This article is from: Cointelegraph

Translation|Odaily Planet Daily (@OdailyChina);

Translator|Moni

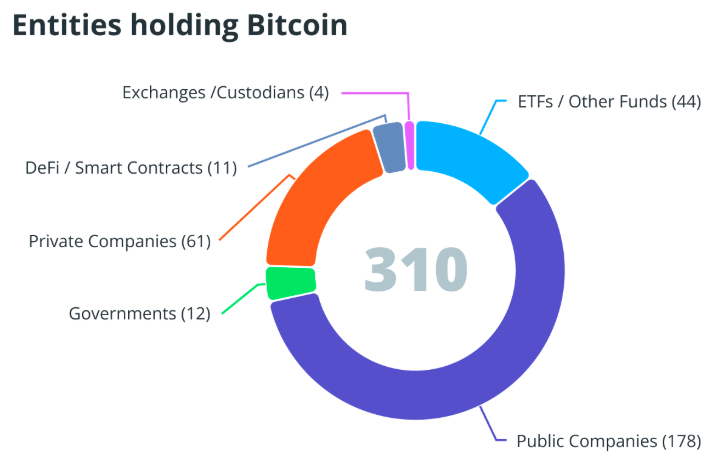

Since Strategy first launched its Bitcoin treasury strategy, its Bitcoin holdings have reached 632,457 BTC, and the company's stock price has increased by 2200% compared to when the strategy was initiated in August 2020. Now, more and more companies are following Strategy's lead by using financing tools such as convertible bonds to build Bitcoin treasuries. According to BitcoinTreasuries, as of August 29, 2025, 174 publicly traded companies hold Bitcoin, with 161 companies holding more than 1 BTC, and the total holdings reaching 989,926 BTC, accounting for approximately 4.7% of the total Bitcoin supply.

However, this seemingly innovative capital frenzy appears to be gradually cooling down, as the stock prices of some companies adopting the Bitcoin treasury strategy have not risen significantly as expected. Let’s take a look at six publicly traded companies that have yet to see success from their BTC bets—

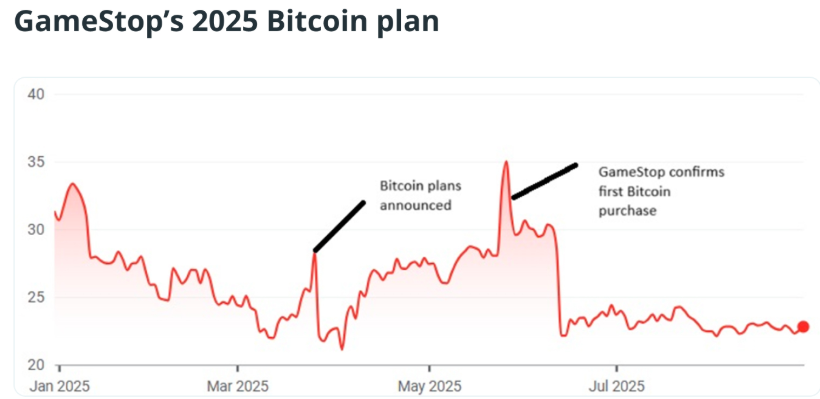

GameStop: Holds 4,710 BTC

GameStop's fate has long been intertwined with Bitcoin and cryptocurrency. In 2021, retail traders on the r/WallStreetBets subreddit triggered a short squeeze on GameStop stock, bringing meme finance into the mainstream. On March 26, 2025, GameStop announced plans to invest in Bitcoin, leading to a 12% increase in its stock price. Following the disclosure of purchasing 4,710 BTC on May 28, the stock price soared to a peak of $35 per share.

However, the good times did not last long, as investors quickly announced sell-offs after these two positive events, resulting in GameStop's stock price dropping over 27% year-to-date.

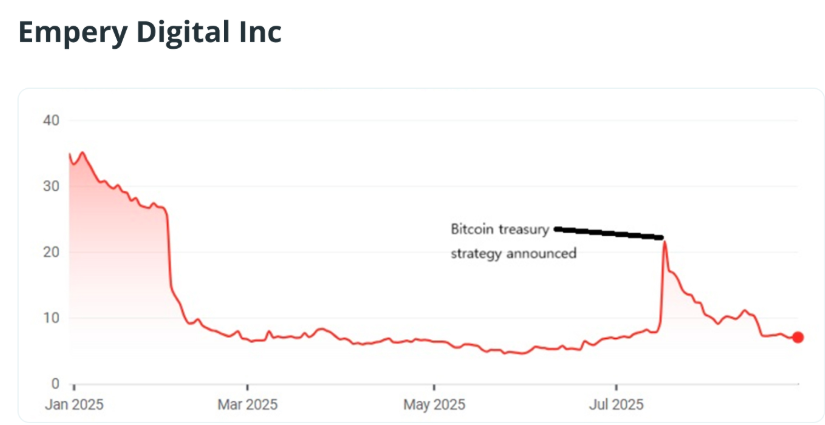

Empery Digital: Holds 4,019 BTC

Not all companies purchasing Bitcoin have a background story like GameStop. Many companies are unrelated to cryptocurrency or blockchain, such as MicroStrategy, which was a business intelligence software company before launching Bitcoin bonds, and Japan's Metaplanet, which initially operated budget hotels.

Electric vehicle manufacturer Volcon announced a $500 million Bitcoin funding strategy on July 17, and two weeks later rebranded to Empery Digital, changing its Nasdaq ticker to EMPD.

Before this adjustment, Empery Digital's stock price mostly hovered between $6 and $7, far below the $35 peak in January. After announcing the Bitcoin treasury strategy on July 17, the stock price briefly surged to $21, but the momentum did not last, and it fell back to the $7 range this week.

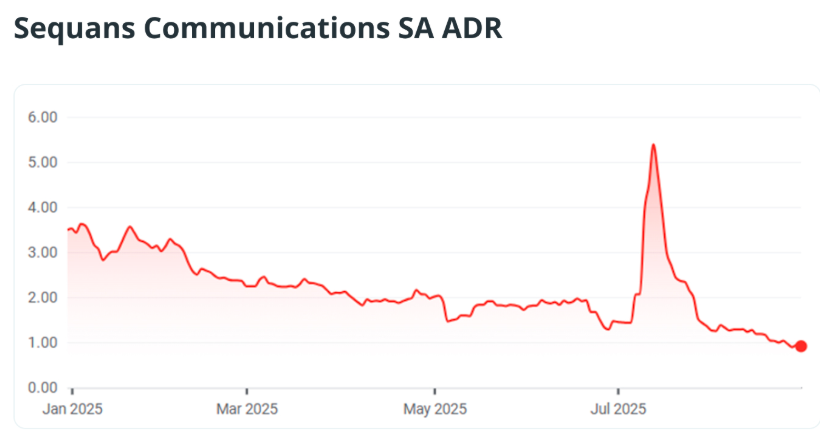

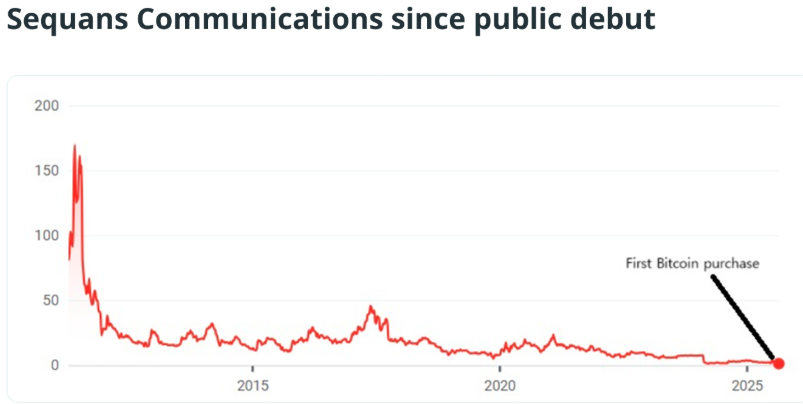

Sequans Communications: Holds 3,170 BTC

Sequans Communications is a French semiconductor company that went public on the New York Stock Exchange in 2011 under the ticker SQNS. In early July 2025, Sequans Communications' stock price hovered around $1.45 after a year of steady decline. On July 10, the company announced its first Bitcoin purchase, causing the stock price to rise, and in the following days, the stock price briefly soared to $5.39, but this upward momentum quickly faded, and by early August, it had fallen back to $1.25.

Recently, Sequans announced plans to raise $200 million through a stock offering to support its goal of accumulating 100,000 BTC by 2030. However, this positive news did not prevent SQNS's stock price from declining, which has now dropped to the $0.90 range.

Vanadi Coffee: Holds 100 BTC

Like many companies turning to Bitcoin, the Spanish coffee chain Vanadi Coffee adopted this strategy due to financial difficulties. In 2024, the company reported an annual loss of €3.33 million ($3.9 million), up from €2.87 million the previous year.

On June 29, the company announced the launch of a Bitcoin reserve plan, and the next day its stock price surged to €1.09, with the closing price for the month rising over 300%. However, as of August 29, 2025 (Friday trading session), Vanadi Coffee's stock price had fallen back to €0.35. Although its stock price has still risen 95.6% year-to-date, it is down 44% compared to the same period in 2024.

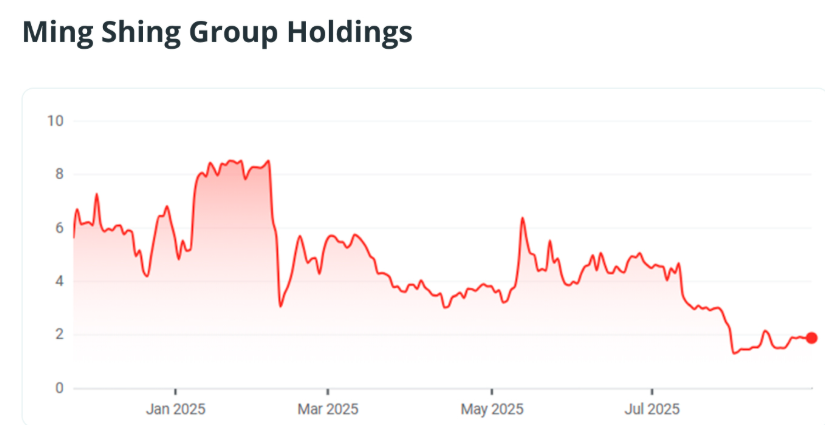

Ming Cheng Group: Holds 833 BTC

Ming Cheng Group is a construction company based in Hong Kong that went public on Nasdaq in November 2024, with an initial price of $5.59. It has now launched a Bitcoin treasury reserve and made its first purchase of 500 BTC on January 13, 2025, bringing its total holdings to 833 BTC.

Ming Cheng Group's Bitcoin strategy initially drove its stock price to a historical high of $8.50, but it quickly fell to $1.85 thereafter.

On August 21, the company announced plans to acquire an additional 4,250 BTC through a stock issuance at a price of $483 million. If the transaction is completed, Ming Cheng will become the largest corporate holder of Bitcoin in Hong Kong, surpassing Boyaa Interactive, which holds 3,640 BTC and is currently the second-largest publicly traded Bitcoin treasury company in Asia, behind Metaplanet. Although this announcement briefly boosted Ming Cheng Group's struggling stock price, most of the gains were erased the same day.

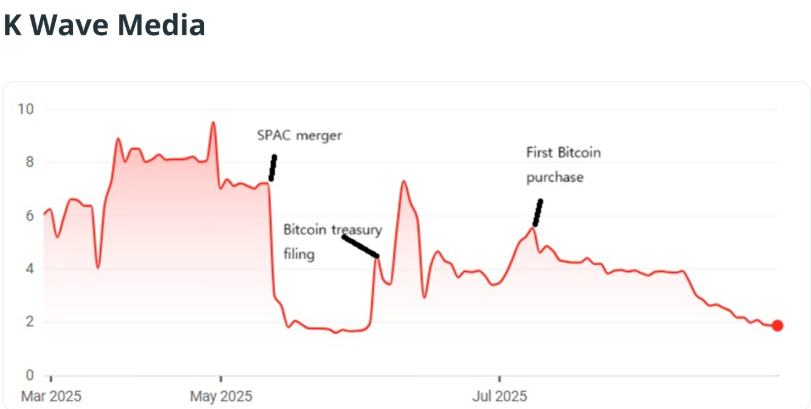

K Wave Media: Holds 88 BTC

K Wave Media, a South Korean entertainment company, made its first Bitcoin purchase in July 2025, but its stock price has been declining since then. The company has raised $1 billion for Bitcoin acquisitions, but its stock price remains under pressure.

Global Star Acquisition and K Enter Holdings completed a special purpose acquisition company (SPAC) merger on May 13, forming K Wave Media. However, since K Wave Media's first Bitcoin purchase on July 10, its stock price has continued to decline, closing at $1.85 on August 28, slightly below the recent high of $1.92 set on July 3 (the day before it submitted its Bitcoin financial report).

How long can Michael Saylor's Bitcoin investment strategy remain effective?

Michael Saylor, co-founder and chairman of Strategy, has stirred waves in the financial world with his Bitcoin investment strategy. The method by which Strategy purchases Bitcoin is not complicated: it issues stock or stock-linked securities to raise funds to buy Bitcoin, then holds that asset on its balance sheet. Typically, issuing more stock leads to stock price depreciation, but large-scale Bitcoin purchases can drive up BTC prices, thereby increasing Strategy's company valuation and allowing it to issue more debt.

The cycle continues…

This strategy has been very successful for Strategy, attracting numerous imitators. However, in recent weeks, the Bitcoin financial model advocated by Michael Saylor has been gradually losing momentum. Once the price of BTC drops too close to the per-share Bitcoin price metric or net asset value (NAV) of a company, that stock loses the valuation buffer that could have boosted its price, leading to the so-called "death spiral," where the company's market value shrinks, and its financing channels diminish. No one buys the company's equity, and no lenders are available, preventing the company from expanding its holdings or refinancing existing debt. Once loans mature or margin calls arrive, forced liquidations occur.

On the other hand, whales are collectively fleeing BTC for ETH (reference reading: “Whales are collectively fleeing BTC for ETH, is a new king being born?”), analysis suggests that the long-term holding logic of Bitcoin is being re-evaluated, while the asset allocation value of Ethereum is being repriced. The strategic layout of treasury companies is an important driver of Ethereum's rise, and recently, SharpLink and Bitmine have sparked a "strategic arms race" for Ethereum, while as a pioneer in Bitcoin treasuries, Strategy's purchasing scale has significantly shrunk in the past two weeks, dropping from thousands of BTC to just hundreds.

Currently, the market situation may be relatively stable, and the White House's policies continue to firmly support cryptocurrency, but the winter of cryptocurrency will eventually come. When that happens, what will be the fate of Bitcoin treasury companies?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。