Altcoin Supercycle Begins as BTC Dominance Falls

The altcoin market cap, excluding Bitcoin , surpassed a critical resistance level of $1.4 trillion in August 2025. This breakout is after a recurring double bottom trend on the monthly chart, which is similar to the 2018–2021 cycle.

In the last cycle, the same kind of structure led to a run-up in price of $140 billion to $1.7 trillion, a 12X increase in value. The market capitalization is currently at the value of $1.55 trillion and keeps growing, which indicates a new wave of capital inflow into other coins apart from Bitcoin.

Market Cap : Source : X

In addition to the bullish formation, the MACD indicator has also given a bullish signal as the indicator is showing a positive crossover and green histogram bars. The same indicator was present before the 2020 bull run, resulting in a long-lasting rally in the crypto space .

Should history repeat itself, a 15-fold increase would bring the altcoin market cap to nearly $21 trillion. Although speculative, the contemporary pattern is similar to that of the prior supercycle in terms of structure and momentum indicators.

Bitcoin dominance Breaks Support

Bitcoin dominance continued to fall below its long-term ascending trendline and has lost support on the horizontal plane at the 60% mark. The trendline break and loss of support indicate a significant change in the structure towards altcoins.

BTC Dominance | Source : X

Dominance has also fallen to 58.16%, which adds further to the idea that capital is moving to altcoins and out of the Bitcoin market share. The decline follows a steady increase in BTC.D since the beginning of 2023, when it stood at 38% and reached a high of 66% in mid-2025.

Technical indicators support the bearish trend because a dotted trend-following line has crossed above the weekly candles. This crossover indicates bearish momentum, and it implies that Bitcoin may continue losing dominance to the rest of the market.

The declining BTC.D is consistent with the breakout in market cap and can be used to further support the theory of an evolving altcoin cycle. The projections indicate that the dominance might drop to the mid-50% range in case the trend continues.

Altcoin Season Index Climbs

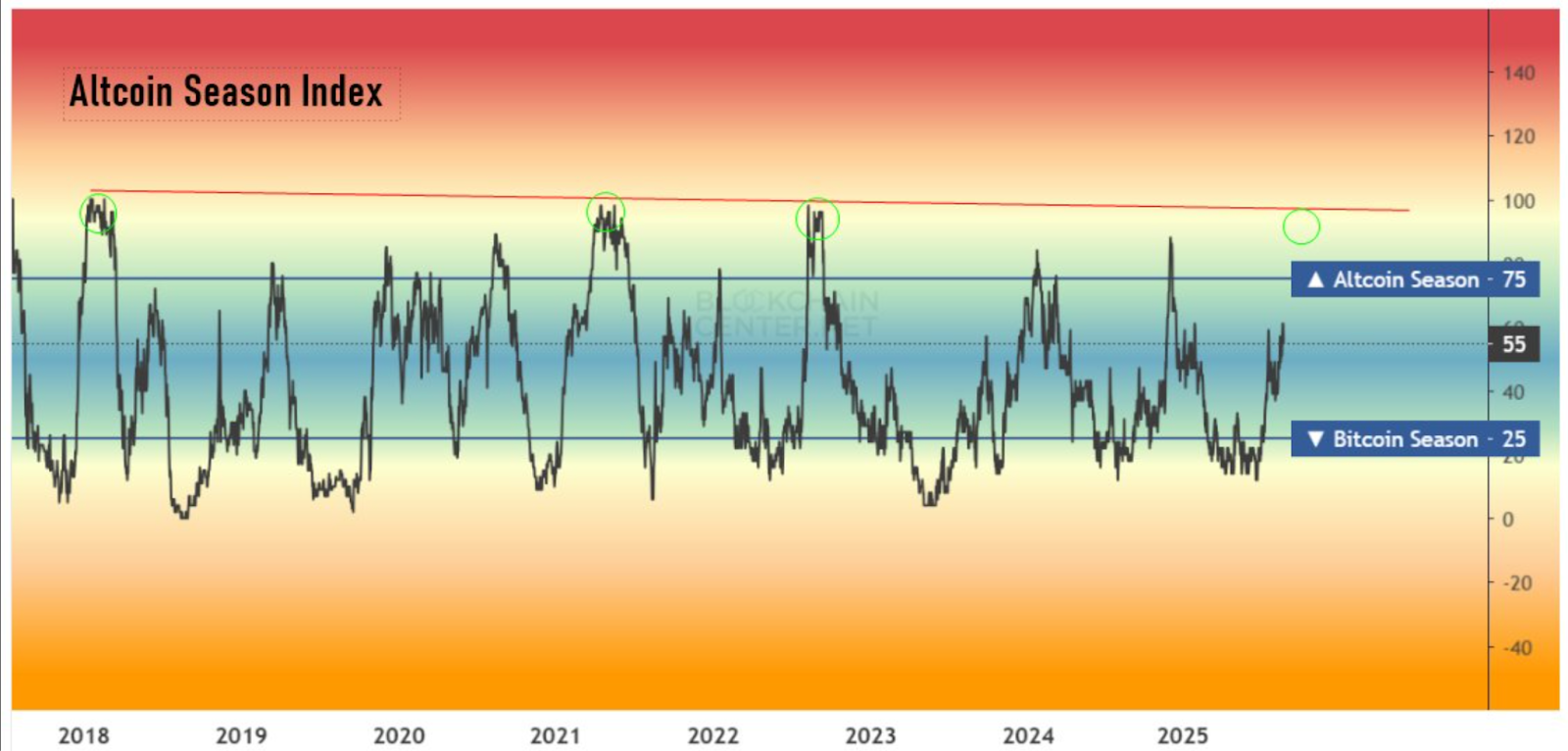

The Altcoin Season Index has climbed to 55, showing a rising but neutral trend in altcoin outperformance versus Bitcoin. Values above 75 typically signal a confirmed altcoin season, which is not yet in effect.

Altseason Index | Source : X

Previous peaks near 75–100 coincided with strong altcoin cycles in 2018, 2021, and early 2023. While current levels show potential, the index must break the 75 level for an official confirmation.

At the same time, Bitcoin dominance continues to slide and now stands at 57.40%, down 0.47% over recent sessions. This adds further support to the emerging trend, aligning with broader capital shifts in crypto markets.

Meanwhile, derivatives data shows Open Interest has fallen by 4.46%, now totaling $204.61 billion. This decline indicates reduced leverage, suggesting traders are either cautious or waiting for directional confirmation.

Total liquidations have dropped 10.91% to $777.45 million, reflecting lower market volatility after recent swings. Sentiment remains neutral, with the Fear & Greed Index at 47 and the RSI at 43.97.

In addition, exchange balances have risen, with 16 more BTC moved onto platforms, pushing total holdings to 2.25 million BTC. This may indicate potential selling pressure, depending on how demand responds in the coming sessions.

Macro factors are also at play, as Gold Futures rose 0.64% to $3,387, signaling renewed interest in traditional safe-haven assets. Simultaneously, the U.S. Dollar Index dropped 0.30% to $98.027, improving the outlook for risk assets like crypto.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。