在加密货币中赚钱很简单。保持盈利?这才是真正的挑战。大多数信号组在牛市中可以赢得几笔交易,但只有少数加密信号提供者能够在超过三年的时间里实现持续、稳定的投资组合增长。最好的加密信号服务遵循一个真正的交易系统,旨在长期资本保值——不是炒作,不是赌博,绝对不是将10,000美元一夜之间变成500,000美元的幻想。

随着成千上万的加密信号组涌入Telegram、Discord和社交媒体,几乎不可能知道谁是真正盈利的——谁只是牛市中运气好而已。

这就是为什么MyCryptoParadise,一家以长期业绩和深厚市场洞察力而闻名的加密交易公司,创建了这个诚实的检查清单。

本指南帮助您区分真正的专业人士与假“导师”、兼职赌徒和所谓的专家,这些人的投资组合在完整的市场周期(通常为2到3年)中被抹去。

时间揭示真相:真正的交易者专注于概率、结构化风险控制和长期投资组合增长。大多数信号组最终会失去一切,就像赌场中的赌徒,因为他们忽视了您将在下面的检查清单中看到的内容。

您将学习该寻找什么,避免什么,以及真正的专业人士是如何思考的。无论他们是机构交易者还是对冲基金经理。他们不根据情绪或炒作进行交易。他们遵循系统,管理风险,专注于长期优势。

✅ 检查清单:如何识别最佳加密信号

以下是您对真正的专业加密信号提供者实际做什么的详细分析,以及如何避免假信号组或不熟练信号组使用的陷阱。 一些故意误导,利用自己的追随者进行拉高出货的计划。其他人则缺乏生存完整市场周期所需的技能、结构或交易策略。

拿起笔。这份加密信号检查清单将保护您的投资组合,并为您节省数年的痛苦和昂贵的错误。

1. 知道何时进攻,何时防守 ✅

专业交易者根据市场情况调整他们的风险敞口。

有时,高概率的设置证明围绕一个想法进行多笔交易或使用更高的杠杆是合理的。其他时候,明智的做法是保持防守——也许进行一笔小交易,低杠杆,或者完全不参与。

这种战术灵活性保护资本并推动长期盈利。

❌ 在相同的风险敞口和攻击性下进行持续高风险交易,无论背景如何,这不是交易,而是赌博。

🃏 想象一下扑克。这是唯一一款技能可以让你占据优势的赌场游戏。 你不会每一手都全押。当你的牌很弱时,你会弃牌或小额下注。当赔率对你有利时,你会加大押注。交易也是如此。如果你不知道何时保护和何时进攻,最终你会把资金全部亏光。

2. 胜率次于风险/收益 ✅

关键不在于你赢得的频率——而在于当你正确时获得多少与当你错误时损失多少。如果仅仅2次亏损就能抹去8次盈利的收益,那么90%的胜率毫无意义。

❌ 小心那些华丽的“90%+胜率”声明。没有明确的风险/收益策略,即使频繁获胜也可能导致长期亏损。

3. 仅一次全仓(头寸)入场 ✅

❌ 专业交易者不依赖于多次DCA入场。他们根据自己的优势以全仓头寸入场。小心那些提供“多次买入机会”的信号,而没有明确的头寸大小定义。

陷阱在于:这些交易者通常在第一次入场时仅以25%的头寸入场。如果达到止盈1,他们会发布“+60%收益”的华丽结果——但这仅仅是25%头寸的60%。

然而,当交易触及止损时,他们通常已经进入了全仓100%,因此整个头寸都承受了损失。这意味着他们的盈利很小(且具有误导性),而他们的亏损则很大且非常真实。

这种头寸大小和百分比的操控扭曲了风险/收益,并伪造了长期盈利。这是信号组中最常用的诈骗手段之一。

4. 质量胜于数量 ✅

❌ 更多的交易并不意味着更好的结果。 过度交易是摧毁投资组合的最快方式之一,尤其是在无聊、情绪或生产力幻觉的驱动下。

最好的加密交易者保持耐心和纪律,只等待具有真实优势的高概率设置。较少且经过良好规划的交易几乎总是能在长期内超越频繁且冲动的交易。

5. 上下文很重要 ✅

❌ 如果你的交易者没有在多个时间框架中分析市场,或者忽视更广泛的背景,比如DXY、TOTAL(1、2、3)、BTC.D、OTHERS.D和其他关键指数,他们就错过了关于聪明资金流入或流出的关键信息。

仅依赖TradingView的纯技术分析而不考虑链上数据、订单流、市场情绪或宏观背景,就像近视交易。就像近视限制了你能看到的距离,近视的交易策略在长期内也无法生存。

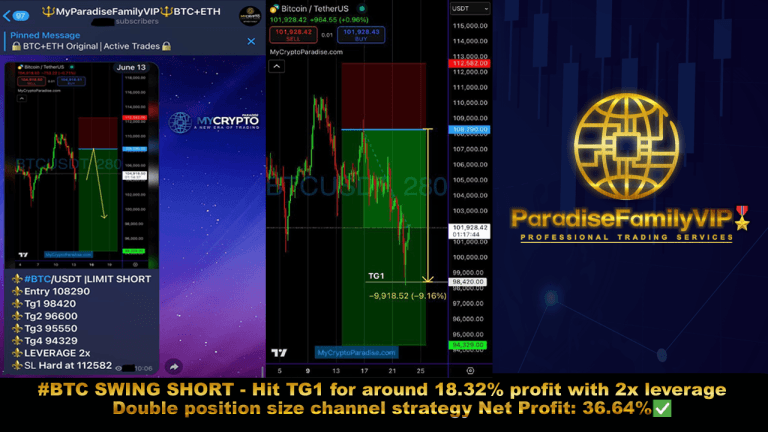

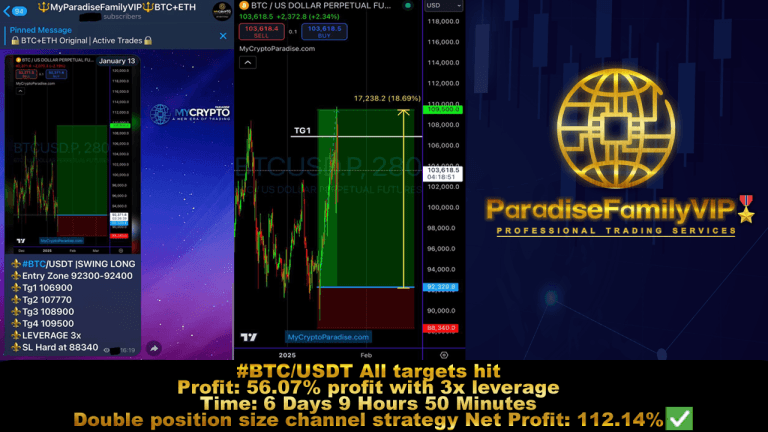

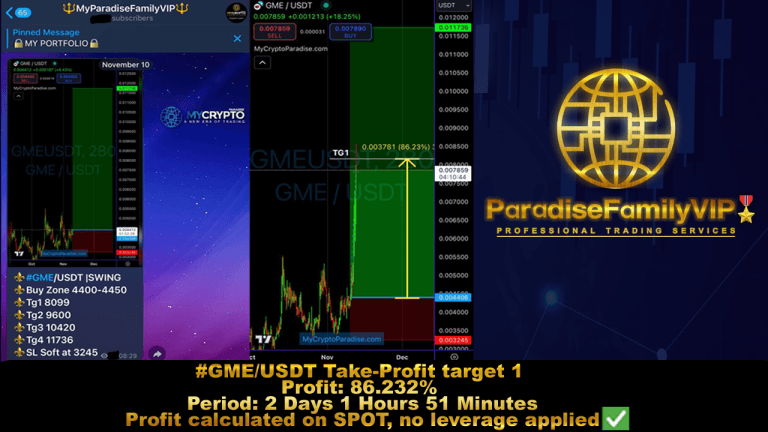

6. 视觉验证 ✅

每笔交易都应该附带一张图表截图,显示入场、止损、止盈和整体设置。这使你能够验证交易背后的逻辑,并评估它是否真正提供了有效的风险/收益优势。

❌ 仅有文本信号 = 没有责任。没有图表,你无法确认:

- 交易是否真实

- 交易是在移动之前还是之后发送的

- 这是否是拉高出货的一部分

- 或者它在实时中是否真的可执行

始终要求图表截图。 它们帮助你验证入场、时机和合法性,并保护你免受诈骗和伪造结果的影响。

7. 第一次止盈至少是止损的两倍 ✅

专业信号应以至少2:1的收益与风险比为目标。 这意味着第一次止盈至少是止损距离的两倍。

❌ 低于2:1的任何情况都会使你的投资组合面临长期风险。 即使有96%的胜率,如果你的盈利太小而亏损太大,仍然会随着时间的推移而亏损。

大多数亏损交易者:

- 出于恐惧迅速获取小利润

- 将止损设置得太远(或完全不设置止损)

- 握住亏损的头寸,希望“反弹”

- 避免被证明是错误的——直到一次大亏损抹去所有过去的收益

专业交易者则相反:他们早期接受小亏损,让大盈利持续。理想情况下,至少25%的交易应该是较大的盈利,足以弥补其他交易的损失。这就是实现长期增长的方式。

8. 清晰的交易策略和战术 ✅

一个真正的加密信号提供者应该能够清楚地解释他们的交易策略和入场战术。你应该理解他们设置背后的逻辑,包括为什么进行这笔交易、他们使用了什么确认,以及什么会使这个想法失效。

✅ 每笔交易都应该遵循一个可重复的、结构化的系统。不是凭直觉或猜测。

❌ 如果他们不能(或不愿)解释他们的过程,这很可能意味着他们没有一个。这不是交易,而是赌博。没有明确的、基于规则的系统,他们只是在凭运气,而不是概率进行交易。

9. 情绪控制和纪律 ✅

真正的专业交易者在冷静、专注和情绪中立的状态下运作。像狙击手,而不是赌徒。无论他们赢还是输,他们的心态保持稳定,因为他们信任自己的系统,而不是自己的情感。

❌ 谨慎对待那些以炒作或过于情绪化的方式庆祝胜利的交易者。如果他们在盈利的日子里大声欢呼,他们很可能在亏损后会恐慌或报复性交易——这是不一致和情绪控制不佳的明显迹象。这种行为会摧毁长期盈利能力。

✅ 情绪纪律是一个关键优势。如果你还没有达到这一点,就要努力去改善。像每日冥想、冷水浸泡、写日记和严格的日常安排等技巧可以训练你的神经系统,使其在波动市场中保持敏锐和韧性。

10. 头寸大小 ✅

每个真实的交易策略都包括精确的头寸大小。每笔交易应分配多少资本。这应该在每个信号中明确说明并一致应用。这是风险管理和长期盈利能力的核心支柱之一。

❌ 如果一个信号组从不提及头寸大小,或者让其模糊或随机,那就是一个巨大的红旗。这意味着交易背后没有系统,只有情绪猜测。

没有头寸大小 = 没有结构 = 纯粹的赌博。

✅ 真实的专业人士知道:你冒的风险和你入场的位置同样重要。

11. 清晰的单一买入/卖出价格 ✅

一个专业信号会给你一个明确的入场价格,或者最多是一个紧凑的入场区间(在1%以内),这是一个定义明确的策略的一部分。你应该确切知道在哪里入场,就像信号背后的交易者一样。

✅ 如果你在复制交易,你的入场应该与他们完全一致。没有猜测。

❌ 宽泛、模糊的入场区间是一个主要的红旗。它们允许虚假团体操控结果,挑选最佳入场点而忽视真实的交易执行。

没有明确的入场,你无法验证交易,他们声称的收益毫无意义。

12. 只关注高概率交易 ✅

❌ 专业交易者不会追逐噪音。如果每一个小的市场波动都触发一个信号,那很可能只是为了吸引参与,而不是基于真实的优势。交易者每周或每月进行多少交易并不重要。质量总是胜过数量。

一个交易者可能进行20笔交易,仍然会被一个进行一次高信念交易并捕捉到主要走势的人超越。

作为经验法则:初学者因无聊或害怕错过而过度交易和反向交易。专业人士会等待。他们已经训练自己保持耐心,只在最佳、经过充分验证的设置和交易想法上采取行动。

13. 严格的风险管理规则 ✅

真正的专业人士在每笔交易或与单一交易想法相关的一组交易中执行精确的头寸大小。每个设置都围绕明确的风险与收益(R/R)倍数和基于他们整体市场判断的定义风险分配构建。

❌ 如果一个提供者没有在这方面教育你,或者从不展示他们如何在交易中管理风险,那就是一个明显的迹象,表明他们没有在专业框架下运作,应该避免。

14. 风险/收益策略 ✅

专业交易者只进行潜在收益至少是风险2倍的交易。 这意味着在入场附近设置紧凑的止损,并将止盈目标放置得足够远,以捕捉到有意义的趋势运动。

❌ 如果一个信号提供者将止盈设置得离入场太近,仅仅是为了达到TP1并提高他们的胜率,或者如果他们的风险/收益比低于2:1,那就是一个严重的红旗。在这些情况下,一次亏损可能会抹去几次盈利的收益——使长期盈利几乎不可能。

15. 耐心等待合适的设置 ✅

专业交易者有耐心等待高概率设置的纪律。 他们不会为了保持活跃而强迫交易,他们知道最佳的加密交易信号是在各个时间框架、重叠和背景都对齐时出现的。

❌ 避免那些迫使你频繁交易或每天发布信息以显得活跃的信号组。频繁交易并不意味着聪明交易!低质量的设置会导致不一致的结果、情绪疲惫和长期损失。

16. 严格的风险管理规则 ✅

专业的加密货币交易者遵循严格的风险管理。他们根据明确的风险与收益(R/R)倍数来确定头寸大小,并根据他们的市场理论在交易中分配风险——而不是情绪或直觉。无论是一个设置还是围绕单一想法的一组交易,每个头寸都是受控、计算和计划的。

❌ 如果一个加密信号提供者从不解释他们的头寸大小、投资组合分配或在多笔交易中的风险控制,他们就不是在专业交易。缺乏风险结构意味着一次糟糕的交易可能会抹去你的收益,甚至是你的整个账户。

17. 连胜和投资回报率跟踪 ✅

专业的加密信号组会跟踪 连胜记录。每笔交易对你整体投资组合的累积影响。 他们衡量你的资本如何随着时间的推移而增长(或缩小),而不仅仅是赢或输的交易数量。

这包括每笔交易的确切风险百分比、头寸大小、交易是现货还是杠杆,以及每笔交易对你的投资回报率(ROI)的影响。这是评估真实表现的唯一方法。

顶级加密信号提供者甚至建议在连胜期间的某些里程碑时提取利润。这就是现实交易者管理成功的方式,通过锁定收益,而不是幻想无限复利。

❌ 如果一个小组不跟踪投资回报率连胜记录,只展示挑选的胜利,他们就是在隐藏真相。没有投资组合跟踪,你是在跟随噪音,而不是一个专业系统。

18. 知识分享 ✅

专业的加密信号提供者不仅仅是发布信号,他们还教授。他们带领成员理解每笔交易背后的逻辑,回答问题,并帮助你理解设置背后的思考。他们的目标是将赌徒转变为一致、独立的专业交易者。

他们知道:当小圈子变得更聪明时,整个VIP小组就会变得更强大。

❌ 如果你的信号组回避问题,隐藏他们的推理,或者表现得他们的交易是“秘密武器”,那就是一个重大红旗。真正的专业人士分享知识,因为他们的优势来自于纪律和结构,而不是神秘或运气。

19. 适应市场周期 ✅

专业的加密信号提供者会调整他们的交易策略以匹配当前的市场环境。无论是牛市趋势、震荡区间、低成交量的周末,还是高波动性的突破。他们的优势不是固定的——而是不断演变的。他们知道何时换挡、减少风险敞口,或根据波动性、结构和情绪加大投入。

这种适应性思维使他们能够在所有市场周期中保持持续盈利。

❌ 如果你的信号组在每种环境中都以相同的方式交易,使用相同的设置、相同的攻击性,无论条件如何——那就是一个红旗。市场不断变化。一个不演变的僵化策略最终会失败,无论它曾经多么有效。

20. 每笔交易相同的头寸大小 ✅

除非加密交易策略明确围绕着分批建仓或以结构化计划进行摊平,否则每笔交易都应使用相同的头寸大小。这种一致性使你的风险可预测,投资组合行为在时间上保持稳定。

专业信号组执行这一规则,因为它对控制回撤、管理情绪和实现可持续的长期结果至关重要。

❌ 如果一个信号提供者随机或没有解释地改变头寸大小,那就是一个严重的警告信号。不一致的头寸大小使风险不可预测,并暗示他们没有遵循真实的系统——他们只是在反应。

21. 多元化投资组合 ✅

一个专业的加密货币信号组应该提供健康的交易风格组合,包括剥头皮、摆动交易、现货头寸和期货。他们还应该根据当前市场阶段和周期在积累和分配策略之间进行调整。

这种多样化确保交易系统在所有条件下都能表现良好:趋势、区间、牛市或熊市。

❌ 仅依赖一种方法,如持续高杠杆剥头皮或仅进行摆动交易,是一个重大弱点。不同的策略在不同的市场周期中表现出色。在牛市中有效的策略可能在横盘或熊市中遭遇重创。

只有专业交易者知道在每个周期中哪种风格具有最大的优势,他们会相应调整以最大化在所有条件下的盈利能力。

22. 透明的交易记录 ✅

加入任何VIP加密信号组后,检查所有交易,特别是亏损,是否在频道内公开记录。完全透明是专业系统和诚实风险管理的标志。

❌ 如果一个小组只发布盈利交易,删除亏损交易,或定期清理VIP频道中的旧消息,那就是一个重大红旗。如果他们隐藏亏损,他们就是在隐藏真相。快跑。

23. 合理的退出策略 ✅

每笔交易在加密信号组中都应包括一个明确的入场点,完整的头寸大小,定义的止损,以及最多4个获利水平。所有这些都有明确的退出指导。这表明交易是基于结构化计划,而不是随机猜测。

❌ 没有退出策略 = 没有计划。而如果没有计划,那么计划就是失败。

24. 入场时机 ✅

专业的加密信号应该提前、冷静地发送,并留有足够的时间采取行动,理想情况下是在行情开始之前或在低波动性期间,此时入场干净且可控。这使得每个人,包括像经理和企业主这样非常忙碌的人,都有时间入场。

❌ 如果信号在拉升或下跌的中间发出,通常会导致FOMO入场、严重滑点和糟糕的成交。追逐无法捕捉的行情不是专业交易——这是反应性、情绪化的猜测。

在每个严肃的加密信号组背后,必须有真正的专业交易者,他们以纪律、结构和先进的知识进行操作。以下是需要注意的事项:

A) 多时间框架市场分析 ✅

他们必须在做出交易决策之前,分析多个时间框架的市场——从月度 → 周度 → 日度 → 4小时 → 1小时 → 15分钟。

这使他们获得全面的背景,避免短视的交易。

B) 拥有带有策略、战术和明确确认规则的交易系统 ✅

他们必须使用适当的、专业的交易策略,并有明确的进入头寸的战术,包括一个确认清单,列出入场前需要满足的确切条件。

他们还应有提前退出交易(在TP或SL之前)和在满足特定标准时将止损移动到盈亏平衡的规则。

如果这个结构没有清晰解释或始终如一地遵循,他们的系统可能不可靠。

C) 深刻理解流动性和聪明资金策略 ✅

专业交易者必须理解流动性、市场制造者和大户(鲸鱼)的运作方式。

这包括识别通过以下方式的操控:

- 新闻时机

- 影响者帖子

- 委托单诱饵

- 针对散户交易者的情绪触发

D) 理解并遵循聪明资金行为 ✅

专业交易者必须跟踪大玩家(鲸鱼和机构)的行为,并与他们保持一致,而不是与他们对抗。

他们需要理解聪明资金如何利用以下方式操控价格:

- 新闻

- 影响者

- 社交媒体叙事

- 委托单陷阱以创造流动性

真正的专业人士意识到幕后发生的事情:

他们认识到鲸鱼如何诱捕散户交易者,他们的位置,以及如何识别这些动作留下的足迹。

然后,他们应用反策略并遵循聪明资金的战术——而不是被其所迷惑。

如果你的信号提供者不谈论这些或盲目进入散户陷阱,你的资本就处于风险之中。

在信任任何小组之前的最终关键检查

✅ 了解小组背后的人

真实姓名、真实面孔、真实电话号码、真实声誉。如果他们是匿名的,你的钱就处于风险之中。

✅ 检查免费教育内容

真正的专业人士会提前提供价值。免费的市场分析、解读和鲸鱼活动的见解。如果一切都隐藏在付费墙后,要保持怀疑。

✅ 公共存在很重要

他们在YouTube或TradingView上吗?他们是否公开解释他们的逻辑,而不仅仅是在封闭的Telegram频道中?确保他们没有仅仅隐藏在Telegram或Discord上。

✅ 每个结果都应该附带图表

没有图表 = 没有背景。没有视觉效果,你无法验证入场、出场或风险/回报。没有这些,结果毫无意义。

⚠️ 注意接近入场的微小TP1

这是一个常见的把戏,用于人为提高营销的胜率。一次大的亏损可以抹去九次小的盈利。不要上当。

这个检查清单帮助你识别真正的专业人士,避免无数的拉高出货小组。

非常感谢MyCryptoParadise(The ParadiseTeam)的专业交易团队对此进行的详细分析。他们帮助我们理解什么是持续的、长期盈利的交易,以及如何通过明智的交易来保护你的资本。

为什么MyCryptoParadise与Bitcoin.com共同创建了这个加密信号指南

大多数信号组的问题

经过多年的研究,我们发现超过99%的加密信号组未能提供持续的长期结果。他们中的许多:

❌ 删除亏损交易

❌ 追溯赢利呼叫

❌ 进行拉高出货计划

❌ 将追随者作为退出流动性

在匿名的加密世界中,任何人都可以假装是专家。

虚假的结果、虚假的社交证明、虚假的购买粉丝——普通交易者几乎不可能分辨谁是真正的,谁只是想拿走他们的钱。

更糟糕的是,这些小组大多由缺乏经验的交易者运营,他们不适应市场周期。他们在牛市中可能看起来聪明,但:

- 在下跌期间,他们会全部回吐

- 在积累期间,他们过度交易并流失资金

我们称之为“超级周期陷阱”——一种模式,在轻松的趋势中表现良好的不纪律小组在条件变化的瞬间崩溃。

悄然培养专业交易者的加密信号

在阅读完上述完整检查清单后,有一件事变得清晰:

专业的加密交易并不是追逐更多的交易信号——而是遵循一个结构化、经过验证的系统,保护资本并随着时间的推移持续增长。

这就是为什么Bitcoin.com与MyCryptoParadise合作,共同创建这个指南,MyCryptoParadise是一个备受尊敬的专业加密交易公司,拥有长期盈利的交易策略和专业的交易心态。

自2016年以来,MCP ParadiseTeam帮助交易者摆脱短期赌博习惯,开始以专业的方式建立资本——通过纪律、结构化策略和更聪明的决策。

这些见解中的许多令人惊讶地是免费的:

✅ 加密交易大学

✅ YouTube比特币预测

✅ Telegram上的免费比特币信号

仅这些免费的资源,加上他们网站和免费Telegram频道上提供的更多内容,已经帮助成千上万的交易者从冲动决策演变为有意图的、结构化的交易。他们学会了如何管理风险,等待适当的确认,避免成为退出流动性,并像真正的专业人士一样接近市场。

当然,并非所有内容都可以公开分享。

ParadiseFamilyVIP 内圈小组是为管理较大投资组合的交易者而设,需要直接访问他们个人交易设置的清晰准确的入场、出场和结构化投资组合保护。

因为每笔交易都是为了保护和保全资本而建立的,会员名额通常是满的且不可用。这是任何专业VIP加密交易小组的必要条件,因为太多交易者进入相同的头寸会增加市场滑点,吸引鲸鱼和加密止损/流动性狩猎机器人关注,从而降低交易优势。这就是为什么新名额只有在交易量条件允许时才会开放。

无论你是刚开始你的旅程,还是已经管理着一个严肃的投资组合,通往专业交易的道路都是相同的:

通过学习该领域中最优秀的交易者实际上在做什么——并做得更多。

关键要点:严肃交易者如何使用最佳加密信号

如果你能读到这里,你可能并不是在追逐炒作或快速获利。

你在寻找可靠的、专业的加密交易信号,一种稳步增长和保护资本的方法,而不陷入导致大多数交易者失败的陷阱。

1. 专业加密信号不是猜测

来自合法信号提供者的每笔交易都应该是更大、经过回测的交易策略的一部分。

- 基于风险/回报系统

- 以严格、基于规则的纪律执行

- 旨在提高你获胜的概率,而不是依赖情绪反应

2. 避免炒作、花招和拉高出货陷阱

如果一个加密信号小组:

- 推广迷因币

- 炫耀不切实际的胜率

- 分享模糊的买入/卖出区域

- 使用情绪压力推动交易

……这就是一个红旗,而不是专业交易。

3. 使用这个加密信号检查清单作为你的优势

你刚刚阅读的检查清单不仅仅是建议——它是一个工具,可以:

- 帮助你识别骗局和虚假信号

- 保护你的投资组合免受鲁莽交易的影响

- 指导你实现长期、独立的交易成功

底线:专业加密交易是关于结构,而不是运气

最佳的加密信号提供者以系统、纪律和长期一致性进行交易。

如果你的提供者没有以专业基金经理的严肃态度对待交易,他们就不值得你信任、时间或资本。

___________________________________________________________________________

Bitcoin.com 对于因使用或依赖文章中提到的任何内容、商品或服务而造成或声称造成的任何损害或损失不承担任何责任。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。