Source: arca

Translation: Golden Finance

The race for control over the value acquisition of cryptocurrencies has officially begun. If you think the Layer 1 battle is cooling down, you are mistaken. The latest entrants are the world's largest fintech and stablecoin companies.

Last week, Stripe announced the launch of Tempo, an EVM-compatible blockchain designed specifically for stablecoin payments and enterprise applications. Tempo aims to build a blockchain optimized for cross-border settlements that Stripe can fully control. Previously, Stripe acquired Bridge (stablecoin infrastructure) and Privy (crypto wallet), indicating its intention to take control of the entire stack from payments to rails to wallets.

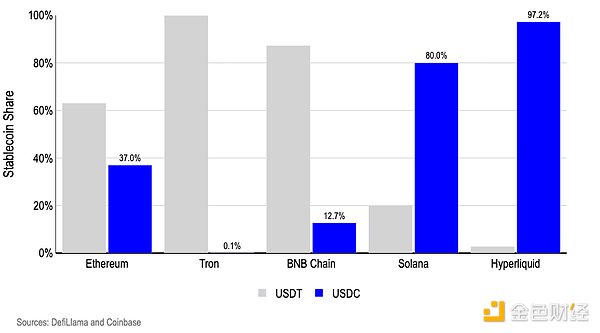

Following Stripe, Circle, the issuer of USDC, launched Arc, its own EVM-compatible Layer 1 chain. Arc is designed entirely around stablecoins, using USDC as the gas token, offering optional privacy features and a built-in foreign exchange engine. Circle's validator set will be permissioned, further highlighting its disconnection from decentralization; rather, it is related to efficiency, compliance, and margin acquisition. Arc is expected to go live on the mainnet in 2026, but Circle's intentions are already clear: it no longer wants to be a guest in someone else's ecosystem. It wants to own the home. This could hurt Solana more than Ethereum, as Solana's stablecoin base is primarily USDC (about 80% USDC / about 20% USDT), while Ethereum's stablecoin base is primarily USDT (about 37% USDC / about 63% USDT).

Earlier this year, Tether and Bitfinex announced the launch of Plasma, their own blockchain initiative aimed at building settlement and financial infrastructure. While specific details are yet to be determined, its positioning echoes the same theme: since they can autonomously control the rules, fees, and transaction processes, why rely on external chains? For Tether, which already dominates the stablecoin issuance space, Plasma is a logical extension of its business empire, as it not only issues stablecoins but also operates its underlying systems. For Bitfinex, Plasma further solidifies the vertical integration between the exchange, token issuance, and infrastructure.

As we recently stated, it is almost impossible to value a Layer 1 blockchain. That said, we clearly indicate that these blockchains do have value; we just cannot determine how much they are worth. But nearly everyone realizes that infrastructure is the most profitable part of cryptocurrency. Simply being an application on someone else's chain is no longer enough—the real allure lies in owning the chain itself.

It is worth noting that none of this is new. Cosmos (ATOM) has been promoting "sovereign blockchains" since 2017, launching the Cosmos SDK and Tendermint consensus engine. Their promotion aligns with what Stripe, Circle, and Tether are currently pursuing—building dedicated blockchains based on your application without renting block space on Ethereum or other blockchains. Cosmos achieves modularity by providing plug-and-play components (consensus, governance, staking), while allowing projects to customize fees, tokens, and execution environments.

Some of the earliest vertical integration projects in the cryptocurrency space originated from the Cosmos ecosystem. Binance Chain, dYdX's new chain Osmosis, and dozens of application chains are all built using the Cosmos SDK. These projects are not intended to be applications competing for block space; they aim to become ecosystems with autonomy, extracting more value from users, sorting fees, and governance. The vision of Cosmos is that every company will eventually have its own Layer 1, which is precisely the shift we see today with Stripe, Circle, and Coinbase.

In many ways, Cosmos is ahead of its time. The current wave of enterprise L1 and application chains validates Cosmos's argument: customization and sovereignty are the ultimate goals. The question is whether the companies building projects like Tempo, Arc, and Plasma can successfully launch applications.

However, not everyone is building their own chain. There are also notable counterexamples. Coinbase, despite its strong vertical integration capabilities, has thoughtfully decided to build Base as an Ethereum Layer 2 rather than a new Layer 1. They believe that aligning with Ethereum's liquidity, developer ecosystem, and credibility is more important than starting from scratch. Similarly, Robinhood has chosen to build a new chain on Arbitrum Orbit to accelerate its launch speed. Both decisions reflect a trade-off—sacrificing some control and theoretical long-term value acquisition for faster deployment speed, credibility, and network effects.

However, it is worth noting that Coinbase's goal remains to have a complete vertical stack. For example, during Coinbase's Q2 earnings call, Brian Armstrong explained how Coinbase integrates decentralized exchanges (such as Aerodrome - AERO). Aerodrome will also become the decentralized exchange (DEX) for Coinbase to achieve its goals of tokenizing stocks and other assets. The old model of Coinbase's exchange only generated trading fees at the time of trading. The new model will allow Coinbase to earn from three sources: CEX trading fees, sorting fees from Base (wholly owned by Coinbase), and a share of DEX fees (Coinbase Ventures is an investor in AERO).

Ironically, this cycle looks remarkably similar to Web 2.0. Just as Amazon and Apple built vertically integrated stacks to control distribution, hardware, software, and payments, cryptocurrency companies are now racing to build their own sovereign layers. Some companies will succeed, but most will underestimate the difficulty of driving actual usage outside their exclusive ecosystems.

Whether it is the collaboration between Stripe and Tempo, Circle and Arc, or Coinbase and Base and Aerodrome, the commonality is clear—everyone wants to move up (or down) the tech stack to maximize profits. But history tells us that network effects are stubborn, and developing in isolation rarely fares better than growing where there are existing users. For every collaboration like Tempo and Arc, there will be dozens of failures. The ultimate winners will be those who strike the right balance between control and ecosystem coordination.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。