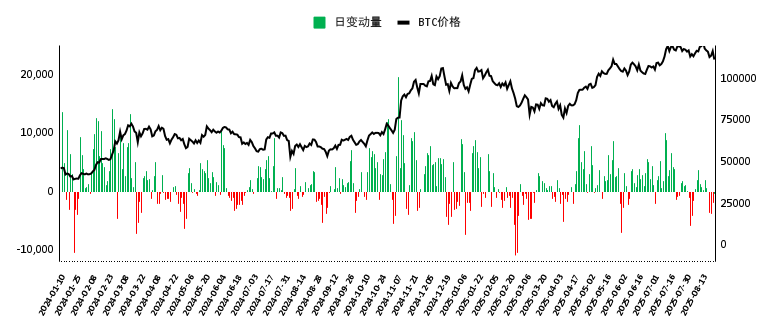

Even from the trading volume of BTC, it can be seen that the trading volume has been very sluggish in the last four months since April, especially in the past week. Even though there has been a drop in the price of $BTC, there are no significant signs of an increase in trading volume, indicating that there has been neither substantial buying nor substantial selling.

Compared to the trading volume changes caused by larger price fluctuations in the previous four months, it can be roughly inferred that the number of investors participating in BTC trading has been decreasing in recent months, meaning that both buyers and sellers are reducing. Therefore, once negative information leads to a slight increase in selling and a slight decrease in buying, the price of BTC will be challenged.

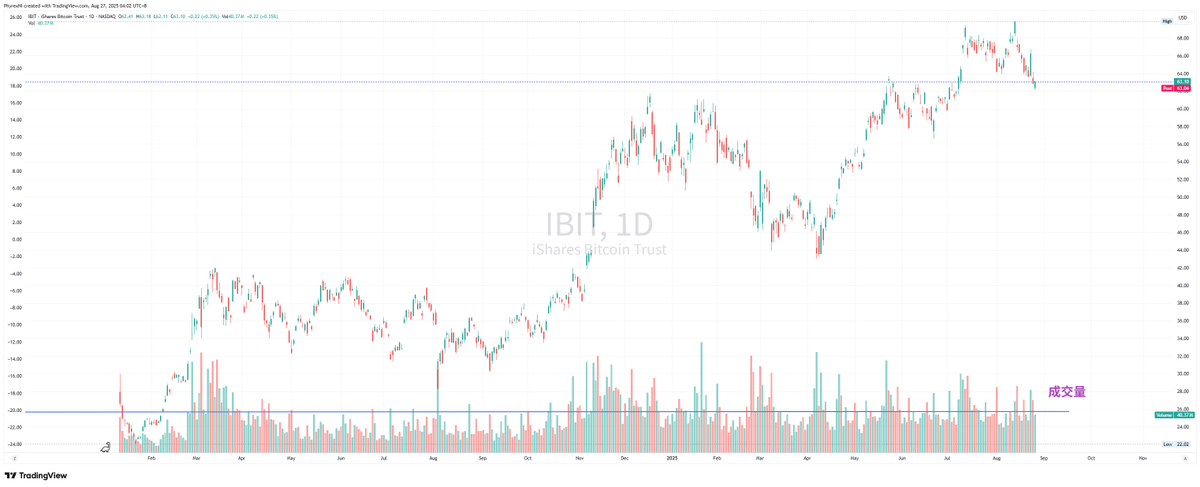

This is not only the case in the spot market but also in the ETF market. It is evident that the trading volume of the main ETF $IBIT, although better than the spot market, is still very limited, and the overall trading volume is gradually declining.

The primary market for ETFs is even more concerning, as there has been a net outflow for all five working days in the past week, which represents a lack of enthusiasm from traditional investors towards current BTC investments. Of course, due to policy support, the sentiment for selling BTC is indeed not high.

The main reason for this phenomenon is likely the lack of an independent narrative for BTC. Currently, BTC resembles a tech stock in the U.S. When the overall tech sector is rising, BTC's performance is not too bad.

However, since it is not the narrative of BTC itself, it will be difficult to break through the limitations of tech stocks or macro factors, unless information similar to the U.S. strategic reserves emerges to stimulate investors' buying sentiment and enhance purchasing power. Otherwise, BTC is likely to re-enter a "garbage time."

"Garbage time" has occurred in both 2023 and 2024, each lasting for about eight months of consolidation, during which there is approximately a 20% fluctuation, but the trading volume is very low. It is only when new positive or negative stimuli arise that the price can break out of the consolidation range.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。