Recently, many fans and partners have asked me, "The price of gold has surged recently; what is the logic behind it?"

Today, gold has already surpassed $3600 per ounce, and in mainland China, it has also broken through 1000 RMB per gram.

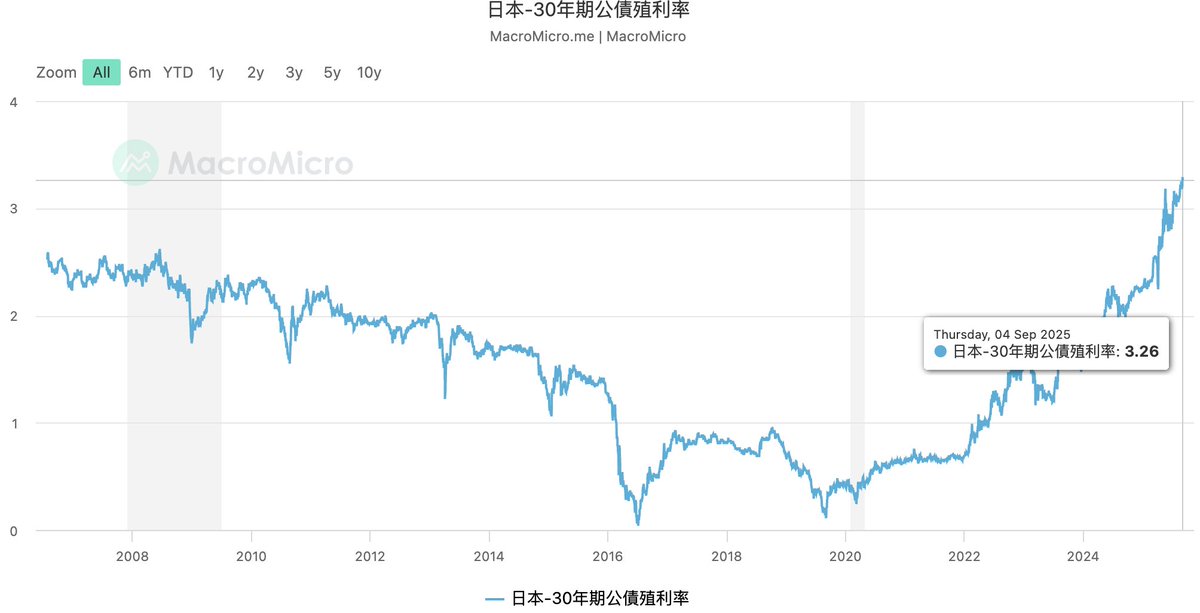

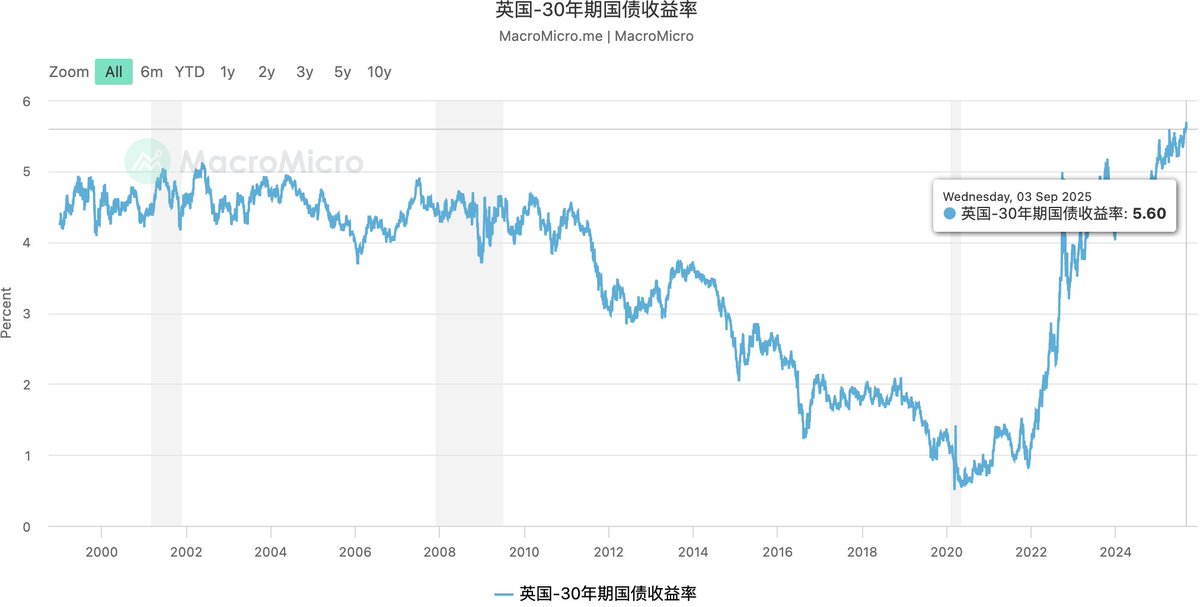

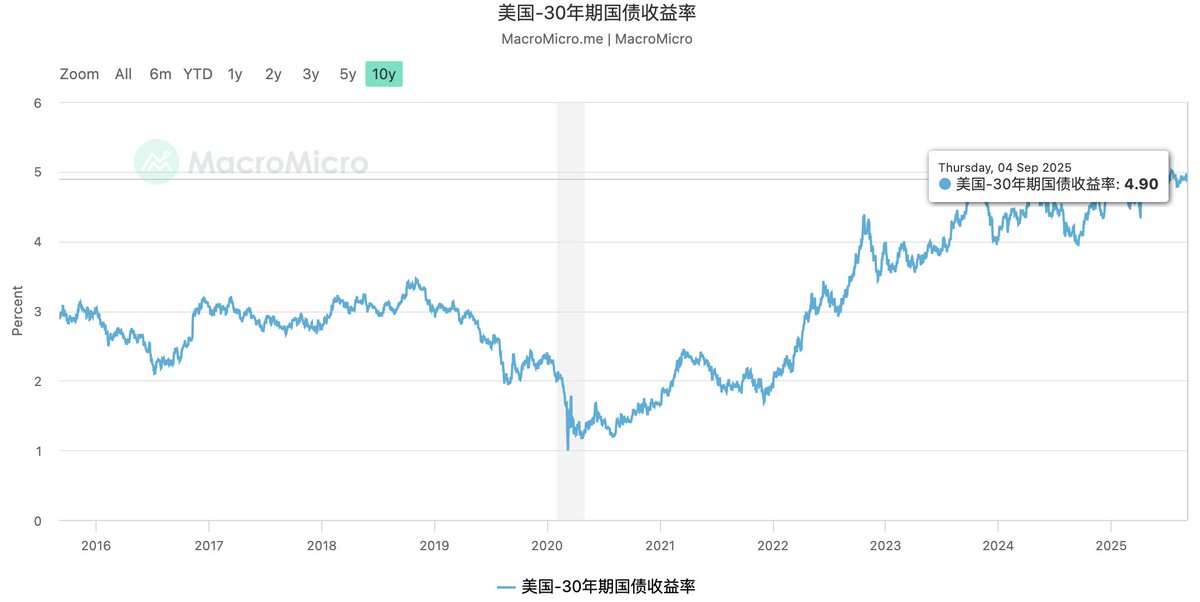

Additionally, our community members have raised an interesting question: "Isn't it said that we have entered a rate-cutting cycle? Why are the yields on 30-year government bonds skyrocketing while prices are plummeting?" (As shown in the chart below, the yields on 30-year government bonds in countries like the US, Japan, the UK, and Germany have recently surged.)

In fact, these two questions are essentially the same; they are fundamentally linked. Let me break it down today:

1️⃣ The logic of long-term capital has changed.

Long-term government bonds are essentially you lending money to the government for 30 years in exchange for interest. The core logic that determines their price is: future inflation levels + central bank attitudes + government fiscal credibility.

In the past decade, low inflation, central banks providing unlimited support, and relatively stable fiscal policies combined to encourage everyone to buy long-term bonds. At that time, buying 30-year government bonds was stable, attractive, and reliable.

But now, all three of these support points have collapsed:

❌ Inflation cannot be suppressed; oil prices and wages are driving it up.

❌ The central bank is hesitant and cannot continue to print money indefinitely.

❌ Governments around the world are borrowing and spending more aggressively, leading to a massive increase in bond supply.

Buyers of bonds are starting to doubt: can this really be worth that much? Can it really be stable for 30 years?

2️⃣ Why are yields soaring?

Yields are a reflection of prices. If no one dares to buy, prices fall, and yields naturally spike. For example, in the UK, the yield on 30-year government bonds has surged to 5.68%, the highest since 1998. In Japan, it’s even more dramatic; a country that previously had zero interest rates now sees 30-year yields breaking 3.2%, setting a historical record.

This is essentially the market players shouting: I want higher interest rates to compensate for greater future risks!

3️⃣ Rate cuts ≠ bond bull market.

Previously, the experience was that as long as the central bank cut rates, a bull market in bonds would follow. But this time is different. The backdrop for rate cuts is not simply economic weakness but high inflation + high debt.

Even if the central bank cuts rates, the market does not believe it can sustain this because the government needs to continuously issue debt for financing. Where will the money come from? Without a safety net, interest rates can only rise to "entice" buyers back.

4️⃣ Political uncertainty has become an accelerator.

The no-confidence vote in France, the turmoil in Japan's ruling party, and the internal disputes over fiscal spending in the US—all these political risks have turned into "risk premiums" added to long-term bonds.

In the past, buying long-term bonds from the US, UK, or Japan was considered risk-free; now, people are hesitant to think that way. The anchor of sovereign credit is being pulled out one by one.

5️⃣ So why are gold and silver rising (which is also good for #BTC)?

It's simple: when the "risk-free" label of long-term bonds falls off, investors look for a new "anchor." Gold and silver are natural alternatives that do not rely on government credit and are recognized globally. As the bond market collapses, precious metals become a safe haven for funds, which also benefits cryptocurrencies like #BTC.

So, overall, the recent surge in 30-year government bond yields is essentially the market re-pricing the future:

- Accepting a higher and more persistent interest rate environment;

- Accepting that the government is no longer a "stable borrower";

- Accepting that the central bank can no longer be the eternal backstop.

This is why the logic that "rate cuts = bond bull market" has failed. The market is seeking a new equilibrium, and this process is painful. Therefore, I see the current 30-year long bonds as being in a phase where "prices are being squeezed down to remove excess, and yields are searching for an anchor." Don't expect a violent rebound in the short term; long-term capital still needs to continue reassessing. Embracing good safe-haven assets may be a correct option! 🧐

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。