撰文:比推

在加密行业最火热的叙事之一——现实世界资产(RWA)代币化浪潮中,Anthony Scaramucci又一次走在了前列。

这位出身华尔街的投资人,曾任高盛副总裁,也因短暂担任特朗普政府的白宫通讯联络主任而广为人知,如今则以SkyBridge Capital的掌门人身份,押注「基金代币化」这一新兴赛道。他最近宣布,SkyBridge 将把旗下约 3 亿美元的资产(约占其总管理规模的 10%)进行代币化,并选择Avalanche作为承载区块链。

对于 Scaramucci 来说,这不仅是一次投资组合上的技术尝试,更是一种对未来金融格局的判断。他在接受《财富》杂志采访时直言,2026 到 2027 年将会成为「现实世界资产代币化的时代」。在他看来,代币化的价值不仅在于效率的提升,更在于重新定义传统金融的交易与流通方式。

Scaramucci 的金融与政治旅程

在进入加密世界之前,Scaramucci 的经历本身就足够传奇。他早年在哈佛法学院毕业后加入高盛,担任投资银行部门副总裁。1996 年,他创立了 Oscar Capital,后卖给 Neuberger Berman。2005 年,他再次创业,创立了 SkyBridge Capital,并逐渐将其打造成在另类投资领域颇具影响力的资产管理公司。

2017 年,他因短暂担任特朗普政府的白宫通讯联络主任而成为美国媒体的焦点人物,任期仅 11 天,但从此「白宫风暴」与「华尔街老兵」的双重身份让他长期处于公众视野。离开政坛后,Scaramucci 并未退居幕后,而是继续深耕投资,并在 2020 年后迅速拥抱加密货币。SkyBridge 陆续设立比特币和以太坊基金,Scaramucci 本人也多次公开为加密行业站台。

尽管他也曾因 FTX 投资而栽过跟头,但这并未动摇其长期信念:加密与传统金融的融合是不可逆的趋势,而 代币化是最具潜力的桥梁。

RWA 热潮:美债 vs 基金代币化

RWA 赛道的起点几乎是「链上美债」。在美联储加息周期下,美国国债和货币市场基金成为链上最受追捧的资产。它们风险低、收益稳定,是 DAO、稳定币发行方、交易所的理想配置。

主流 RWA 项目一览

| 项目/机构 | 资产类型 | 部署区块链 | 当前规模/状态 |

|---|---|---|---|

| BlackRockBUIDL | 美债/货币基金 | 以太坊 | 数十亿美元规模,RWA 龙头 |

| Franklin Templeton | 货币市场基金 | Polygon,Stellar | 数亿美元,合规投资者为主 |

| VanEck | 货币基金试点 | Solana,Aptos | 新兴探索阶段 |

| Ondo Finance | 美债/短期债券 | 以太坊, Solana | 市场化程度高,吸引 DeFi 用户 |

| SkyBridge Capital | 对冲基金份额 | Avalanche | 3 亿美元(约 AUM 的 10%),首次进军基金类 RWA |

可以看到,SkyBridge 与主流的 RWA 路线差异明显:它选择的不是低风险的国债,而是两只对冲基金:一只是比特币等未被 SEC 认定为证券的加密资产基金,另一只是「基金中的基金」,涵盖了 SkyBridge 的风险投资与加密基金产品。这类资产面向的投资群体门槛更高,流动性相对有限,却意味着更高收益和差异化竞争。

Avalanche 的现状:热度下滑,能否靠 RWA 逆转?

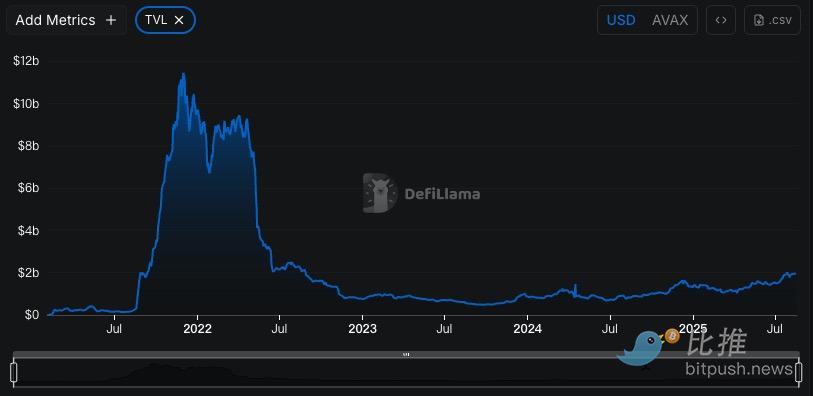

Avalanche 曾在 2021–2022 年 DeFi 热潮中一度跻身「以太坊杀手」之列,其 TVL 高峰期超过 110 亿美元。但随着市场回落、Solana 强势反弹、以太坊 L2 爆发,Avalanche 的热度明显减弱:

TVL 缩减:根据 DefiLlama,当前 Avalanche 的 DeFi 资产规模不足 20 亿美元,远低于高峰期。

生态活跃度下降:相较于 Solana 在 meme、NFT 与 DeFi 上的全面复苏,Avalanche 的用户增长和应用热度表现平平。

缺乏新叙事驱动:在 Layer2 叙事、Solana 生态、比特币二层不断涌现的背景下,Avalanche 缺乏足够的爆款话题。

大多数 RWA 项目选择以太坊,因其合规基础设施和机构认可度最高;Solana 依靠高性能低成本迅速崛起;Aptos 则定位为「合规新公链」的试验场。Avalanche 并非 RWA 的第一选择,但它的 Subnet 架构为机构量身打造,允许为合规、托管、审计设计专属区块链环境,这正是 SkyBridge 所看重的地方。

不同公链在 RWA 领域的角色

| 公链 | 优势 | 典型 RWA 项目 |

|---|---|---|

| 以太坊 | 合规基础设施成熟、机构偏好 | BlackRock BUIDL, Ondo |

| Solana | 高性能、低交易成本 | Franklin Templeton, Ondo 部分产品 |

| Avalanche | Subnet 灵活性、交易速度快 | SkyBridge 对冲基金代币化 |

| Aptos | 新兴,试水合规市场 | VanEck 货币基金试点 |

Avalanche 借助 SkyBridge 的「背书」,试图在拥挤的 RWA 赛道上突围,但SkyBridge 的基金代币化并不是 Avalanche 在 RWA 领域的唯一动作。

今年,美国新泽西州 Bergen County——纽约最富裕的郊区之一——宣布将 37 万份房产契约迁移至 Avalanche 链,总价值高达 2400 亿美元。这些契约将被存放在一个不可篡改、可搜索的链上账本中,代表了全球首个大规模将房地产契约数字化并上链的案例。

这意味着,Avalanche 并不是单纯押注金融产品,而是试图在 「基金 + 房产」 两大类传统资产上,建立自己的链上生态。

那么,RWA 能否为 Avalanche 带来流动性?

问题在于,RWA 并非一蹴而就的市场。即便 SkyBridge 与 Bergen County 的案例有标志意义,它们在短期内未必能直接转化为链上交易活跃度:

对冲基金份额的代币化面向的是高净值人群,流动性天然有限;

房产契约的上链更接近「数字档案库」,距离真正的金融化(比如抵押贷款、二级交易)还有制度与市场距离;

Avalanche 需要的不仅是「头条新闻」,还需要围绕这些资产建立完整的应用场景与金融产品,才能让资金真正流入链上生态。

换句话说,RWA 为 Avalanche 提供了新的故事,但是否能变成新的流动性,还取决于生态能否围绕这些资产构建交易、借贷、保险等链上市场。

前景展望:Avalanche 的三种可能

RWA 给了 Avalanche 一个全新的故事,但结果可能出现分化:

成功转型为机构链

如果 SkyBridge 与 Bergen County 的案例能引来更多基金、银行、地方政府跟进,Avalanche 有机会在「链上机构与公共资产」这个赛道建立壁垒。它可能不会成为 DeFi 的主战场,却能成为现实资产上链的基础设施。继续边缘化

如果 RWA 只是停留在「新闻效应」,没有带来真正的交易与流动性,那么 Avalanche 的地位不会有本质改善。RWA 的光环最终可能被以太坊、Solana、甚至新的合规链吸走。等待下一个叙事

Avalanche 也可能通过 RWA 赢得一部分关注度,为下一波行业叙事(例如 AI+区块链、国家数字货币、跨境结算等)积累资源。RWA 不一定直接带来流动性,但可能为它保留未来翻盘的筹码。

结语

RWA 已经从实验走向现实:RWA.xyz 的数据显示,代币化市场在过去一年翻倍至260 亿美元,McKinsey、Ripple、BCG 等机构预测到 2030 年或将成长为万亿美元级别。在这一大背景下,Avalanche 押注的不是热门的国债赛道,而是高净值基金和房地产契约。

这条路风险更大,但如果走通,Avalanche 或许真能凭借 RWA 找到一条与以太坊、Solana 不同的生存之道。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。