Outlook

1. Summary of Macroeconomic Trends and Future Predictions

Last week, the focus of the U.S. macroeconomy was on Federal Reserve Chairman Powell's speech at Jackson Hole, which hinted at a possible interest rate cut in September to address labor market risks, leading to a significant surge in the stock market, with the Dow Jones reaching an all-time high. However, at the same time, the S&P Global PMI indicated that both manufacturing and services remained strong, with a rebound in business activity, but rising costs pushed inflation to a three-year high. Retail giant Walmart's performance fell short of expectations, and the housing market data showed mixed results, further highlighting the coexistence of economic recovery and inflationary pressures.

Looking ahead, the market generally believes that the Federal Reserve is likely to implement a modest interest rate cut in September, but due to inflation not being fully controlled, the pace of easing may be cautious. If employment and consumption continue to weaken, the monetary policy easing will intensify, benefiting the stock and bond markets; conversely, if inflation rises again, it may delay the interest rate cut window. Additionally, political interference with the Federal Reserve has increased uncertainty, making future policy paths more volatile.

2. Market Movements and Warnings in the Cryptocurrency Industry

This week, the cryptocurrency market showed significant divergence. Bitcoin experienced a substantial pullback after reaching a high of approximately $124,000, dropping nearly 8% over the week to settle in the range of $113,000 to $115,000, indicating considerable profit-taking pressure. In contrast, Ethereum surged strongly after Powell hinted at a possible interest rate cut, rising over 14% in a single day to reach a new all-time high of approximately $4,880, driving net inflows into the market and significantly increasing on-chain activity. Some altcoins also recorded gains driven by whale investments, showing clear signs of capital rotation.

Looking ahead, caution is warranted as Bitcoin's short-term pullback pressure has not been fully released; if the macro environment tightens or investor sentiment cools, it may further drag down prices. For Ethereum, attention should be paid to potential selling pressure from staking unlocks. On the macro level, the Federal Reserve's September meeting and inflation data will determine market risk appetite; if an interest rate cut is realized, ETFs and institutional funds may continue to support crypto assets; conversely, if the policy leans hawkish or regulation tightens, it may exacerbate volatility and lead to deeper adjustments.

3. Industry and Sector Hotspots

Star institution CSX co-invested $5.5 million in TACEO, a collaborative zero-knowledge proof network focused on low latency and high privacy. TACEO is a provider of cryptographic infrastructure dedicated to achieving collaborative, privacy-preserving computation through coSNARK (a hybrid solution combining zero-knowledge proofs and multiparty computation (MPC)); GAIB is an economic layer focused on reshaping AI infrastructure investment methods by transforming GPU-supported assets into revenue-generating opportunities.

Market Hotspot Sectors and Potential Projects of the Week

1. Overview of Potential Projects

1.1. Analysis of TACEO, a Collaborative Zero-Knowledge Proof Network with $5.5 Million Co-Investment from Star Institution CSX

Introduction

TACEO is a provider of cryptographic infrastructure focused on achieving collaborative, privacy-preserving computation through coSNARK (a hybrid solution combining zero-knowledge proofs and multiparty computation (MPC)). With tools like coCircom and coNoir, developers can run encrypted computations on shared data without exposing any input data. Its real-time proof delegation network TACEO:Proof supports off-chain Groth16 proof generation in a decentralized MPC subnet.

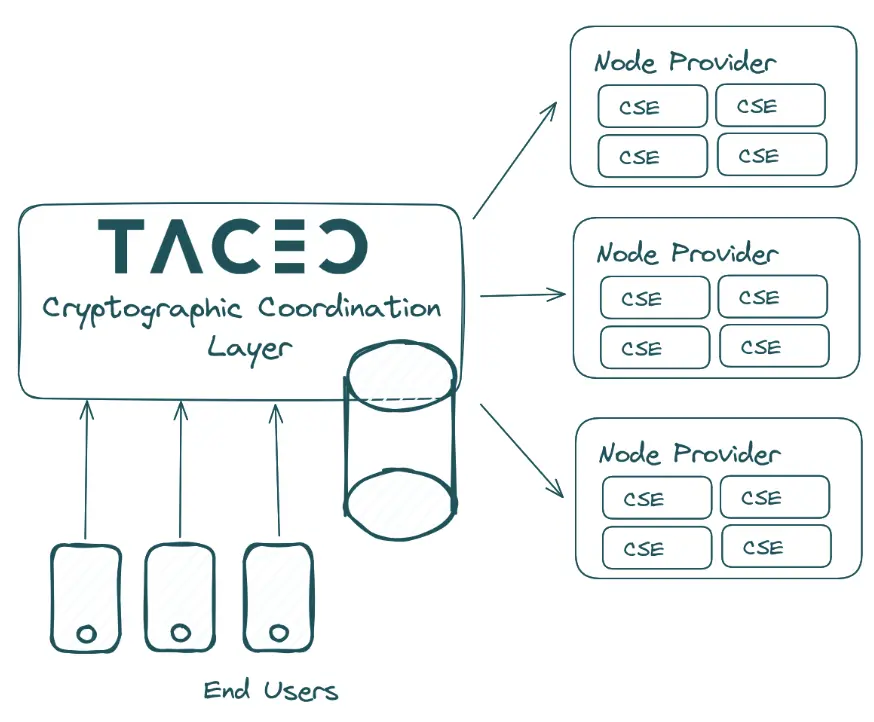

Architecture Overview

TACEO:Proof

TACEO:Proof is a network that combines multiparty secure computation (MPC) and collaborative zero-knowledge succinct non-interactive arguments of knowledge (coSNARK), designed to help developers offload the work of Groth16 proof generation from browsers and mobile devices. Clients submit encrypted input shares and a short-lived voucher, then receive a standard zero-knowledge proof that can be verified by existing verifiers, while no single node in the network can see the complete witness data.

Key Terms

- CCL (Cryptographic Coordination Layer): Responsible for coordinating tasks, managing vouchers and blueprints, distributing tasks via gRPC, and collecting generated proofs.

- Node Provider: Provides computational power to the network by running the CSE (coSNARK Engine). The computation for each coSNARK is jointly completed by a randomly selected group of node providers.

- CSE (coSNARK Engine): A containerized executable that connects peer-to-peer via TCP, executes MPC + SNARK circuits, and generates proof shares. A single node provider can host multiple CSE instances to enhance scalability.

- Blueprint: Refers to the circuit definition and the corresponding set of generation/verification keys.

- Voucher: A permission created by CCL on behalf of the blueprint creator, used to authorize specific blueprint calls and limit their usage.

- MPC (Multiparty Computation): Shares input secrets among multiple nodes to complete function calculations without exposing private data.

- coSNARK: A mechanism that embeds SNARK provers into the MPC protocol, allowing multiple parties to jointly generate succinct zero-knowledge proofs.

High-Level Architecture

- The client packages input data (optionally extending the witness locally), encrypts the data shares using the public key of the selected node provider, and calls the CCL.

- The CCL verifies the voucher, records task information, and notifies the corresponding node provider.

- The CSE receives the task via gRPC, forms an MPC group in the TCP network, runs the complete SNARK circuit within the MPC, assembles the Groth16 proof, and returns the result to the CCL.

- The CCL aggregates the final proof, verifies node signatures, stores the result, and returns the proof to the client.

Two Proof Generation Methods:

- Client-Extended Witness: Generates the complete witness locally, then shares and submits it.

- MPC Network-Extended Witness: Only submits input; the network completes witness extension during the MPC phase.

Simplified Call: Only one API call is needed to replace the traditional prove().

Rapid Response: Typical circuits (~2¹⁶ constraints) return Groth16 proofs in about 500 milliseconds.

Highly Compatible: The generated Groth16 proofs are identical to the native version and can be directly used by existing verifiers.

CoSNARKs

Collaborative SNARK (coSNARK) is a new cryptographic technology proposed in 2021 that combines the advantages of multiparty secure computation (MPC) and zero-knowledge succinct non-interactive proofs (zkSNARK).

It allows multiple participants to jointly generate a proof for verifying the correctness of computations without revealing their private input data.

This method addresses a key challenge: performing computations on shared private data without a trusted third party. In the coSNARK protocol, each participant joins a distributed protocol to jointly generate a unique SNARK proof that can verify the correctness of the joint computation without exposing any individual input information.

The final proof is both concise and efficient, and can be verified by anyone, ensuring data privacy while guaranteeing the trustworthiness and integrity of the computation results.

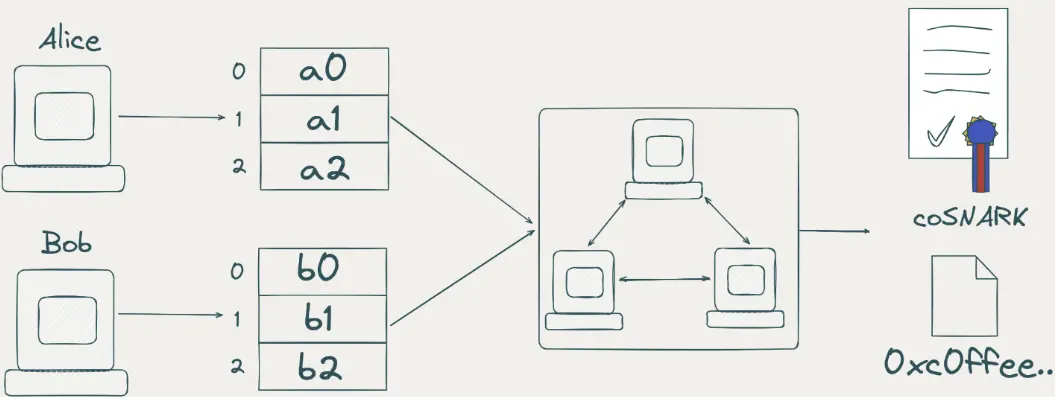

Core Use Case: Example of Alice and Bob

- Goal: Alice has a secret value a, and Bob has a secret value b. They want to compute Poseidon hash(a, b) and generate a ZK proof that the computation is correct without revealing each other's data.

- Challenge: They cannot hand over the data to a trusted third party.

- Solution: Use the coSNARK protocol, with the following steps:

- Secretly Share Inputs: Alice and Bob share their respective a and b secretly and send the shares to the MPC network.

- MPC Network Runs Circuit: The MPC network, composed of multiple nodes, runs the circuit (e.g., Poseidon hash circuit) using the secret shares to generate intermediate results (extended witness).

- Generate Proof: The same batch or another batch of nodes generates a zkSNARK proof without exposing any inputs, proving that the computation result is correct.

- Final Output: A Poseidon hash value and a coSNARK zero-knowledge proof that anyone can verify that the hash is correctly computed based on a and b, but no one knows the values of a or b.

Commentary

TACEO's advantage lies in its innovative combination of MPC and zkSNARK, achieving collaborative computation under privacy protection through coSNARK technology, supporting standard Groth16 proofs, low latency (1 second return), and a developer-friendly experience (ZK proof can be generated with a single API call), while being compatible with existing verifiers, making it suitable for building high-privacy, high-trust off-chain proof systems.

Its disadvantage, however, is that the network relies on multiple nodes to coordinate the completion of MPC, which may be limited by node availability and network stability, and the system's complexity poses a certain barrier to understanding and onboarding for initial users.

1.2. Interpretation of GAIB, a New Revenue Infrastructure Connecting AI Computing Power and On-Chain Finance with $10 Million Led by Amber

Introduction

GAIB is an economic layer focused on reshaping the investment approach to AI infrastructure by transforming GPU-supported assets into revenue-generating opportunities. The AI synthetic dollar AID launched by GAIB enables investors to seamlessly enter the AI economic system and gain real returns from AI-driven computing power. Staking AID as sAID can generate passive income while maintaining liquidity, thereby encouraging more users to participate in AI-driven financial markets. GAIB also enhances the efficiency of access to computing resources for cloud service providers and data centers by providing capital solutions, supporting the development of AI infrastructure. By integrating with decentralized finance (DeFi) protocols, including lending and structured products, GAIB builds a bridge between AI and blockchain finance, unlocking new opportunities at the intersection of technology and investment.

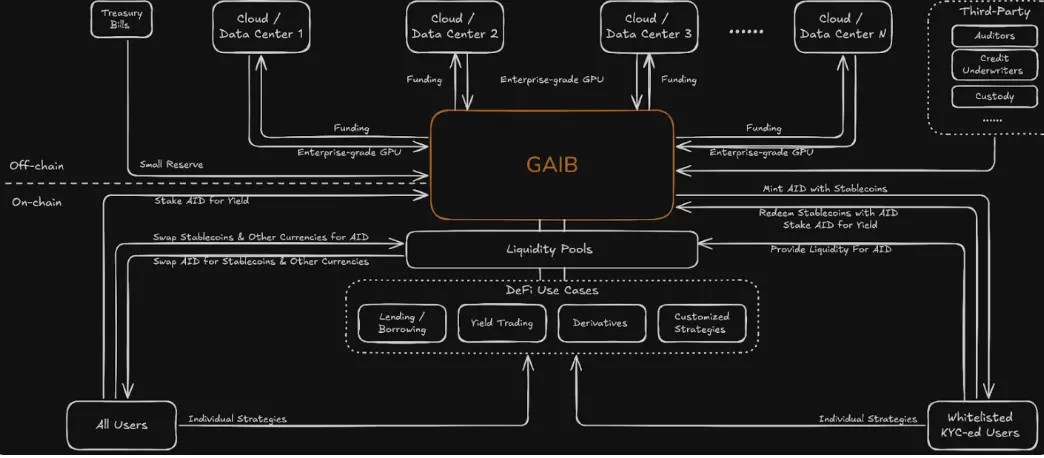

Architecture Overview

Off-chain Components

Cloud Service Providers / Data Centers (1, 2, 3… N)

GAIB has reached financing agreements with high-quality cloud service companies and data centers that own GPU clusters, with relevant contracts and equipment serving as asset support.

Transaction Structure Types

- Debt Model: Cloud service providers/data centers pay interest on borrowed capital.

- Equity Model: Cloud service providers/data centers pay a share of the income generated by GPUs.

- Hybrid Model: Pay interest while sharing GPU income.

Collateral Assets

- All agreements are backed by physical GPU assets. Currently, priority is given to market-scarce enterprise-grade GPUs, such as NVIDIA H100, H200, GB200, etc.

- GAIB structures financing transactions based on GPU clusters, prioritizing existing customers who have reserved GPU clusters for 1 to 3 years.

- All transactions will adopt a bankruptcy-remote structure to enhance security.

Maturity Period

Flexibly set according to the transaction structure, ranging from 3 months (e.g., bridge financing) to 3 years. Due to the short payback period for enterprise-grade GPUs, the maturity of GPU collateral loans is usually much shorter than traditional debt.

Expected Returns (Annualized)

- Debt Model: Estimated annualized return of 10% - 20%

- Equity Model: Estimated annualized return of 60% - 80% or more

Risk Management

- GAIB and other underwriters on the platform conduct strict due diligence on each transaction based on a "credit analysis framework," collaborating with third-party auditing firms when necessary.

- All loans are secured through over-collateralization to ensure fund safety.

- In the event of default, GAIB has the right to liquidate GPU assets to repay investors or continue operating GPUs through strategically partnered data centers to generate ongoing returns for investors.

Strategic Cooperation with Decentralized Computing Protocols

With the rise of decentralized computing protocols (integrating idle computing resources and matching supply and demand through blockchain), GAIB collaborates with these protocols (such as Aethir) to tokenize on-chain income from computing nodes across different platforms, providing additional monetization channels for GPU investments.

Treasury Reserves

GAIB holds a portion of U.S. Treasury bonds as reserves to ensure liquidity safety for users during redemption.

Third-Party Services

GAIB will collaborate with third-party auditing, credit assessment, custody, certification, and professional service providers when necessary to maximize investor rights and the risk-return ratio of each GPU financing transaction.

On-chain Components

Minting and Redemption

Through the smart contracts of the GAIB protocol, whitelisted users who have completed KYC can use stablecoins to mint GAIB's AI synthetic dollar AID, and can also redeem stablecoins using AID.

Staking Mechanism

All users can stake AID to receive a liquid voucher token sAID representing their staking position.

sAID can continuously accumulate returns, and users can claim accumulated returns upon unstaking (specific rules can be found on the AID -> sAID page).

Liquidity Pool

GAIB will integrate with mainstream automated market makers (AMMs) and maintain an on-chain liquidity pool for AID. Users can interact with these external liquidity pools through the GAIB interface to freely exchange AID for stablecoins.

DeFi Application Scenarios

Lending

GAIB will integrate with mainstream lending protocols, allowing users to deposit AID into lending pools for additional returns; users can also borrow AID by staking mainstream crypto assets, enhancing the capital efficiency and liquidity of the ecosystem.

Yield Trading

sAID, as a yield-generating asset, will be integrated into specialized yield trading protocols.

Users can create or trade Principal Tokens (PT) and Yield Tokens (YT) based on sAID, or provide liquidity for PT/YT trading pairs, supporting a variety of strategies from stable returns to high-risk speculation.

Derivatives

With its stable yield capability and liquidity, AID and sAID can serve as underlying assets for various derivatives, further driving market innovation and meeting users' diverse needs for hedging, speculation, and risk management.

Customized Yield Strategies

GAIB will integrate with yield aggregators, treasury strategy protocols, etc., supporting users in building personalized yield portfolios based on the tokenization characteristics of GPU assets, catering to different risk preferences and enhancing the accessibility and customization of the GAIB ecosystem.

Commentary

GAIB's advantage lies in its ability to combine physical GPU assets with DeFi, creating a bridge connecting AI infrastructure and on-chain finance, achieving the dual potential of stable returns and high growth; its diversified financing models, over-collateralization, strict risk control mechanisms, and collaboration with decentralized computing protocols provide investors with a highly transparent and secure participation path. Additionally, through the design of AID and sAID, users can obtain real returns while maintaining liquidity.

However, its disadvantage is that the model relies on fluctuations in GPU market demand and computing utilization rates, the credit and disposal mechanisms for off-chain assets are relatively complex, and the overall system structure is new and heavy, facing educational costs and practical operational challenges.

2. Key Project Details of the Week

2.1. Detailed Explanation of Falcon Finance, a Decentralized Finance Platform with a Modular Stablecoin Architecture and Yield Enhancement Mechanism, Backed by a $10 Million Investment from WLFI

Introduction

Falcon Finance is the first universal collateral infrastructure protocol aimed at creating sustainable yield opportunities.

Falcon Finance's mission is clear: Your assets, your yields. Falcon is dedicated to helping users and institutions unlock the true yield potential of their digital assets.

Falcon is built on trust, transparency, and robust technology. The team consists of seasoned professionals from fields such as blockchain, financial engineering, and quantitative analysis, ensuring a balance between reliability and performance for the protocol. The team consistently adheres to high standards of accountability, helping users maximize asset value.

Its mission is not just to build a protocol but to create a system centered on user yields and sustainable growth.

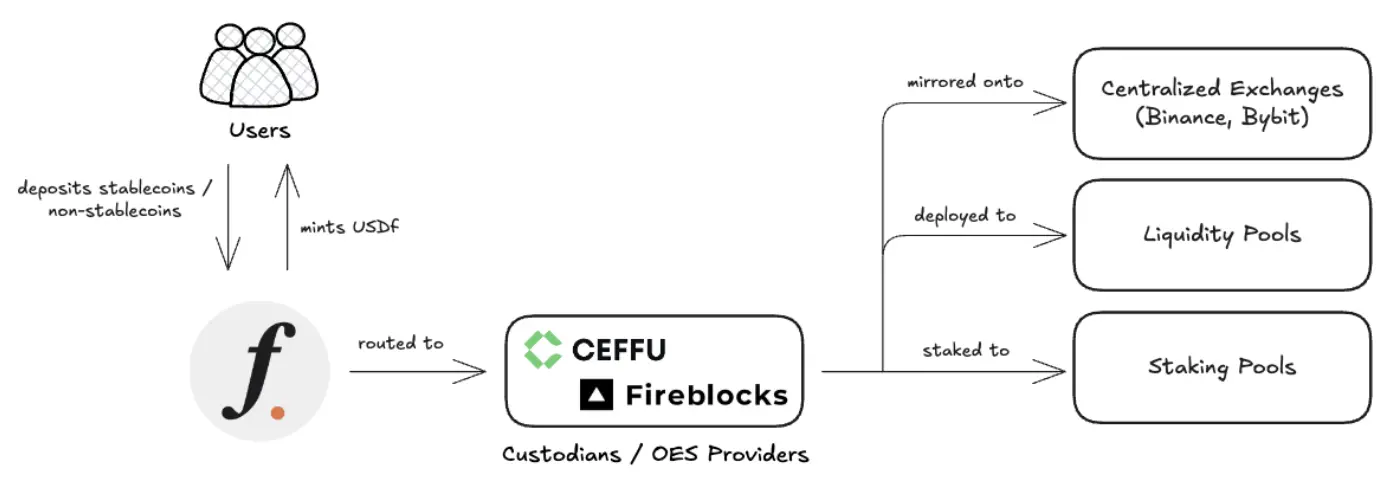

Architecture Analysis

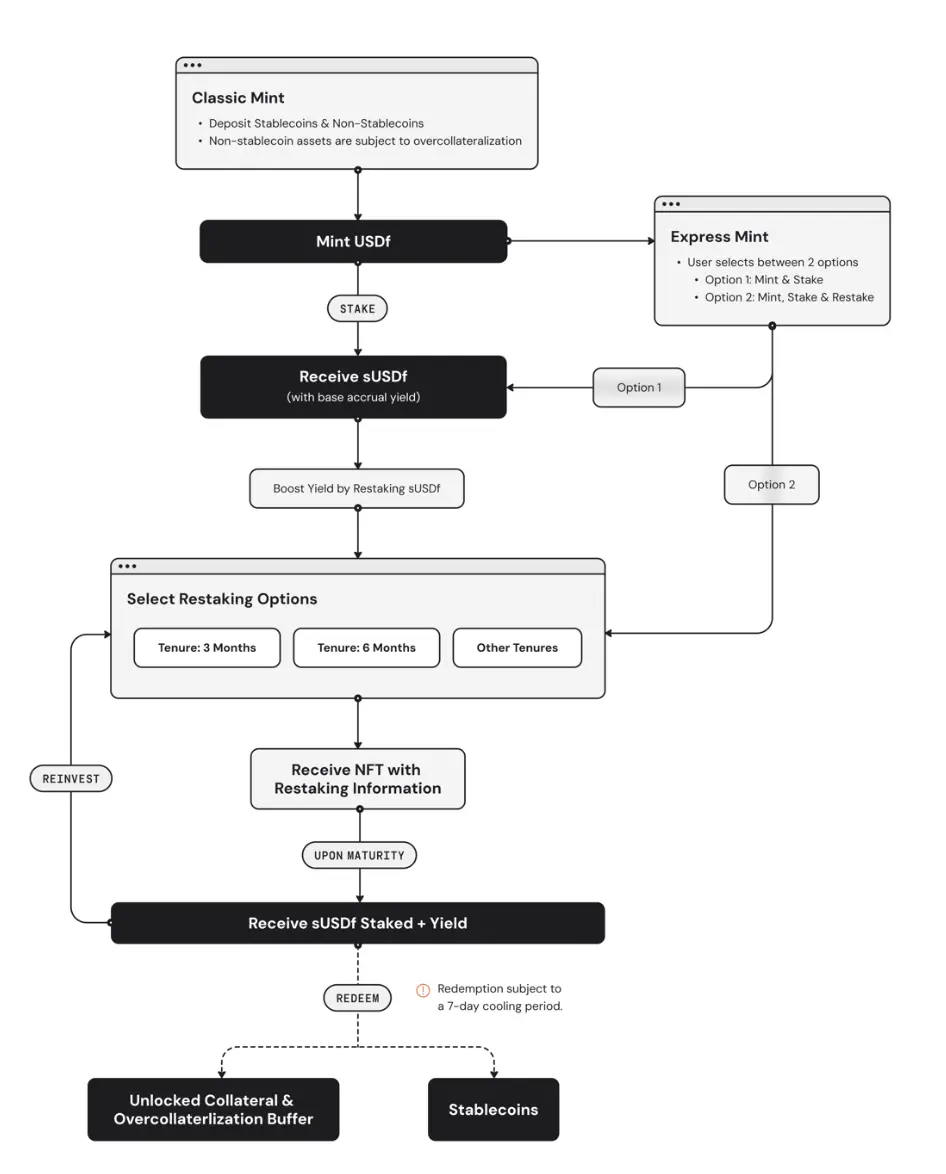

The following diagram outlines the overall process of how user assets are stored and utilized after being deposited into Falcon.

Overall Flow of User Assets:

Users deposit collateral assets (including stablecoins and non-stablecoins) into Falcon, and in return, the system mints USDf stablecoins.

All user-deposited assets are transferred to a third-party custodian and managed securely using multi-signature (multi-sig) or multiparty computation (MPC) mechanisms.

Withdrawing funds requires approval from multiple independent authorized signers, ensuring that no single person or entity can unilaterally withdraw or transfer assets.

Falcon does not directly control or hold user assets, ensuring that no single party can misappropriate funds.

Falcon uses an "off-exchange settlement" mechanism to mirror the assets in the custody account to centralized exchange accounts and deploy strategies and conduct trades on these platforms.

Some assets will be deployed to first-tier on-chain liquidity pools to generate returns through decentralized trading activities and arbitrage strategies.

Falcon will also use some assets that support native staking for on-chain staking, further generating additional returns for spot assets.

USDf: Over-Collateralized Synthetic Dollar

USDf is an over-collateralized synthetic dollar launched by Falcon Finance. When users deposit eligible collateral assets (including stablecoins like USDT, USDC, DAI, and non-stablecoin assets like BTC, ETH, and some quality altcoins), they can mint USDf.

Its over-collateralization mechanism ensures that the value of the collateral assets always exceeds the value of the issued USDf, thereby maintaining the stability of USDf in different market environments.

The collateral assets used to mint USDf are managed through neutral market strategies, ensuring full asset backing while minimizing the impact of price fluctuations. This mechanism enhances the stability and reliability of USDf as an over-collateralized synthetic dollar.

Falcon offers two methods for minting USDf: Classic Mint and Innovative Mint, providing users with flexible options based on different asset holdings and strategy preferences.

Classic Mint: Users can mint USDf at a 1:1 ratio using supported stablecoins (such as USDT, USDC) or use non-stablecoin assets like BTC and ETH for over-collateralized minting, ensuring that each USDf is backed by assets of equal or greater value, effectively avoiding market slippage and price volatility risks.

Innovative Mint: Users can stake non-stablecoin assets for a fixed term in exchange for USDf liquidity while retaining the potential for price appreciation. The minting limit is conservatively set based on parameters such as staking duration, strike price multiple, and capital efficiency, always maintaining an over-collateralized state. All collateral assets are managed through neutral market strategies, and a liquidation mechanism will be triggered under extreme market conditions to ensure the system operates robustly.

Falcon consistently adheres to the over-collateralization mechanism, ensuring that every USDf is supported by assets worth more than $1, safeguarding the security and stability of this synthetic dollar.

- Classic Mint

Classic Mint is Falcon's foundational minting mechanism, supporting the minting of USDf using both stablecoin and non-stablecoin assets.

- Stablecoin Minting: Mint USDf at a 1:1 ratio.

- Non-Stablecoin Minting: Uses an over-collateralization rate (OCR) dynamically set based on asset risk levels to ensure safety and stability.

Express Mint is an enhanced feature of Classic Mint, allowing users to choose to automatically complete subsequent steps during the minting process without manual operation:

- Option 1: Mint & Stake: Automatically stakes USDf after minting, allowing users to directly receive sUSDf.

- Option 2: Mint, Stake & Restake: Users select a fixed term, and the system automatically stakes USDf and restakes the received sUSDf into a designated treasury, ultimately receiving an ERC-721 NFT representing the locked position.

This mechanism simplifies the operational process, enhances user efficiency, while still maintaining asset security and compliance management throughout.

- Innovative Mint

Innovative Mint is an innovative minting mechanism provided by Falcon, allowing users to mint USDf through non-stablecoin assets within a locked period while retaining limited rights to price appreciation.

Users need to set three key parameters: Staking Duration (3–12 months), Capital Efficiency Level, and Strike Price Multiple. These parameters determine the minting limit, liquidation price, and strike price.

Collateral assets will be continuously monitored during the lock-up period, and based on market price fluctuations, three possible outcomes may occur:

- Price below the liquidation price (at any time)

The collateral assets are liquidated, and the user loses ownership of the original assets but retains the minted USDf, which can be exchanged for stablecoins like USDT, USDC. - Price between the liquidation price and the strike price (at maturity)

The user can retrieve all collateral assets after returning the originally minted USDf, while having gained USDf liquidity during the lock-up period. - Price above the strike price (during the term or at maturity)

The collateral assets are exited by the system, and the user cannot retrieve the original assets but can receive additional USDf compensation, calculated as:

(Strike Price × Collateral Amount) − Initially Minted USDf, returning the asset appreciation gains in the form of USDf based on the preset increase.

This mechanism provides users with flexible liquidity acquisition methods while ensuring over-collateralization and retaining some potential for asset appreciation.

- Over-Collateralization Rate (OCR)

Over-Collateralization Rate (OCR) is a key parameter set by Falcon when users mint USDf using non-stablecoin assets, ensuring that each USDf is backed by assets of equal or greater value, reducing risks from market slippage and volatility.

OCR Definition and Calculation Formula

OCR = Initial Mark Price of Collateral Assets × Collateral Amount ÷ Number of USDf Minted

- The OCR for each non-stablecoin asset is dynamically adjusted based on its market volatility, liquidity, slippage risk, and historical price performance.

- The assessed value of user assets depends on the market price at the time of collateralization, and Falcon does not bear responsibility for asset value fluctuations or losses.

OCR Safety Buffer (OCR Buffer)

The OCR Buffer is the portion of collateral assets retained in the system that exceeds the minted USDf, serving as a risk buffer.

Calculation Formula:OCR Buffer = (OCR − 1) × Collateral Amount

- If the current market price ≤ Initial Mark Price: Users can retrieve the original unit amount of collateral assets.

- If the current market price ≥ Initial Mark Price: Users can only retrieve an equivalent USD amount (calculated at the initial price).

This mechanism ensures the safety of the protocol while optimizing user capital efficiency, making the entire USDf minting system more robust and risk-resistant.

- Peg Stability

Falcon Finance ensures that USDf remains stable at $1 through three main strategies: neutral hedging strategies, over-collateralization mechanisms, and cross-market arbitrage.

Core Points of the Pegging Mechanism:

Neutral Hedging Strategy (Delta-Neutral): Market-neutral management of collateral assets eliminates the impact of price fluctuations, ensuring that changes in a single asset or market do not affect the supporting value of USDf.

Over-Collateralization Mechanism: Requires users to collateralize with assets valued above USDf, creating a safety buffer to ensure that every USDf is fully supported.

Cross-Market Arbitrage Mechanism:

When USDf is above the pegged price (> $1.00): KYC-completed users can mint USDf at a 1:1 ratio on Falcon and sell it at a higher price in external markets for arbitrage.

When USDf is below the pegged price ($1.00): KYC users can buy USDf at a lower price in external markets and then exchange it for collateral assets on Falcon at $1.00 for profit.

These mechanisms encourage users and arbitrageurs to participate in the pegging stability process, allowing USDf to maintain stable value across various market environments.

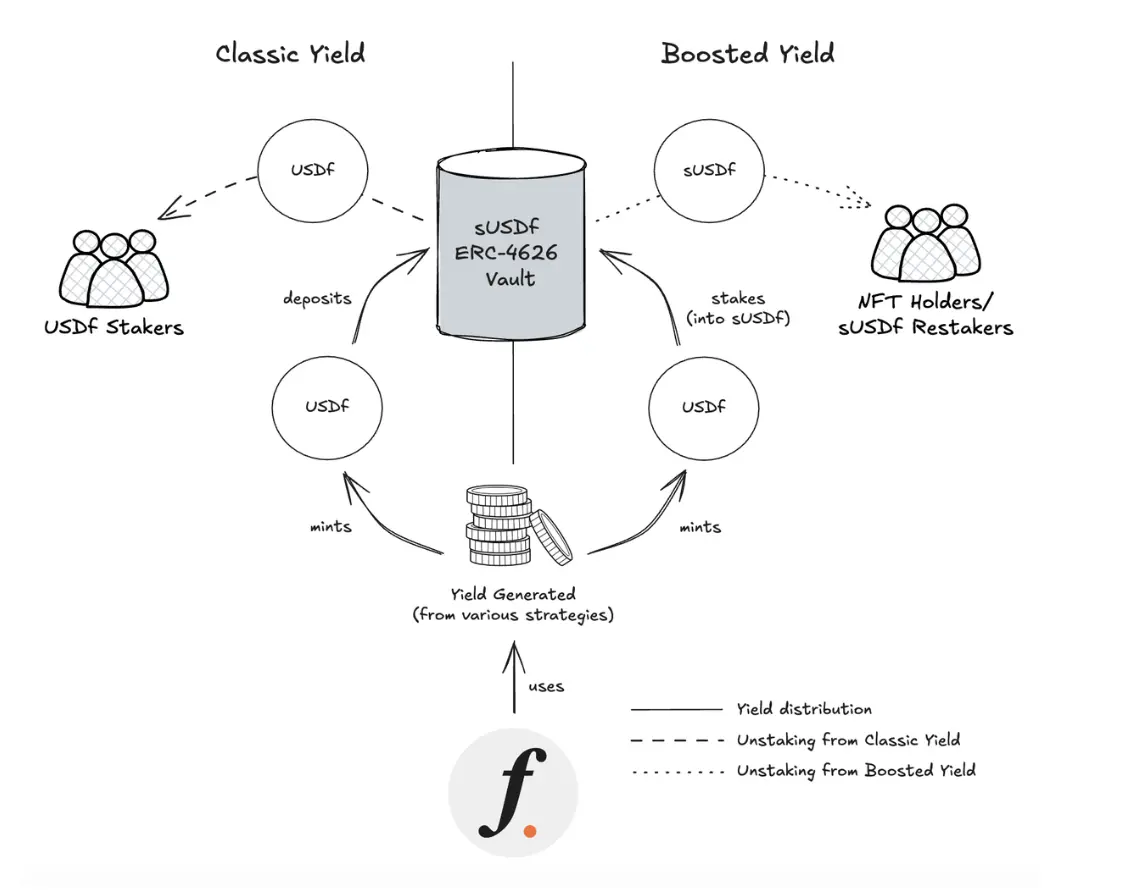

- sUSDf

sUSDf is the yield-bearing version of USDf and is another core token in Falcon's dual-token system. When users deposit and stake USDf into Falcon's ERC-4626 treasury, they receive sUSDf, representing their share of equity in the treasury and continuously earning yields.

sUSDf Value and Yield Mechanism:

- Current value of sUSDf = (Total Staked USDf + Total Rewards) ÷ Total Supply of sUSDf

- Number of sUSDf received by users = Staked USDf ÷ Current sUSDf Value

The value of sUSDf grows over time, reflecting cumulative yield performance. Yield sources include:

- Arbitrage from positive and negative funding rates

- Strategies such as staking altcoins

Role of the ERC-4626 Standard:

- It is a unified standard for treasuries on EVM chains, enhancing the interoperability and asset composition capabilities of DeFi systems;

- Ensures that Falcon's yield distribution mechanism is efficient and transparent;

- Lays the foundation for sUSDf to access more DeFi applications in the future, enhancing user experience and asset security.

Through this mechanism, users can not only gain liquidity from USDf but also earn stable yields through staking.

- Restaking

To achieve higher yields, Falcon allows users to periodically restake their held sUSDf. Users can choose a lock-up period from optional ranges, such as 3 months, 6 months, etc., with longer terms yielding higher expected returns.

Since assets are non-redeemable during these staking periods, Falcon can leverage its time advantage to execute more complex yield strategies, thereby generating higher returns for users.

After users restake, the protocol will mint and issue a unique ERC-721 NFT, representing the user's locked position.

- Yield Distribution

Falcon's yield distribution mechanism is based on the daily calculated yields, primarily rewarding users through two methods:

- Classic Yield Users:

A portion of USDf generated daily is injected into the sUSDf ERC-4626 treasury, enhancing the sUSDf to USDf ratio.

When users redeem sUSDf, they exchange it for USDf at the current rate, indirectly gaining yields.Boosted Yield Users:

Remaining yields are distributed in the form of sUSDf to users holding Boosted Yield NFTs (i.e., those who have restaked).

These users can claim additional sUSDf upon maturity, achieving higher yields.

Yield Calculation Method: Each user's yield = (User's staked USDf / Total staked USDf) × Total distributed yield.

Transparency: The ratio of sUSDf to USDf is based on the ERC-4626 standard, and all calculations and exchange rates can be verified in real-time on Etherscan.

Locking Window: The daily locking period is approximately 21:00–22:00 (GMT+8), during which the system freezes interactions to prevent yield dilution. If users redeem assets before this time, they may lose part of the day's yield.

- Redemption

Falcon offers two redemption methods, both requiring a 7-day cooling period before assets can be claimed:

- Classic Redemptions:

Users exchange USDf for supported stablecoins (such as USDC, USDT).

Suitable for users who prefer stable returns.

Asset Claims:

Users can exchange USDf back for the non-stablecoin assets (such as ETH, ALT tokens, etc.) they previously used to mint USDf.

If using Classic Mint, users can retrieve over-collateralized assets, with the return format being the original asset, USDT, or a mixed form.

If using Innovative Mint, assets can only be claimed after the staking period expires, and the originally minted USDf must be repaid to retrieve all assets. Claims must be completed within 72 hours, or the right may be lost.

- Collateral Asset Acceptance Standards and Risk Framework

Falcon Finance employs a data-driven three-stage screening mechanism and a quantitative risk assessment framework to filter collateral assets acceptable for minting USDf. The goal is to ensure the stable peg of USDf while ensuring that all accepted assets have good market liquidity, price transparency, and risk resistance.

- Collateral Asset Screening Process (Eligibility Screening Workflow)

- Main Market Listing

Is it listed on Binance?

No → Reject; Yes → Proceed to the next step

Market Trading Depth

Does it support both spot and perpetual contracts on Binance?

Yes → Accept

Only supports one → Proceed to the next step

Neither → Reject

Cross-Exchange Verification: Is there real order depth and trading volume on top centralized exchanges (CEX) or mainstream decentralized exchanges (DEX)?

Yes → Accept

No → Reject

Only assets that pass the above three-stage screening are deemed qualified collateral assets and allowed for use on the Falcon platform.

- Quantitative Risk Assessment Indicators (Quantitative Risk Assessment)

Each asset will be scored based on the following four market dimensions and classified as low risk, medium risk, or high risk:

- Final Risk Rating Standards (Composite Risk Grade)

- If there are no high-risk scores and no more than one medium-risk score → the asset is qualified

- If there are two medium-risk scores → it is conditionally qualified, possibly requiring a higher collateralization rate

- If there is any high-risk score → reject or immediate review

Summary

Falcon Finance's advantage lies in its comprehensive, modular over-collateralization infrastructure: through Delta-neutral/market-neutral strategies, cross-market arbitrage, and strict over-collateralization to keep USDf close to the $1 peg, the dual-token design (USDf+sUSDf) combined with the ERC-4626 treasury achieves automated, transparent yield accumulation and restaking gains; Express Mint, Classic/Innovative Mint provide flexible liquidity paths, while on-chain smart contracts, multi-signature/MPC custody, and cooling mechanisms enhance asset security and risk control.

The disadvantages include a relatively complex system with a high understanding threshold for users; reliance on third-party custodians and centralized exchanges introduces external counterparty risks; liquidity and liquidation/peg risks still exist under extreme market volatility; parts of the arbitrage and stability mechanisms require KYC participation, and the 7-day redemption cooling period and lock-up period may affect fund immediacy; additionally, the technical risks of smart contracts and cross-chain integration cannot be completely eliminated.

1. Market Overall Performance

1.1. Spot BTC vs ETH Price Trends

BTC

Analysis

Key resistance this week: $117,500, $118,900, $124,000

Key support this week: $112,000, $110,300, $105,200

ETH

Analysis

Key resistance this week: $4,960

Key support this week: $4,680, $4,580, $4,390, $4,080

2. Public Chain Data

2.1. BTC Layer 2 Summary

- Bitcoin Hyper (HYPER) ICO fundraising exceeds $10 million

Reports indicate that the Bitcoin rapid Layer-2 project Bitcoin Hyper has successfully raised over $10 million in its first ICO, highlighting the market's high expectations for enhancing Bitcoin's smart contract and high-speed payment capabilities. The network aims to introduce Solana-level speed and smart contract functionality by bridging BTC and minting equivalent WBTC for use in its ecosystem.

As early as last week, the project was still in the fundraising phase, with a funding scale of $8.5–8.5 million, continuing to rise rapidly this week.

- Lightning Network smart tools continue to advance

Latest data shows that the Lightning Network is steadily advancing the simplification of enterprise-level infrastructure and development tools, including:

Lightspark: Provides automatic deployment of enterprise-level Lightning nodes, smart routing engines, and SDK/API, lowering the entry barrier for enterprises;

Breez SDK: Supports personalized Lightning nodes for each user with cloud hosting but device control, built-in Watchtower protection, and fiat deposit capabilities;

Other projects like Voltage, Amboss Technologies, and Lightning Dev Kit (LDK) further enhance the usability and development efficiency of the Lightning Network.

2.2. EVM & Non-EVM Layer 1 Summary

Important EVM-Compatible L1 Public Chain Dynamics

Circle launches "Arc" — EVM L1 dedicated to stablecoins

- Arc is Circle's newly launched, self-built EVM-Compatible L1 blockchain, designed specifically for stablecoin payments, foreign exchange, and capital market scenarios. Its native fuel token is USDC, featuring sub-second settlement speeds, optional privacy features, and enterprise-level characteristics such as stablecoin exchange rate engines. It is expected to launch on the testnet later this year and will be deeply integrated with Circle's existing services, also interoperable with multiple partner blockchains.

Stripe collaborates with Paradigm to create "Tempo"

- Stripe is working with Paradigm to develop a new EVM-Compatible L1 blockchain called Tempo, aimed at achieving ultra-fast, low-cost global payments. The chain is designed from the ground up to be developer-friendly and will be compatible with existing Ethereum development tools.

Berachain mainnet officially launched

- Berachain is an EVM-compatible L1 blockchain based on the Cosmos SDK architecture. Its mainnet was announced this week, featuring an innovative Proof-of-Liquidity (PoL) consensus mechanism aimed at enhancing liquidity and security.

Stable launches "Stablechain"

- Stablechain is currently the first L1 blockchain to use USDT (Tether) as its native gas and settlement token, compatible with EVM, supporting near sub-second transaction finality. It also integrates a decentralized USDT0 payment mechanism, achieving a gas-free efficient payment experience.

Non-EVM L1 or Cutting-Edge Technological Achievements

Academic Breakthrough: Sei Giga

- The latest research paper titled "Sei Giga" proposes a highly parallel EVM L1 architecture, achieving over 5 gigagas/sec throughput and less than 400 ms transaction finality, using the Autobahn consensus model to eliminate execution bottlenecks, demonstrating extremely high scalability potential.

2.3. EVM Layer 2 Summary

Mantle (MNT) — High-Quality Ethereum Layer-2 Network

- Leading the market with outstanding performance

- MNT saw a strong surge this week, with prices soaring about 17%, making it one of the most eye-catching projects in the Layer-2 sector, with a cumulative increase of nearly 50% in August.

- Amid a broad market correction, MNT rose 13.6%, while Ethereum fell 5%, demonstrating exceptional resilience.

- Key Factors Driving: Strategic Cooperation with Bybit Increases Attention

- The integration with Bybit is the main driver of this price surge. MNT leverages the Bybit platform to expand its practical use cases, attracting the attention of traders and institutions.

- On-chain data shows that the number of active addresses has reached a historical high, the number of MNT holding wallets has increased, and the supply of stablecoins has reached $713.8 million, a year-on-year increase of 210%.

- Technical Patterns and Market Expectations are Bullish

- Technically, MNT has formed a classic "double bottom" reversal pattern, and if the price breaks through the $1.30–$1.35 range, it is expected to target $1.63.

- Continuous Ecosystem Expansion and TVL Growth

- Mantle has accumulated approximately $1.38 billion in total locked value (TVL) to date, with an active ecosystem.

- Its modular architecture, cross-chain interoperability (such as integration with deBridge), and increasing number of decentralized applications further solidify its position in the Layer-2 ecosystem.

Linea — A New Force in zk-Rollup EVM Networks

- Token Model and Economic Mechanism Officially Revealed

- Linea has launched a model that aligns technology with economic incentives, promising to price gas fees in ETH and implement a "20% burn + 80% buyback and burn" strategy to enhance ETH's value capture.

- The Token Generation Event (TGE) has not yet been scheduled, but airdrops and staking mechanisms are expected to kick off in October.

- Token Design and Ecosystem Allocation

- The total issuance is approximately 72 billion tokens, with about 85% allocated for ecosystem incentives and 15% belonging to the ConsenSys treasury, locked for five years.

- This token has no governance function, with strategic decisions and technological advancements managed by ConsenSys and its governance alliance (Linea Consortium).

- Current Ecosystem Performance and User Activity Remains Strong

- According to July data, Linea ranks among the top in user daily active metrics, total locked value (TVS ~ $540 million), and on-chain profitability within L2 protocols.

- Incentive projects like "Voyage" effectively enhance user engagement and increase ecosystem activity.

- Ecosystem Scrutiny and Market Anxiety

- There are also viewpoints questioning Linea's lack of explosive ecosystem development since the testnet, suggesting that the token release may not bring substantial momentum.

### 4. Macroeconomic Data Review and Key Data Release Points for Next Week

The latest PMI from S&P Global shows the manufacturing index rising to 53.3 (a three-year high), while the services sector remains steady at 55.4, indicating a rebound in overall economic activity. However, businesses are facing rising cost pressures and are passing some of the increases onto consumers, pushing inflation to a three-year high.

Key macroeconomic data points for this week (August 25 - August 29) include:

August 28: Initial jobless claims in the U.S. for the week ending August 23

August 29: U.S. July Core PCE Price Index Year-on-Year

### 5. Regulatory Policies

United States

At the "Blockchain Summit in Wyoming on August 19, 2025," Federal Reserve Governor Michelle Bowman advocated for reducing the cautious approach to regulating emerging technologies, including cryptocurrencies, encouraging regulators to actively collaborate with financial institutions to shape regulatory frameworks and avoid overly restrictive innovation.

The Trump administration continues to promote crypto-friendly policies, including key legislation such as the GENIUS Act, CLARITY Act, and the Anti-CDBC Surveillance National Act, aimed at clarifying stablecoin regulations, institutional responsibilities, and limiting the development of Central Bank Digital Currencies (CBDCs).

United Kingdom

- The UK's Financial Conduct Authority (FCA) has established a dedicated team to strengthen enforcement against "rogue crypto firms." The team currently consists of three full-time employees and twelve seconded staff, focusing on monitoring violations in the crypto asset space and introducing new frameworks related to capital requirements, insider trading, and more. Additionally, the approval process remains lengthy, with an average authorization taking 317 days, and refusals and withdrawals taking even longer.

India

- The Indian Central Board of Direct Taxes (CBDT) is consulting with industry stakeholders to explore the need for new legislation on virtual digital assets (VDAs). Discussion topics include whether the current 1% withholding tax rate on crypto transactions is too high, whether to allow loss offsets against taxes, and whether to encourage the migration of trading offshore, among other key issues.

Indonesia

Starting from August 1, 2025, Indonesia will implement a new tax reform for crypto transactions:

Domestic platform transaction tax will increase from 0.1% to 0.21%;

Overseas platform transaction tax will rise from 0.2% to 1%;

Value-added tax (VAT) for buyers will be eliminated;

The value-added tax on crypto mining will increase from 1.1% to 2.2%; the special income tax on mining will be eliminated and replaced with the standard income tax rate applicable from 2026.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。