撰文:Lorenzo Valente

随着加密市场的成熟,投资者正在从过去的技术繁荣中寻找线索,以预测下一个大趋势或拐点。

历史上,数字资产难以简单地与先前的技术周期相比较,这使得用户、开发者和投资者很难预测其长期发展轨迹。这种动态正在改变。

根据我们的研究,加密领域的「应用层」正在演变,很像 SaaS(软件即服务)和金融科技平台所经历的解绑(unbundling)和再捆绑(rebundling)周期。

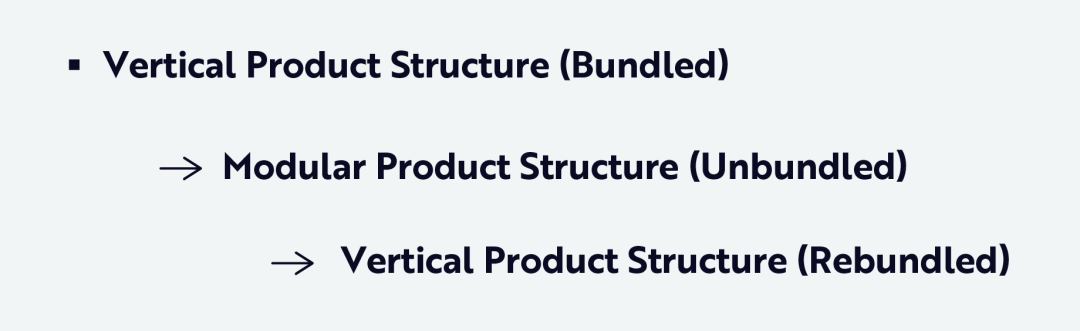

在本文中,我将描述 SaaS 和金融科技中的解绑和再捆绑周期如何在 DeFi(去中心化金融)和加密应用中上演。其模式演变如下:

「可组合性」(Composability)的概念是理解解绑和再捆绑周期的关键。

这是金融科技和加密社区使用的一个分析术语,指的是金融或去中心化应用及服务——尤其是在应用层——能够像乐高积木一样无缝地交互、集成和相互构建的能力。以此概念为核心,我们在以下两个小节中描述产品结构的转变。

从垂直化到模块化:大解绑(The Great Unbundling)

2010 年,Spark Capital 的 Andrew Parker 发表了一篇博客文章,描绘了数十家初创公司如何利用 Craigslist 的解绑机遇。Craigslist 是当时的「水平式」互联网市场,提供从公寓、零工到商品销售等各种服务,如下图所示。

来源:Parker 2010。仅供说明之用,不应视为投资建议或购买、出售或持有任何特定证券的建议。

Parker 的结论是,许多成功的公司——Airbnb、Uber、GitHub、Lyft——都是从专注于并垂直化 Craigslist 广泛功能中的一小部分开始,并极大地改进了它。

这一趋势开启了「市场解绑」的第一个主要阶段,在此期间,Craigslist 完全捆绑、多用途的市场让位于单一用途的应用程序。新来者不仅仅是改进了 Craigslist 的用户体验(UX)——他们重新定义了体验。换句话说,「解绑」将一个基础广泛的平台分解成范围严格、自主的垂直领域,通过以独特的方式服务用户颠覆了 Craigslist。

是什么使得那波解绑成为可能?技术基础设施的根本性转变,包括 API(应用程序编程接口)、云计算、移动用户体验和嵌入式支付的进步,降低了构建具有世界级用户体验的专注应用程序的门槛。

同样的解绑也在银行业中演变。几十年来,银行在单一品牌和应用下提供一套捆绑的金融服务——从储蓄贷款到保险的一切服务。然而,在过去十年中,金融科技初创公司一直在精准地 dismantling(拆解)这个捆绑包,每个都专注于一个特定的垂直领域。

传统的银行捆绑包包括:

-

支付和汇款

-

支票和储蓄账户

-

生息产品

-

预算和财务规划

-

贷款和信贷

-

投资和财富管理

-

保险

-

信用卡和借记卡

在过去十年中,银行捆绑包已系统地分解成一系列由风险投资支持的金融科技公司,其中许多现在已成为独角兽、十角兽或接近百角兽:

-

支付和汇款:PayPal, Venmo, Revolut, Stripe

-

银行账户:Chime, N26, Monzo, SoFi

-

储蓄和收益:Marcus, Ally Bank

-

个人理财和预算:Mint, Truebill, Plum

-

贷款和信贷:Klarna, Upstart, Cash App, Affirm

-

投资和财富管理:Robinhood, eToro, Coinbase

-

保险:Lemonade, Root, Hippo

-

卡片和支出管理:Brex, Ramp, Marqeta

每家公司都专注于一项它能够比现有企业更好地打磨和提供的服务,将其技能组合与新的技术杠杆和分销模式相结合,以模块化方式提供以增长为导向的利基金融服务。在 SaaS 和金融科技领域,解绑不仅颠覆了现有企业,还创造了全新的类别,最终扩大了总可寻址市场(TAMs)。

从模块化回到捆绑化:大再捆绑(The Great Rebundling)

最近,Airbnb 推出了新的「服务与体验」并重新设计了其应用程序。现在,用户不仅可以预订住宿,还可以探索和购买附加服务,如博物馆参观、美食之旅、餐饮体验、画廊漫步、健身课程和美容护理。

Airbnb 曾是一个点对点住宿市场,现在正演变成一个度假超级应用(superapp)——将旅行、生活方式和本地服务重新捆绑到一个单一、 cohesive(连贯)的平台中。此外,在过去两年中,该公司已将其产品范围扩展到房屋租赁之外,现在正将支付、旅行保险、本地指南、礼宾式工具和精选体验集成到其核心预订服务中。

Robinhood 正在经历类似的转型。该公司以免佣金股票交易颠覆了经纪行业,现在正积极扩展为一个全栈金融平台,并正在重新捆绑先前被金融科技初创公司解绑的许多垂直领域。

在过去两年中,Robinhood 采取了以下举措:

-

推出支付和现金管理功能(Robinhood Cash Card)

-

增加加密货币交易

-

推出退休账户

-

推出保证金投资和信用卡

-

收购了 Pluto(一个由人工智能驱动的研究和财富咨询平台)

这些举措表明,Robinhood 与 Airbnb 一样,正在将先前碎片化的服务捆绑起来,构建一个全面的金融超级应用。

通过控制更多的金融堆栈——储蓄、投资、支付、贷款和咨询——Robinhood 正在重塑自我,从经纪商转变为全方位的消费者金融平台。

我们的研究表明,这种解绑和再捆绑的动态正在影响加密行业。在本文的剩余部分,我们提供两个案例研究:Uniswap 和 Aave。

DeFi 的解绑与再捆绑周期:两个案例研究

案例研究 1:Uniswap——从单体 AMM 到流动性乐高,再回到交易超级应用

2018 年,Uniswap 在以太坊上作为一个简单但革命性的自动化做市商(AMM)推出。在其早期阶段,Uniswap 是一个垂直集成的应用程序:一个小的智能合约代码库,并由其团队托管官方前端。核心 AMM 功能——在恒定乘积池中交换 ERC-20 代币——存在于单个链上协议中。用户主要通过 Uniswap 自己的网络界面访问它。这种设计被证明非常成功,截至 2023 年中,Uniswap 的链上交易量累计爆炸性增长至超过 1.5 万亿美元。凭借其严格控制的技术堆栈,Uniswap 为代币交换提供了流畅的用户体验,这在其初期引导了 DeFi 的发展。

当时,Uniswap v1/v2 在链上实现了所有交易逻辑,不需要外部价格预言机(oracle)或链下订单簿。该协议在一个封闭系统内通过其流动性池储备(x*y=k 公式)内部确定价格。Uniswap 团队开发了主要的用户界面(app.uniswap.org),直接与 Uniswap 合约交互。早期,大多数用户通过这个专用前端访问 Uniswap,这类似于专有的交易所门户。除了以太坊本身,Uniswap 不依赖任何其他基础设施。流动性提供者和交易者直接与 Uniswap 的合约交互,没有内置的外部数据馈送或插件钩子。该系统简单但孤立。

随着 DeFi 的扩展,Uniswap 演变成了可组合的流动性「乐高」,而不是一个独立的应用。该协议开放、无需许可的性质意味着其他项目可以集成 Uniswap 的池并为其添加层。Uniswap Labs 逐渐放弃了对部分堆栈的控制,允许外部基础设施和社区构建的功能发挥更大作用:

-

去中心化交易所(DEX)聚合器和钱包集成:Uniswap 的大部分交易量开始通过外部聚合器(如 0x API 和 1inch)流动,而不是通过 Uniswap 自己的界面。到 2022 年底,估计 85% 的 Uniswap 交换量是通过像 1inch 这样的聚合器路由的,因为用户寻求跨多个交易所的最佳价格。像 MetaMask 这样的钱包也将 Uniswap 流动性集成到其交换功能中,使用户可以从他们的钱包应用程序在 Uniswap 上交易。这种外部路由减少了对 Uniswap 原生前端的依赖,并使 AMM 更像 DeFi 堆栈中的一个即插即用模块。

-

预言机和数据索引器:虽然 Uniswap 的合约过去和现在都不需要价格预言机来进行交易,但围绕 Uniswap 构建的更广泛的生态系统需要。其他协议使用 Uniswap 的池价格作为链上预言机,而 Uniswap 的界面本身也依赖外部索引服务。例如,Uniswap 的前端使用 The Graph 的子图(subgraphs)在链下查询池数据,以获得更流畅的用户界面(UI)体验。Uniswap 没有构建自己的索引节点,而是利用了社区驱动的数据基础设施——这是一种模块化方法,将繁重的数据查询卸载给专业的索引器。

-

多链部署:在模块化阶段,Uniswap 扩展到以太坊之外的众多区块链和 Rollup:Polygon、Arbitrum、BSC 和 Optimism 等。Uniswap 的治理授权其核心协议在这些网络上部署,有效地将每个区块链视为 Uniswap 流动性的基础层插件。这种多链策略强调了 Uniswap 的可组合性:该协议可以存在于任何与以太坊虚拟机(EVM)兼容的链上,而不是将其命运与一个垂直集成的环境绑定。

最近,Uniswap 一直在向垂直整合回归,其目标似乎是捕获更多的用户旅程并为其用例优化堆栈。关键的再整合发展包括:

-

原生移动钱包:2023 年,Uniswap 发布了 Uniswap Wallet——一个自托管移动应用程序——随后又发布了浏览器扩展,用户可以在其中存储代币并直接与 Uniswap 的产品交互。推出钱包是朝着控制用户界面层迈出的重要一步,而不是将其让给像 MetaMask 这样的钱包。有了自己的钱包,Uniswap 现在垂直集成了用户访问,确保交换、浏览非同质化代币(NFT)和其他活动在其控制的环境中进行,并可能路由到 Uniswap 流动性。

-

集成聚合(Uniswap X):Uniswap 还引入了 Uniswap X,一个内置的聚合和交易执行层,而不是依赖第三方聚合器来寻找最佳价格。Uniswap X 使用一个由链下「填充者」(fillers)组成的开放网络,从各种 AMM 和私人做市商那里获取流动性,然后在链上结算交易。因此,Uniswap 已将其界面转变为一个一站式的交易门户,为用户利益聚合流动性源——类似于 1inch 或 Paraswap 提供的服务。通过运行自己的聚合器协议,Uniswap Labs 重新整合了该功能,将用户保留在内部,同时保证最优价格。重要的是,UniswapX 被集成到 Uniswap 网络应用本身——未来可能也集成到钱包中——因此用户不再需要为了聚合器而离开 Uniswap。

-

应用专用链(Unichain):2024 年,Uniswap 宣布了自己的第 2 层区块链——被称为「Unichain」——作为 Optimism Superchain 的一部分。将垂直整合提升到基础设施层面,Unichain 是一个为 Uniswap 和 DeFi 交易量身定制的定制 Rollup,目标是将 Uniswap 用户费用降低约 95%,延迟降低至约 250 毫秒。Uniswap 将控制其合约运行的区块链环境,而不是作为另一个链上的应用程序。通过运营 Unichain,Uniswap 将能够为其交易所优化从 Gas 成本到最大可提取价值(MEV)缓解的一切,并引入与 UNI 持有者的原生协议费用分享。这个完整的循环转型使 Uniswap 从一个依赖以太坊的去中心化应用(dApp)演变为一个拥有专有 UI、执行层和专用区块链的垂直集成平台。

案例研究 2:Aave——从 P2P 借贷市场到多链部署,再回到信贷超级应用

Aave 的起源可追溯至 2017 年的 ETHLend,这是一个自包含的借贷应用程序,后在 2018 年让位于一个更名为 Aave 的去中心化点对点借贷市场。该团队开发了用于借贷的智能合约,并提供了一个官方网络界面供用户参与。在这个阶段,ETHLEND/Aave 以订单簿方式匹配贷款人和借款人的贷款,并处理从利率逻辑到贷款匹配的一切。

随着它向类似于 Compound 的池化借贷模式演变,Aave 进行了垂直整合。以太坊上的 Aave v1 和 v2 合约包含了诸如闪电贷(flash loans)等创新——这是一种协议内功能,允许在同一交易中还款的情况下无抵押借款——以及利率算法。用户主要通过 Aave 网络仪表板访问该协议。该协议内部管理关键功能,如利息累积和清算,很少依赖第三方服务。简而言之,Aave 的早期设计是一个单体化的货币市场:一个拥有自己 UI 的 dApp,在一个地方处理存款、贷款和清算。

Aave 是更广泛的 DeFi 共生的一部分,从一开始就集成了 MakerDAO 的 DAI 稳定币作为关键抵押品和借贷资产。事实上,在其作为 ETHLend 的化身时,Aave 与 Maker 同时推出并立即支持 DAI,这反映了那些垂直集成的先驱之间的紧密耦合,并早在早期就表明没有协议是孤岛。即使在其「垂直」阶段,Aave 也受益于另一个协议的产品——稳定币——来运作。

随着 DeFi 的发展,Aave 解绑并采用了模块化架构,将其部分基础设施外包,并鼓励其他人在其平台上构建。几个转变说明了 Aave 向可组合性和外部依赖性的迈进:

-

外部预言机网络:Aave 没有独家运行自己的价格馈送,而是采用 Chainlink 的去中心化预言机来为抵押品估值提供可靠的资产价格。价格预言机对任何借贷协议都至关重要,因为它们决定了贷款何时抵押不足。Aave 治理选择 Chainlink Price Feeds 作为大多数资产在 aave.com 上的主要预言机来源,从而将定价基础设施外包给专业的第三方网络。虽然这种模块化方法提高了安全性——例如,Chainlink 聚合了许多数据源——但也意味着 Aave 的稳定性依赖于外部服务。

-

钱包和应用集成:Aave 的借贷池成为许多其他 dApp 集成的构建块。像 Zapper 和 Zerion 这样的投资组合管理器和仪表板、像 DeFi Saver 这样的 DeFi 自动化工具以及收益优化器都通过其开放的软件开发工具包(SDK)接入 Aave 的合约。用户可以通过与 Aave 接口的第三方前端进行存款或借款,但官方的 Aave 界面只是众多访问点之一。甚至 DEX 聚合器也间接利用 Aave 的闪电贷,用于像 1inch 这样的服务执行的复杂多步交易。通过开源其设计,Aave 允许可组合性:其他协议可以集成 Aave 的功能——例如,在 Uniswap 套利机器人内部使用 Aave 闪电贷——所有这些都由外部聚合器协调。作为一个流动性模块而不是孤立的应用程序,其可组合性扩大了 Aave 在 DeFi 生态系统中的影响力。

-

多链部署和隔离模式:与 Uniswap 类似,Aave 也部署在多个网络上——例如 Polygon、Avalanche、Arbitrum、Optimism——本质上是跨链模块化。Aave v3 引入了诸如某些资产的隔离市场等功能——架构模块化——为每个市场创建不同的风险参数,有时与主池分开运行。它还推出了许可变体,如用于「了解你的客户」(KYC)机构使用的「Aave Arc」,这些在概念上是 Aave 的独立「模块实例」。

这些例子展示了 Aave 在各种环境中运作的灵活性,而不仅仅是一个集成环境。在这个解绑阶段,Aave 依赖更广泛的基础设施堆栈:Chainlink 预言机获取数据,The Graph 用于索引,钱包和仪表板用于用户访问,以及其他协议的代币——如 Maker 的 DAI 或 Lido 的 staked ETH——作为抵押品。模块化方法增加了 Aave 的可组合性,并减少了「重新发明轮子」的需要。权衡之处是 Aave 部分失去了对那些堆栈部分的控制,以及依赖外部服务相关的风险。

最近,Aave 通过开发先前依赖他人的关键组件的内部版本,显示出回归垂直整合的迹象。例如,2023 年,Aave 推出了自己的稳定币 GHO。历史上,Aave 促进了各种资产的借贷,尤其是 MakerDAO 的 DAI 稳定币,它在 Aave 上规模显著。有了 GHO,Aave 现在在其平台上有了一个原生稳定币,它充当其他协议稳定币的分销渠道。与 DAI 一样,GHO 是一种超额抵押、去中心化、与美元挂钩的稳定币。用户可以用他们在 Aave V3 上的存款来铸造 GHO,这使 Aave 获得了借贷堆栈中先前外包的垂直部分——稳定币发行。因此:

-

Aave 是一个稳定资产的发行者——而不仅仅是现有稳定币的借贷场所——并直接控制稳定币的参数和收入。GHO 是 DAI 的竞争对手,所以现在 Aave 可以将利息支付回收到自己生态系统中,GHO 利息可以使 AAVE 代币质押者受益,而不是间接增加 MakerDAO 的费用。

-

GHO 的引入也需要专用的基础设施。Aave 有「facilitators」(促进者)——包括主要的 Aave 池——可以铸造和销毁 GHO 并设置治理策略。通过控制这一新功能层,Aave 构建了一个 MakerDAO 产品的内部版本来服务自己的社区。

在另一项值得注意的举措中,Aave 正在利用 Chainlink 的智能价值路由(SVR)或类似机制,为 Aave 用户重新捕获 MEV(最大可提取价值,类似于股票中的订单流支付)。与预言机层更紧密的耦合以将套利利润重定向回协议,正在模糊 Aave 平台与底层区块链机制之间的界限。这一举动表明,Aave 有兴趣为了自身利益定制甚至更低层级的基础设施,如预言机行为和 MEV 捕获。

虽然 Aave 尚未像 Uniswap 和其他公司那样推出自己的钱包或链,但其创始人的其他 venture(项目)表明他的目标是构建一个自给自足的生态系统。例如,用于社交网络的 Lens Protocol 可以与 Aave 集成,用于基于社交声誉的金融。在架构上,Aave 正朝着提供所有关键金融原语的方向发展:借贷、稳定币(GHO),可能还有去中心化社交身份(Lens)等,而不是依赖外部协议。在我看来,该产品策略是关于深化平台:拥有稳定币、贷款和其他服务,Aave 的用户留存和协议收入应该会受益。

总之,Aave 从一个闭环借贷 dApp 发展成为一个接入 DeFi 并依赖 Chainlink 和 Maker 等他人的开放乐高,现在正在回归到一个更 expansive(expansive)的垂直集成金融套件。特别是 GHO 的推出,强调了 Aave 重新整合它曾外包给 MakerDAO 的稳定币层的意图。

我们的研究表明,Uniswap、Aave、MakerDAO、Jito 和其他协议的历程展示了加密行业中更广泛的周期性模式。在早期,垂直整合——构建一个具有非常具体用途的单体化产品——对于开创自动化交易、去中心化借贷、稳定币或 MEV 捕获等新功能是必要的。这些自包含的设计允许在新兴市场中快速迭代和质量控制。随着该领域的成熟,模块化和可组合性成为优先事项:协议解绑其部分堆栈以推出新功能或为外部利益相关者提供更多价值,依靠其他协议的优势成为「货币乐高」。

然而,模块化和可组合性的成功带来了新的挑战。依赖外部模块引入了依赖风险,并限制了捕获协议在其他地方创造的价值的能力。现在,最大的参与者和具有强大产品市场契合度(PMF)和收入流的协议正在将其策略转回垂直整合。虽然它们没有放弃去中心化或可组合性,但这些项目出于战略原因正在重新整合关键组件:推出自己的链、钱包、稳定币、前端和其他基础设施。他们的目标是提供更无缝的用户体验,捕获额外的收入流,并防范对竞争对手的依赖。Uniswap 正在构建钱包和链,Aave 正在发行 GHO,MakerDAO 正在分叉 Solana 以构建 NewChain,Jito 正在将质押 / 再质押与 MEV 合并。我们认为,任何足够大的 DeFi 应用程序最终都会寻求自己的垂直集成解决方案。

结论

历史不会重演,但总会惊人地相似。加密领域正在哼唱一首熟悉的曲调。就像过去十年的 SaaS 和市场革命一样,DeFi 和应用层协议正专注于新的技术原语、不断变化的用户期望以及对更多价值捕获的渴望,同时沿着解绑和再捆绑的轨迹前进。

在 2010 年代,专门从事庞大的 Craigslist 市场某一细分领域的初创公司有效地将其原子化为 distinct( distinct)的公司。这种解绑催生了巨头——Airbnb、Uber、Robinhood、Coinbase——所有这些后来都开始了自己的再捆绑之旅,将新的垂直领域和服务整合到 cohesive( cohesive)、有粘性的平台中。

加密领域正在以革命性的速度遵循同样的道路。

最初作为范围严格的垂直实验——Uniswap 作为 AMM,Aave 作为货币市场,Maker 作为稳定币金库——模块化为无需许可的乐高,开放了流动性,外包了关键功能,并让可组合性蓬勃发展。现在使用规模已经扩大,市场正在碎片化,钟摆开始回摆。

今天,Uniswap 正在成为一个拥有自己钱包、链、跨链标准和路由逻辑的交易超级应用。Aave 正在发行自己的稳定币,并将借贷、治理和信贷原语捆绑在一起。Maker 正在构建一个全新的链以改进其货币生态系统的治理。Jito 将质押、MEV 和验证者逻辑统一为一个全栈协议。Hyperliquid 将交易所、L1 基础设施和 EVM 合并为一个无缝的链上金融操作系统(OS)。

在加密领域,原语在设计上是解绑的,但最佳的用户体验——和最可防御的业务——越来越是再捆绑的,这不是对可组合性的背叛,而是对其的实现:构建最好的乐高积木,并用它来建造最好的城堡。

DeFi 正在将整个周期压缩到短短几年内。如何做到?DeFi 的运作方式截然不同:

-

无需许可的基础设施降低了实验的摩擦:任何开发者都可以在几小时而不是几个月内分叉、复制或扩展现有协议。

-

资本形成是即时的——借助代币,团队可以比以往更快地为新项目、想法或激励措施提供资金。

-

流动性具有高度流动性。总锁定价值(TVL)以激励的速度移动,使得新实验更容易获得关注,成功的实验能够呈指数级扩展。

-

潜在市场规模更大。协议从第一天起就进入一个全球性的、无需许可的用户和资本池,通常比受地理、法规或分销渠道限制的 Web2 同行更快达到规模。

DeFi 的超级应用正在实时快速扩展。我们认为,赢家不会是拥有最模块化堆栈的协议,而是那些确切知道应该拥有堆栈的哪些部分、共享哪些部分以及何时在两者之间切换的协议。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。