2025年全球加密货币采用指数将印度和美国列为加密货币采用的顶尖国家,强调了亚洲基层零售需求和北美监管清晰度的双重驱动因素。

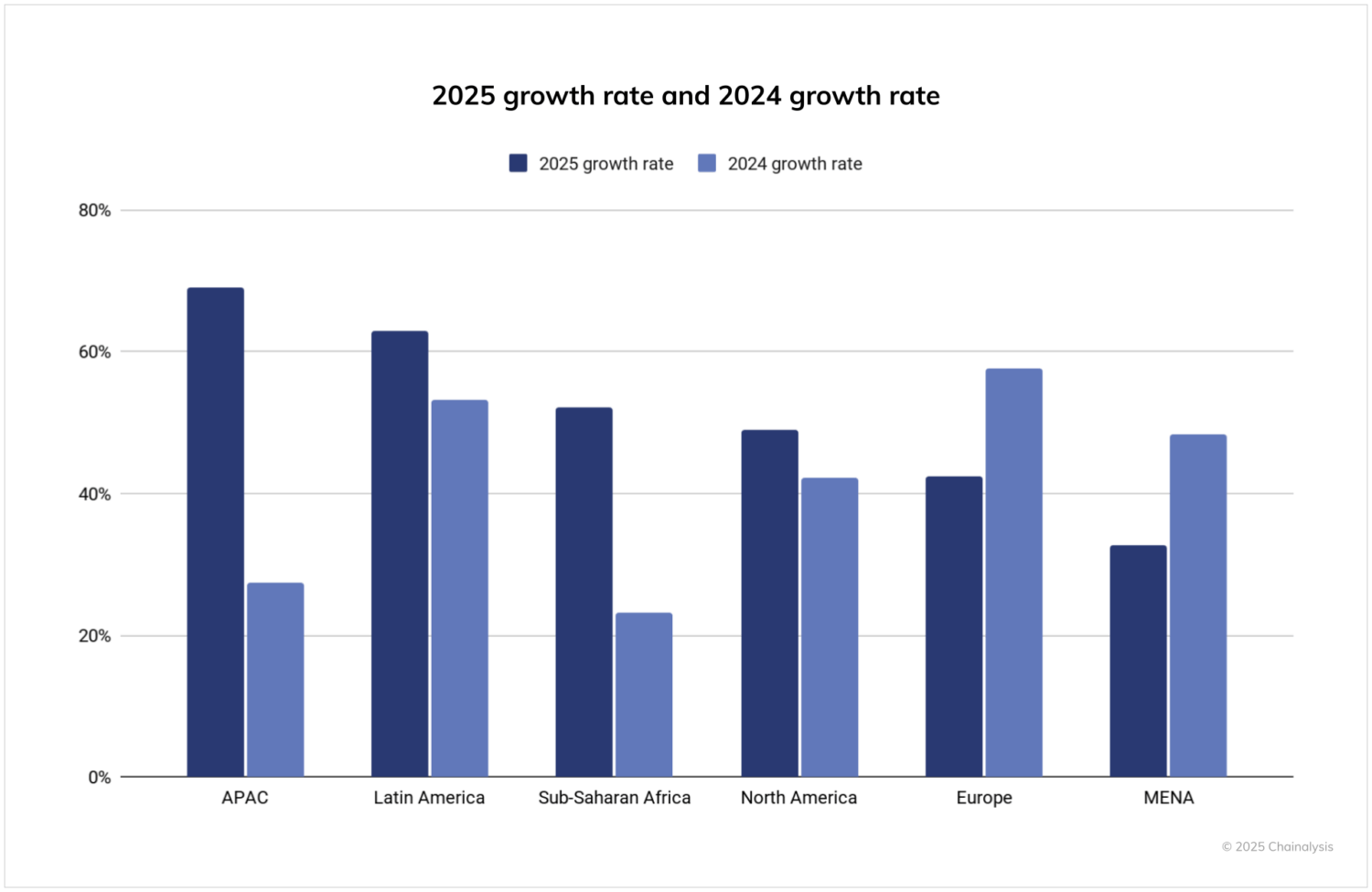

根据Chainalysis在完整报告发布前的博客文章,亚太地区巩固了其作为全球增长最快的加密货币中心的角色,交易量同比增长69%,达到2.36万亿美元,印度、巴基斯坦和越南领衔。拉丁美洲以63%的增长紧随其后,而撒哈拉以南非洲则增长了52%,主要受到汇款和支付用例的推动。

相比之下,北美和欧洲在绝对金额上仍然占据主导地位,分别处理了2.2万亿美元和2.6万亿美元的活动。北美49%的增长反映了受到现货比特币交易所交易基金(ETF)和更清晰规则推动的强劲机构流入,而欧洲42%的增长在其已经较高的基数上也显得相当可观。

2024年与2025年各地区增长率

稳定币在加密基础设施中仍然占据核心地位,USDT和USDC每月处理数万亿美元。2024年6月至2025年6月,仅Tether每月处理超过1万亿美元,而USDC在2024年10月激增至3.29万亿美元,共同巩固了它们在支付和机构活动中的稳定币角色。

在法币入口方面,比特币占据主导地位,法币流入达4.6万亿美元,是Layer 1代币的两倍多,远超稳定币和山寨币。美国在全球领先,法币流入量为4.2万亿美元,其次是韩国和欧盟。

总体而言,数据表明全球南方的采用速度加快,同时巩固了比特币和稳定币作为加密全球经济的支柱。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。