撰文:White55,火星财经

一夜之间,纳斯达克的一纸监管通知让疯狂的加密资产财库热潮骤然降温,上市公司通过发行股票疯狂购买加密货币的模式面临严峻考验。

纳斯达克交易所正在加强对旗下上市公司投资加密货币行为的审查,要求部分公司在发行新股购买代币前必须获得股东批准,并要及时向市场披露。如果不遵守规定,则要面临退市和暂停交易处理。

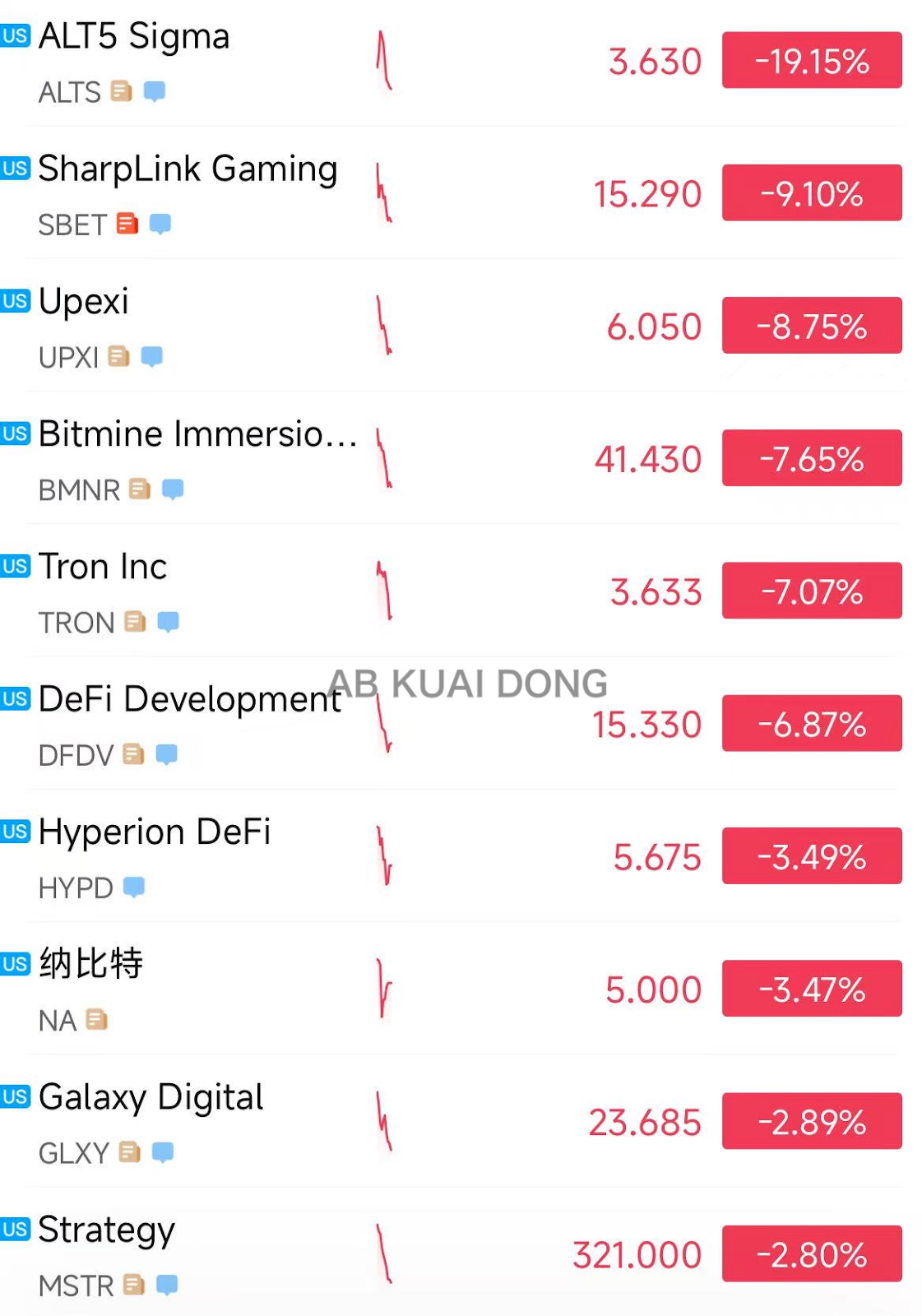

这一监管举措迅速在市场引发震动,大量加密资产财库公司(DATs)股价大幅下挫。

其中,与特朗普家族项目挂钩的代币和企业跌幅最为显著,ALT5 Sigma Corp 股价重挫 12%,过去一周累计跌幅已超 50%。

这一规定旨在确保投资者充分了解相关风险,减缓当前的加密货币热潮。

纳斯达克的审查是基于对交易活动的内部审查后做出的。审查发现了与「‘拉高出货’骗局相关的模式」,尤其是在美国跨市场交易环境中,其中加密货币领域占据了一定比例。

微策略模式:上市公司加密投资的热潮与风险

MicroStrategy(微策略)作为这场热潮的始作俑者,开创了上市公司大量持有加密货币作为财库储备资产的模式。这家软件制造商目前的主要业务是购买比特币,过去五年已累积价值 710 亿美元的加密货币,成为热门股票。

微策略公司由迈克尔·塞勒(Michael Saylor)领导,自 2020 年开始利用现金流以及股权和债务融资收益来积累比特币作为主要库存储备资产。

截至 2025 年 7 月 8 日,该公司持有 63.6 万枚比特币,公司市值过去两年从低点上涨超过 10 倍。

微策略的成功引发了广泛模仿。到了 2024 年底,当比特币价格再次突破 10 万美元关口,加密储备热潮彻底爆发。

从医疗企业 Kindly MD 到农产品贸易商,30 家不同行业的上市公司争相入场。

这种策略在加密货币上升市场中效果最佳,因此任何延迟都可能导致公司错失机会窗口。但随着比特币价格攀升,微策略通过融资购买比特币的边际效应正在递减。

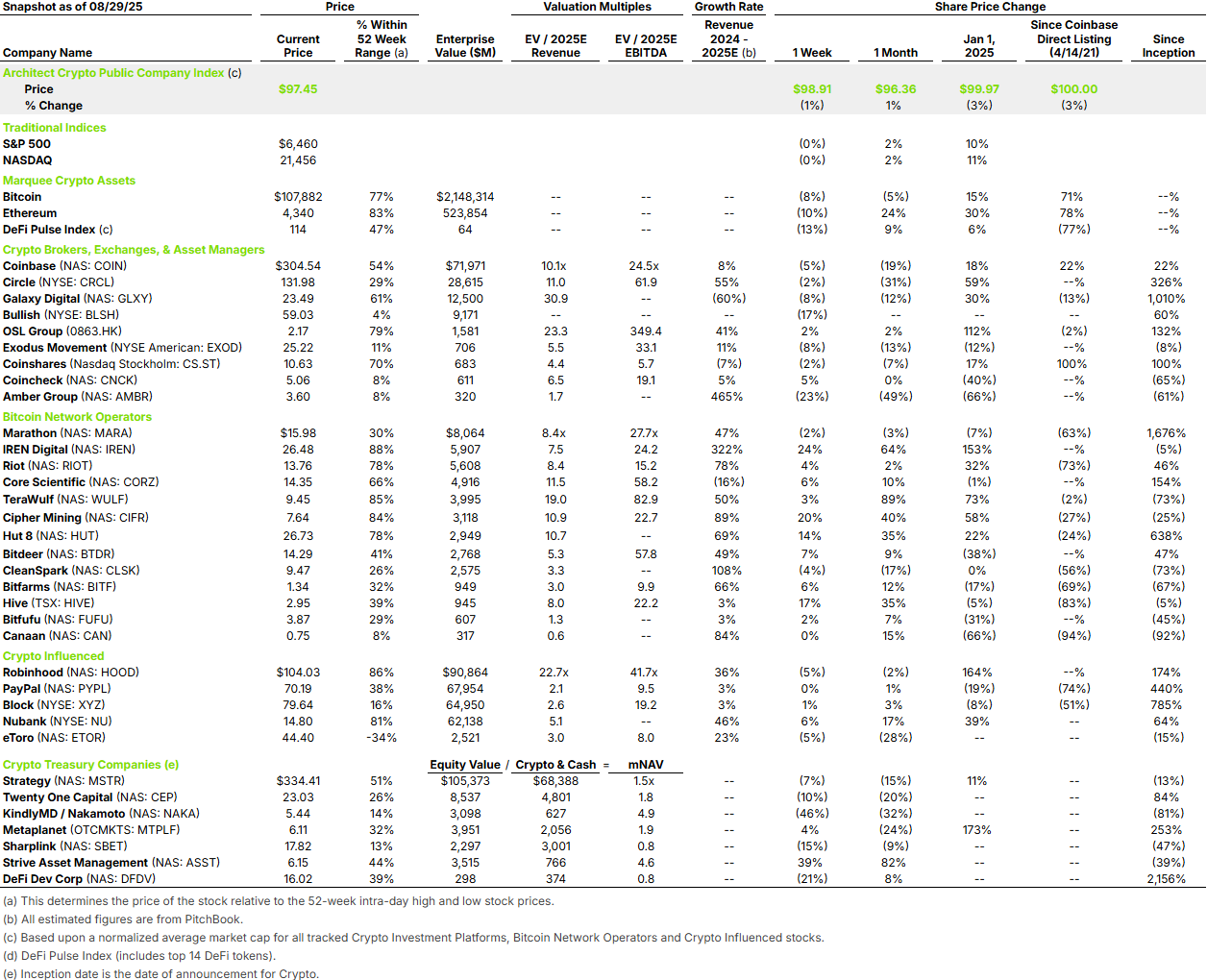

财务咨询公司 Architect Partners 的数据显示,过去 12 个月,加密货币上市公司活动呈爆炸式增长,主要受常规 IPO(Circle、eToro、Bullish;Kraken、Figure、Gemini 等即将上市)、上市(Galaxy、Exodus、Coincheck、Amber、Sol Strategies)和数字资产财务(DAT)公司(Twenty One Capital、Nakamoto、Strive、ProBTC、SharpLink、BitMine 等)的推动。

对于 DAT,已有 184 家上市公司宣布计划筹集超 1320 亿美元资金,用于购买各类加密货币。其中 94 只股票在纳斯达克上市,仅 17 只在纽约证券交易所交易。

市场反应:加密财库公司集体重挫

纳斯达克的新监管要求迅速在市场引发反应。加密货币财库公司股价普遍走低,其中与特朗普旗下去中心化金融项目 World Liberty Financial Inc. 关联的 WLFI 代币持仓机构 ALT5 Sigma Corp 股价重挫 12%,过去一周累计跌幅已超 50%。

WLFI 代币当日下跌 25%,较上市首日价格腰斩。

由埃里克·特朗普参与的矿企 American Bitcoin Corp 周三上市后最大跌幅达 22%。

图表源于加密KOL:@_FORAB

其他众多加密货币财库公司同样走低,其中 Sharplink Gaming 股价下跌 8.26%,持有Solana代币的 DeFi Technologies 股价下跌 3.88%。

甚至行业龙头微策略公司也未能幸免,其股价已较去年 11 月创下的 543 美元高点大跌超过 40%。

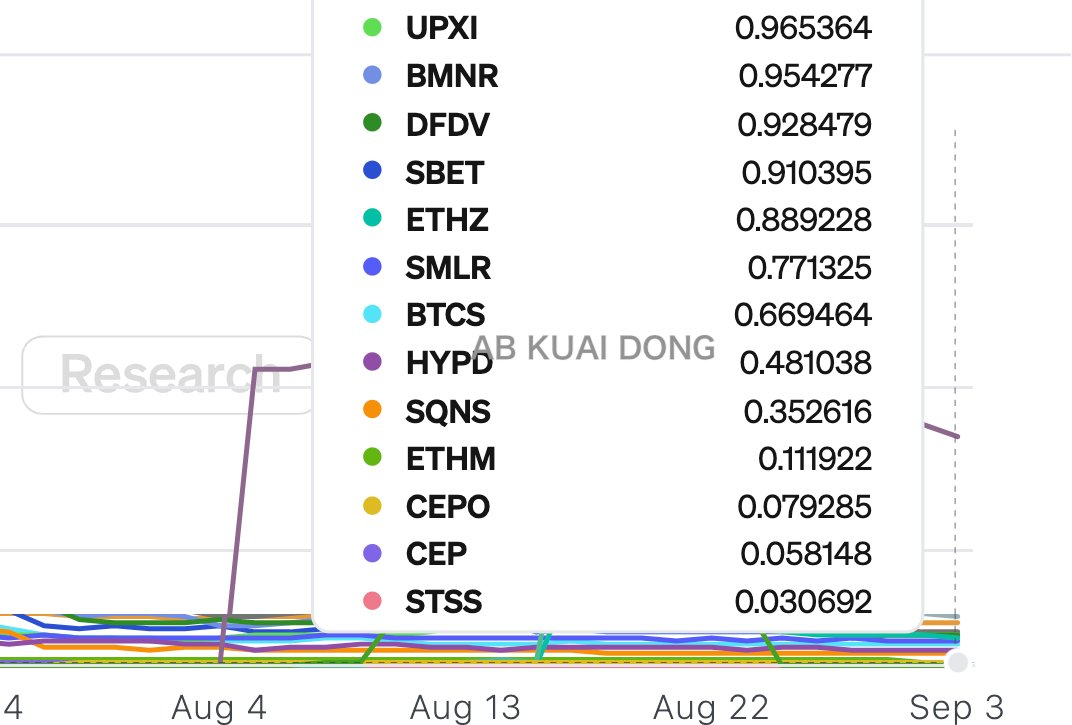

估值重构:mNAV 全面小于1的现象解析

在这场暴跌中,一个关键现象引起了市场关注:许多加密财库公司的股票总市值已低于其持有代币的总价值,即 mNAV(市值与净资产比率)全面小于 1。

这种现象反映了市场对这些公司的不信任加剧。投资者正在重新评估这些公司资产负债表中底层代币的实际价值。

WLFI 代币投资者 Morten Christensen 指出:「我认为目前 ALT5 Sigma Corp 的股票与 WLFI 代币之间存在大量套利操作,直到两者的估值比例回归合理水平。」

根据巴伦周刊计算,微策略所谓的「比特币溢價」,即该公司的价值与其比特币持有量之比,已经下降。目前微策略股票交易价约为比特币价值的 1.7 倍,11 月底的峰值则为三倍。

美股上涨与加密市场独跌

与加密资产财库公司集体重挫形成鲜明对比的是,美股市场在 9 月 4 日表现强劲。8 月「小非农」数据强化降息预期,美股周四收盘三大指数集体上涨,标普 500 指数涨 0.83%,再度触及历史新高。

纳斯达克指数上涨 0.98%,报 21,707.69 点。这种分化走势凸显了加密资产财库公司的独立风险。

加密货币市场本身也面临压力。数字资产及其相关股票延续下跌态势,比特币也处于其近期交易区间的低位。

未来影响:加密财库模式何去何从

纳斯达克的新规可能从根本上改变加密财库公司的发展轨迹。通过股东批准要求,纳斯达克实际上是在表明,股东通常会在公司经历真正变革性的所有权或运营变化之前拥有发言权。

这种规定可能会减缓相关交易的推进速度。对于加密财库公司来说,融资和发行股票的速度至关重要。任何延迟都可能导致公司错失机会窗口。

市场担忧监管层可能会对近几个月涌现的众多「上市数字资产财库公司」采取限制措施。许多这类曾陷入困境的公司转型加密货币领域后,其股价曾一度大幅飙升。

King & Spalding 律师事务所合伙人 Dan Kahan 表示:「通过股东批准要求,纳斯达克实际上是在表明,如果你投资纳斯达克公司,股东通常会在公司经历真正变革性的所有权或运营变化之前拥有发言权。」

截至 9 月 5 日晨间,比特币回升突破 11.1 万美元,以太坊回升突破 4300 美元,24 小时跌幅均收窄。

但加密货币总市值仍为 3.907 万亿美元,24 小时下跌 0.8%。

纳斯达克的新规已经让市场意识到,上市公司借发行股票炒币的疯狂时代可能即将结束。随着监管收紧,那些仅仅依靠加密叙事而非实际业务价值的公司,将面临市场重新定价的考验。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。