XRP在美联储主席杰罗姆·鲍威尔周五明确提出9月降息的情况下上涨了3%,导致比特币(BTC)和主要代币上涨。

4.7亿代币的抛售推动了交易量激增,并在$2.92处形成了强大的阻力,而ETF的延迟和疲弱的安全排名加剧了看跌压力。

新闻背景

• 机构清算主导了交易,在8月21日至22日的窗口期内,4.7亿XRP在主要交易所被抛售,触发了剧烈的抛售。

• 8月18日链上结算量激增500%,达到8.44亿代币,这是今年最大的激增之一,尽管市场疲软,但仍显示出采用增长的信号。

• 美国证券交易委员会(SEC)推迟了对XRP ETF申请的裁决,包括纳斯达克的CoinShares申请,现预计在10月作出决定。该延迟增加了监管的不确定性。

• 一项安全评估将XRPL的排名列为15个区块链中最低, raising concerns about network robustness and adding to bearish sentiment.

价格行动总结

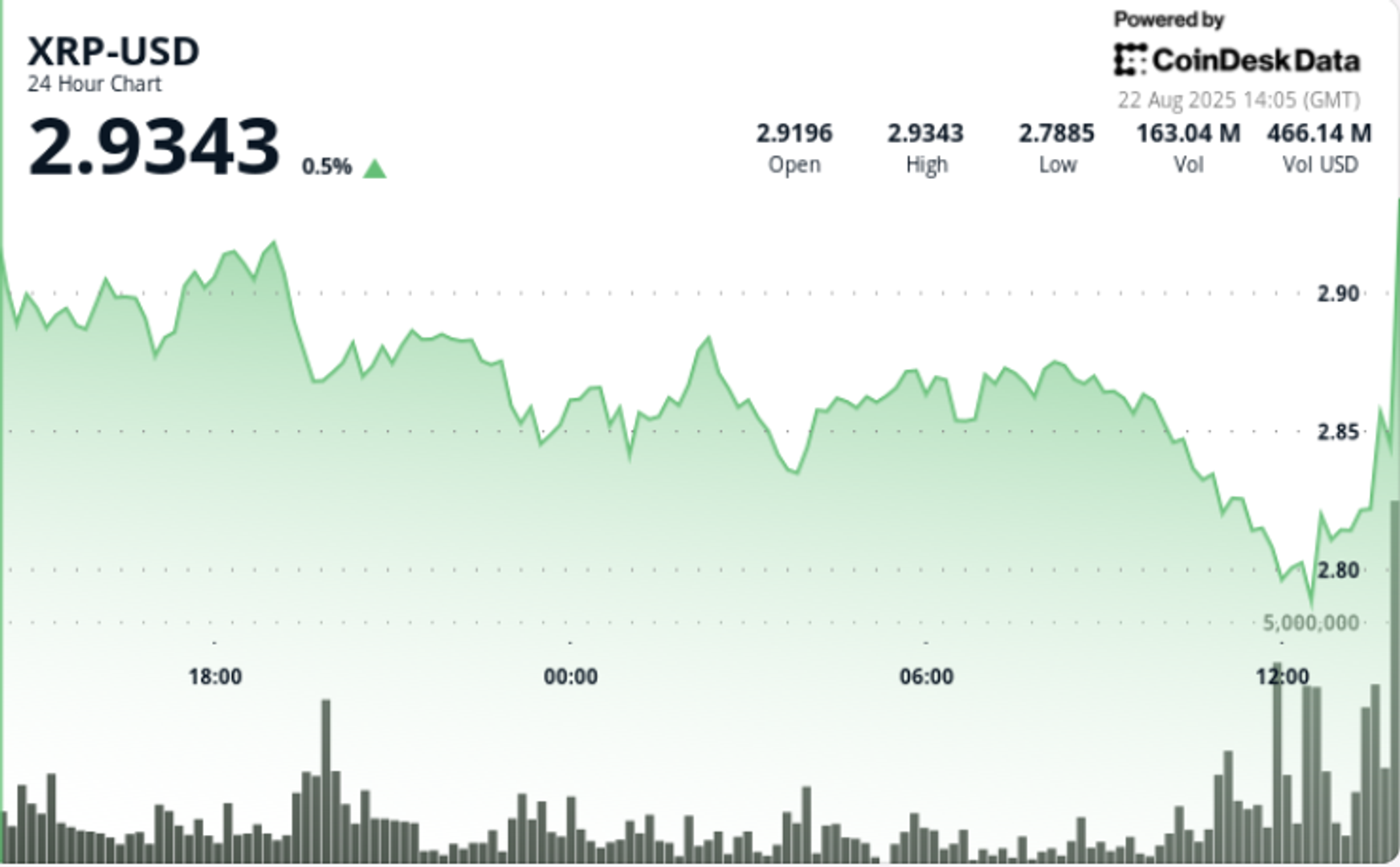

• XRP在8月21日13:00至8月22日12:00的24小时交易中下跌了3.1%,从$2.89跌至$2.80。

• 该代币在$2.92的峰值和$2.80的谷值之间波动$0.12,波动幅度为4.25%。

• 最剧烈的波动发生在8月21日19:00,当时XRP在69.1M的交易量下被拒绝于$2.92,确认了主要阻力。

• 最后一小时的交易(8月22日11:24–12:23)中,XRP从$2.82下跌2.5%至$2.80,交易量激增至7.2M,确认了看跌延续。

• 支撑位出现在$2.80–$2.85附近,但每次重测时积累兴趣减弱。

技术指标

• 在69.1M的交易量拒绝下,阻力在$2.92处加固。

• 支撑位在$2.80–$2.85区域被识别,尽管在重复测试中减弱。

• 8月22日11:00时交易量激增至96M,确认了看跌延续。

• $0.12(4.25%)的交易区间突显了波动集中。

• 最后一小时的2.5%抛售伴随7.2M的交易量验证了看跌延续。

交易者关注的事项

• $2.80是否能作为支撑位;一旦突破,风险加速向$2.75。

• 与ETF相关的头条新闻,10月的决定对更广泛的机构流动至关重要。

• 巨鲸的积累模式——链上采用在增长,但价格未能反映基本面。

• $2.92–$3.00的阻力区作为看涨反转的突破触发点。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。