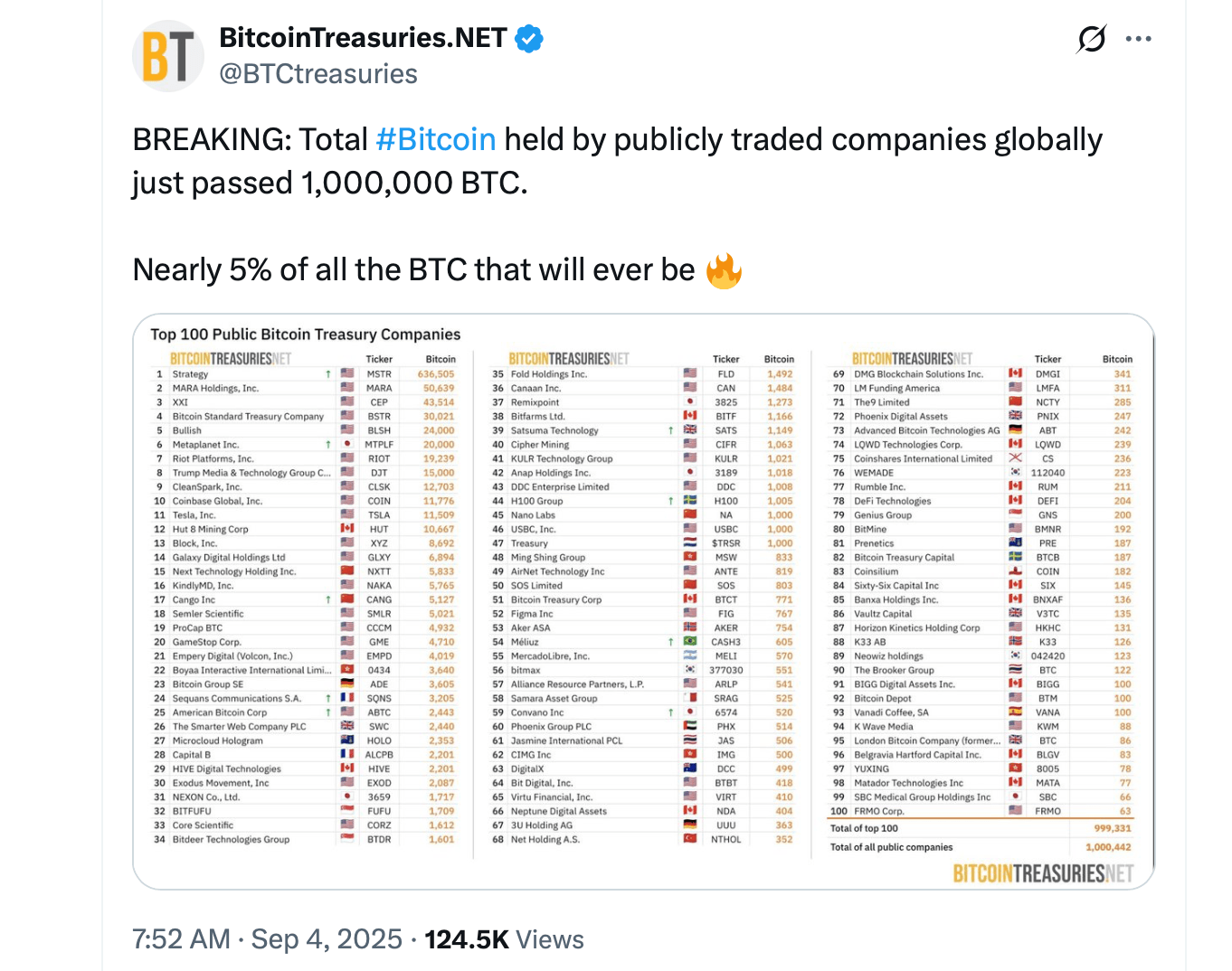

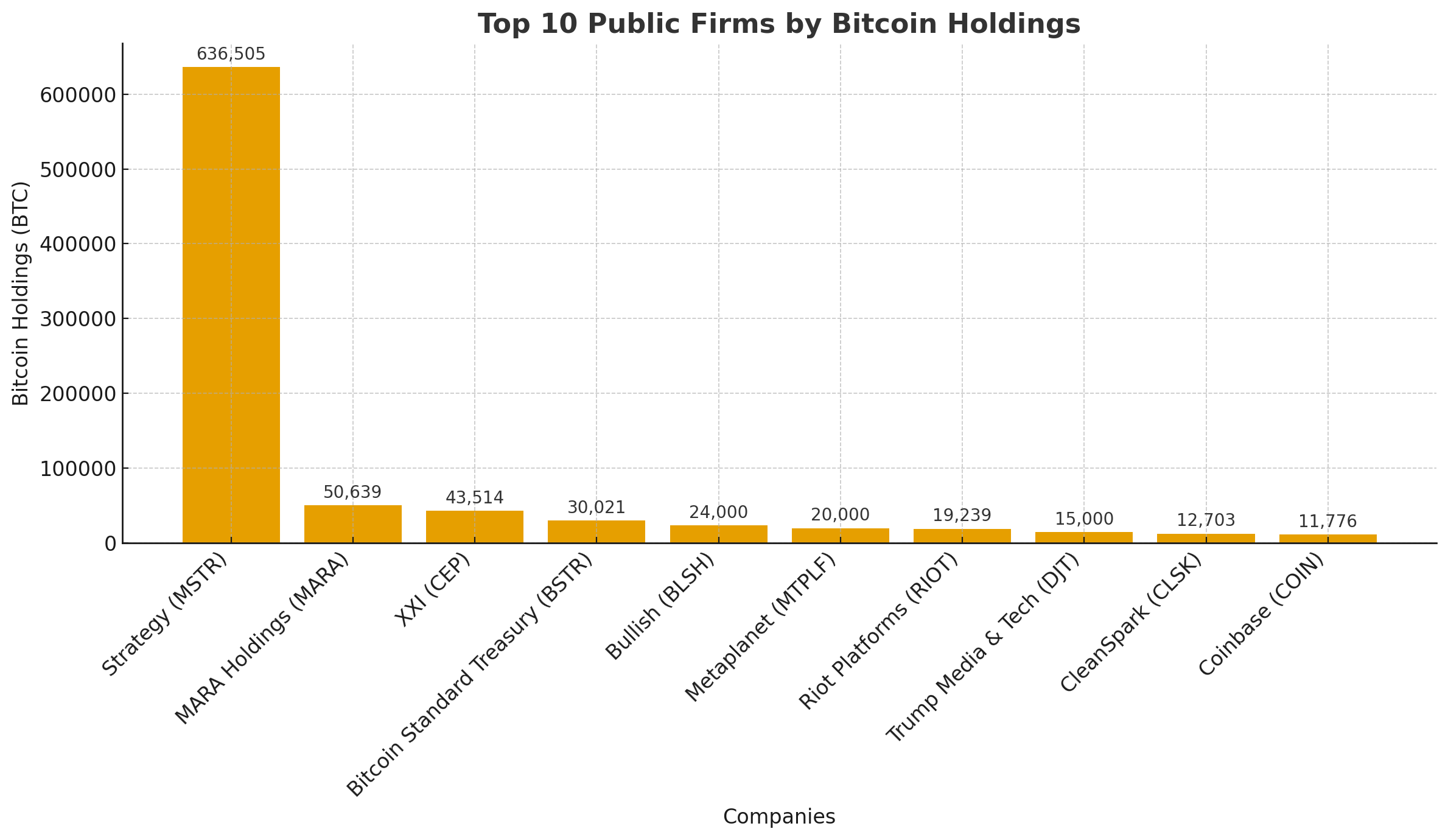

As of today’s tally, bitcointreasuries.net shared an image that shows publicly traded firms controlling more than 1 million BTC. The leaderboard is led by Strategy (MSTR) with 636,505 BTC, followed by MARA Holdings, Inc. (MARA) at 50,639 BTC and XXI (CEP) at 43,514 BTC. Rounding out the top five are Bitcoin Standard Treasury Company (BSTR) with 30,021 BTC and Bullish (BLSH) with 24,000 BTC.

The next five highlight a broadened corporate mix. Metaplanet Inc. (MTPLF) holds 20,000 BTC, while miners and platform operators are well represented by Riot Platforms, Inc. (RIOT) at 19,239 BTC. Trump Media & Technology Group Corp. (DJT) lists 15,000 BTC, Cleanspark, Inc. (CLSK) shows 12,703 BTC, and Coinbase Global, Inc. (COIN) reports 11,776 BTC.

Large, diversified names remain in the top cohort. Tesla, Inc. (TSLA) holds 11,509 BTC; Hut 8 Mining Corp (HUT) carries 10,667 BTC; and Block, Inc. appears with 8,692 BTC on the site’s table. Galaxy Digital Holdings Ltd (GLXY) is listed with 6,894 BTC, while Next Technology Holding Inc. (NXTT) shows 5,833 BTC.

Rounding out the top 20 are KindlyMD, Inc. (NAKA) at 5,765 BTC; Cango Inc (CANG) at 5,127 BTC; Semler Scientific (SMLR) at 5,021 BTC; Procap BTC (CCCM) at 4,932 BTC; and Gamestop Corp. (GME) at 4,710 BTC. The breadth of sectors—from software to health care, e-commerce, and gaming—illustrates how exposure to bitcoin has expanded beyond early miners and crypto-native companies.

Top 10 public companies by BTC holdings according to bitcointreasuries.net data.

The next tier is sizable on its own. Positions 21 through 25 include Empery Digital (Volcon, Inc.) at 4,019 BTC; Boyaa Interactive International Limited at 3,640 BTC; Bitcoin Group SE at 3,605 BTC; Sequans Communications S.A. at 3,205 BTC; and American Bitcoin Corp at 2,443 BTC.

Slots 26 to 30 feature The Smarter Web Company PLC at 2,440 BTC; Microcloud Hologram at 2,353 BTC; Capital B at 2,201 BTC; HIVE Digital Technologies at 2,201 BTC; and Exodus Movement, Inc. at 2,087 BTC. These holdings, though smaller than the top 10, mark a continued diffusion of treasury strategies across micro- and small-cap issuers.

Rounding out 31 to 35 are Bitfufu at 1,899 BTC; NEXON Co., Ltd. at 1,717 BTC; Core Scientific at 1,612 BTC; Bitdeer Technologies Group at 1,601 BTC; and Fold Holdings Inc. at 1,492 BTC. The concentration diminishes quickly below the top few names, but the cumulative impact of dozens of smaller allocations is central to the million-bitcoin threshold.

Bitcointreasuries.net’s aggregates show that the million- bitcoin mark is a function of both large flagship treasuries and a long tail of companies adding smaller balances. The site’s public-company total—1,000,632 BTC—equates to roughly 4.76% of the fixed 21 million-coin supply, a share that could become more visible on corporate balance sheets if additional issuers adopt treasury allocations.

Whether these balances are held as strategic reserves, operating hedges, or programmatic accumulations, the growth in corporate ownership points to a persistent, measurable bid from public markets. With top holdings concentrated in a handful of names and the remainder distributed across varied sectors and geographies, the data presents a clear picture: BTC is now a significant line item for an expanding roster of listed companies.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。