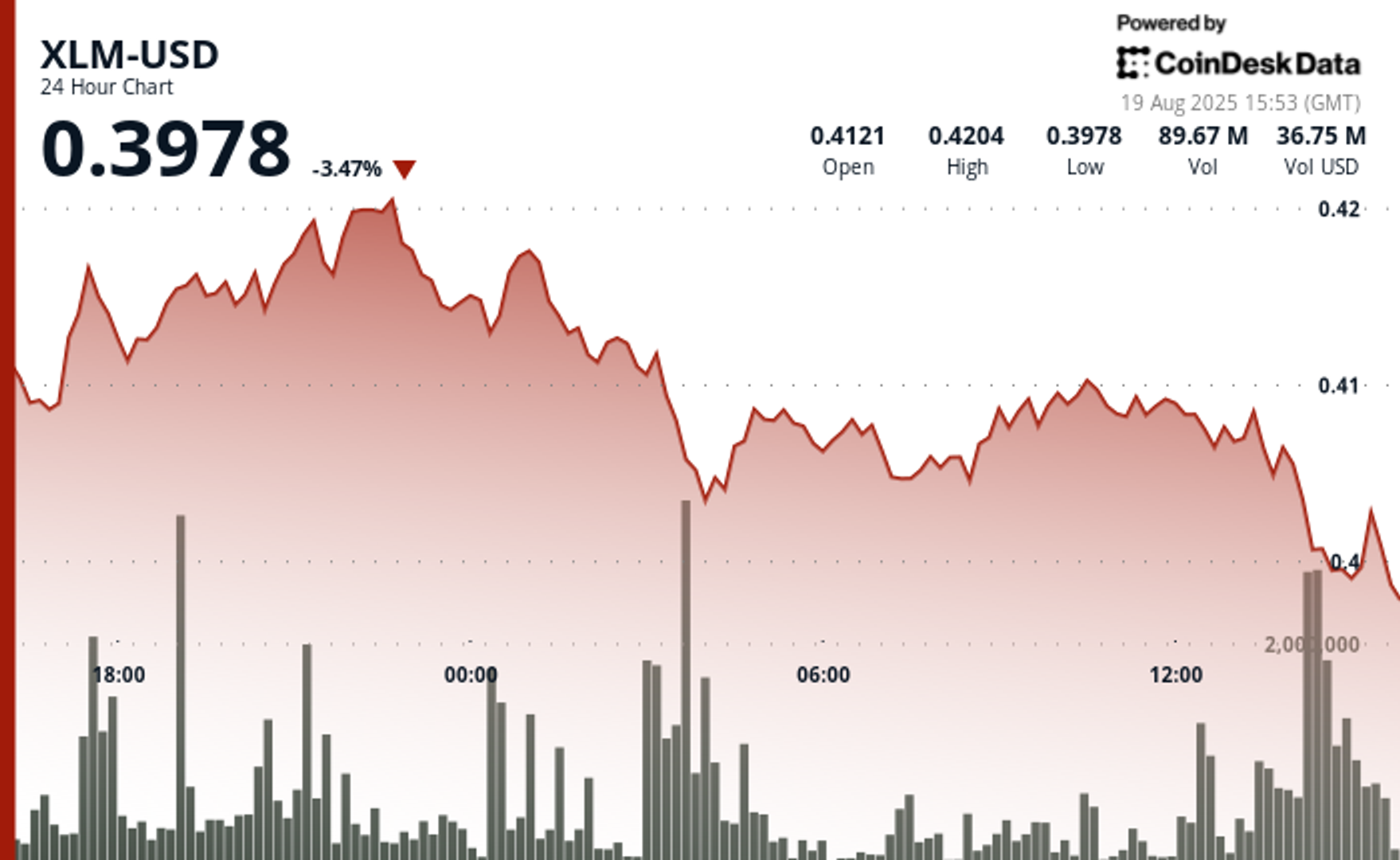

Stellar’s XLM token slipped 1.75% over the past 24 hours, falling from $0.41 to $0.40 as volatility picked up across the market. The trading range widened to 4.32% during the period, with a sharp selloff at 03:00 UTC on Aug. 19 driving volumes to 52.17 million — more than double the daily average. The move cemented resistance at $0.41 while leaving a narrow support band in the $0.403–$0.405 range.

The pressure intensified into the session’s close, with XLM sliding from $0.407 to $0.403 between 13:25 and 14:24 UTC. Selling was heaviest in the 13:30–13:46 window, when the token dropped from $0.410 to $0.404 on unusually high per-minute volumes. That action reinforced new resistance at $0.410 while further weakening support at $0.403–$0.405.

The latest downturn comes as broader crypto markets consolidated, with bitcoin hovering near $115,000 and most altcoins in the red. While institutional interest in Stellar continues to grow — underlined by the foundation’s investment in digital securities exchange Archax — market headwinds have overshadowed those developments.

XLM’s failure to hold above $0.41 leaves it vulnerable to deeper losses if the $0.403 level gives way. A breakdown below that zone would open the door to further declines, particularly as volumes tapered off late in the session, hinting at fading buyer support. For now, traders will be watching whether the token can defend its critical support or risk a move lower in line with broader altcoin weakness.

Technical Indicators

- Volume surges to 52.17 million during major decline, exceeding 24-hour average of 25.43 million by 105%.

- Resistance solidifies at $0.41 following multiple rejection attempts.

- Support zone materializes between $0.403-$0.405 amid repeated buying waves.

- Secondary resistance confirmed at $0.418-$0.420 after multiple price failures.

- Recent volume drops below average, indicating potential bearish continuation.

- $0.403 support level requires immediate monitoring for breakdown or reversal patterns.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk's full AI Policy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。