撰文:邓通,金色财经

日本金融巨头SBI最近在加密货币领域动作频频。8月,Ripple 与 CB Insights 和英国区块链技术中心合作发布最新报告指出,花旗集团、摩根大通、高盛和日本 SBI 集团已成为支持区块链初创企业的传统金融领域最活跃的参与者。近日,SBI与Chainlink、Ripple、Startale等达成合作,助力全球范围内机构对数字资产的应用。

SBI 在加密领域有哪些布局?SBI为何从传统金融转型至传统金融+加密金融?日本的加密赛道现状如何?

一、SBI 的加密布局

1.跻身稳定币热潮

2025年8月21日,Ripple 宣布与日本SBI集团合作。Ripple 的公告提到了与 Ripple Labs 达成的关于在日本分销 RLUSD 的新谅解备忘录,SBI VC Trade(SBI VC Trade已于 3 月完成注册,以支持 USDC 运营)的目标是在截至 2026 年 3 月的财年内推出该稳定币。SBI 指出:「成立该合资企业的目的是促进 USDC 在日本的使用,并在 Web3 和数字金融领域创造新的用例。」SBI VC Trade 首席执行官近藤智彦表示:「RLUSD 的推出不仅扩大了日本市场稳定币的选择范围,也是日本市场稳定币可靠性和便利性向前迈出的重要一步。」

2.打造交易平台

2025年8月21日,SBI Holdings宣布与加密基础设施公司Startale Group达成战略合作,将共同推出一个链上代币化股票交易平台。 该平台将结合SBI的金融生态系统和Startale的区块链基础设施,支持24小时不间断交易代币化股票,提供更快的跨境结算和零碎股权所有权功能。其他功能包括高级账户抽象、机构托管以及国际法规的实时合规监控。Startale Group 创始人 Sota Watanabe 表示:「我们相信,代币化股票革命是最大的机遇,而链上交易是下一个前沿领域。虽然传统市场 70% 的时间处于关闭状态,但我们的平台将支持代币化股票的持续、可编程交易,包括美国和日本的本土股票。」

2018 年 7 月 17 日,SBI Holdings 正式公开推出其加密货币交易所 SBI VC Trade。2019 年 7 月 31 日,SBI VC Trade 推出了虚拟货币现货交易服务 VCTrade Pro。2025 年 3 月 4 日,SBI VC Trade 宣布已完成日本稳定币交易的首次注册。获得批准后,它于 3 月 12 日开始处理 USDC 交易。该公司将能够向个人和法人客户提供 USDC 的买卖和出入金服务,并需要保全与客户存入的 USDC 等额以上的美元抵押品,SBI 集团的新生信托银行将承担信托保全的角色。

3.收购 Web3 媒体

2025年8月22日,SBI控股宣布与CoinPost部分现有股东签署股份转让协议,CoinPost 经营 Web3 相关媒体和活动业务。通过此次交易,SBI 控股将收购 CoinPost 的多数股权,使其成为 SBI 控股的合并子公司,合并预计将于 2025 年 10 月 1 日完成,但需完成所有必要的股份转让手续。

SBI 控股董事长兼首席执行官北尾吉孝表示:「随着 CoinPost 加入 SBI 集团,我们将进一步加强 CoinPost 在加密货币和 Web3 领域构建的可靠信息基础设施。在确保媒体公正中立的同时,我们将与集团旗下公司携手合作,加速 Web3 的社会化落地,为构建新的金融和数字产业基础做出贡献,从而促进日本的加密产业发展。」

4.创建加密工具

2025年8月25日,SBI 集团与区块链预言机平台 Chainlink 合作。SBI 与 Chainlink将研究允许跨区块链标记现实世界资产的工具,例如链上债券,并使用 Chainlink 的技术为稳定币储备提供链上验证等。

SBI 指出:与Chainlink的交易将使该公司将其区块链互操作性协议用于一系列用例,包括标记 RWA 并帮助促进外汇和跨境交易。Chainlink 联合创始人谢尔盖·纳扎罗夫 (Sergey Nazarov) 表示:「我很高兴看到我们的出色工作正在向大规模生产使用状态迈进。」

2024年3月29日,SBI Holdings、SBI Real Estate Finance和 Sumitomo Real Estate Sales合作开发了基于区块链的房地产交易文档和数据共享解决方案SREC。SREC可用于共享有关销售交易过程进度的文档和数据,使其更加透明。

5.申请 ETF

2025年7月31日,SBI 提议推出两只新的交易所交易基金 ,涵盖XRP、BTC和黄金。SBI的加密资产ETF将提供对XRP和BTC的直接投资。如果获得批准,它将成为推动日本机构采用XRP的关键催化剂。通过将加密货币的增长潜力与黄金的稳定性相结合,SBI 提供了新颖的风险调整投资工具。这一策略迎合了更广泛的投资者群体,也使 SBI 成为传统金融与区块链创新交汇点的开拓者。市场分析师认为,SBI的举措可能会促使其他金融机构推出类似产品。

6.拓展全球市场

2024年11月5日,日本SBI Digital Markets加强了其在新加坡金融管理局(MAS)「守护者项目」(Project Guardian)中的作用,推出了新的试点项目,旨在推动代币化证券在全球市场中的应用。 这家日本 SBI 集团子公司与金融机构合作,正在为代币化资产开发一个跨境框架,将多个地区受监管的数字资产交易所连接起来,以提高流动性和降低成本。该公司周一宣布,通过其固定收益试点项目,SBIDM 正在为代币化资产支持证券创建一个国际网络,涵盖初始发行和二级交易。

7.进军链游赛道

2024年8月29日,链游平台Oasys宣布与日本金融集团SBI Holdings建立战略合作伙伴关系,并获得资金支持。与SBI Holding的合作将推动Oasys达到新的高度,提高 OAS 代币的流动性,并加强生态系统发展。此前,Oasys 已与 SBI 集团开展了多项合作,包括于 2023 年 5 月在 SBI VC Trade 上线 OAS 代币,以及与 SBINFT Market 进行整合。

SBI 控股株式会社代表董事、董事长、总裁兼首席执行官北尾吉孝表示:「Oasys 是一个极具前景的日本区块链项目,它专为游戏应用而设计。自成立以来,它已吸纳多家全球知名的大型游戏开发公司作为初始验证者。我们集团从早期就积极投资区块链和加密货币领域,始于 2016 年对瑞波币 (Ripple) 的投资,以及 2017 年对 R3 的投资,并已构建一个能够提供广泛产品和服务的生态系统。通过与 Oasys 的合作,我们致力于进一步拓展区块链技术的用例。」

二、SBI 为何从传统金融转向传统+加密金融?

1.日本监管政策逐渐明朗

2016 年,日本修订《支付服务法》:首次将虚拟货币纳入监管范畴,建立交易所强制注册制度,要求交易平台实施客户资产隔离、年度外部审计及反洗钱(AML)措施。这一修订为后续监管奠定了法律基础,使日本成为全球首个为加密货币交易所颁发牌照的国家。2017 年修订的《资金结算法》,首次将虚拟货币纳入合法支付工具范畴,并建立交易所牌照制度。这一政策突破直接促成 SBI 在同年成立加密交易所 SBI VC Trade 并获得牌照。

2020 年修订《金融工具与交易法》,明确证券型代币(STO)的法律地位,允许其通过区块链技术发行与交易,SBI 集团成为首个获批开展 STO 业务的金融机构。

2025年6月24日,日本金融厅发布文件,宣布将认真考虑将加密资产监管从《支付服务法》转移至《金融工具与交易法》框架下。

总之,日本的加密监管框架处于全球领先水平,愈发完善的监管体系助力 SBI 向加密金融转型。

2.区块链重构金融基础设施势不可挡

区块链技术重构金融基础设施的趋势是促成 SBI 转型的核心动力。SBI 通过合资公司 SBI Ripple Asia,将 XRP 作为跨境结算的桥梁货币,使日本至菲律宾的汇款成本降低 30%,结算时间从 3 天缩短至 3 秒。SBI 与新加坡 Startale合作开发区块链股票数字化平台,计划 2026 年底前将日本股票转化为 ERC-20 标准代币。代币化股票可实现T+0 实时结算,交易成本降低 70%,并支持碎片化持有(如 0.0001 股)。

区块链通过技术重构实现了金融效率的跃迁。SBI 作为传统金融巨头,顺应了科技发展潮流,在金融基础设施重构浪潮中主动拥抱区块链技术,与诸如贝莱德等传统金融巨头一同在加密赛道中成为了传统金融企业转型的先行者。

3.抢占加密行业话语权

截至 2025 年 8 月,日本加密货币交易账户数突破1200 万,占总人口的9.5%,这一数据较 2024 年增长了 50%。抢占愈发庞大的加密产业话语权对于 SBI 而言具有重要意义。SBI 集团曾在过去几年深度参与了日本加密货币与数字资产监管政策的制定与实施,影响力可见一斑。

SBI 主导成立的日本 STO 协会于 2020 年获得金融厅(FSA)正式认证,成为稳定币与证券代币领域唯一的自治监管机构;SBI 在 2020 年完成日本首个证券代币发行(STO),将子公司 SBI e-Sports 的股票代币化,这直接促使 FSA 在 2021 年修订《金融工具与交易法》;SBI 作为日本数字证券发行协会的领导人,推动建立了全球首个数字证券自律框架(SRO),相关技术方案被写入 2023 年《数字证券基础设施法案》;2024 年新加坡金管局(MAS)的 Project Guardian 中,SBI 主导构建的跨境代币化证券分销框架,推动日本、新加坡、瑞士三地交易所达成监管互认,相关协议被纳入 FSA《数字资产跨境交易指导方针》。

三、日本的加密产业现状如何?

日本长期以来一直被公认为加密货币应用和监管领域的先驱。以下是日本加密货币监管的重大时间节点:

2016 年 5 月:为应对Mt.Gox事件,日本金融厅根据《支付服务法》(PSA)建立了加密资产服务提供商的监管制度。

2017 年 4 月:2016年修订的《加密货币法》生效,根据日本法律对加密货币进行定义。交易所必须在日本金融厅注册,遵守反洗钱/了解你的客户 (AML/KYC) 标准,并实施严格的网络安全措施。

2017 年 9 月:日本金融厅批准 11 家交易所,正式标志着日本开启受监管的加密货币交易时代。

2018 年 1 月:加密货币交易所 Coincheck 遭受黑客攻击,导致当时约 5.3 亿美元的 NEM 代币损失,引发更严格的监管。

2018 年 4 月:随着监管收紧,加密货币交易所联合成立了日本虚拟货币交易协会 (JVCEA)。

2018 年 10 月:日本金融服务局授予 JVCEA 自律地位。

2020 年 5月:修订后的《公共服务法》(PSA)和《金融工具交易法》(FIEA)生效,进一步明确了加密货币监管。根据FIEA,加密货币托管服务被引入,从而将托管业务与交易所分离,并增加了投资者保护。

2022 年 6 月:日本议会出台新法规,允许持牌金融机构发行法定支持的稳定币,要求发行人以国内持有的日元储备完全支持稳定币。

2023 年 4 月:日本自民党发布白皮书,概述了Web3 和区块链采用的战略,建议调整税收政策和交易所交易基金 (ETF) 审批框架。

2025 年 6 月 24 日:日本金融服务局(FSA)提议将加密资产重新归类为传统金融产品,并对其实施新的税收制度。新制度预计将于2026年起生效。

2025 年 8 月 18 日:日本稳定币发行商 JPYC 获得日本「资金转账服务提供商」牌照,并称这是日本首次向数字货币发行商颁发此类牌照。

如上所述,日本加密产业在今年的两大主题分别是加密货币税和日元稳定币。

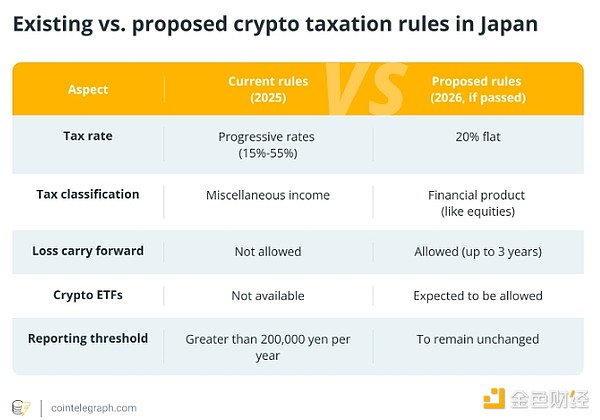

8月25日,日本参议院议员Satsuki Katayama 指出,日本正推动加密货币分类调整,计划将其从 「杂项收入」 归入《金融工具和交易法》监管范畴,以将最高55%的税率降至20%(与美国接轨),目前需与多党协商,力争年底敲定方案。若加密货币税率调整落地,稳定币在日常交易中的应用可能进一步普及。

历史上,日本对加密货币投资者的税收制度一直是最严格的国家之一。在日本现行的税制下,所有加密货币交易的利润都被归类为「杂项收入」。这意味着,与股票或房地产的利润不同,加密货币交易、消费或赚取的收益需要缴纳累进所得税。这些税率通常从低收入者的 5% 到高收入者的 45% 不等。如果算上 10% 的地方居民税,实际税率最高可达 55%,使其成为世界上最高的加密货币税之一。但随着税收新规的通过,日本金融监管机构有望打造全球最有利于投资者的税收结构之一。

以下是加密资产现有税制与拟议税制的比较:

《日经新闻》此前有报道指出,JPYC 预计将于 10 月前推出受监管的日元稳定币。据Swift统计数据,日元是跨境支付领域第四大广泛使用的货币,受监管的日元稳定币未来可能在国际支付中发挥重要作用。

JPYC首席执行官Noritaka Okabe曾在新闻发布会上指出,该稳定币将与日元完全可兑换,由国内储蓄和日本政府债券(JGB)作为支撑。公司计划三年内发行1万亿日元(68.1亿美元)规模的JPYC稳定币。若JPYC被广泛使用,可能会提振日本政府债券需求,「未来JPYC很可能会开始大量购入日本国债」。

四、总结

SBI 在加密领域的全方位布局并非偶然,而是传统金融巨头在面对日益成熟的新兴产业时的必然选择。在传统金融基础设施不断被重构、加密监管框架不断完善的当前,积极拥抱区块链技术、拥抱加密产业才是顺应时代潮流之举。而日本也正迎来加密破局之年,加密税制改革将为全球加密税收框架奠定监管基础、日元稳定币的推出也将推动日本加密资产在跨境支付等现实金融层面的实际应用。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。