比特币(BTC)在周二跌破了113,000美元,股市表现也不佳,全面下跌,暗示加密货币与传统股票之间的相关性正在加大。标准普尔500指数、纳斯达克和道琼斯指数分别下跌了0.53%、1.27%和0.01%,而根据Coinmarketcap,整体加密市场下跌了3%。

旗舰芯片制造商英伟达(纳斯达克:NVDA)在股票中领跌,股价下跌约3%,原因是该公司首席执行官黄仁勋根据周一提交给美国证券交易委员会(SEC)的监管文件,出售了价值超过2700万美元的公司股票。文件显示,这150,000股股票均在上周的8月14日至15日之间出售。

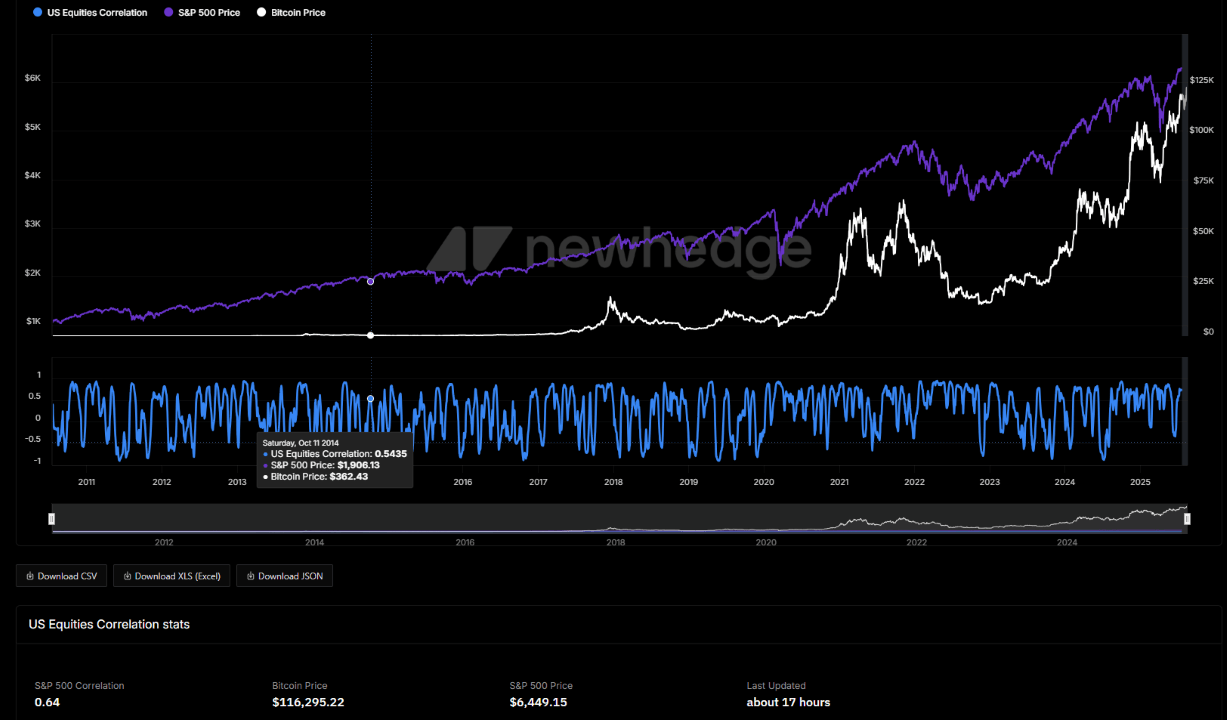

这家市值4.3万亿美元的公司并不是唯一一家下滑的公司;主要竞争对手超威半导体(纳斯达克:AMD)暴跌5%,其他主要科技公司如Meta和特斯拉也表现不佳。现在,看起来通常被视为传统资产替代品的比特币,再次成为现状的奇怪伴侣。根据Newhedge,加密货币与标准普尔500指数的相关性已飙升至0.64,这在一定程度上解释了今天BTC价格的下跌。

(比特币与股票的相关性已上升至0.64 / Newhedge)

根据Coinmarketcap,在撰写时,比特币报价为113,377.52美元,24小时内下跌2.58%,一周内下跌5.39%。自周一以来,这一数字资产的价格一直在112,970.33美元和117,050.37美元之间波动。

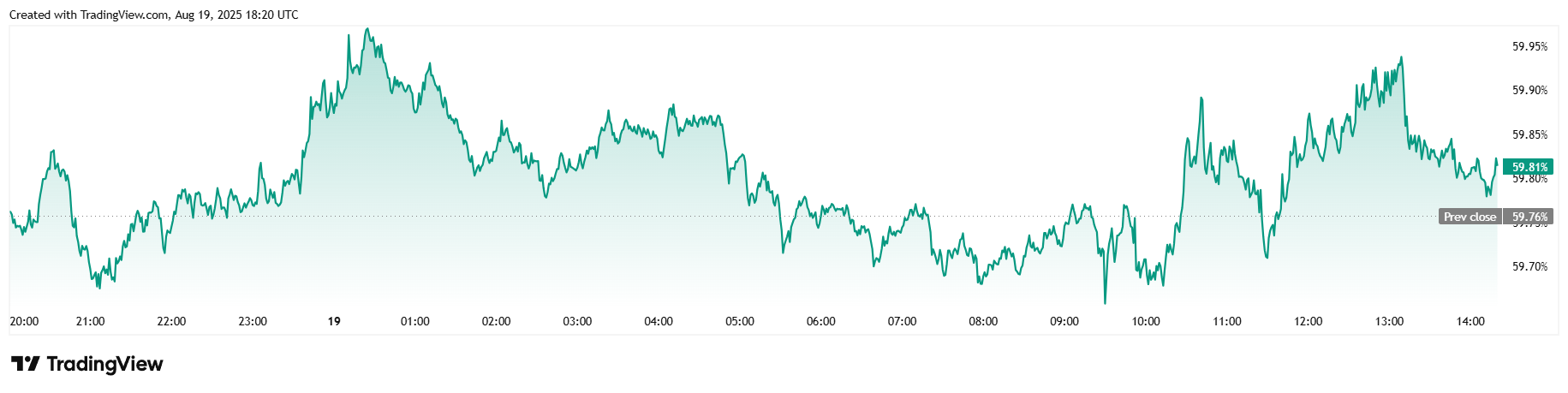

(比特币价格 / Trading View)

24小时交易量下降3.15%,降至690.6亿美元,市值在24小时内下降2.51%,降至2.25万亿美元。比特币的主导地位基本持平,维持在59.82%。

(BTC主导地位 / Trading View)

根据Coinglass,总比特币期货未平仓合约下降了1.94%,在撰写时为812.4亿美元。自周一以来,比特币的清算量保持在高位,总计达到9637万美元。其中大部分为多头清算,金额为9103万美元,其余为空头清算,金额为534万美元。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。