8 月 29 日,BNB Chain 五周年庆典在香港隆重举行,众多项目云集。两天后,CZ 专门引用 Asseto Finance 官方推文,表示「欢迎 Asseto 和招商加入 BNB Chain 生态」。在众多生态项目中,CZ 独为 Asseto「站台」,引发了市场的广泛关注。

一、频频亮相 BNB 生态重点支持项目

Asseto 与 BNB 生态最早的渊源可以追溯到今年七月举行的 MVB(Most Valuable Builder Accelerator Program)孵化计划。该计划由 BNB Chain 与 YZi Labs 及 CoinMarketCap Labs 共同主办,在本期第 10 季中,有 500 多个项目参选,涉及 AI、DeFi、DePin、DeSci、支付、RWA 等时下热门赛道,Asseto 作为 RWA 赛道的代表项目脱颖而出,成为 15 个入选项目之一,将获得 MVB 在品牌策略、项目曝光、生态资源、投资人对接等方面的众多支持。

八月,Asseto 开始在 BNB 生态频频亮相。

8 月 16 日,Asseto 登上纽约证券交易所 Demo Day 的舞台,联合创始人兼 CEO Bridget Li 就项目阶段成果进行了展示,标志着其正式进入国际主流金融视野。

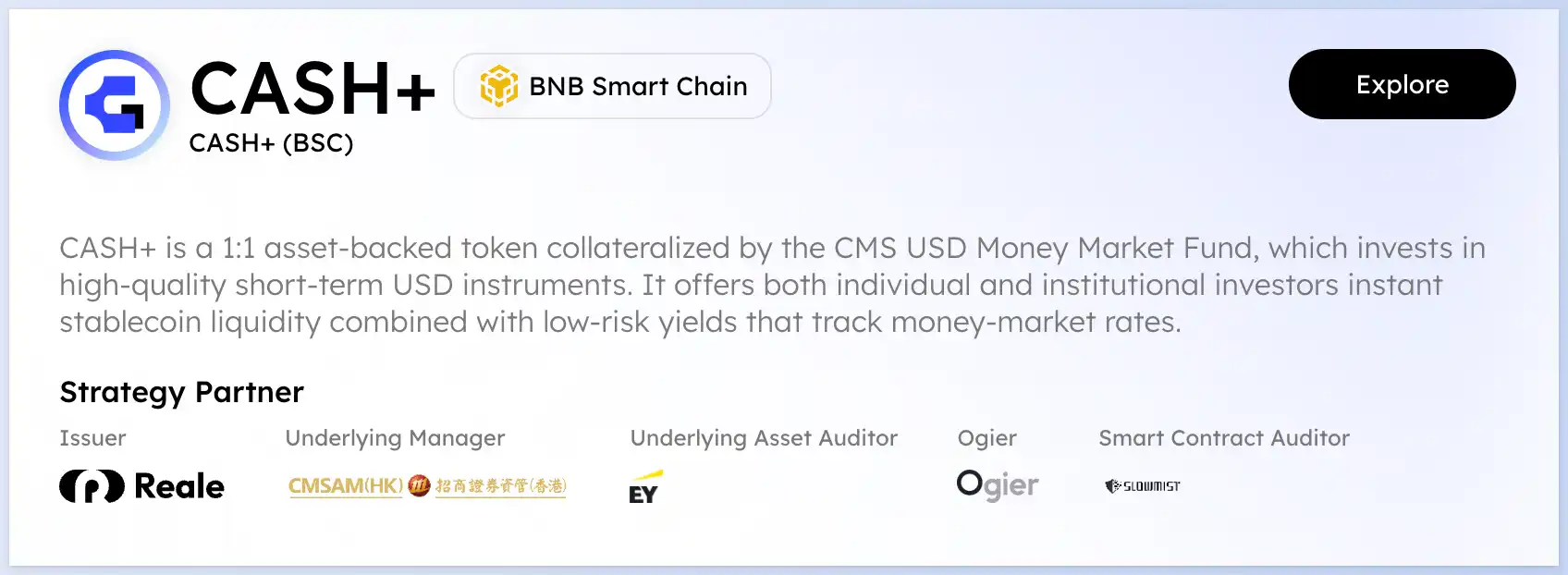

8 月 19 日,Asseto 的核心产品 CASH+ 正式上线 BNB Chain,成为首个在该链发行的亚洲资管美元货币市场基金衍生代币。

紧接着在 8 月 25 日,OpenFi 宣布成功集成 Asseto 的 CASH+,实现了 BNB Chain 上基于 RWA 资产的借贷功能,获得了 BNB Chain 官号的转发与认可。

随后就是 8 月末的 BNB Chain 五周年庆典,CZ 本人亲自发文欢迎 Asseto 及合作方招商证券资管(香港)加入生态,奠定了 Asseto 在 BNB Chain 生态中的重要地位。

二、Hashkey Group 与德林控股双双押注

今年七月初,Asseto 获得亚洲顶尖数字资产金融服务集团 HashKey Group 的战略投资。此次合作远不止于财务支持,更意味着 Asseto 的机构级 RWA 发行能力将与 HashKey Chain 进行深度集成,携手构建覆盖现金管理、基金、债券等多类资产发行、结算与流通的全链路解决方案,HashKey Chain 还将为 Asseto 提供生态激励、流动性扶持、开发者资源等支持。

月末,Asseto 再获传统金融领域的上市公司——德林控股集团的战略注资。德林控股通过此次投资,旨在借助 Asseto 的区块链技术与资产网络,切入快速增长的 RWA 赛道,推动其全球资产管理业务的数字化转型并丰富其产品组合。

在短短一个月内,Asseto 连续获得两大头部机构的战略投资:既有 Web3 领军企业 HashKey Group,也有深耕传统资本市场的德林控股集团。这不仅验证了市场对 Asseto 在 RWA 代币化领域技术实力、产品能力与市场愿景的高度认可,更充分体现了其「连接传统金融与链上金融」的定位获得了新旧金融体系的广泛认同。

三、Asseto 项目初窥:RWA 赛道的关键玩家

Asseto Fintech Limited,这家总部设在香港的 RWA 代币化金融科技公司,是本地最早一批把基金代币化真正落地的团队。他们最初从现金管理类 RWA 产品切入,如今业务已铺开到基金、债券、股票、私募信贷、房地产、黄金等多个资产类别,给投资者提供了合规且多元的 RWA 选择。

表面上看,Asseto 像是今年七月才突然走进大众视野,看似「突然崭露头角」,但实际上它已是香港代币化服务领域中落地案例最丰富、合作生态最成熟的机构之一。Asseto 帮助了香港多家资管机构把在岸和离岸的代币化产品一一落地。无论是 OFC、开曼 SPC-SP 还是 LPF 等不同基金结构,Asseto 都做得驾轻就熟。更有意思的是,Asseto 还是 Ripple 在香港的首家官方合作代币化服务商,并且和 HashKey、OSL、EX.IO 这些主流虚拟资产平台保持紧密联系,和圆币科技、京东币链签署了合作备忘录,甚至与 Circle 也有直接合作。

说到底,投资项目其实就是在投人,那我们就不得不了解一下 Asseto 的团队背景。根据官方信息,Asseto 创始人和核心成员大多来自摩根士丹利、瑞银、渣打银行等国际大行,还有 Web3 行业的早期玩家。团队不但懂传统金融里的资产管理、投行、财富、基金运作,也深谙 Web3 玩法,这种复合型背景,做 RWA 确实是再合适不过了。

就在前几天的 BNB Chain 五周年庆典上,Asseto 还带着他们的主打产品 CASH+ 亮了相。

笔者特意翻了下他们的官网,CASH+ 其实就是一款 RWA 代币(年利率高达 4.37%),底层资产是招商证券资管(香港)管理的美元货币市场基金,基金主要投向高质量的美元短期金融工具。简单来说,个人或机构买了 CASH+,既能拿到货币市场基金的低风险收益,还能享受链上的即时流动性。现在 CASH+ 已经被多家 DeFi 协议纳入合格抵押品。该代币底层资产由招商证券资管(香港)负责管理,也难怪这次 BNB Chain 的活动,Asseto 会和招商证券资管(香港)携手亮相。值得一提的是,除了 CASH+,Asseto 即将上线的产品 AmSRS 同样由招商证券资管(香港)担任投资管理方,双方的合作显然已经非常深入。

总体来看,Asseto 在 RWA 的布局颇有几分「低调但精准」的意味——它绝不仅仅是一个「上链工具」,而是一个真正意义上的「桥梁」。Asseto 老老实实做了两件事:在上游,啃下了传统资产上链中最硬的骨头——从合规结构、链上发行到资产托管,降低机构入场门槛;在下游,他们借力打力,依托背后豪华的资方资源,借助 BNB Chain、Hashkey、Pharos、Arbitrum、Avalanche 等生态合作网络和和 DeFi 协议集成,快速铺开应用场景。其团队既熟知传统金融的游戏规则,又有众多 Crypto Native 成员,懂协议、懂玩法,显然如何非常清楚如何在 DeFi 里玩出真实效用。

Asseto 不仅有潜力吸引真正的传统资金入场,更可能成为那个「终于搞明白怎么打通 DeFi 和 TradFi」的关键玩家——而这,才是 RWA 叙事最值得期待的地方。

四、引领 RWA 万亿市场 新的金融时代正在到来

RWA 今年的火热无需多言。只要走进任何一场 Web3 大会,除了稳定币,讨论最多的必然是 RWA。为什么这个赛道被视为下一个万亿级市场?本质上,是因为它把传统金融庞大的资产池和区块链的高效流通、透明机制结合在了一起。放眼全球,债券、基金、黄金、房地产这些传统金融资产的体量远超加密市场,但普通人想参与,往往受限于高门槛、地域、托管和交易时间。资产上链,不仅极大地提升了流动性和透明度,也为全球投资者打开了全新的入口。这场资产数字化和流通方式的变革,是 RWA 被普遍看好的最核心理由。

与此同时,稳定币的崛起给 RWA 带来了坚实的支付和结算基础。今年堪称稳定币元年:美国 GENIUS 法案的通过,香港《稳定币条例草案》的实施,以及英国 FCA 的稳定币及加密资产监管提案,无不预示着行业格局正在被全面重塑,加密货币将不再是 Crypto 这个小圈子的专属,而是成为全球金融支付的新底层设施。

从第三方视角看,香港正逐渐成为 RWA 创新的前沿阵地。Asseto 在政策红利下率先实现多项落地,积累了丰富的本地实操经验,也成为众多机构在香港布局 RWA 的重要承接方。

结语

Asseto 团队在产品和技术上的创新力,使其获得了 BNB Chain、HashKey、德林控股等头部机构的背书和资源。随着监管愈发清晰,Asseto 的合规优势会更突出。更重要的是,Asseto 代表着未来发展的核心方向——连接传统金融与去中心化世界。RWA 代币化市场正处于爆发前夜,Asseto 抓住了这个历史性机遇,推动传统金融与去中心化经济的融合从理论成为现实。一个全新的金融时代,或许正在悄然成型。

本文来自投稿,不代表 BlockBeats 观点

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。