Price outlook

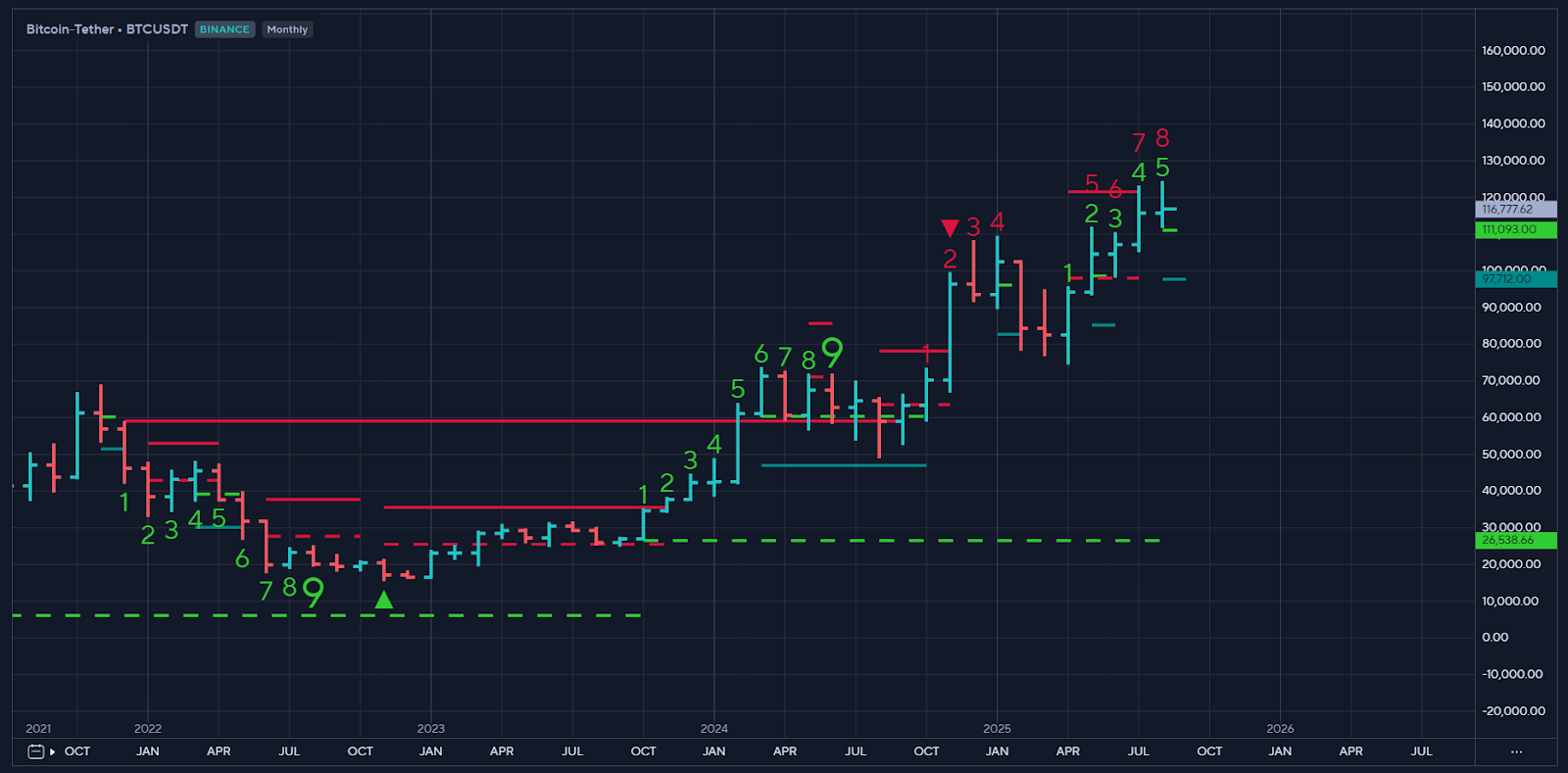

Our analysis for the remainder of 2025 forecasts bitcoin reaching a target of $150,000 to $160,000 driven by a Fed policy pivot and rate drop expectations in the United States, beneficial liquidity conditions and the increasingly positive crypto regulatory environment.

The latest announcement from the Trump administration allowing cryptos into 401(k)s adds an extra layer to the crypto adoption narrative, and a clear pathway to expanding the existing crypto market cap via the estimated 9 trillion USD retirement market in the United States.

Webinar alert: On September 9 at 11:00am ET join Michelle Noyes from AIMA and Andy Baehr from CoinDesk Indices as they discuss building a sustainable business in the cyclical markets of crypto. Register today. https://aima-org.zoom.us/webinar/register/4917558078322/WN_3jAGIrqMTK2z7e74q5bkWg#/registration

Event alert: CoinDesk: Policy & Regulation in Washington D.C. on September 10th. The agenda includes senior officials from the SEC, Treasury, House, Senate and OCC, plus private roundtables and unparalleled networking opportunities. Use code COINDESK15 to save 15% on your registration. http://go.coindesk.com/4oV08AA.

Ongoing crypto catalysts

- Liquidity conditions: Ongoing liquidity injections from the PBOC and the overall expansion of Global M2.

- Corporates & funds: Institutions are putting their balance sheets to work in bitcoin like never before. Additionally, the number of bitcoin and ether funds continues to rapidly grow.

- ISM survey is expected to rise above 50.0. When the ISM survey goes into positive territory it has previously correlated with the start of “alt season.”

Quantitative models and risks

Our quantitative models remain positive and show significant scope for further upside in bitcoin and the broader market:

- Our Vanguard model, which is a trend detection system, continues to generate long conviction weekly signals.

- Weekly price closes above $119,000 will keep the bullish sentiment alive and cement the technical backdrop for further upside into uncharted waters for bitcoin.

Source: Biyond.co, August 2025

Risks

- An acceleration of negative data points in the United States, leading to stagflation fears and risk-off over fears of a global slowdown.

- A significant pullback in the S&P 500 in Q3, possibly from the 6,660 level, which remains a primary target.

- Negative tariff headlines, and more specifically, a breakdown in Sino-U.S. trade talks.

- Extensive profit taking from ETF holders if bitcoin crosses $150,000 or even $160,000

Insights from Demark indicator

Demark TD sequential monthly chart is pointing to a possible top at the end of the year with the index moving towards setup 9 and countdown 13. When the Demark indicator has approached 9 or 13 previously, it has signalled strong overbought exhaustion.

Source: Symbolik Demark TD Sequential

Crypto total market cap

The potential breakout of the crypto total market capitalization chart presents another dynamic to the ongoing and previously mentioned bullish catalyst for the crypto market. Namely:

- An initial Q3 target of five trillion USD.

- A broad-based crypto market rally encompassing the top 150 cryptos.

- Limited scope for downside under 4 trillion USD once a definitive chart breakout occurs.

Conclusion

Bitcoin and the cryptocurrency market are well-placed to explode to new trading highs, with projections expected to reach between $150,000-160,000, and a five trillion USD market capitalization.

Key upcoming risk events include higher CPI readings in the coming months and a halt in trade negotiations between the United States and China, although we feel it is far more likely a “kicking of the can” down the road and an extension of ongoing trade talks to appease markets.

Based on all the positive developments surrounding bitcoin and technical indicators, a strong case can be made for further strong price appreciation running into year-end.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。