News Background

- Whales accumulated about 340M XRP (~$960M) over the last two weeks. This offsets broader selling pressure and shows longer-horizon conviction.

- September is often a weak month for crypto. Macro uncertainty around central bank policy and growth outlook continues to pressure risk assets.

- On-chain and trading activity stayed elevated. Early in the session volumes ran well above normal, then cooled as the day progressed. The pattern matches institutional-led buying in the open and retail-driven trading into the close.

Price Action

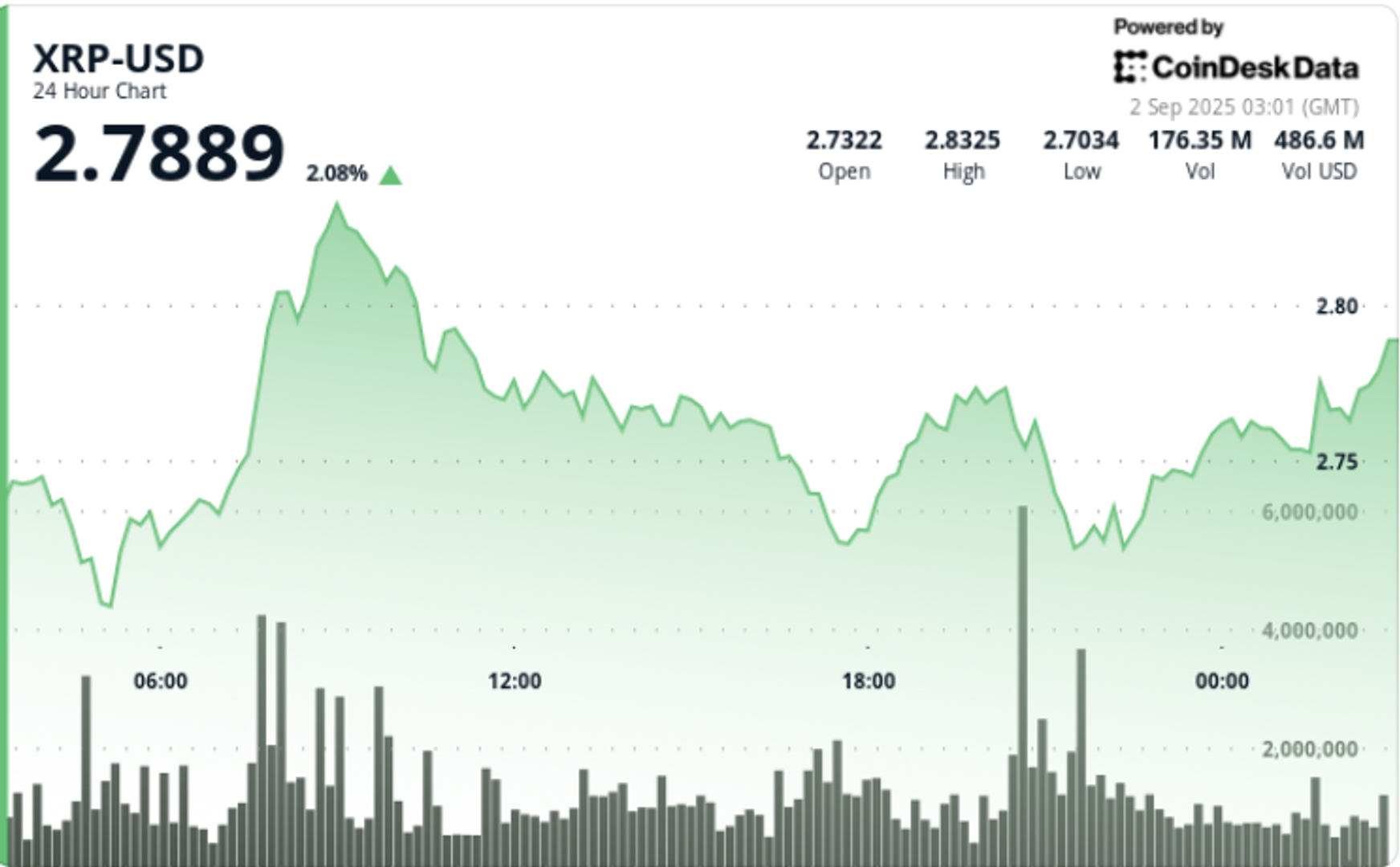

- Window: Sept. 1, 14:00 → Sept. 2, 13:00 (24h).

- Range: $2.70–$2.83, about a 4% swing. Price tagged $2.71 around 21:00 before rebounding to highs near $2.83.

- Volume: Surged to 101.36M and 93.66M in bursts, compared with a 24h average of 65.49M. Weekly pace was about 19% higher than average.

- Levels: A base formed at $2.70–$2.72. Repeated rejection near $2.83 capped the upside. The session ended consolidating just under resistance.

Technical Analysis

- Support: $2.70–$2.72 with volume-backed demand. Secondary levels at $2.65 and $2.50 if stress builds.

- Resistance: $2.83 near term. Above that, $3.00 psychological and $3.30 structural breakout levels.

- Momentum: RSI in the mid-50s, showing neutral-to-bullish conditions.

- MACD: Histogram is converging toward a bullish crossover. This would confirm constructive momentum if volumes remain high.

- Patterns: A symmetrical triangle is forming under $3.00. A sustained move above $3.30 could target $4.00 and beyond. Intraday higher lows point to continued accumulation.

- Flows: Early heavy prints suggest institutional buying. Later fades show retail profit-taking under resistance.

What Traders Are Watching

- A breakout above $2.83 and then $3.00. A clean close through $3.30 is needed for upside extension.

- Whether $2.70–$2.72 support holds. A close below this range shifts focus to $2.50.

- Confirmation from RSI moving above 60 with a MACD cross on rising volume.

- Ongoing whale accumulation and whether it can absorb further September weakness.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。