比特币仍然低于关键阻力,发出谨慎信号。趋势在不同时间框架上发生了变化,但成交量缺乏确认宏观反转所需的强度。更深的回调或突破可能会定义下一阶段。

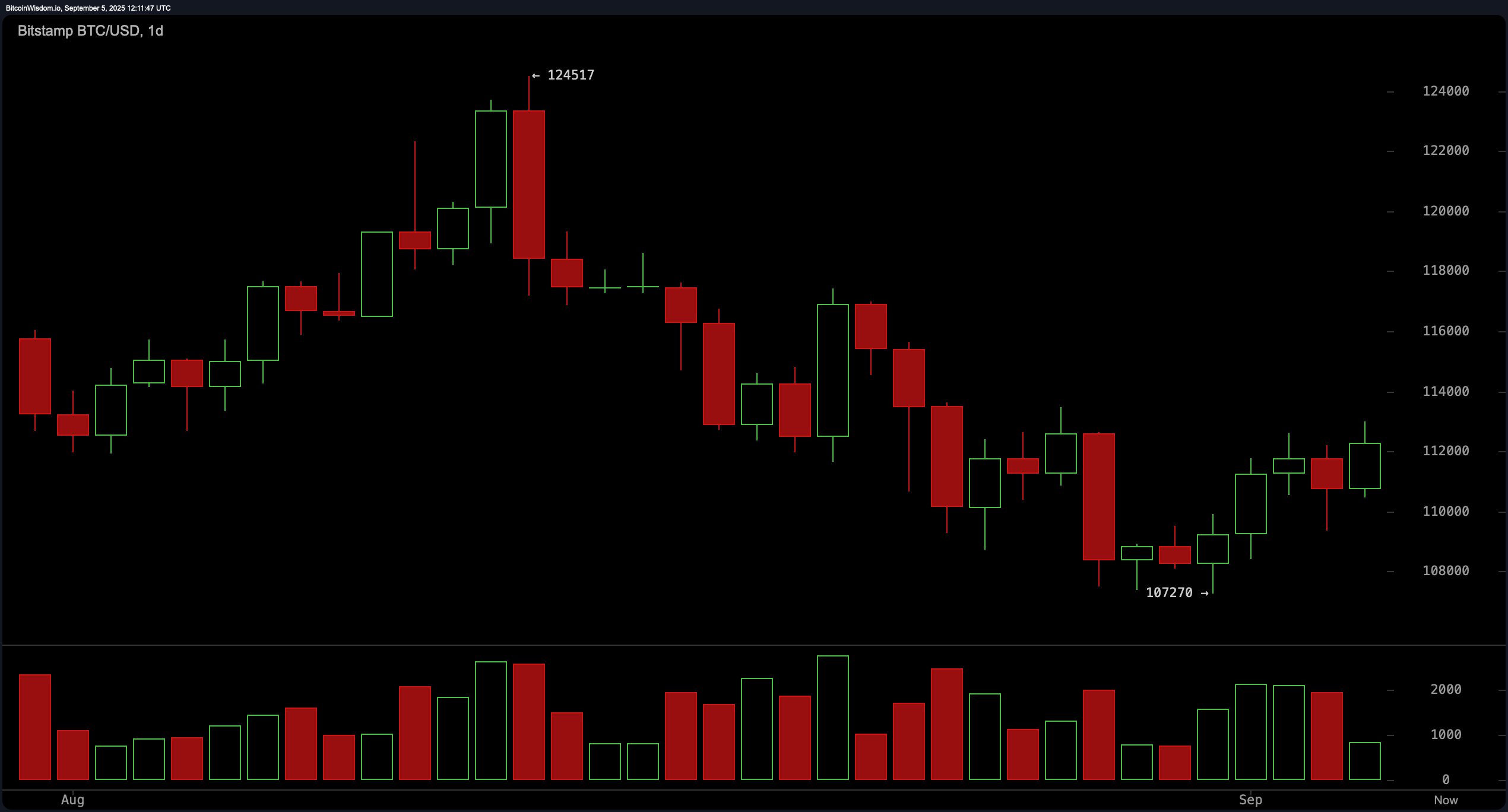

日线比特币图表显示,从124,517美元的高点开始,明显的下行趋势。在107,270美元处触及局部底部后,比特币反弹,但这一走势缺乏后续跟进。结构仍然看跌,形成了更低的高点。阻力重重位于113,000美元和114,000美元之间,卖方曾在此介入。支撑位接近107,000美元,105,000美元以下是最后的防线。买入兴趣有所增加,但不足以改变更大的趋势。

BTC/USD 1日图表,来源于Bitstamp,日期为2025年9月5日。

在4小时比特币图表上,动能已转为看涨。比特币重新夺回107,270美元,并向113,002美元推进,这是一个与日线阻力相符的关键水平。在这一过程中,成交量增加,显示买方重新回到市场。如果回调至111,000–111,500美元并得到成交量的支持,可能会提供一个良好的多头入场机会。如果113,000美元的阻力未能突破,获利了结可能会导致价格下跌。

BTC/USD 4小时图表,来源于Bitstamp,日期为2025年9月5日。

1小时比特币图表讲述了一个更短的故事。比特币形成了一系列更高的高点和低点,峰值为113,002美元。现在它在阻力下横盘整理。成交量在高点时激增,然后减弱,表明买方疲惫。突破113,000美元可能会触发突破。但如果跌破112,000美元,可能会测试111,500美元甚至110,000美元。日内交易应针对该区间,直到出现明确的突破。

BTC/USD 1小时图表,来源于Bitstamp,日期为2025年9月5日。

振荡器描绘了中性到轻微看涨的图景。相对强弱指数(RSI)为49。随机振荡器读数为44。两者都表明市场处于平衡状态。商品通道指数(CCI)为−9,平均方向指数(ADX)为18——均为中性。动能为628,显示出看涨信号。移动平均收敛发散(MACD)水平为−1,365,也显示出看涨信号。

移动平均线(MAs)显示市场正在过渡。短期均线看涨。10和20周期的指数移动平均线(EMA)和简单移动平均线(SMA)均处于正区间。但30到50周期的长期EMA和SMA则暗示卖压。100和200周期的移动平均线,无论是指数还是简单,仍然偏向多头,表明在更深的水平上有支撑。

市场在趋势之间徘徊。动能正在改善,但阻力依然坚固。如果比特币以成交量突破113,000美元,可能会重新测试114,000美元或更高。但如果未能守住111,000美元,可能会拖向109,000美元或107,000美元。交易者应密切关注成交量。这一轮反弹可能仍然是熊市反弹。

看涨判决:

如果比特币在强劲成交量的支持下突破并保持在113,000美元以上,将确认短期看涨反转。买方可能会推动价格向114,000美元进发,并在动能持续的情况下重新夺回更高水平。

看跌判决:

如果比特币未能守住111,000美元,可能会回落至109,000美元甚至107,000美元。没有成交量的支持,这一轮反弹可能会作为更广泛下行趋势的延续而消退。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。