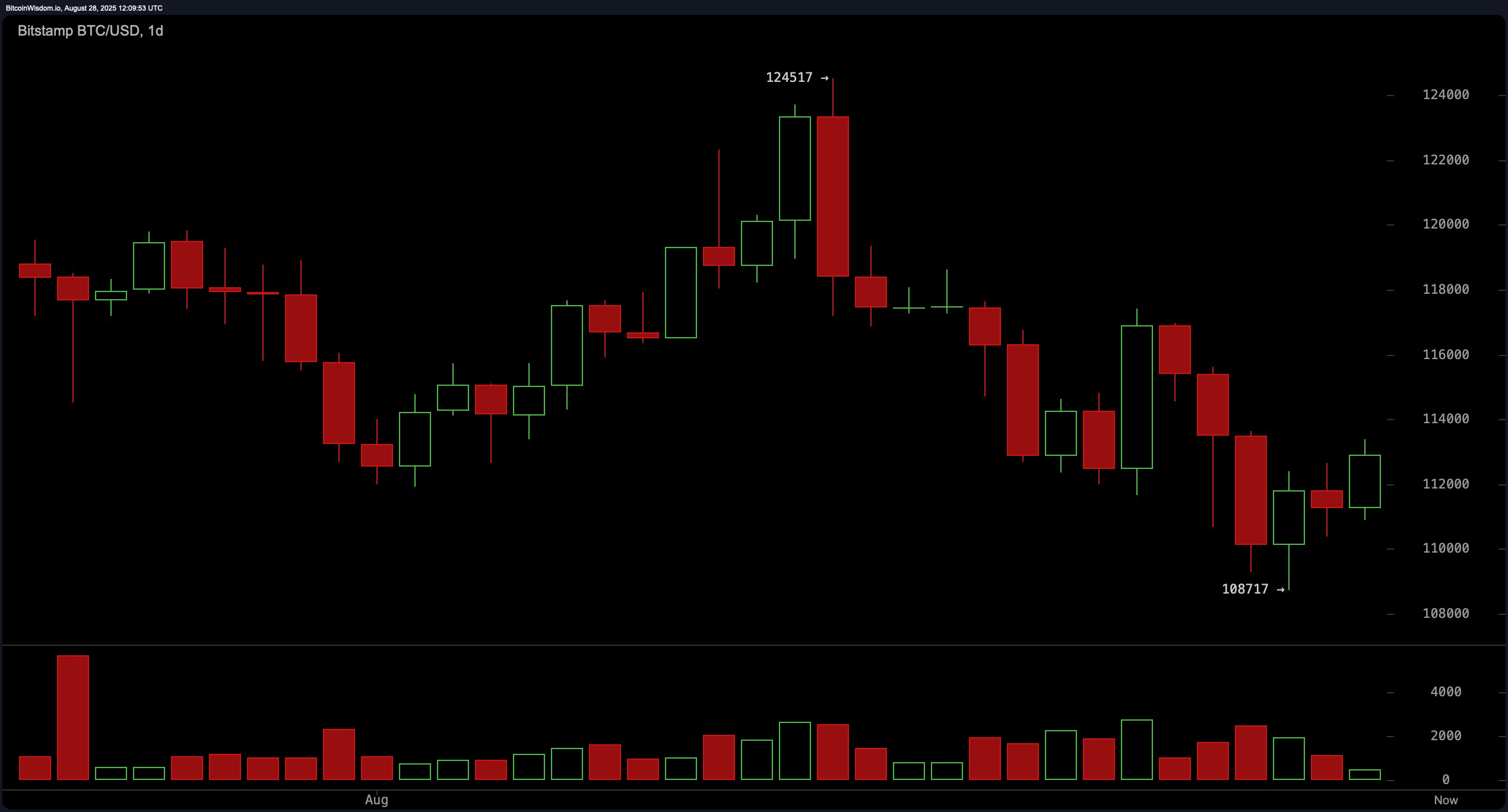

Bitcoin’s daily chart reveals a market in short-term consolidation following a downward break from a descending triangle pattern. Price structure indicates a lower high at $124,517 and a lower low at $108,717, placing current price levels near $113,000. A potential rebound is forming with volume increasing at recent lows, suggesting possible accumulation. Immediate support lies at $108,500, while resistance is seen at $117,500 and $124,500. A break above the $117,500 mark on strong volume could serve as a confirmation for bullish continuation, whereas a breach below $108,000 would likely negate this setup.

BTC/USD 1-day chart via Bitstamp on Aug. 28, 2025.

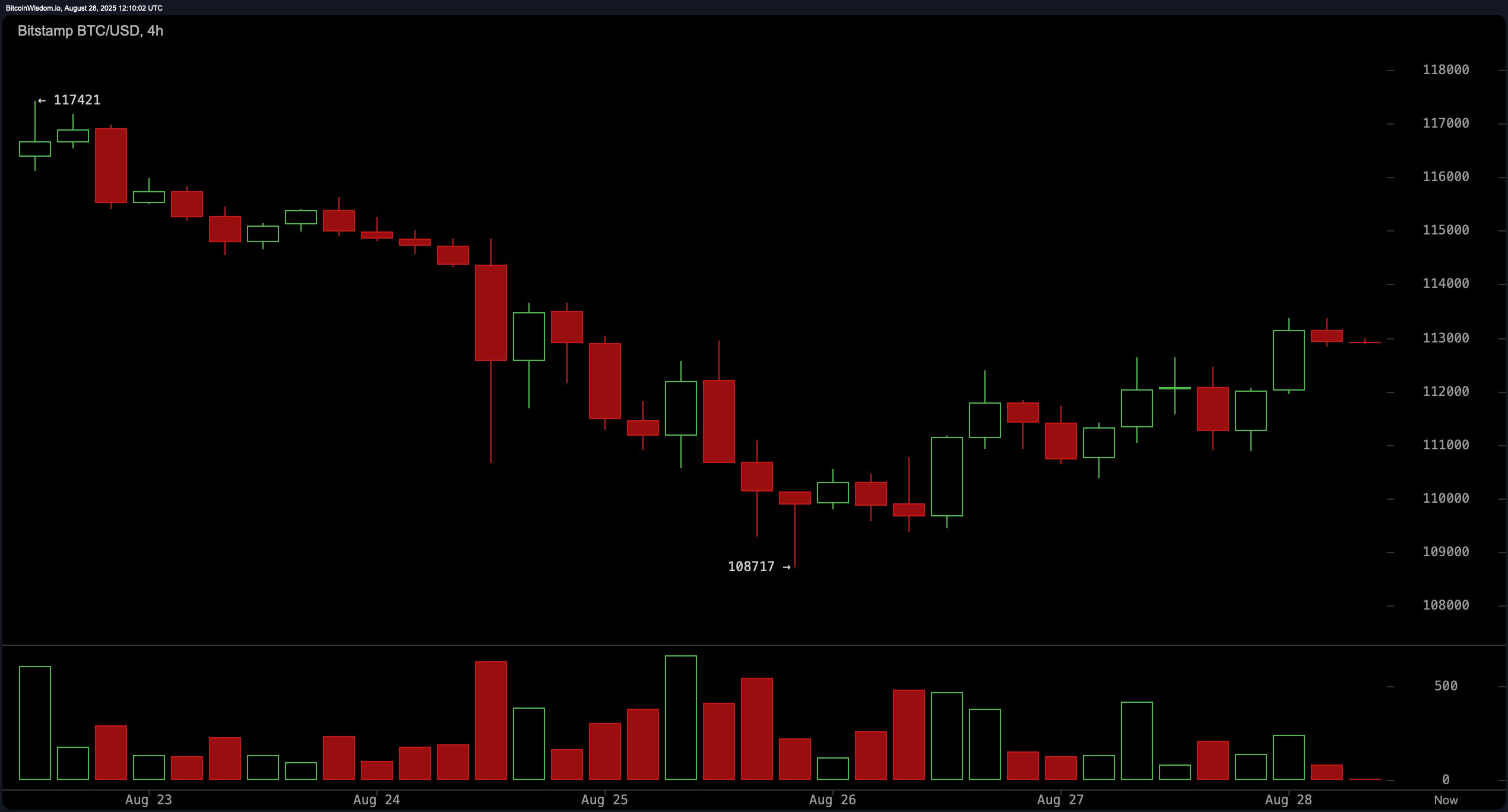

The 4-hour bitcoin chart illustrates a notable shift in trend from bearish to bullish, characterized by a higher high and higher low following a drop to $108,700. Momentum indicators show a subtle reversal pattern, supported by increased green volume bars. Bitcoin is currently trading near the $113,000–$113,500 range, a key resistance zone. A sustained breakout above this range with volume confirmation would reinforce upward momentum. Conversely, a failed attempt here combined with increased selling pressure could push prices back toward the $110,000 level, warranting cautious trade management.

BTC/USD 4-hour chart via Bitstamp on Aug. 28, 2025.

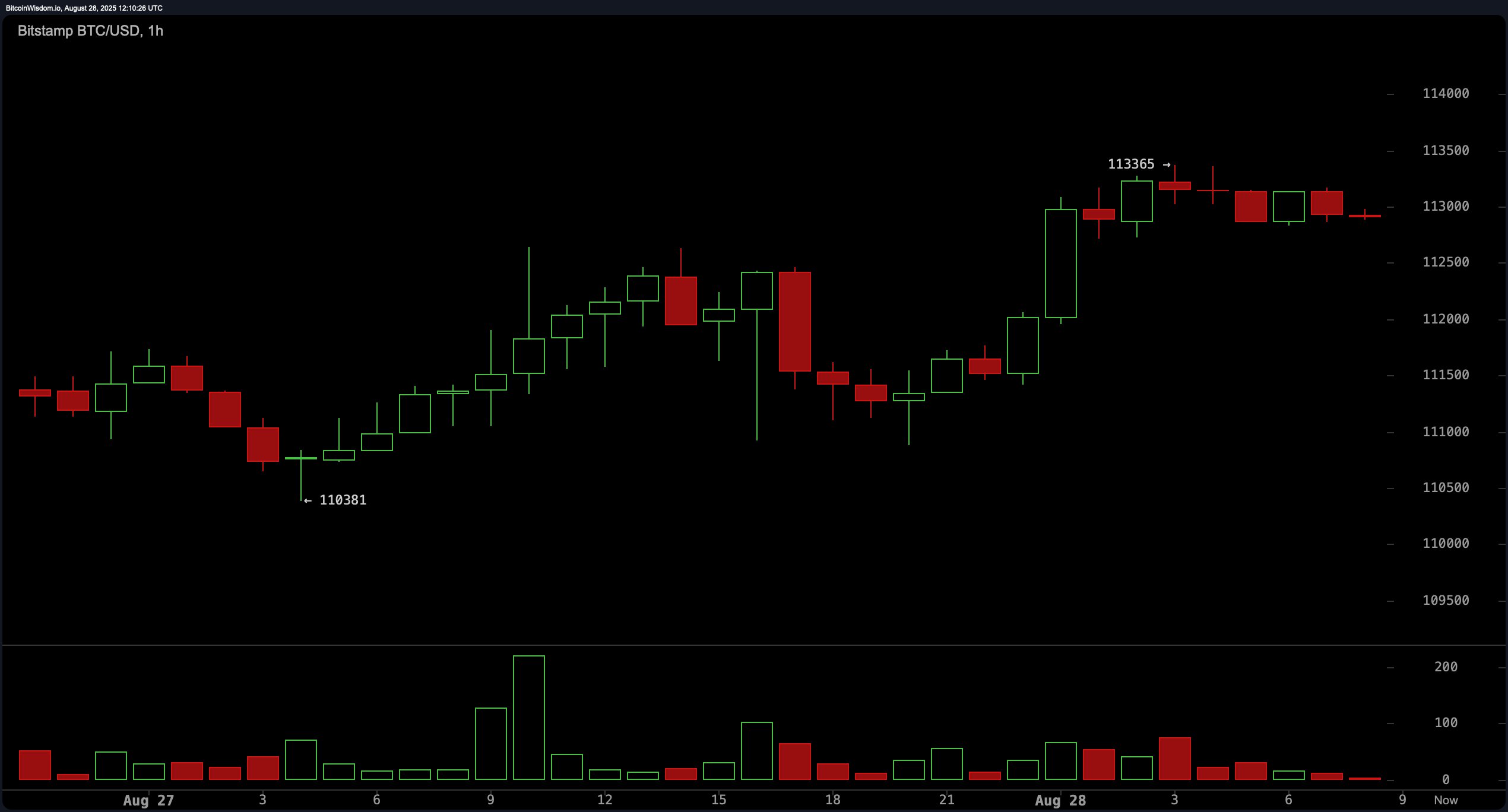

On the 1-hour chart, bitcoin is in a clear intraday uptrend, progressing from a base near $110,381 up to a recent high of $113,365. The price action is coiling within a flag-like pattern, typically indicative of a pending breakout or breakdown. Declining volume alongside this consolidation suggests trader indecision, awaiting a catalyst. An upside move above $113,500 could invite quick long entries targeting the $114,000–$114,500 region. However, if price slips below $111,500, stop-loss triggers should be considered for intraday trades.

BTC/USD 1-hour chart via Bitstamp on Aug. 28, 2025.

Oscillator readings across multiple indicators are largely neutral. The relative strength index (RSI) stands at 46, Stochastic oscillator at 25, and the commodity channel index (CCI) at -84, all suggesting indecision without extreme overbought or oversold signals. The average directional index (ADX) at 17 implies a weak trend. Notably, the momentum oscillator highlights a bullish signal at -3,349, while the moving average convergence divergence (MACD) level at -1,183 suggests a bearish trend. This divergence reflects the broader uncertainty within the market’s current phase.

Moving averages (MAs) portray a split landscape across timeframes. Shorter-term averages, including the exponential moving average (EMA) and simple moving average (SMA) for 10, 20, and 30 periods, all reflect bearish conditions with sell signals. However, longer-term EMAs and SMAs at the 100 and 200 intervals are bullish, indicating underlying strength. The EMA (100) at $110,905 and SMA (100) at $111,726 suggest the price is well supported at lower levels, while the EMA (200) at $103,939 and SMA (200) at $101,094 underline the broader bullish trend that remains intact despite recent volatility.

Bull Verdict:

If bitcoin decisively breaks above the $113,500 resistance level on strong volume and sustains this move, bullish momentum may accelerate toward the $117,500 and $124,500 resistance zones. The presence of higher lows, a recovering 4-hour trend, and longer-term moving average support all bolster the case for continued upward movement in the short to medium term.

Bear Verdict:

Should bitcoin fail to overcome the $113,500 resistance and instead drop below the $111,500–$110,000 support band, bearish pressure could resume. The presence of multiple short-term moving average sell signals and the lack of strong oscillator conviction warn that a downside continuation toward the $108,000 level remains a credible risk.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。