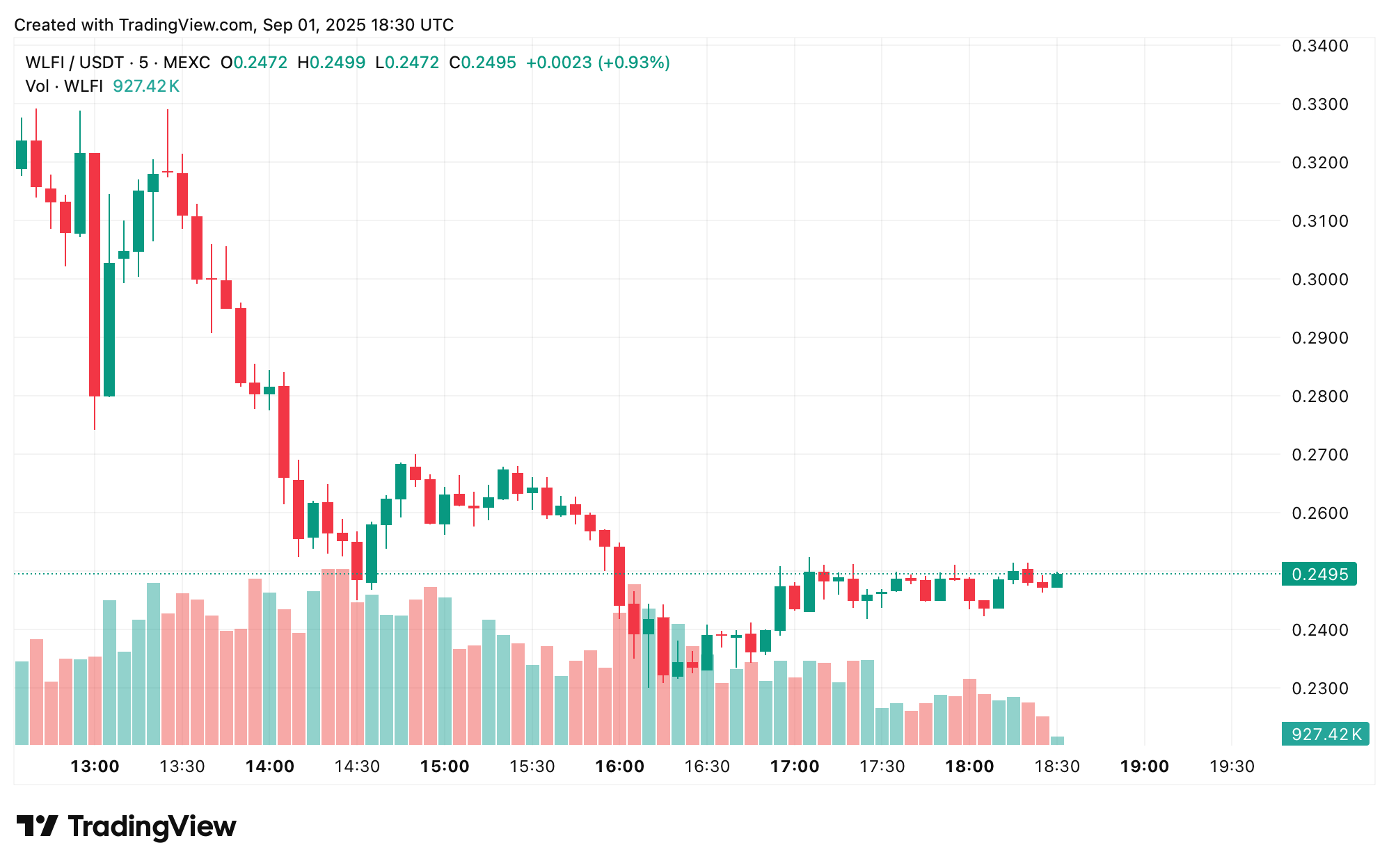

WLFI的首个交易时段在早期高点后围绕四分之一美元的水平活跃,纽约时间下午中段的日内交易在0.25美元附近整合。交易所支持覆盖主要的集中交易场所,现货交易对包括WLFI/USDT和WLFI/USDC,在某些情况下还有其他与法币相关的交易对。根据与上市信息一起分享的启动细节,大多数平台的存款已上线,提款将于9月2日开放。

价格发现始于0.30–0.33美元,受各交易场所的预市场指示影响,包括最近几天在提供预发布曝光的平台上观察到的报价。在早期推高至0.3313美元后,市场逐渐进入更紧凑的区间,流动性围绕新的订单簿建立,早期分配也在轮换。WLFI在首日的交易广度——覆盖多个顶级交易所——似乎有助于将价格行动集中到更窄的增量中。自首次亮相以来,交易量已达到约16亿美元。

项目材料也被称为“金纸”,将世界自由金融(WLFI)描述为世界自由金融协议的治理代币,旨在连接传统金融与Web3,并与USD1稳定币计划相关联,在启动时支持以太坊和Solana网络。上市群体包括广泛的集中交易所;几家交易所已标明按照新资产的常规入驻程序,首先进行存款,然后进行提款的标准分阶段推出。

在市场首次亮相的同时,世界自由金融启用了使用Chainlink的跨链互操作协议(CCIP)进行WLFI的跨链转移。Chainlink在一份声明中表示:“WLFI,@worldlibertyfi的本地治理代币,现在正式支持跨链转移,由Chainlink CCIP保障,首日支持……世界自由金融采用了跨链代币(CCT)标准,通过CCIP解锁以太坊、Solana和BNB链之间的安全转移,以增加WLFI的实用性和可达性。”该消息还指出,持有者可以通过项目的门户或Transporter进行桥接。

桥接支持为希望在支持的网络之间移动WLFI的持有者提供了即时的实用性,因为流动性在各个场所和链上建立。对于交易者来说,跨链可转移性可以减少在路由到最深的订单簿或首选保管环境时的摩擦,而对于协议治理,它可能通过允许利益相关者在最适合其工具的链上操作来扩大参与。团队对去中心化金融(DeFi)集成的重视表明,初始推出后,其他场所和网络可能会继续发展。

早期交易时段的背景还包括项目启动材料中提到的流通供应机制和解锁时间表。尽管在首日只有一部分总供应量自由流通,但现货活动表明,存在足够的双向参与,以促进在0.20–0.33美元区间内的价格发现。市场参与者将关注流动性如何在首个完整交易周内加深,以及一旦提款上线,是否会影响日内价差。

根据coingecko.com的数据,WLFI代币的价格为每枚0.25美元,市值接近70亿美元,流通供应量为28,457,073,047 WLFI。Coinmarketcap.com(CMC)提供的数字略有不同,流通量接近246.6亿。WLFI的最大供应量固定为1000亿,其完全稀释估值(FDV)估计在240亿到280亿之间,具体取决于参考coingecko.com还是CMC。此外,根据Arkham Intelligence的统计,Tron创始人Justin Sun持有约8.912亿美元的WLFI。

Sun谈到了WLFI,表示:

“我们没有计划在短期内出售我们的解锁代币。这里的长期愿景太强大了,我完全支持这个使命。”

随着WLFI在开盘日创下首个历史新高,随后在0.25美元附近整合,市场的关注点转向跨链访问、交易所广度和即将激活的提款如何影响下一阶段的交易。目前,市场正在围绕四分之一美元的水平建立参考区,同时基础设施部分——由CCIP驱动的桥接——也在同步上线。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。