Diving deep into CZ's retweet and the recently popular RWA infrastructure project @AssetoFinance

The results were somewhat unexpected.

1/ Combination of Cross-Industry and Professionalism - Asseto Team

Founder: Bridget Li

Educational Background: Holds a Master's degree in "Computer Science and Molecular Biology" from MIT.

Work Experience:

Dandelion Diagnostics Machine Learning Intern - A Danish startup founded in 2024, focused on developing an AI-driven instant diagnostic platform.

Nabla Bio Machine Learning Expert - A biotechnology company based in Cambridge, Boston, focused on using AI to design antibodies. Since its launch in 2021, Nabla Bio has raised $37 million.

Professionalism is reflected in the fact that core members of the Asseto team come from institutions such as Morgan Stanley, UBS, Standard Chartered, and Taikang Asset Management Hong Kong, possessing experience in asset management, investment banking, compliance, and blockchain implementation.

2/ Strong Endorsement and Compliance Capability

Successful RWA projects share a common characteristic: compliance comes first.

For instance, Ondo Finance's ability to gain support from BlackRock and Mantra's ability to attract institutional users are fundamentally based on their positioning of compliance capability as the infrastructure of their products, rather than a remedial measure afterward.

As a "ultimate RWA launchpad based on financial asset and strategy tokenization," Asseto's compliance capability is also impressive.

As of now, Asseto has launched two RWA products:

AoABT: An Asseto fund product launched in collaboration with Dongfang Securities. It focuses on on-chain funding rate arbitrage strategies.

AoABT is issued on HashKey Chain, which has been officially recommended by HashKey Chain.

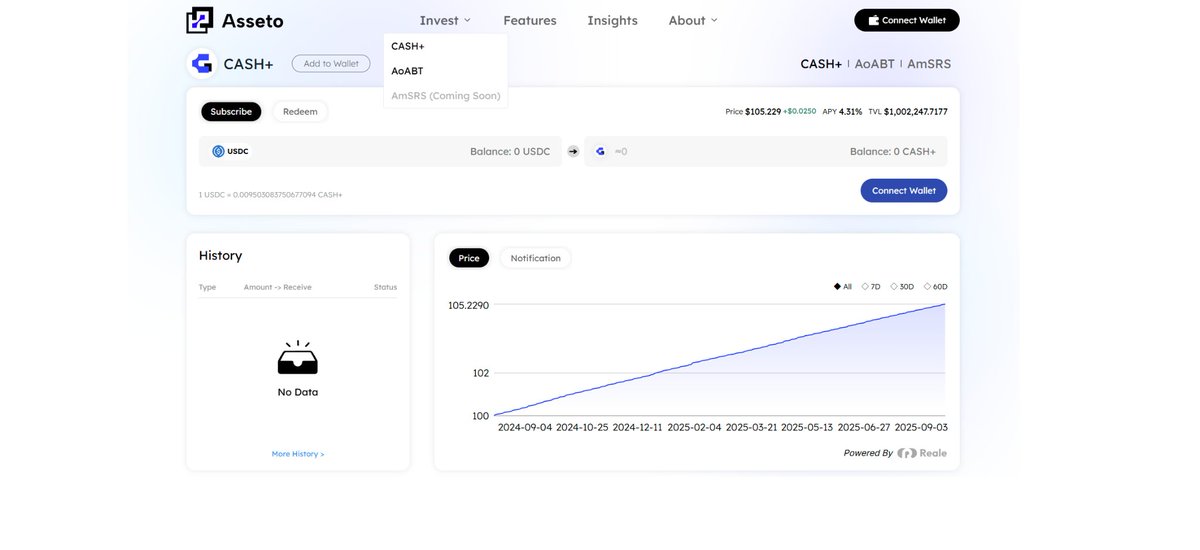

CASH+: Issued on BNB Chain, launched in collaboration with China Merchants Securities Asset Management (Hong Kong). It is a derivative token aimed at US dollar money market funds.

CZ previously specifically QT, roughly meaning: Welcome Asseto and China Merchants to build on BNB Chain.

Additionally, Asseto has also received strategic investment from HashKey Group and has been shortlisted for the BNB Chain MVB program, which is a plus.

3/ Conclusion

Finally, let's summarize that Asseto, as an RWA tokenization and compliance infrastructure, derives its compliance capability from:

Collaborative relationships with multiple brokerages, including China Merchants Securities and Dongfang Securities.

Deep cooperation with several mainstream public chains, including BNB Chain, HashKey Chain, and Pharos.

Strategic investment from HashKey Group.

Early RWA projects often attempted to bypass the traditional financial system, reconstructing asset issuance and trading processes through blockchain technology. However, reality has proven that this radical path faces significant regulatory risks and market acceptance issues. Asseto has chosen a different path: deeply integrating into the traditional financial system, using blockchain technology as a tool to enhance efficiency rather than a weapon to disrupt the existing order.

This approach of "connecting" rather than "disrupting" is indeed the version answer for the RWA track.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。