Author: Yueqi Yang

Translation: Block unicorn

In the world of cryptocurrency, Solana is the wild "younger brother," eager for recognition. Known for its meme coins and collaboration with the cryptocurrency exchange FTX, this blockchain is on the verge of entering mainstream finance.

According to Bloomberg ETF analyst James Seyffart, who tracks asset management company applications, the U.S. Securities and Exchange Commission (SEC) is expected to be more favorable towards cryptocurrencies under President Donald Trump’s leadership, and is likely to approve exchange-traded funds (ETFs) holding Solana tokens by mid-October.

This would make it the third cryptocurrency token packaged as a stock trade, following Bitcoin and Ethereum. Crypto ETFs are thriving, as are crypto stocks like Strategy (formerly Microstrategy). Currently, the total value of crypto-related securities traded in the stock market exceeds $400 billion.

An increasing number of publicly traded companies are raising funds to purchase and hold Solana tokens. This is part of a surge in company stocks that primarily aim to hold cryptocurrencies. The two main supporters of Solana—Multicoin Capital and SkyBridge Capital—are considering investing in some upcoming Solana-related stocks, as stated by Multicoin partner Kyle Samani and SkyBridge founder Anthony Scaramucci in separate interviews. This could drive up the token price.

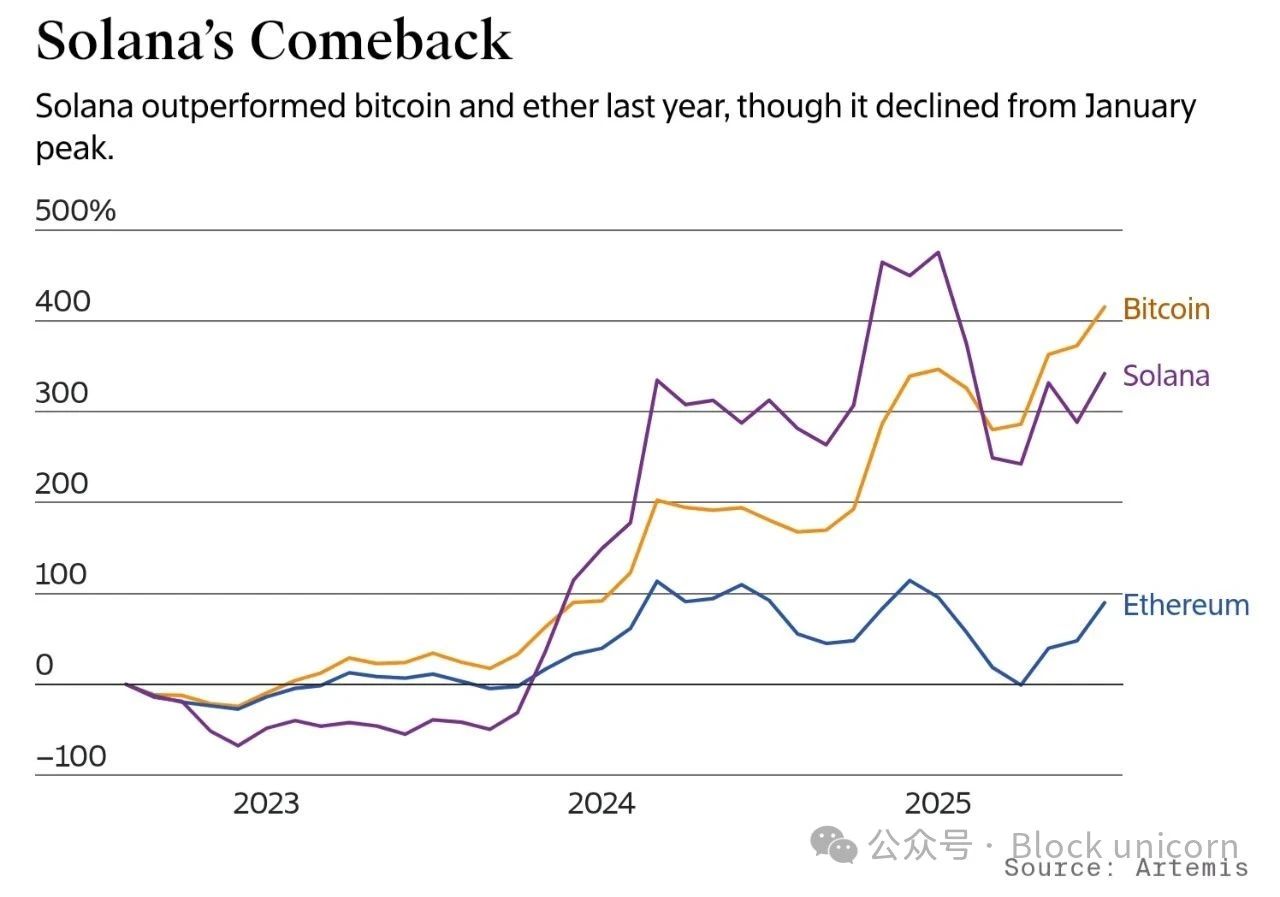

Solana has largely shed its close association with FTX founder Sam Bankman-Fried, who was a major shareholder and supporter of Solana. After the FTX scandal broke, users and developers distanced themselves from Solana, but the situation has changed over the past two years. Solana's token (code: SOL) has surged 820% since August 2023, becoming the sixth-largest cryptocurrency token with a circulating market cap of $99 billion, although it has retreated from its January highs.

Part of the growth can be attributed to the popularity of the Solana blockchain, which was launched in 2020 by Solana Labs founders Anatoly Yakovenko and Raj Gokal. It is seen as a faster and cheaper alternative to the established Ethereum blockchain. These features have made Solana the preferred trading platform for meme coins like $Trump and Fartcoin, which are highly popular but extremely volatile.

Solana is trying to shake off the frivolous reputation of existing solely for speculation with meme coins. Anna Yuan, former head of stablecoins at the Solana Foundation and co-founder of stablecoin startup Perena, stated, "The advantage and disadvantage of Solana is that it is very consumer-oriented. The team there is passionate about building consumer products."

As the meme coin craze has waned, Solana's token price has dropped nearly 40% from its January peak. Supporters of the blockchain hope to restart its growth by creating internet-based capital markets. The goal is to trade individual stocks, bonds, and stablecoins as tokens on the Solana blockchain.

The shift from meme coins to stablecoins is particularly important for Solana, as stablecoins are supposed to maintain a fixed value, in stark contrast to meme coins.

Armani Ferrante, founder and CEO of the crypto exchange Backpack and an early Solana developer, stated, "Stablecoins are currently at the forefront, and the target audience is more serious than the meme coin crowd… I think this is a distinct market segment."

At least two companies—Circle, which issues the second-largest stablecoin, and payment company Stripe—are developing stablecoin blockchains. These upcoming projects may compete with Solana and the current leader Ethereum for stablecoin adoption.

Solana is also seeking support in Washington, promoting its efforts to create internet capital markets. It has quickly established significant partnerships with financial giants like Visa, BlackRock, Fiserv, and traditional companies like R3 that develop blockchain for banks.

Just as bringing crypto assets into the stock market has opened trading doors for a new group of investors, converting stocks into crypto tokens has also made it easier for crypto traders to bet on stocks. This is already happening, with crypto tokens representing stocks like Tesla, Nvidia, and Circle becoming increasingly popular among overseas crypto investors who cannot easily access the U.S. stock market. According to data tracked by crypto analytics platform RWA.xyz, the total value of tokenized stocks has reached $357 million.

In June, one of the fastest-growing tokenized stock providers, Backed Finance, launched xStocks for non-U.S. users on exchanges like Kraken. RWA.xyz data shows that Solana has quickly become the preferred blockchain for trading these stocks. Kraken, which invested in Backed Finance, plans to offer tokenized stocks to more markets (including Europe) in the coming weeks, according to Mark Greenberg, head of consumer business at Kraken. This could bring more trading volume to Solana.

Solana is also seeking support from banks. This year, the Solana Foundation made an undisclosed investment in R3, a blockchain company backed by U.S. banks and others, which is reportedly exploring various options, including sales, in 2024. Lily Liu, chair of the Solana Foundation, has joined the R3 board.

Meanwhile, Solana is expanding its influence in Washington. The Solana Policy Institute was established this year and has hired veteran cryptocurrency lobbyist Kristin Smith, former CEO of the Blockchain Association. She is meeting with lawmakers and urging the SEC to provide guidance to make it easier for companies to transfer stocks, bonds, and other assets to the blockchain.

Solana has also made donations to Senate leadership funds, Congressional leadership funds, the Senate Majority PAC, the House Majority PAC, the Sentinel Action Fund, and the pro-crypto Fairshake group in preparation for the 2026 midterm elections.

Smith stated that Solana's meme coin reputation has not been mentioned in her Washington discussions. She said, "Our conversations with many members of Congress start from the most basic level… They don't understand that Solana is not just a company, but a community, an ecosystem."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。