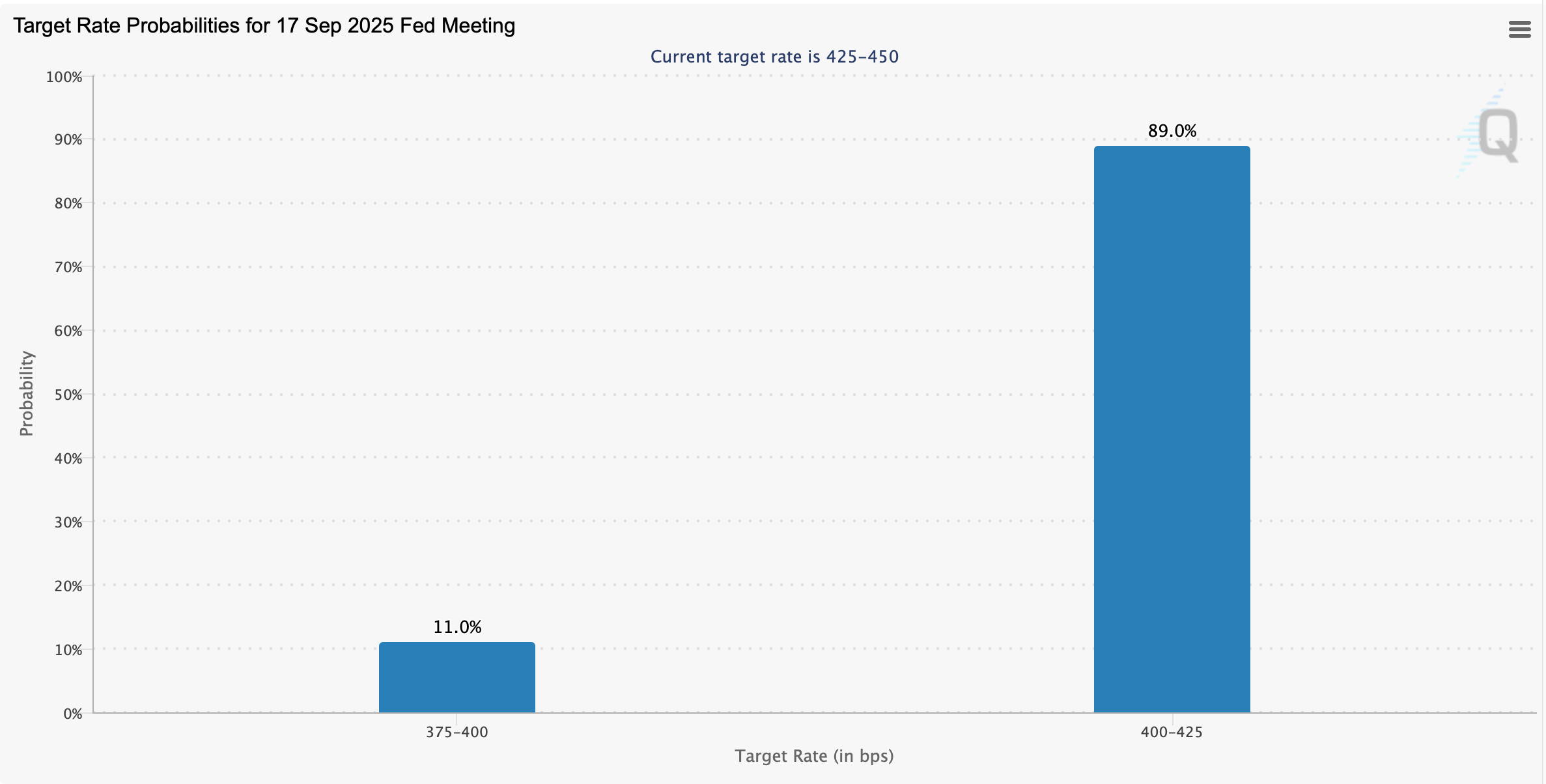

来源:2025年9月6日CME Fedwatch工具。

为了评估预期,市场参与者通常会转向CME Fedwatch工具。该工具由CME集团运营,通过分析与联邦基金利率相关的期货合约来计算即将召开的美联储会议的概率。它提供了交易者对政策结果定价的实时视图。截至9月6日,Fedwatch工具目前显示,25个基点降息至4.00%–4.25%的概率为89%,而降息50个基点至3.75%–4.00%的概率为11%。

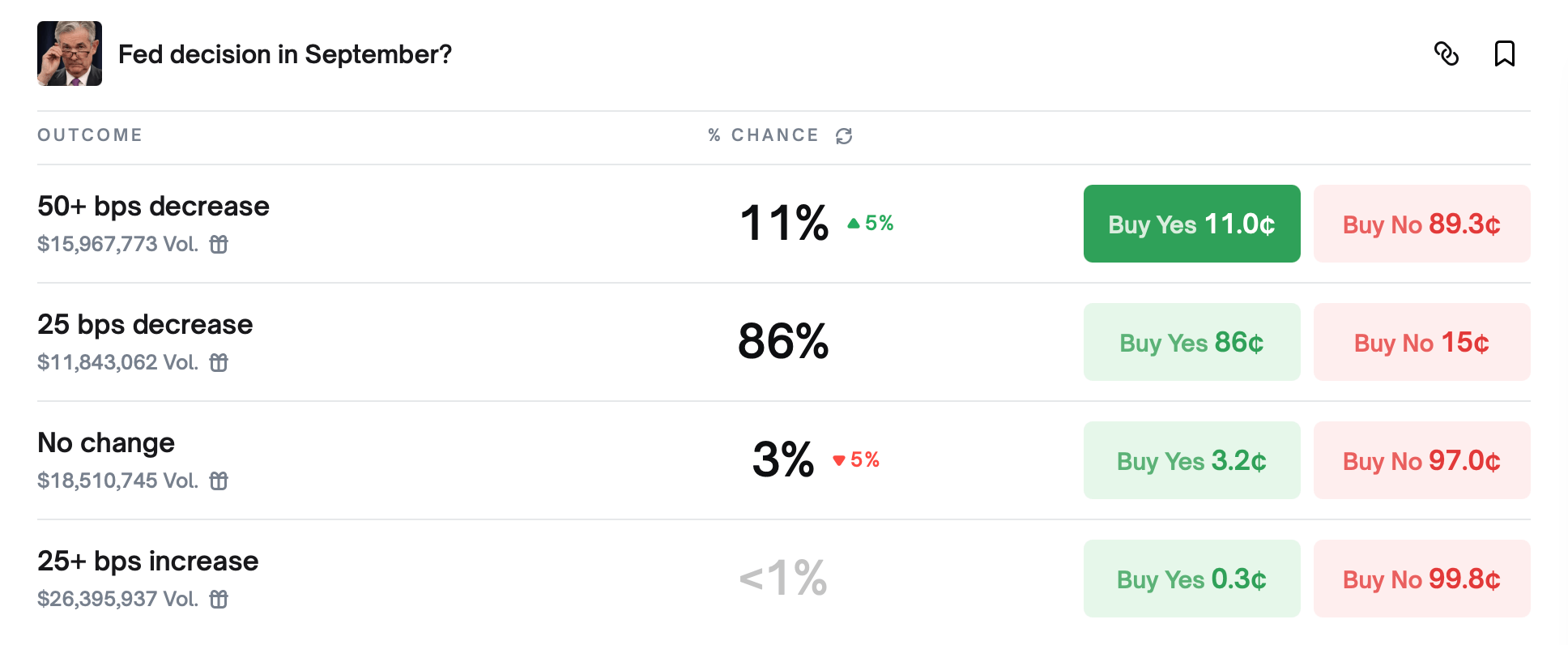

来源:2025年9月6日Polymarket美联储投注。

预测市场提供了另一层见解。Polymarket是一个基于区块链的交易平台,允许参与者对事件结果进行投注,包括经济和政治决策。虽然它目前在国际上运营,但该公司已透露计划很快扩展到美国。Polymarket的交易者压倒性地认为9月会降息25个基点,给这一结果分配了86%的概率。对更大50个基点变动的概率为11%,而仅有3%的人预计不会改变。加息的概率定价在1%以下。

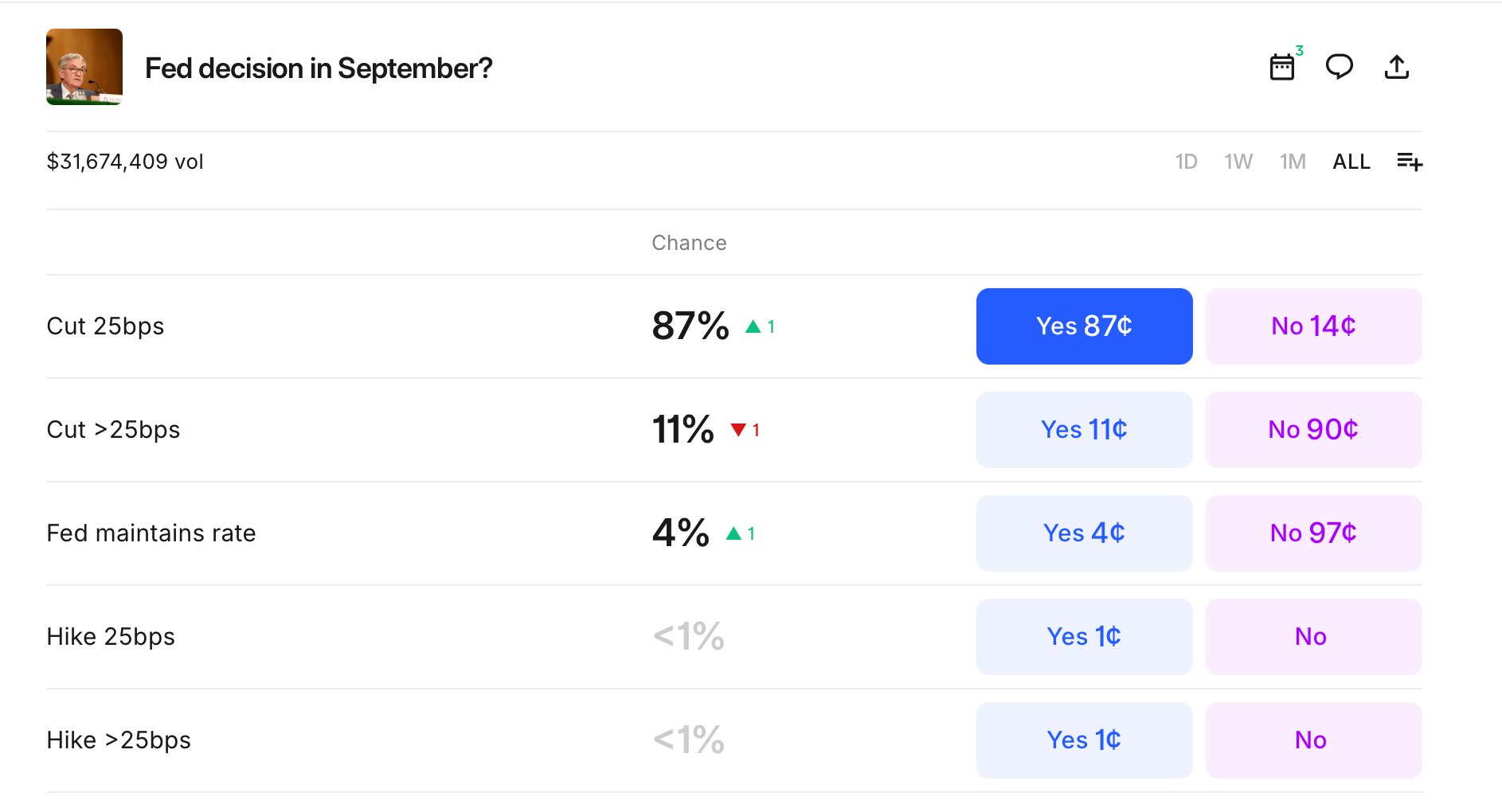

Kalshi是另一个位于美国的受监管预测市场,也提供与经济指标和美联储决策相关的合约。Kalshi之前已获得商品期货交易委员会(CFTC)的批准,使其在事件驱动合约方面在国内占有一席之地。今天来自Kalshi的数据表明,25个基点降息的概率为87%,更大变动的概率为11%,而4%的人预计美联储将维持利率不变。对加息的投注仍然低于1%。

来源:2025年9月6日Kalshi美联储投注。

综合来看,CME期货和预测市场数据指向同一结论:多个平台的交易者预计将放松政策。对四分之一点降息的几乎一致预期突显了投资者对美联储将在即将召开的会议上降低借贷成本的强烈信心。然而,仍然存在微小的可能性进行更激进的降息,如果中央银行带来意外,市场反应仍有空间。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。