Written by: 0xTodd

Good Outcome 1 - Cashing Out

When the price of crypto assets is significantly higher than their acquisition cost, they cash out under shareholder/tax requirements, even though the transfer address may slightly affect unrealized gains.

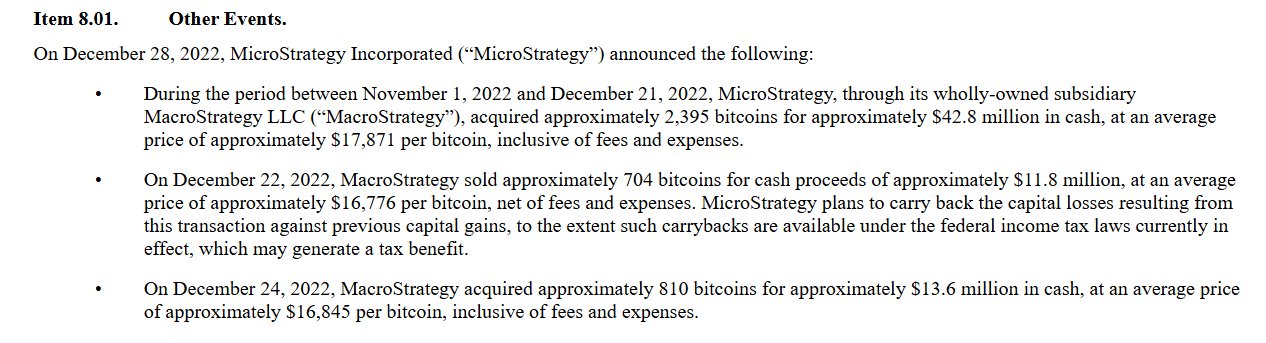

MicroStrategy has previously transferred some coins to "optimize taxes," which did not result in a settlement or a market crash.

However, for their scale of funds—it's irrelevant. Buying at an average cost of 3000 and selling at 6000, large funds are already quite satisfied.

Good Outcome 2 - Changing Affections

If they have made enough money, human nature is to replicate their successful path. Those who started with Ethereum DAT may attempt to venture into other altcoins in the future, at which point they might switch vehicles.

Ordinary Outcome 1 - Hedging and Selling

If they believe that holding assets is nearing its peak, they will stop buying and even prepare to sell.

Even if their on-chain addresses are transparent, it does not prevent them from discreetly hedging through contracts and options, thus retaining a bit of their victory.

Ordinary Outcome 2 - No One Cares

If the mNAV remains below 1 for a long time, the company may think that continuing to issue stocks is a loss, so they might sell some coins to appropriately pull back the mNAV.

In my experience, among all anchors in the world, only the "two-way hard currency anchor" is effective; relying solely on "psychological anchors" cannot stabilize without a project.

Bad Outcome 1 - Financial Pressure

For example, in 2022, Tesla had to sell 3/4 of its Bitcoin holdings due to financial pressure. These institutions may face similar financial pressures at some point in the future.

Bad Outcome 2 - Stop Loss

If the reverse position goes wrong, with the acquisition cost significantly higher than the current price, the entire game cannot continue, and one day they can only stop loss and attempt to recover through a lower bottom.

Of course, these are just long-term speculative conclusions and do not represent my current bearish view or negative opinion on DAT. As long as the drumbeat continues, we should keep playing music and dancing.

As for when the drumbeat will stop? That will be shared in the next post, focusing mainly on three key indicators: acquisition cost, changes in CEO/CFO/board personnel, and mNAV remaining below 1 for a long time.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。