原文作者:前Gate高级研究员Mark Lee

前言

Hyperliquid 作为 2024 年崛起的去中心化合约交易协议,依托其自建高性能公链,显著提升了交易执行效率与用户体验。除性能优势外,其核心创新在于深度整合传媒与金融交易功能,通过链上工具将如 James Wynn 这样的顶级交易员的实时交易行为透明化,为市场提供了便捷的跟单机制。

本报告基于对 Hyperliquid 链上合约交易数据及关联社交媒体交互数据的系统性分析,构建 KOL 影响力评估体系。研究样本覆盖 10 位市场头部 KOL 及其关联的 100 个高活跃度“聪明钱”地址(注:聚焦 KOL 主要公开地址,多地址情形下以代表性地址为分析主体)。数据采集截止于 2025 年 8 月 10 日 12 时 (UTC+8)。

1. KOL 链上交易影响力

本报告开篇聚焦于量化 Hyperliquid KOL 的链上的交易影响力。对于交易员而言,其策略的有效性可经由关键绩效指标进行客观衡量,包括交易胜率、累计收益、交易频率、资金规模。本章节将系统性地采集并分析上述核心维度的链上数据,旨在对每位目标 KOL 的交易行为模式与策略特征进行全景式刻画,为后续综合影响力分析奠定数据基础。

1.1 KOL 交易收益排行榜

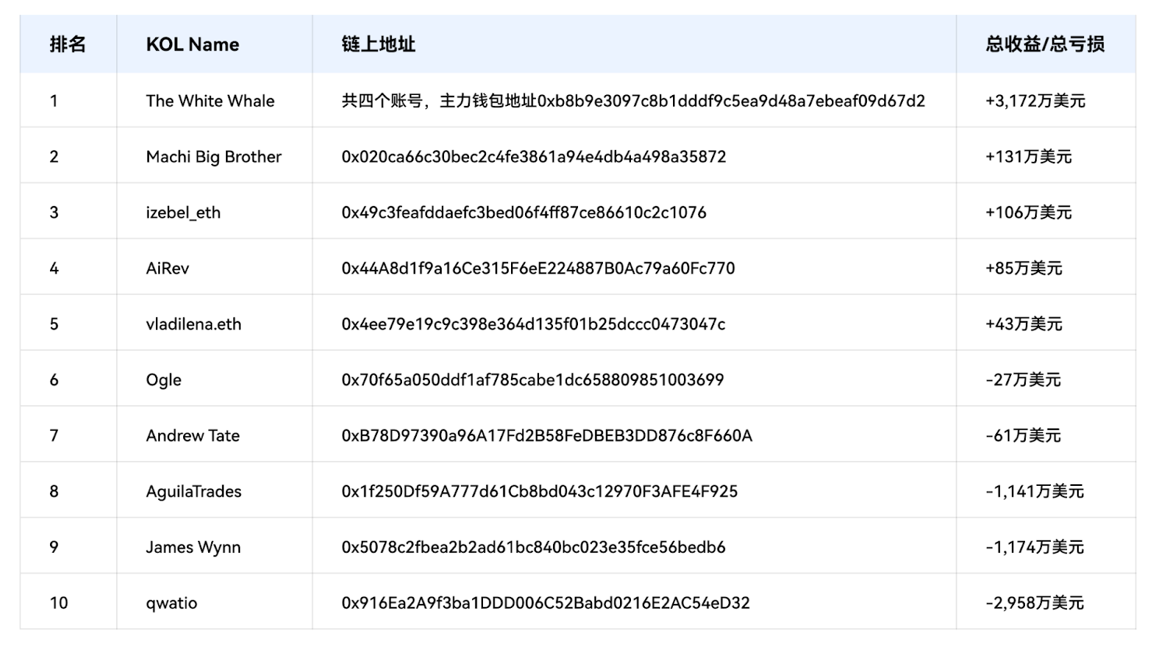

Hyperliquid KOL 交易总收益榜单

由于交易员投入成本存在浮动,其利润率统计难度较高。从交易盈利总额维度观察,The White Whale 显著领先于其他知名 KOL。Hyperdash 数据显示,其四个关联地址累计盈利逾 3,000 万美元。而其余盈利 KOL 的收益均未突破 200 万美元。值得注意的是,部分知名 KOL(如 James Wynn、qwatio、Aguila Trades)累计亏损均超 1,000 万美元。由此可见,高倍杠杆合约交易因爆仓风险较高,实际获利难度较大,交易者需保持审慎态度。

1.2 KOL 交易胜率排行榜

Hyperliquid KOL 交易胜率榜

从胜率维度看,超半数 KOL 的链上合约交易胜率不足 50%,印证了合约交易的高难度特性。其中,Machi Big Brother 与 vladilena.eth 虽录得 100% 胜率,但其交易频次较低,统计显著性有限。对于投资者而言,具备持续跟踪价值的标的为 The White Whale。数据显示,其四个关联地址在 2025 年累计完成逾 1,000 笔交易,胜率高达 72.8%,在同类交易者中表现突出。相比之下,部分高知名度 KOL,如 James Wynn 与 qwatio,其胜率表现则相对欠佳。由此可见,高倍杠杆合约交易因爆仓风险较高,实际获利难度较大,交易者需保持审慎态度。

1.3 KOL 最擅长的交易资产

Hyperliquid KOL 最擅长的交易资产

不同代币价格走势受基本面、资金面及消息面等多重因素驱动,呈现显著差异性。因此,各 KOL 通常拥有其特定擅长的交易标的。典型案例如 James Wynn:其成名作便是以 7,000 美元成本建仓 PEPE,并通过波段操作最终实现超 2,500 万美元收益。合约交易层面,PEPE 亦为其核心盈利资产——通过高倍杠杆操作累计获利逾 2,000 万美元。 需注意的是,其账户亏损主要源于 BTC 与 ETH 合约交易的极低胜率。反观巨鲸 The White Whale,则以 ETH 为主要战场,通过战略性持仓已实现超 2,000 万美元盈利。

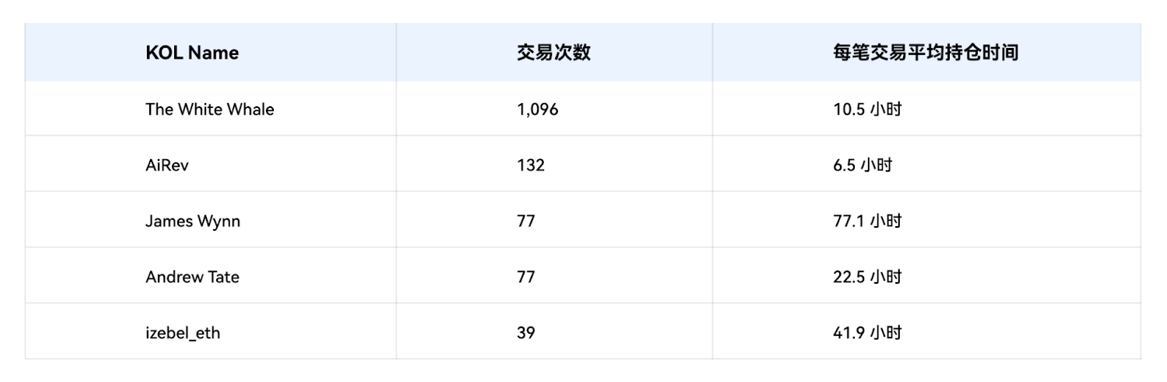

1.4 KOL 合约持仓时间

Hyperliquid KOL 合约持仓时间

资金费率是加密货币合约交易者的核心成本构成之一。以 Hyperliquid 为例,其每 8 小时结算一次资金费率,由持仓占优方向劣势方支付。因此,持仓时间越长,累积支付的资金费率成本越高,同时也反映出交易者对该资产中期走势的较强信心。

数据显示,James Wynn 在统计样本中平均持仓周期最长,达 77 小时。其代表性交易为高倍杠杆 PEPE 合约,持仓超 1,455 小时(约 60 天),最终获利约 2,500 万美元。 相比之下,AiRev 平均持仓周期最短,仅为 6.5 小时。

对合约投资者而言,时间维度的重要性常超越标的资产本身。 高倍杠杆下,持仓时间延长不仅增加资金成本,更显著放大爆仓风险。鉴于加密市场 7*24 小时运行,短期价格波动易导致未及时平仓的头寸爆仓。因此,超短线投资者可参考 AiRev 与 The White Whale 的策略;而倾向捕捉中期趋势的投资者,则可关注 James Wynn 的长周期持仓策略。

1.5 KOL 多空交易的累计收益

Hyperliquid KOL 多空交易收益

在 2025 年加密货币震荡上行的牛市环境中,高倍杠杆做空策略获利难度显著提升。 统计数据显示,样本 KOL 中仅 izebel 通过做空 ETH 实现正收益,其余多数均在做空合约中录得亏损。 值得注意的是,即便累计盈利逾 3,000 万美元的巨鲸 The White Whale,其做空交易亦未能贡献正向回报。 相比之下,被称为“50 x 哥”的 qwatio 则在做空合约中损失惨重,2025 年累计亏损超 3,000 万美元,让其做多收益显得杯水车薪。

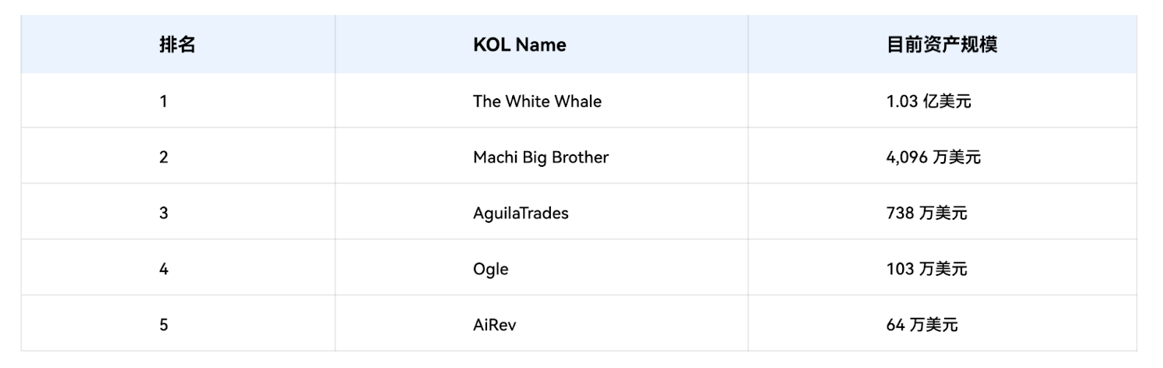

1.6 KOL 资产规模排名

Hyperliquid KOL 当前资产规模

数据显示,部分统计样本中的 KOL 已将主要资产转移出当前钱包地址,导致其链上资产余额不足 1,000 美元。预计此类 KOL 未来或将启用新地址进行操作。 从资产规模维度看,当前仅 The White Whale 与 Machi Big Brother 符合“巨鲸”标准,其余 KOL 在 Hyperliquid 上的资产规模相对有限。 值得关注的是,与传统基金经理类似,管理更大规模资金通常意味着更高的策略执行与风险管理成本。

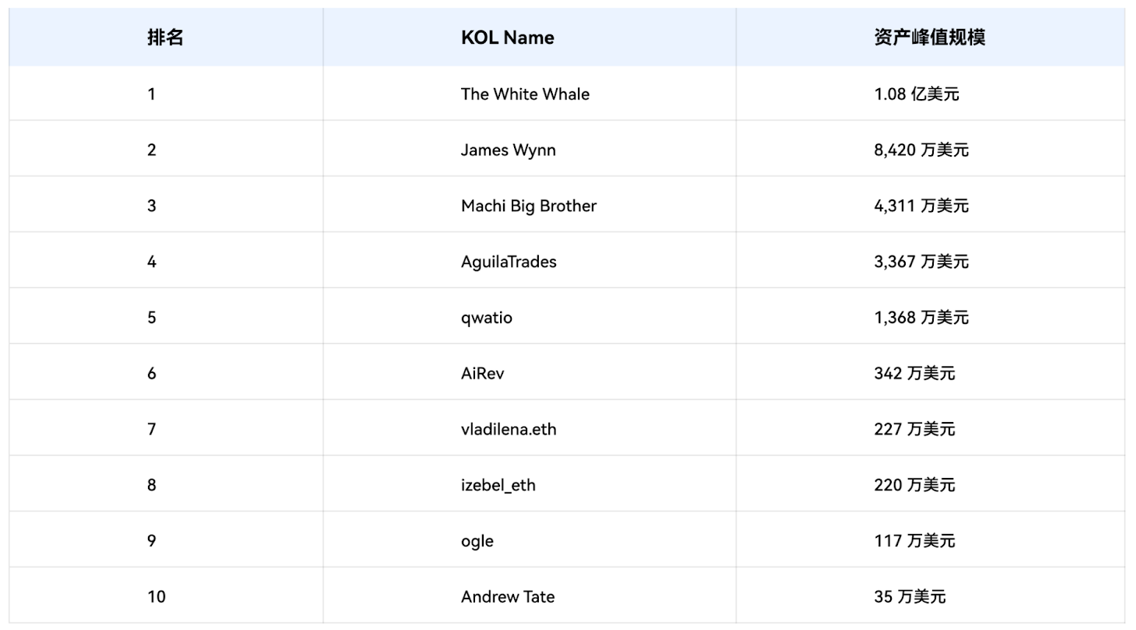

Hyperliquid KOL 资产规模峰值

追溯历史数据可见,多位 KOL 的主力地址曾管理超千万美元量级资产。 典型案例如 James Wynn、AguilaTrades 及 qwatio,其地址资金峰值分别达 8,420 万、3,367 万与 1,368 万美元。值得注意的是,三者当前链上资产均已降至 1,000 美元以下。值得深究的是,此三位 KOL 恰为前文(章节 1.1)统计中累计亏损排名前三位的交易者。 巨额亏损或让这些 KOL 选择使用一个新的钱包地址重新开始,或者彻底离开 Hyperliquid 合约交易市场。

1.7 Hyperliquid 匿名聪明钱与匿名巨鲸地址

Hyperliquid 匿名聪明钱交易地址与交易数据

表九:Hyperliquid 匿名巨鲸交易地址与交易数据

匿名聪明钱地址与巨鲸地址有潜力成为社交媒体具备足够影响力的 KOL,事实上,链上地址 0 x 175 e 7023 e 8 dc 93 d 0 c 044852685 ac 33 e 856 b 577 b 4 已经成为包括 X 社媒账号 Lookonchain、Onchain Lens、Ai 姨高度关注的链上地址。该地址由于胜率高,同时资金体量大,在未绑定个人 IP 的情况下,其一举一动实际上已经起到了 KOL 的效果,散户的交易行为会受到其操作的影响。

匿名聪明钱地址与巨鲸地址有潜力成为社交媒体具备足够影响力的 KOL,事实上,链上地址 0 x 175 e 7023 e 8 dc 93 d 0 c 044852685 ac 33 e 856 b 577 b 4 已经成为包括 X 社媒账号 Lookonchain、Onchain Lens、Ai 姨高度关注的链上地址。该地址由于胜率高,同时资金体量大,在未绑定个人 IP 的情况下,其一举一动实际上已经起到了 KOL 的效果,散户的交易行为会受到其操作的影响。

聚焦于已绑定个人 IP 的 KOL,可观察到两种典型人设策略: “亏损巨鲸”与“高胜率聪明钱”。前者通过塑造“巨额财富波动”的叙事(如“富豪跌落神坛”),利用戏剧性事件吸引市场关注度; 后者则以可验证的高胜率为核心,吸引投资者跟单以期复制其超额收益。值得强调的是,The White Whale 成功突破了资产管理中常见的“规模魔咒”, 兼具顶级资产规模与高胜率,从而成为 Hyperliquid 生态中兼具影响力与盈利能力的标杆 IP。

2. 社交账号影响力

2.1 Hyperliquid KOL 社媒数据

2025 年 1 月 1 日 Hyperliquid KOL 社媒数据

备注:The White whale 在 2025 年 7 月建立账号,其关注者数据在 2025 年 7 月 28 日纳入 LunarCrush 网站统计。qwatio 和 vladilena.eth 由于个人社媒账号的粉丝量较少,因此未纳入 LunarCrush 网站统计。

2025 年 8 月 10 日 Hyperliquid KOL 社媒数据

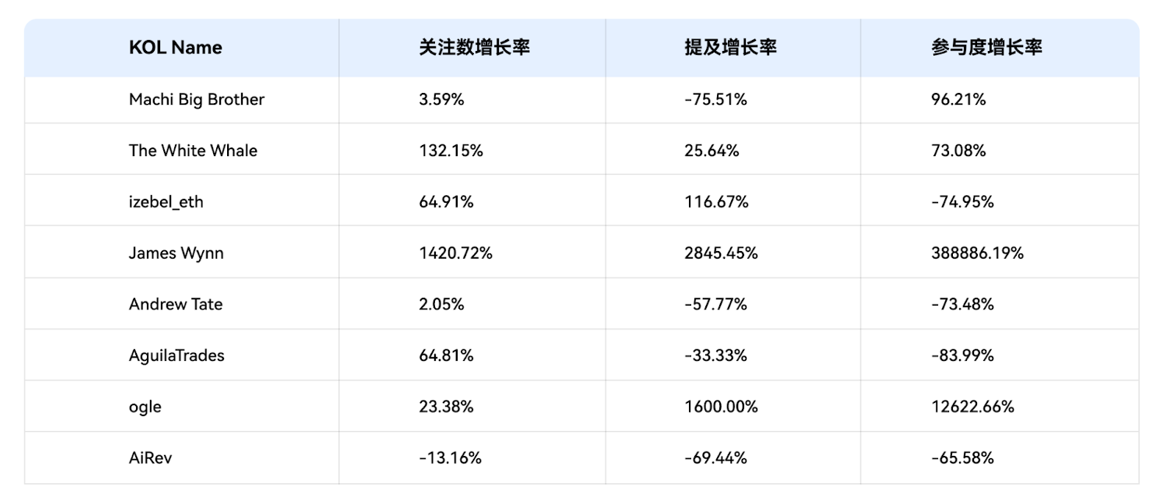

2025 YTD 各大 KOL 数据增长

2025 YTD 各大 KOL 数据增长率

数据显示,James Wynn 无疑是 2025 年粉丝增速最快的 KOL,其粉丝基数增长逾 14 倍,X 平台曝光度与互动率亦大幅攀升。 The White Whale 虽于 7 月新注册 X 账号,首月即吸引超 5,300 名关注者,社交媒体影响力持续扩张。 此外,AguilaTrades 与 izebel_eth 等 KOL 的关注人数也录得显著增长。

值得注意的是跨界影响力案例: 前职业跆拳道选手 Andrew Tate 凭借健身内容已积累超千万粉丝,其账号虽具广泛影响力,但加密货币相关内容占比极低,核心受众聚焦于非加密领域。 这与主营加密货币的垂直型 KOL 形成鲜明对比。

2.2 Hyperliquid KOL 社媒人设

在社媒平台上成为足够有影响力的交易员,除了自身在资金体量或交易胜率上的优势,完整的人设会提升粉丝粘性,传奇的故事会获得更大程度上的曝光。Hyperliquid 链上 KOL 很多都有自己完整的人设,有些是意气风发的天才交易员,有些是草根出身的交易奇才,有些则是深耕代码的技术大咖。下文将介绍部分有代表性的 KOL 人设。

2.2.1 James Wynn,从小镇走出来的天才交易员

James Wynn 是目前链上最具传奇色彩的交易员,他来自英格兰的某个被遗忘的小镇,加密货币交易改变了他的一生。2022 年 James Wynn 首次接触到加密货币,并不富裕的他只能成为 “10 U 战神”(每笔交易投入资本 10 美元)中的一员。2023 年 Jame Wynn 建立了个人的推特账号,他不断地宣传 PEPE 相关的内容。2023 年 4 月,James Wynn 曾预言 PEPE 将会由当时 420 万美元的市值,上升至 42 亿美元。众所周知,James Wynn 成为 PEPE 上涨最大的受益者这一,其社媒账号的人气也水涨船高。

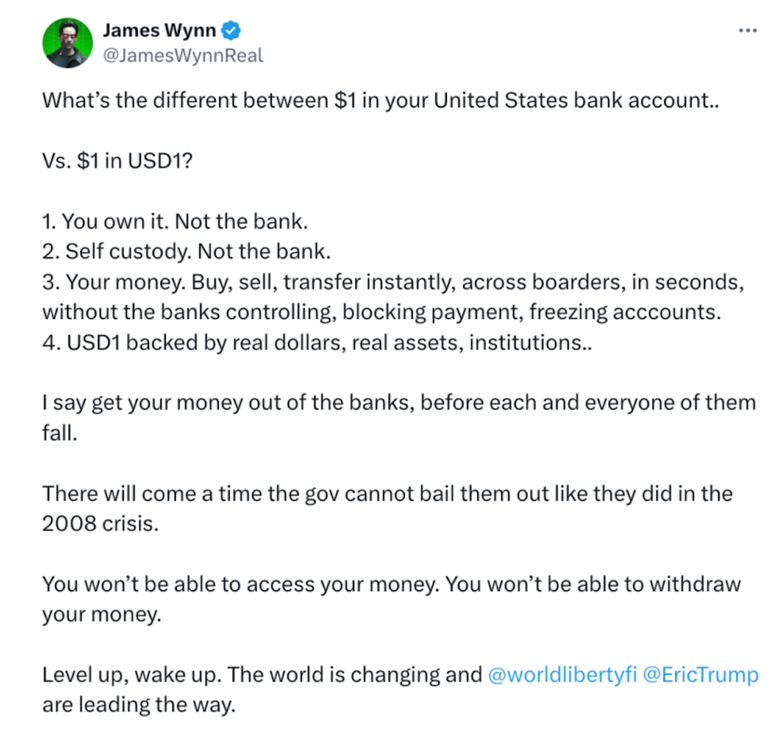

作为一名小镇青年,成功后的 James Wynn 仍然保持了“反资本斗士”的个性。在 7 月 17 日的推文中,他对美国的银行系统提出了质疑,建议所有人选择 USD 1 而非银行。不仅如此,James Wynn 还曾发布多条推文,抨击旧秩序与旧制度。

James Wynn 关于银行的推文

2.2.2 The White Whale,理性主义投资的布道者

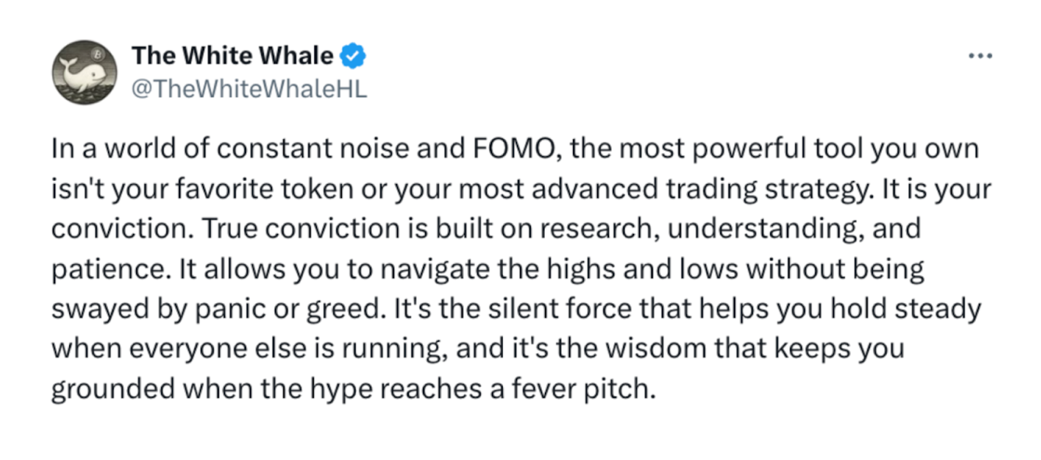

如上文所述,The White Whale 是链上 KOL 中少数战胜“规模魔咒”的交易大师。The White Whale 在 2025 年 7 月才创立个人的 X 账号,作为一名成功的交易员,他的 X 账号更多展示了他对加密货币交易的“道”而非“术”。虽然 The White Whale 也偶有不理性表达,但相对于其它 KOL,他的形象更接近于一个敦厚长者。The White Whale 乐于分享自己对于投资的理解,以及对 ETH 和 SOL 未来走势的看法,他多次发推强调:交易员要减少非理性的交易,要用理性的态度分析数据,从而获得合理的交易判断。

图二:The White Whale 关于理性交易的推文

2.2.3 izebel_eth,擅长技术分析的加密先锋

izebel_eth 是一名很有特点的 Hyperliquid 链上 KOL,他在做交易决策时擅长技术分析,通过交易量、均线、压力与支撑等技术指标来判断是否看多或开空合约。此外,izebel_eth 在社媒账号经常使用动漫以及梗图来表达错事交易机会或交易成功时的心情。相比于其他 KOL,单从他的 X 账号内容上看更像一名二次元博主。此外,izebel_eth 非常善于复盘,通过总结在此前失败的经历来制定新的交易计划。izebel_eth 创作的多篇优质内容也获得了主流区块链媒体的转发。

izebel_eth 关于技术分析的推文

2.2.4 AiRev,不善言辞的 GameFi 重度玩家

在一众加密货币 KOL 中,izebel_eth 与 AiRev 是网上冲浪强度最高的两位。但不同于很多有极强表达欲的 KOL 博主,AiRev 习惯于转发其他 X 博主的内容,只有在被其他博主提及时才会主动发言。AiRev 也是少数在链上监控账号 Lookonchain 披露其交易后,会主动回复的博主。交易之外,AiRev 转发了大量 GameFi 的相关内容,卡牌游戏 Parallel 的相关内容被多次转发。或许对他而言,交易只是赚钱的工具,而游戏才是最大的爱好。

AiRev 回应 Lookonchain 的推文

2.2.5 Machi Big Brother,曾是嘻哈歌手的加密前辈

Machi Big Brother(麻吉大哥),即美籍台湾歌手黄立成的社交媒体 ID,是当下链上交易领域少数真实身份的意见领袖(KOL),同时也是 Hyperliquid 平台上罕见的华人 KOL。他于 2017 年涉足加密货币领域,相较其他交易员,可谓资深前辈。在投身 Hyperliquid 链上交易前,Machi Big Brother 自封为“无聊猿主席”,经常赠送 NFT 给娱乐圈友人,并积极为 Bored Ape Yacht Club (BAYC) 宣传。然而,2022 年 NFT 泡沫破灭后,其账号中 NFT 相关内容有所下降。Machi Big Brother 是 ETH 的坚定支持者,其社交媒体上频频提及 ETH 相关话题。

3. KOL 影响力总结

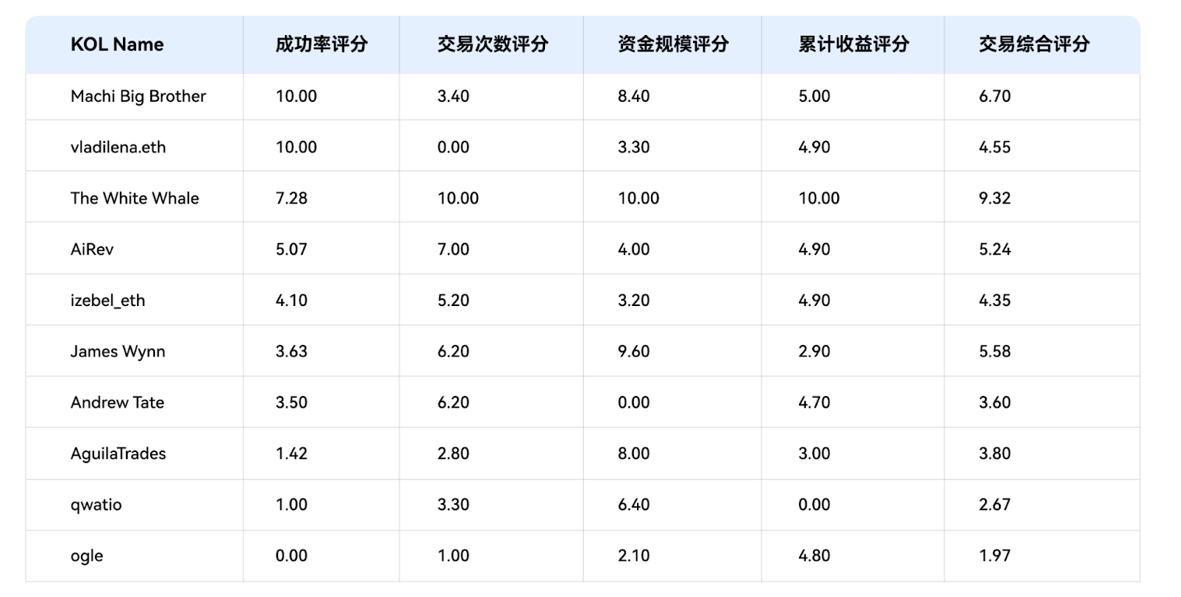

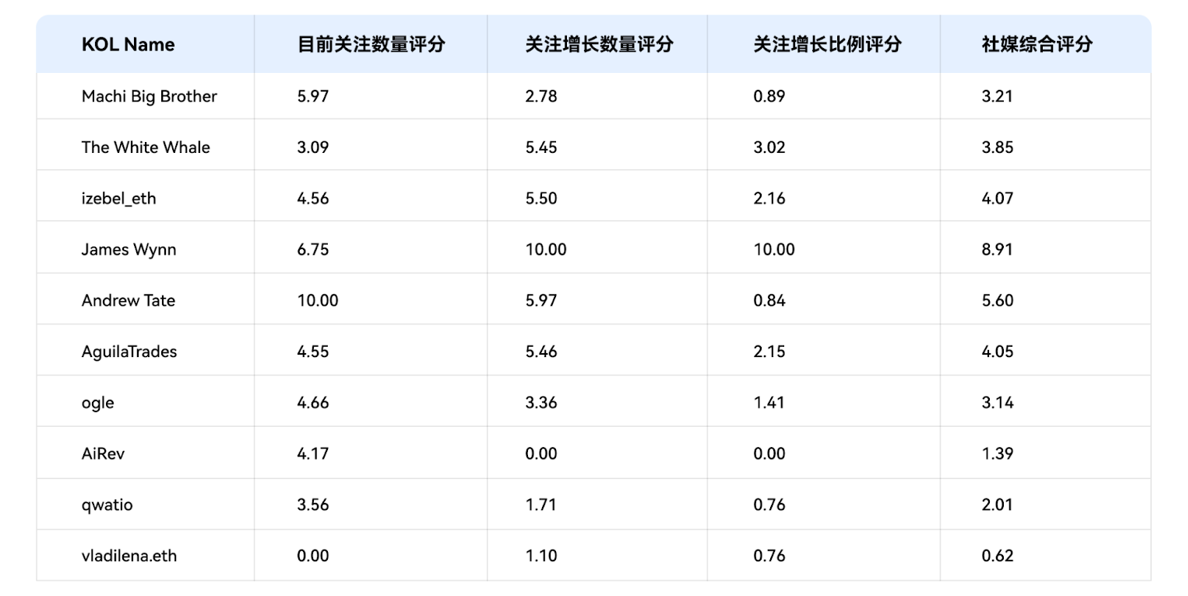

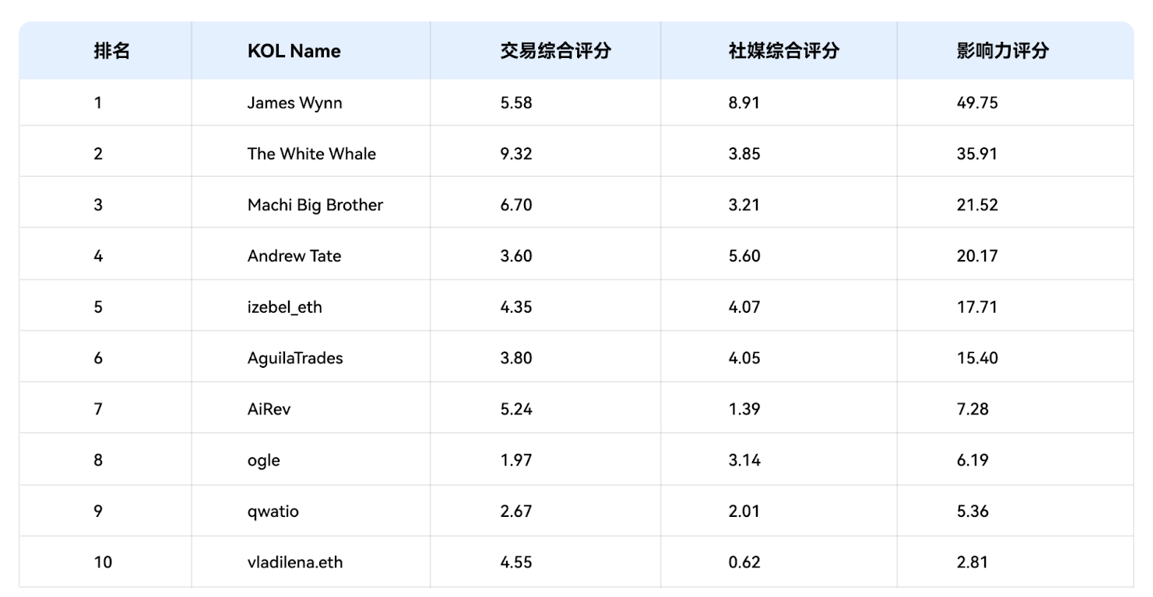

本文将 KOL 的影响力共分为两个维度,首先是交易维度,这里涉及的参数包括交易成功率、交易次数、资金规模、累积收益四个指标。其次是社媒维度,这里涉及粉丝增长的绝对数量以及粉丝增长的环比增长。

KOL 链上交易综合影响力

KOL 社交媒体综合影响力

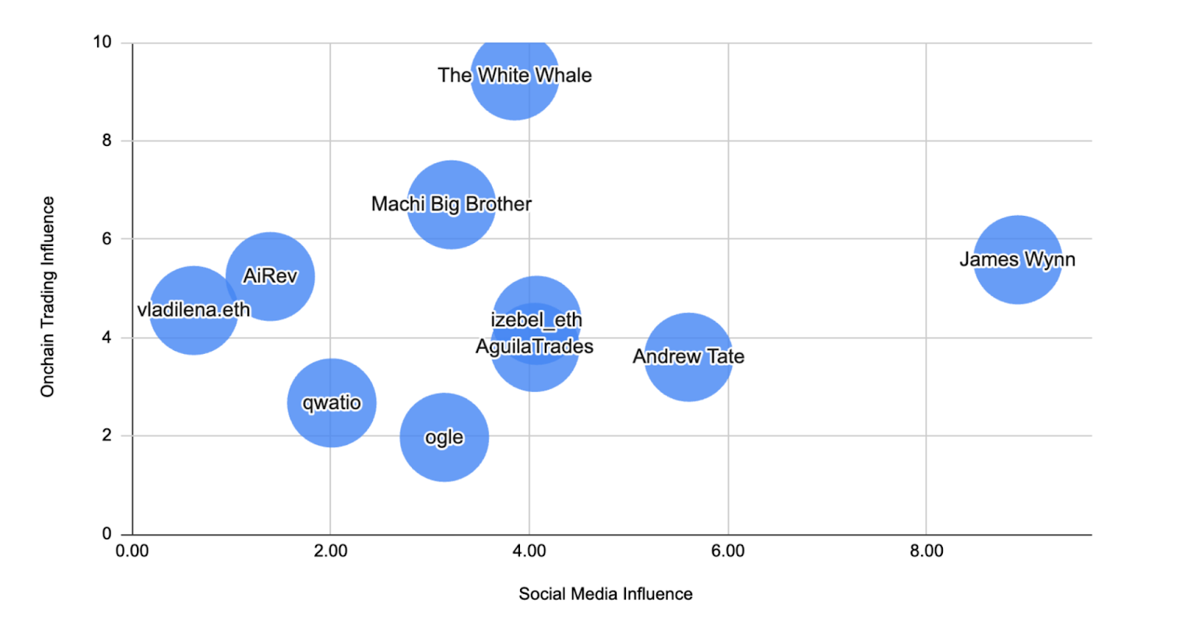

综上所述,本研究基于对 Hyperliquid 平台 KOL 的分析,从社交媒体影响力与链上交易表现两个维度构建了综合影响力评估矩阵。如图所示,The White Whale 在链上交易维度表现显著领先,展现出较强的资金规模与交易胜率;而在社交媒体维度,James Wynn 则占据相对优势,体现出更高的社群关注度和内容传播效力。

表十六:Hyperliquid KOL 影响力坐标图

Hyperliquid KOL 综合影响力排行榜

通过综合评估链上交易影响力与社交媒体影响力两项核心指标(以影响力指数 = 交易影响力 × 社交媒体影响力计),排名前三的分别为 James Wynn、The White Whale 和 Machi Big Brother。值得注意的是,The White Whale 因其账号注册时间较晚,社交媒体积累相对不足,在该项得分中略显劣势,从而影响了其综合排名。

Hyperliquid 已成为加密货币领域顶级交易员扩大声量、提升行业影响力的重要平台。然而,即便成功在链上积累关注,若要在加密世界奠定真正的意见领袖地位,仍离不开两方面的长期努力:一是持续而深度的社区运营,二是保持高胜率的链上交易表现。唯有在交易实力与社群信任上深耕,方能穿越周期,真正立于行业话语中心。

4. 资料来源:

1. https://hyperdash.info/trader/0 x 5078 c 2 fbea 2 b 2 ad 61 bc 840 bc 023 e 35 fce 56 bedb 6

2. https://hyperdash.info/trader/0 x 1 f 250 Df 59 A 777 d 61 Cb 8 bd 043 c 12970 F 3 AFE 4 F 925

3. https://hyperdash.info/trader/0 x 916 Ea 2 A 9 f 3 ba 1 DDD 006 C 52 Babd 0216 E 2 AC 54 eD 32

4. https://hyperdash.info/trader/0 x 44 A 8 d 1 f 9 a 16 Ce 315 F 6 eE 224887 B 0 Ac 79 a 60 Fc 770

5. https://x.com/lookonchain/status/1953130827484938597

6. https://hyperdash.info/trader/0 x 020 ca 66 c 30 bec 2 c 4 fe 3861 a 94 e 4 db 4 a 498 a 35872

7. https://x.com/OnchainLens/status/1951820201470873768

8. https://hyperdash.info/trader/0 xd 5 ff 5491 f 6 f 3 c 80438 e 02 c 281726757 baf 4 d 1070

9. https://hyperdash.info/trader/0 xb 8 b 9 e 3097 c 8 b 1 dddf 9 c 5 ea 9 d 48 a 7 ebeaf 09 d 67 d 2

10. https://hyperdash.info/trader/0 xa 04 a 4 b 7 b 7 c 37 dbd 271 fdc 57618 e 9 cb 9836 b 250 bf

11. https://hyperdash.info/trader/0 xfa 6 af 5 f 4 f 7440 ce 389 a 1 e 650991 eea 45 c 161 e 13 e

12. https://x.com/lookonchain/status/1946957494364103135

13. https://hyperdash.info/trader/0 x 4 ee 79 e 19 c 9 c 398 e 364 d 135 f 01 b 25 dccc 0473047 c

14. https://x.com/lookonchain/status/1943144977199947851

15. https://hyperdash.info/trader/0 xB 78 D 97390 a 96 A 17 Fd 2 B 58 FeDBEB 3 DD 876 c 8 F 660 A

16. https://x.com/lookonchain/status/1933045616063676657

17. https://hyperdash.info/trader/0 x 70 f 65 a 050 ddf 1 af 785 cabe 1 dc 658809851003699

18. https://x.com/lookonchain/status/1930805770947637632

19. https://hyperdash.info/trader/0 x 49 c 3 feafddaefc 3 bed 06 f 4 ff 87 ce 86610 c 2 c 1076

20. https://x.com/lookonchain/status/1910274545912787248

21. https://hyperdash.info/trader/0 x 89 Da 4 BAEC 446 F 35 a 1 cbE 17 a 9 d 1 EE 5 C 70 B 05 Ee 43 f

22. https://hyperdash.info/trader/0 xaEbeeE 47 aC 35377085 eA 2885 c 290 C 081 b 21975 Ec

23. https://hyperdash.info/trader/0 x 2 aa 64388 b 7654389 c 61 c 2145 cae 22816 b 4 f 2 b 760

24. https://hyperdash.info/trader/0 x 175 e 7023 e 8 dc 93 d 0 c 044852685 ac 33 e 856 b 577 b 4

25. https://hyperdash.info/trader/0 x 183 d 0567 c 33 e 7591 c 22540 e 45 d 2 f 74730 b 42 a 0 ca

26. https://lunarcrush.com/creators/x/jameswynnreal

27. https://lunarcrush.com/creators/x/machibigbrother

28. https://lunarcrush.com/creators/x/thewhitewhalehl

29. https://lunarcrush.com/creators/x/izebel_eth

30. https://lunarcrush.com/creators/x/aguilatrades

31. https://lunarcrush.com/creators/x/cryptogle

32. https://lunarcrush.com/creators/x/cobratate

33. https://lunarcrush.com/creators/x/parallelairev

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。