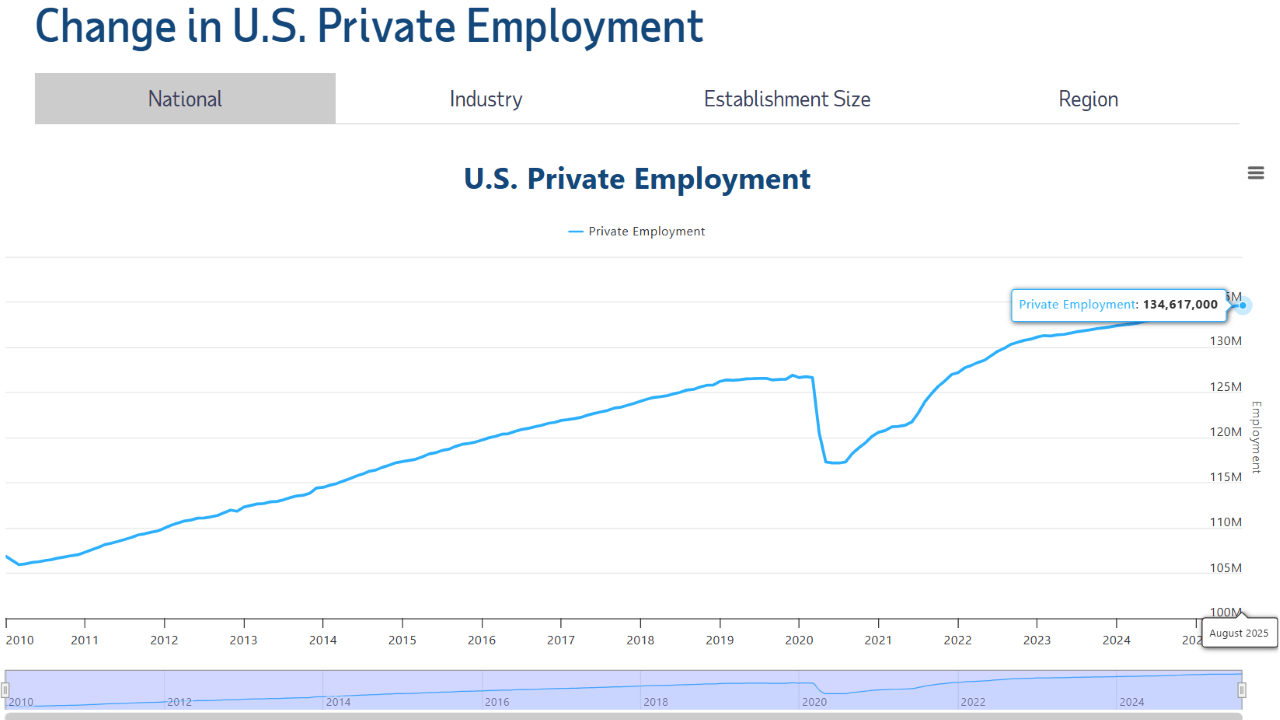

总部位于新泽西的人力资源公司ADP周四报告称,美国私营部门新增了54,000个就业岗位,但这一数字远低于经济学家预期的75,000个岗位。股市似乎对这一消息不以为然,或许是在等待联邦政府周五发布的就业报告,但比特币却遭遇重创,跌幅超过2%。

制造业、贸易、教育、健康甚至金融等行业遭遇了最大的裁员,共计失去38,000个岗位。相对而言,休闲和酒店业表现较好,新增了50,000个职位,建筑和专业服务等领域也报告了就业增长。

(周四的ADP私营部门就业报告显示,美国私营就业增加了54,000个,远低于预期的75,000个岗位 / adp.com)

但随着截至8月30日的一周内,首次申请失业救济的人数也增加了8,000,达到237,000,创下自6月以来的最高水平,而职位空缺降至自2024年9月以来的最低水平,ADP的最新报告无疑是对美国就业市场日益阴暗前景的又一次打击,也可能对比特币产生短期影响。

“年初时就业增长强劲,但这种势头因不确定性而受到冲击,”ADP首席经济学家Nela Richardson博士表示。“多种因素可能解释了招聘放缓,包括劳动力短缺、消费者谨慎以及人工智能的干扰。”

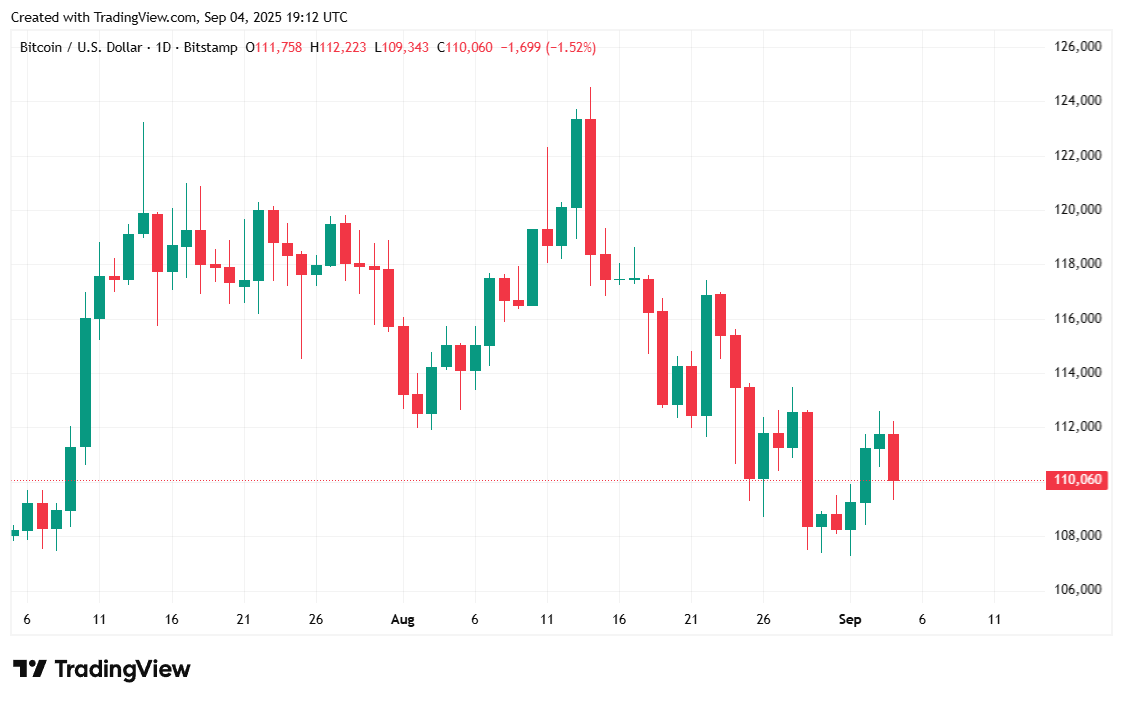

在报道时,比特币的交易价格为$110,122.90,日内下跌1.59%,过去一周也下跌了2.25%。Coinmarketcap的数据表明,这种加密货币在过去24小时内的交易区间为$109,347.23至$112,297.39。

(BTC价格 / Trading View)

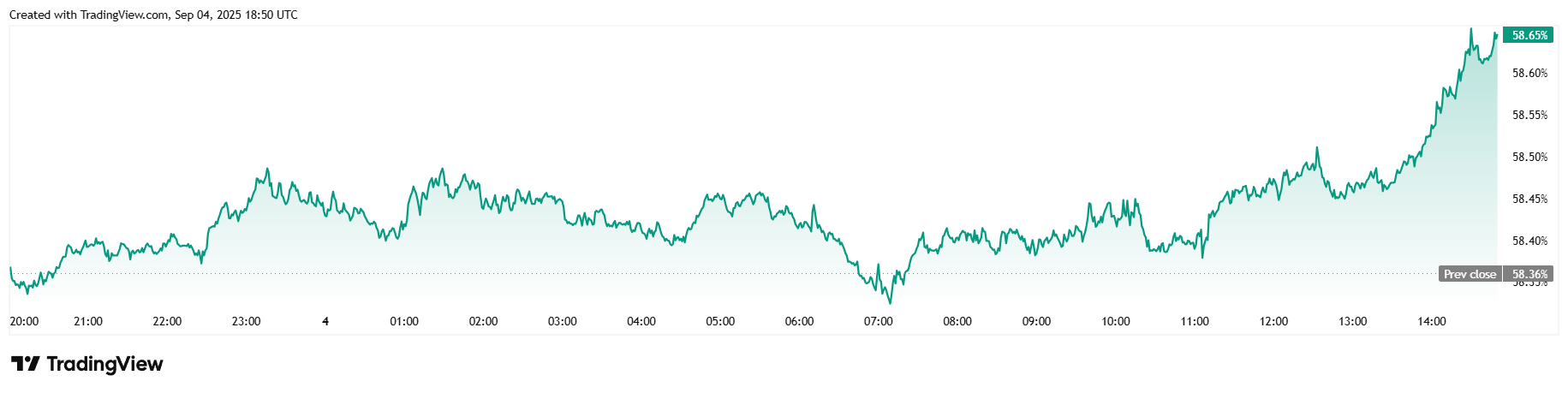

在撰写时,今日的交易量下降了8.77%,为$57.75亿。市场总市值也下降了1.55%,为$2.19万亿,但比特币的市场主导地位微增0.48%,达到58.65%。

(BTC主导地位 / Trading View)

比特币期货的总未平仓合约在24小时内下降了1.53%,降至$79.95亿,而Coinglass显示比特币的清算总额达到了4285万美元。其中大部分为多头清算,金额为3880万美元,空头清算则占剩余的405万美元。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。