作者:Marie Poteriaieva

来源:cointelegraph

编译:善欧巴,金色财经

关键要点

- Web3 日活跃量:2025 年第二季度维持在2400 万,但各赛道构成正在发生转变。

- DeFi:以每周2.4 亿笔交易量居首,但以太坊 Gas 消耗如今主要被RWA、DePIN 和 AI占据。

- 表现突出的资产:智能合约平台代币、能产生收益的 DeFi 与 RWA 代币跑赢大盘;AI 和 DePIN 尽管叙事强烈,却表现落后。

山寨币并不仅仅是比特币之外的投机标的。多数情况下,它们代表或试图代表 Web3 生态中的特定活动领域,Web3 被视为传统互联网及其服务的去中心化替代。

要评估山寨币市场的现状与潜力,不能只看价格。诸如 Gas 消耗、交易量与独立活跃钱包数(UAW)等指标能衡量活动与采用程度,而代币价格表现则揭示市场是否跟随链上趋势。

AI 和社交类 DApp 正在获得广泛采用

UAW(独立活跃钱包)统计的是与 DApp 交互的不同地址,能在一定程度上衡量用户采用的广度(但因多钱包或自动化操作可能会被高估)。

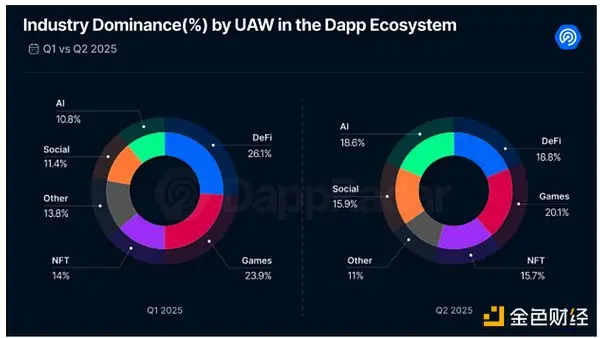

DappRadar 的 2025 年 Q2 报告显示,每日钱包活动量稳定在约 2400 万。然而,但赛道主导地位正在变化。加密游戏仍是最大类别,占有20%+ 市场份额,但较 Q1 下滑。DeFi 也有所下滑,从 26%+ 降至不足 19%。

相比之下,社交和 AI 相关 DApp正在获得发展。Farcaster在社交领域领先,约4 万日活 UAW。在 AI 方向,Virtuals Protocol (VIRTUAL $1.18)等基于智能体的协议表现突出,每周吸引约1900 个 UAW。

UAW 在 DApp 行业占据主导地位。资料来源:DappRadar

DeFi 吸引「大玩家」

交易次数显示智能合约被触发的频率,但容易受到机器人和自动化的影响。

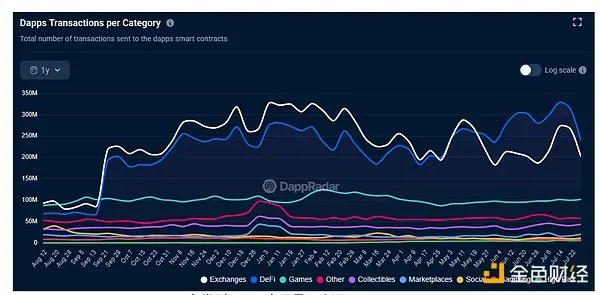

DeFi 的交易足迹颇具矛盾性。其用户群虽然有所下降,但每周仍能产生超过 2.4 亿笔交易——超过任何其他 Web3 类别。交易所相关活动(可能与 DeFi 重叠)进一步巩固了 DeFi 的主导地位,加密游戏的每周交易量为 1 亿笔,「其他」类别(不包括社交,但包括人工智能)的交易量为 5700 万笔。

各类别 DApp 交易量。来源:DappRadar

总锁定价值 (TVL) 则更加有力。根据 DefiLlama 的数据,DeFi TVL 已达到 1370 亿美元,自 2024 年 1 月以来增长了 150%,但仍低于 2021 年底 1770 亿美元的峰值。

TVL 上升与 UAW 下降之间的差异反映了本轮加密货币周期的一个关键主题:机构化。资本正集中在数量更少、规模更大的钱包中,现在也包括基金。由于 DeFi 在许多司法管辖区面临监管不确定性,这一趋势仍处于萌芽阶段。

尽管如此,各机构仍在通过向许可池提供流动性来试水,通过 Ondo Finance 和 Maple (SYROP) 等平台的代币化国债进行贷款,后者还因与投资银行 Cantor Fitzgerald 的合作而闻名。

与此同时,随着 DeFi 逐渐演变为面向大规模收益生成而非零售参与的资本高效层,Lido (LIDO) 或 EigenLayer 等 DeFi 服务提供的协议级自动化进一步抑制了钱包活动。

其他用例正在主导以太坊的 Gas 消耗

单纯的交易数据并不能完整呈现 Web3 的全貌,而以太坊的 Gas 使用情况却能揭示经济与计算负载真正的分布。

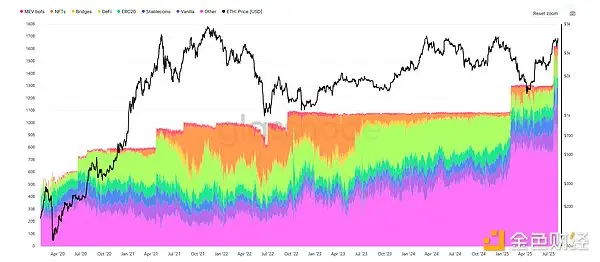

来自 Glassnode 的数据显示,尽管 DeFi 一直是以太坊的核心板块,但其 Gas 消耗如今仅占 11%;NFT 曾在 2022 年占据相当份额,如今已下降至 4%。

相比之下,「其他」类别的占比却从 2022 年的约 25% 飙升至如今的 58% 以上。该类别涵盖了诸如现实世界资产代币化(RWA)、去中心化物理基础设施(DePIN)、AI 驱动的 DApp,以及其他或多或少的新型服务,这些都有可能定义 Web3 的下一阶段增长。

以太坊 Gas 使用量(按类别)。来源:Glassnode

尤其是 RWA,常被视为最具潜力的加密领域之一。若剔除稳定币,其总规模已从 2024 年初的 158 亿美元跃升至今日的 254 亿美元,涉及约 34.6 万名代币持有者。

价格是否会跟随 Web3 叙事?

资产价格很少与链上活动保持同步。短期内炒作可以推动价格飙升,但持续的增长往往与具备真实效用和采用的板块相契合。在过去一年中,基础设施和收益导向型项目的表现就远超那些仅靠叙事驱动的板块。

智能合约平台代币取得了最强劲的涨幅,前十名平均上涨 142%,其中 HBAR 涨幅高达 360%,XLM 上涨 334%。作为 Web3 的底层基石,这类代币的价格增长显示了投资者对该领域长期发展的信心。DeFi 代币同样表现良好,平均同比上涨 77%,Curve DAO(CRV)上涨 308%,Pendle(PENDLE)上涨 110%。

前十大 RWA 代币平均上涨 65%,主要受益于 XDC(+237%)和 OUSG(+137%)。DePIN 板块的亮点 JasmyCoin(+72%)和 Aethir(+39%),依然难以避免整体平均涨幅仅徘徊在 10% 左右。

AI 代币则明显落后:前十大纯 AI 项目同比下跌 25%,其中唯独 Bittensor(TAO)上涨 34%。游戏代币大多录得下跌,仅有 SuperVerse(SUPER)在过去 12 个月中暴涨 750%。至于社交代币,几乎依旧缺席加密领域,主要协议至今仍缺乏原生资产。

总体而言,Web3 投资仍集中在成熟领域,推升了主流智能合约平台的原生货币。以收益为导向的 DeFi 和 RWA 代币也交出了不俗的回报。相比之下,AI、DePIN 和社交这些最受炒作的叙事板块,却尚未能把关注度转化为实际的代币收益。

随着采用的深入以及更多板块的成熟,叙事与表现之间的差距可能会逐渐缩小。但就当下而言,投资者的信心依然牢牢扎根于去中心化经济的基石之上。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。