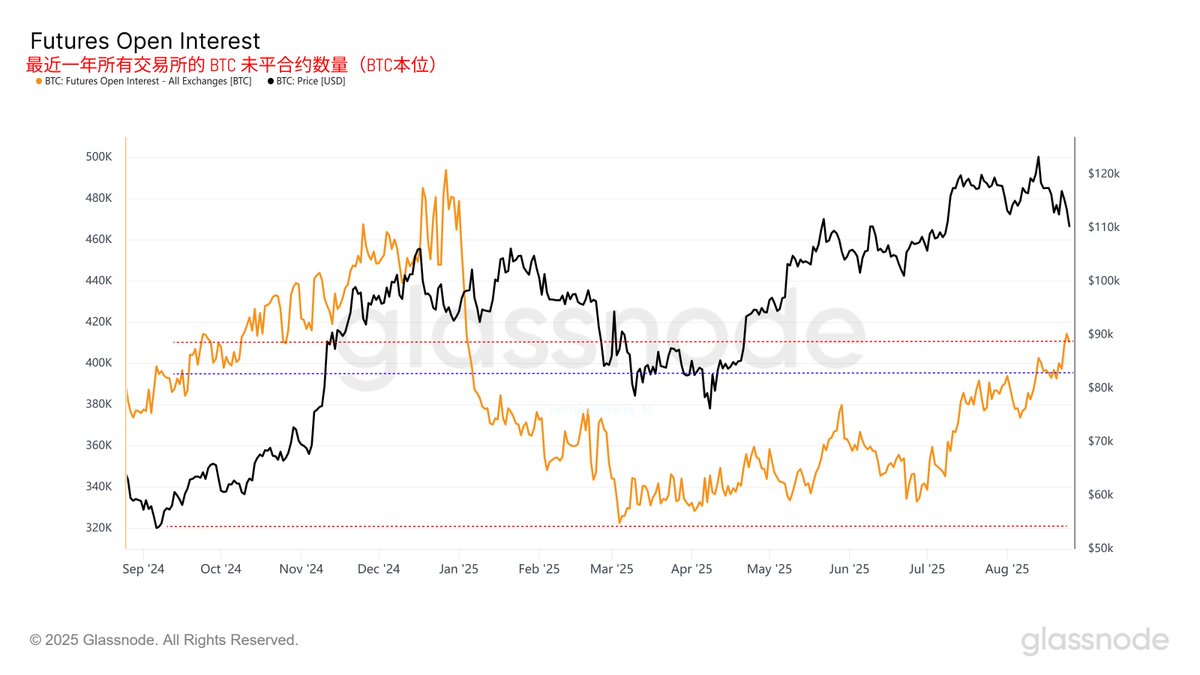

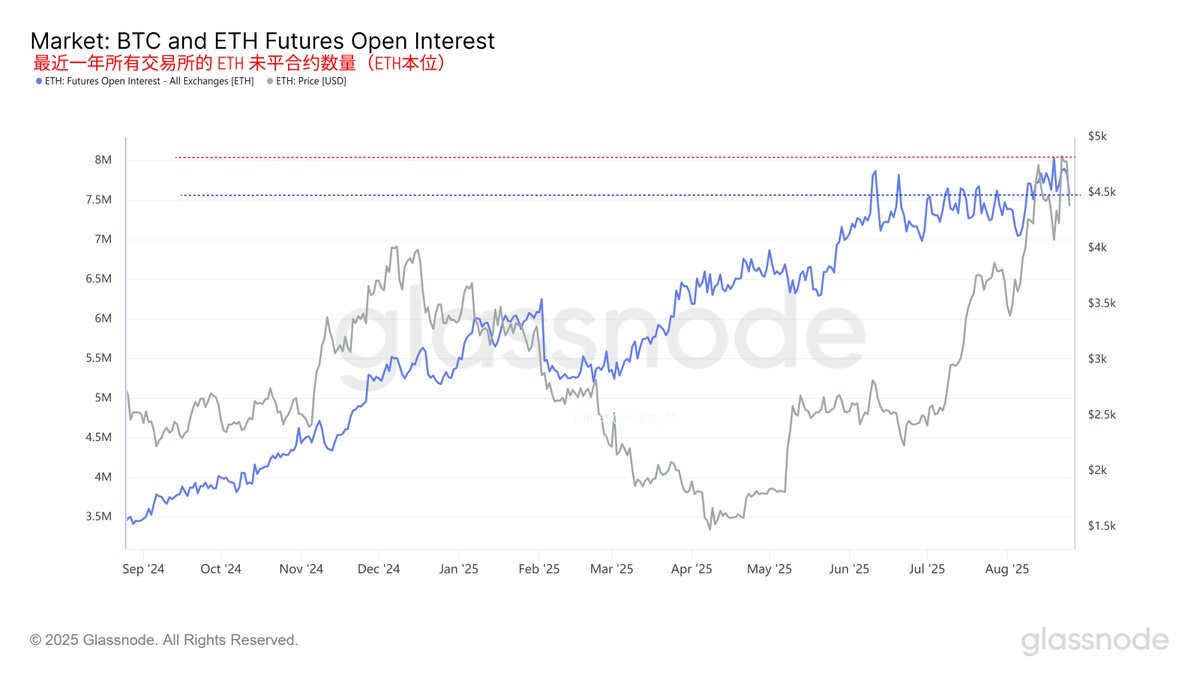

Last week, we also discussed that the open contracts for $BTC and $ETH were at a relatively high position.

A week later, although BTC's price has decreased this week, the open contract volume has not only remained stable but has actually increased. From the data, the blue line represents last week's data, and compared to last week, the open contracts continue to rise, indicating that investors' speculative sentiment is still growing.

The increase in contracts indicates that investors are amplifying their leveraged bets, which may lead to increased volatility. As we mentioned last week, the more leveraged funds there are, the more likely it is for prices to experience dramatic surges and drops.

In contrast, ETH has indeed cleared some leverage during this decline. Although the clearing was not significant, there is a noticeable trend of decreasing open contracts. Of course, the current open contracts for ETH are not far from the highs of the past year.

Moreover, ETH may have a larger on-chain leverage compared to BTC. Once liquidation occurs, the cascading effects could be greater than those for BTC. Therefore, during recent declines, ETH has experienced larger drops, but due to relatively strong buying power, the price rebounds tend to be quicker.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。