API3价格在超买水平和市场下跌后面临修正

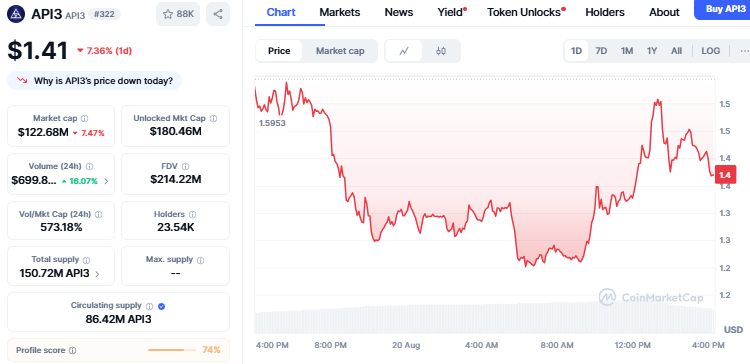

API3价格在经历了一周的大幅上涨后,出现了急剧回调。在过去24小时内,它从近期高点下跌了11.64%。

这一下跌紧随其后的是该代币在过去七天内上涨了86.82%。

来源:CoinMarketCap

该币现在的交易价格为1.41美元,下降了7.36%,而交易量在过去24小时内激增了15%。

交易者认为此次下跌是由于获利了结、技术脆弱性以及整体加密市场的下滑。

技术修正信号

最近的上涨使API3的RSI-14达到了83.02,这一读数表明该币处于超买状态。

在正常情况下,当RSI超过70时,表明买方可能已经疲惫。

API3价格也跌破了1.34美元的重要支撑位,交易者对此保持密切关注。

这一暂停引发了进一步的抛售,因为大多数投资者选择锁定利润或减少损失。在短期内,保持在1.34美元以上被视为重要。

如果价格继续下跌,后续的支撑位在1.10–1.00美元。然而,如果代币突破1.34美元,卖压可能会减缓。

衍生品和市场影响

衍生品市场的波动性是API3价格崩溃的另一个关键原因。8月19日,永续合约的资金费率降至-1.96%,这表明大多数交易者在做空该代币。

未平仓合约仍然高达8571万美元,因此大量资金仍然锁定在杠杆头寸中。

这些条件往往会导致强劲的波动。大量的多头平仓可能加剧了崩溃,因为价格跌破了支撑位。

这也受到整体加密市场的驱动,在同一时期下跌了1.04%。比特币的主导地位上升至58.98%,显示投资者寻求避风港。

恐惧与贪婪指数也降至45,给像API3这样的山寨币施加了更多压力。

未来前景:API3的基本面

尽管最近出现下跌,但其基本面依然良好。其OEV网络于2024年7月推出,旨在捕捉在DeFi协议上生成的MEV价值,而不是让其落入验证者手中。

截至2024年底,其总价值保障从2000万美元增加到6亿美元。

同时,技术图表也在发出谨慎信号。7日RSI在8月19日上升至91.07,为2025年6月以来的最高水平。

交易所上市

最近的交易所活动也是一个主要因素。Upbit的KRW上市促使代币大幅上涨,日内上涨100%至1.85美元。然而,衍生品市场仍然脆弱,过去一周未平仓合约上升了21%,达到了8.8亿美元。

新上市可能会注入流动性,但如果资金再次转为负值,则会使市场面临更高的清算风险。

结论

API3价格的下跌代表了加密市场变化的迅速。在过去7天的大幅上涨、超买水平和整体谨慎情绪的影响下,市场出现了下滑。

在OEV网络采用的情况下,基本面是积极的,交易者应关注1.34美元的支撑位。保持在关键均线以上的持续性将决定是否会出现反弹或更深的修正。

另请阅读: 币安为Alpha平台用户推出ARIA代币空投

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。